Robert Krueger

Alexander Randolph Advisory Inc.

8200 Greensboro Drive, Suite 1125

McLean, VA 22102

703.734.1507

Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Macro Overview

A Congressional standoff surrounding raising the debt limit led to increased market volatility as a political debate lingered. Impasses regarding the debt ceiling have occurred numerous times since the limit was established in 1917.

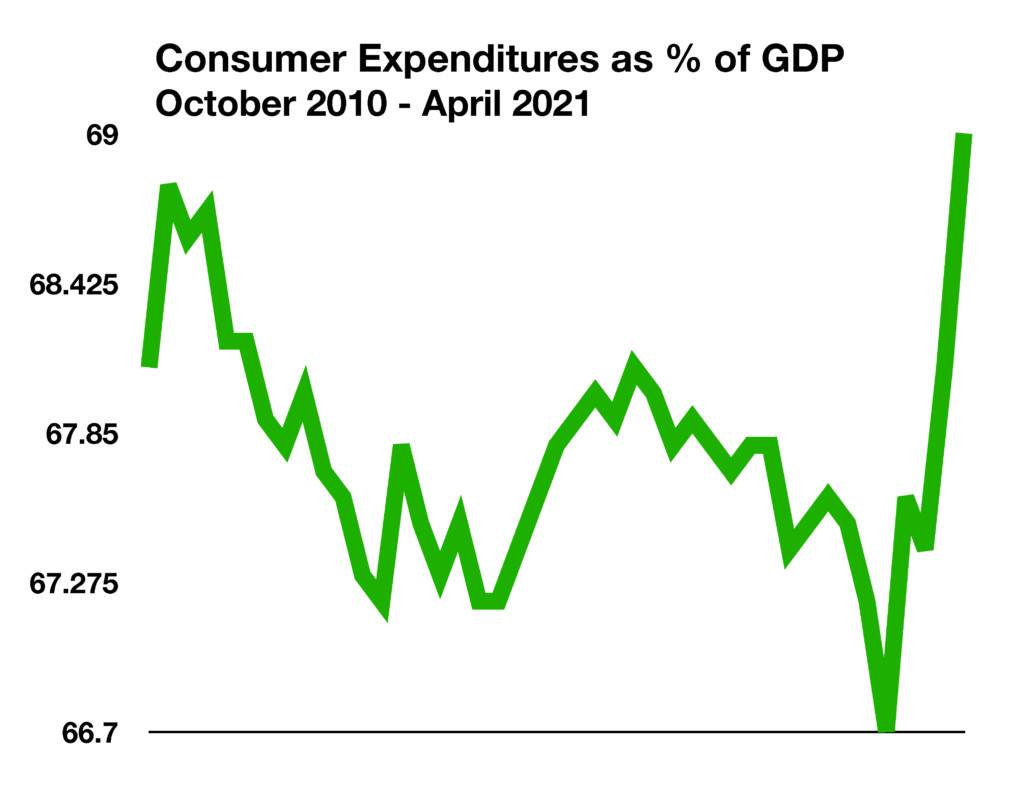

Some economists believe that dissipating stimulus payments along with growing inflationary pressures may hinder economic expansion heading into 2022.

Also adding to consumer tensions are tax reform measures proposed by Congress that are creating uncertainty surrounding tax and estate planning. Among the proposals are heightened capital gains taxes, reduction in estate tax exemptions, and limits on transferring assets to heirs with favorable tax treatments.

The number of known deaths from Covid-19 in the U.S. has now surpassed the number of fatalities from the 1918 flu pandemic. The CDC reported that over 675,000 people have died thus far, equaling those who died in the 1918 pandemic. Notably different is that the population of the U.S. has nearly tripled since 1918, thus having a smaller toll on the overall population of 333 million.

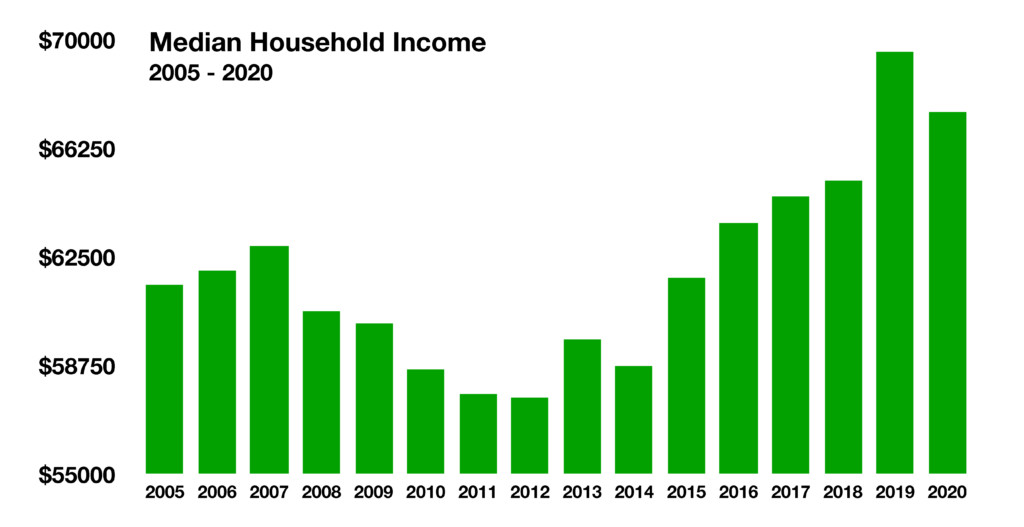

Economists are noting that wage gains have been trailing price gains throughout the economy, meaning that consumers are able to buy less. Rental costs, the largest expenditure for many consumers, are expected to increase as forecast by the Federal Reserve Bank of Dallas.

Interest rates rose in September driven by inflationary influences and the Federal Reserve’s signal that it will start alleviating stimulus support by the end of the year.

Heightened energy prices along with ongoing supply constraints are stoking inflationary concerns as consumers resume spending on products and services. Gasoline, oil, and natural gas prices rose in September as supply constraints and increased global demand added to price pressures.

Cryptocurrency has become highly disputable among various world governments. September saw two significant opposing positions for digital currency as El Salvador became the first country to adopt a cryptocurrency as its legal tender and China’s Central Bank declared all crypto-related transactions illegal, citing concerns about gambling, fraud and money laundering.

Sources: CDC, U.S. Treasury, Federal Reserve