Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

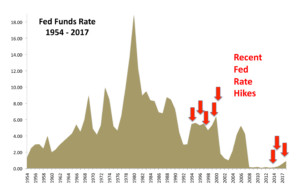

Many analysts believe that the stock market rally following Trump’s election reflects the expectations of a new era of fiscal stimulus. Both economists and analysts agree that the Fed has basically exhausted all of its stimulus efforts by means of using traditional and newly devised monetary policy tools that are now considered ineffective.

Small caps outperformed large caps following the election, primarily driven by the growth factors expected to benefit small cap stocks. Proposed corporate tax rate cuts also favor small caps, which benefit more than large caps from tax rate reductions. Proposed deregulation is good for small caps as large caps can handle higher costs of regulation easier than small caps, leaving small caps to benefit the most under deregulation.

Protectionism is expected to benefit small company stocks which typically generate less than 20% of their sales overseas while larger company stocks generate well over 30% from overseas sales. A reduction in the corporate tax rate to 15% would be much more beneficial for small company stocks, which generally don’t have the resources to bring tax rates below 35%.

The Dow Jones Industrial Average reached 19,000 in November, a milestone level for the index, which was at 1000 in November 1972. The Dow Jones Industrial Average rose 5.4% in November, while the S&P 500 Index increased by 3.4% and the Nasdaq Composite added 2.6% for the month. The Dow Jones Transportation Average climbed 11% in November, it’s single largest monthly gain since October 2011. As a leading indicator of economic growth, strong gains in the index are often a good sign for the U.S. economy.

Sources: S&P, Dow Jones, Bloomberg