Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview / April 2022

The Russia-Ukraine war has intensified inflation expectations due to the threat of global supply chains which are expected to be impaired for an extended period of time. Supply chain issues were already wreaking havoc on global manufacturing, production costs, and consumer availability before the Russian invasion started.

Consumers are rapidly losing purchasing power as rising rates and inflation have created higher borrowing costs for homebuyers and consumers overall. Quickly elevating mortgage rates have some borrowers being disqualified on mortgage loans that had previously been approved.

The Federal Reserve initiated its long awaited rate increase in March, making its first of several additional increases projected this year. Consumer loan rates, mortgage rates, and auto loan rates all increased. The Fed’s objective is to circumvent inflationary pressures by raising rates in order to ease consumer demand for products and services. Economists believe that the tremendous spike in global commodity prices is creating commodity-led inflation, which increases costs for production, manufacturing, and consumers globally.

The pandemic-induced demand for homes nationwide may eventually subside as mortgage rates have reduced affordability for millions of homebuyers. The average 30-year conforming mortgage rate rose to 4.67% in March, up from a low of 2.66% in December 2020.

Short-term Treasury bond yields began to move higher than some long-term Treasury bond yields, viewed as an indication of a possible economic slowdown. Rising short-term rates may signal inflationary pressures, while lower long-term rates may suggest a recessionary environment sometime in the future.

A strengthening U.S. dollar over the past few weeks has been the result of global investors seeking stability as the Russian invasion of Ukraine has progressed. Optimistically, a stronger dollar can help stem inflation as it can make imported products less costly for American consumers. The most recent inflation data revealed a 7.9% annual rate, the highest in 40 years, putting pressure on consumers as wages struggle to keep pace with heightened inflation.

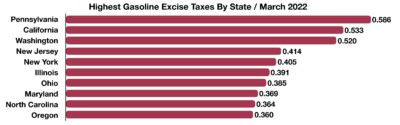

Gasoline prices have soared more in certain states than others, with excise gasoline taxes as a culprit. The federal government imposes a tax of 18.4 cents for each gallon sold nationally, yet some states impose an additional gas tax in order to raise funds for state infrastructure and highway projects. Even though the average cost of a gallon of regular gasoline nationally was $4.23 at the end of March, several states saw much higher prices due to additionally imposed excise taxes.

Sources: EIA, Federal Reserve, Freddie Mac, Treasury

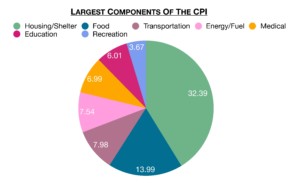

Historically, food and energy prices have always been very volatile, making up more or less of consumer expenditures over time. Where consumers live and how old they are also dictates how influential components of the CPI are. Gasoline for example is less expensive in Oklahoma than in California, and seniors may not spend any funds on education but may spend more on medical expenses. Sources: Dept. of Labor, BLS

Historically, food and energy prices have always been very volatile, making up more or less of consumer expenditures over time. Where consumers live and how old they are also dictates how influential components of the CPI are. Gasoline for example is less expensive in Oklahoma than in California, and seniors may not spend any funds on education but may spend more on medical expenses. Sources: Dept. of Labor, BLS