Aspen Wealth Management, Inc.

9300 W. 110th Street, Suite 680

Overland Park, KS 66210

913.491.0500

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

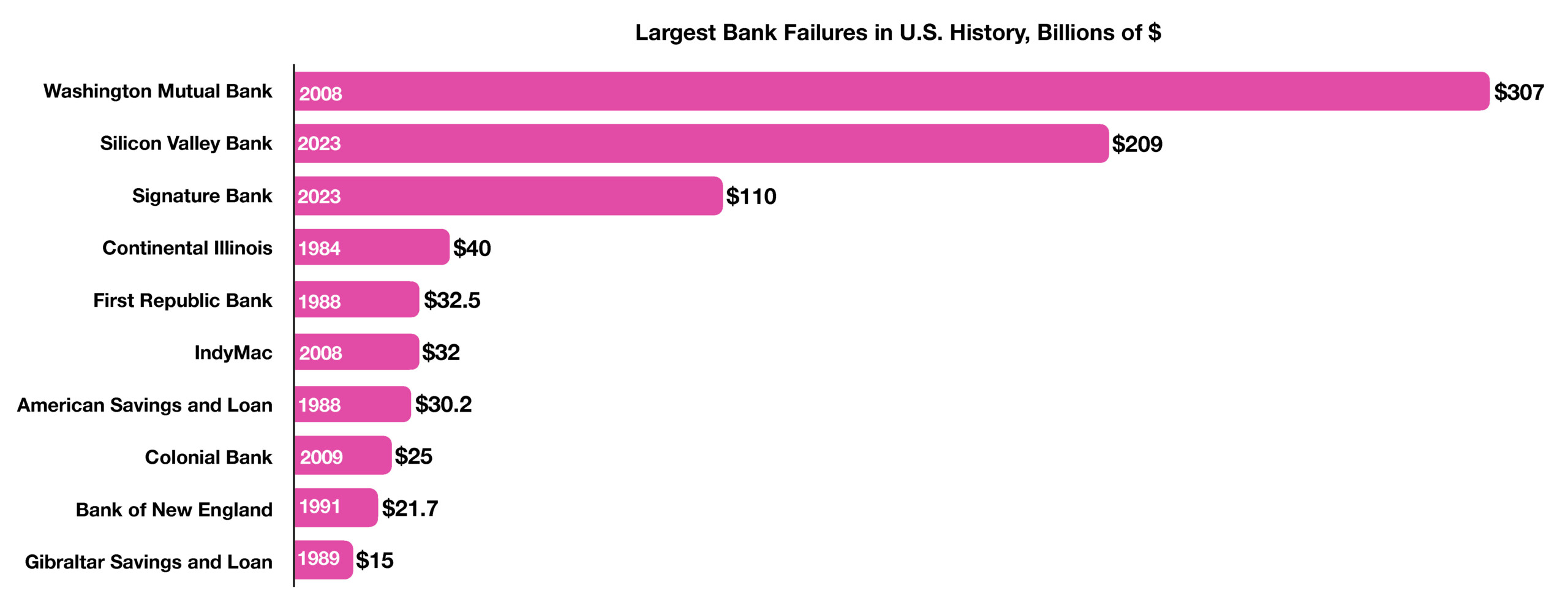

The failure of two regional banks unsettled equity and fixed-income markets globally in March. Financial contagion risks were at the forefront of the financial markets as the closure of Silicon Valley Bank (SVB) and Signature Bank fostered turmoil throughout the banking sector. The recent banking crisis may alter the Fed’s rate increase trajectory, as various analysts believe that the Fed’s rapid rate increases may have triggered the banking mayhem.

Various bank analysts believe that the recent 2023 bank failures are more centralized than widespread in the banking sector, different from the crisis in 2008 when numerous institutions were affected. What occurred in 2008/2009 was systemic, which means that there was a broad effect across many institutions with the same exposure to high-risk Mortgage Backed Securities (MBS). In 2008-2009, the losses in value were permanent losses as the high-risk borrowers defaulted on their mortgages and the underlying real estate declined in value. The current crisis is different as the assets owned by the banks are high quality US-government backed assets. Any losses in these bonds will be temporary.

Some economists are forecasting the likelihood of a heightened recessionary environment should additional banks fail an if the Fed continues to hike rates.(Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Federal Reserve Bank of New York, U.S. Treasury)

Banking Crisis of 2023

How did the US have a banking crisis when the economy and employment was stable? During Covid, the US Government and the Federal Reserve flooded the economy with money. Congress enacted the Paycheck Protection Program for businesses and Covid stimulus relief to individuals. These handouts were deposited in the banks. In general, banks lend out these deposits to make the spread between the deposit interest paid to depositors and the loan interest charged to borrowers. The deposits overwhelmed the banks who didn’t make enough loans as the businesses and consumers didn’t need the money. The banks instead purchased US Treasuries and federal-backed mortgages.

