Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Changes at Texas Elite Advisory – by Vern Bell

This is the first issue of what may be a monthly newsletter to our clients and friends. I say “may be” because time always in short supply and authoring a monthly newsletter is no small undertaking. This issue is being sent only to my clients. I don’t want to write it if you don’t want me to. So, here’s the deal. If you won’t read our newsletter, please re-open the email this document was attached to and click on “UNSUBSCRIBE.” You’ll be doing both of us a big favor. I’m a big believer in democracy. If more than 1/2 of my clients want me to continue with the newsletter I will. Otherwise, you won’t see a February 2017 issue.

2016 was Texas Elite Advisory’s first full year as a Registered Investment Advisory. Here are a few significant changes that occurred during the year:

- We formed an alliance with Virtue Capital Management in order to expand our alternative investment offerings.

- We assisted Dower Strategic Capital in forming an asset management relationship with Virtue Capital Management.

- We formed a relationship with Morningstar Investment Services in order to source best-of-class Mutual Fund, ETF, and Select Stock Basket portfolio management resources.

- Texas Elite Advisory assumed responsibility for managing the Elite Relative Value Strategy, formerly the Dower Strategic Capital’s Value Investment Strategy. As a result of this change, Daniel Dower has joined Texas Elite Advisory as Chief Portfolio Manager. He will continue managing the strategy.

- Robb Rothrock joined the firm as an Investment Advisor Representative. I’ve known Robb for better than 20 years. In addition to being licensed in both insurance and securities, he brings a wealth of business and finance experience and a level of energy that I truly envy. Here’s a link to Robb’s LinkedIn profile:

https://www.linkedin.com/in/robbrothrock

Remember, if you don’t want to be bothered with these newsletters, please unsubscribe from the email to which this one was attached. Thanks in advance for your vote.

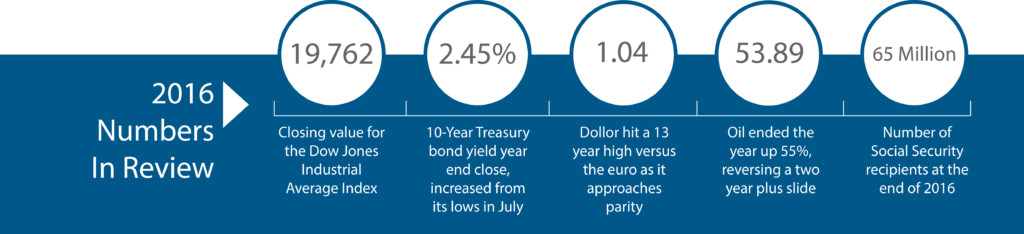

See page 2 for an overview of significant financial events that occurred in 2016. And, call or email if you would like a report of your account performance.

Vern Bell