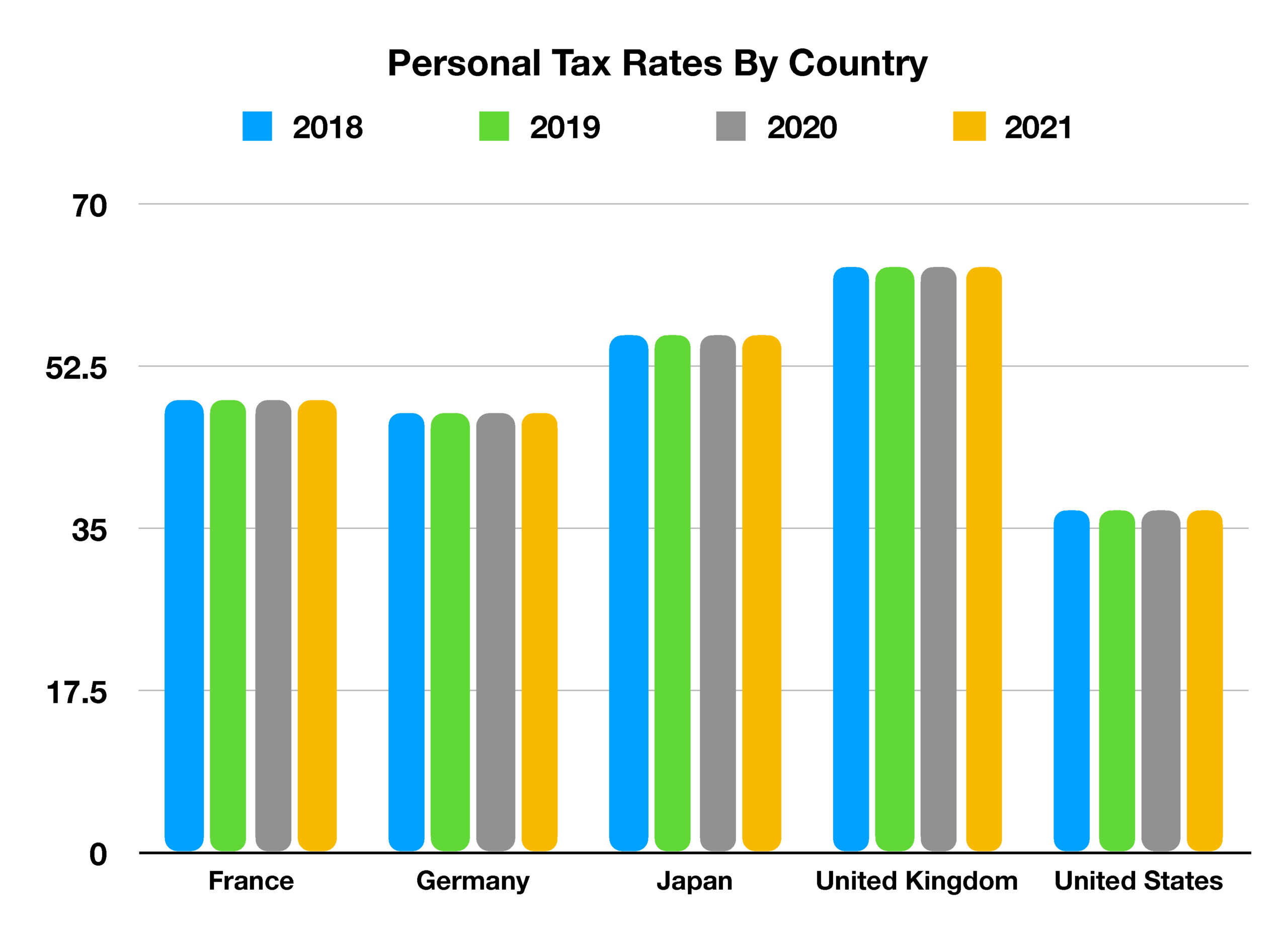

Since the Tax Cuts and Jobs Act of 2017, the top marginal federal tax rate in the U.S. is 37%, applying to incomes of over $578,125 for individuals and $693,750 for married couples filing jointly in 2023. In France, on the other hand, the top income tax rate currently reaches upwards of 45% for any individual earning €250,000 and 49% for individuals earning €500,000. In the UK, marginal income taxes can even reach 63.25% for certain individuals earning over £100,000. In Belgium, income taxes reach as high as 79.5%, more than double the highest marginal rates in the United States.

Since the Tax Cuts and Jobs Act of 2017, the top marginal federal tax rate in the U.S. is 37%, applying to incomes of over $578,125 for individuals and $693,750 for married couples filing jointly in 2023. In France, on the other hand, the top income tax rate currently reaches upwards of 45% for any individual earning €250,000 and 49% for individuals earning €500,000. In the UK, marginal income taxes can even reach 63.25% for certain individuals earning over £100,000. In Belgium, income taxes reach as high as 79.5%, more than double the highest marginal rates in the United States.