W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 41,563 |

| S&P 500 | 5,648 |

| Nasdaq | 17,713 |

Bond Sector Yields:

| 2 Yr Treasury | 3.91% |

| 10 Yr Treasury | 3.91% |

| 10 Yr Municipal | 2.70% |

| High Yield | 6.92% |

YTD Market Returns:

| Dow Jones | 10.28% |

| S&P 500 | 18.42% |

| Nasdaq | 18.00% |

| MSCI-EAFE | 9.72% |

| MSCI-Europe | 9.81% |

| MSCI-Pacific | 9.34% |

| MSCI-Emg Mkt | 7.44% |

| US Agg Bond | 3.07% |

| US Corp Bond | 3.49% |

| US Gov’t Bond | 2.95% |

Commodity Prices:

| Gold | 2,535 |

| Silver | 29.24 |

| Oil (WTI) | 73.65 |

Currencies:

| Dollar / Euro | 1.10 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 144.79 |

| Canadian /Dollar | 0.74 |

Macro Overview

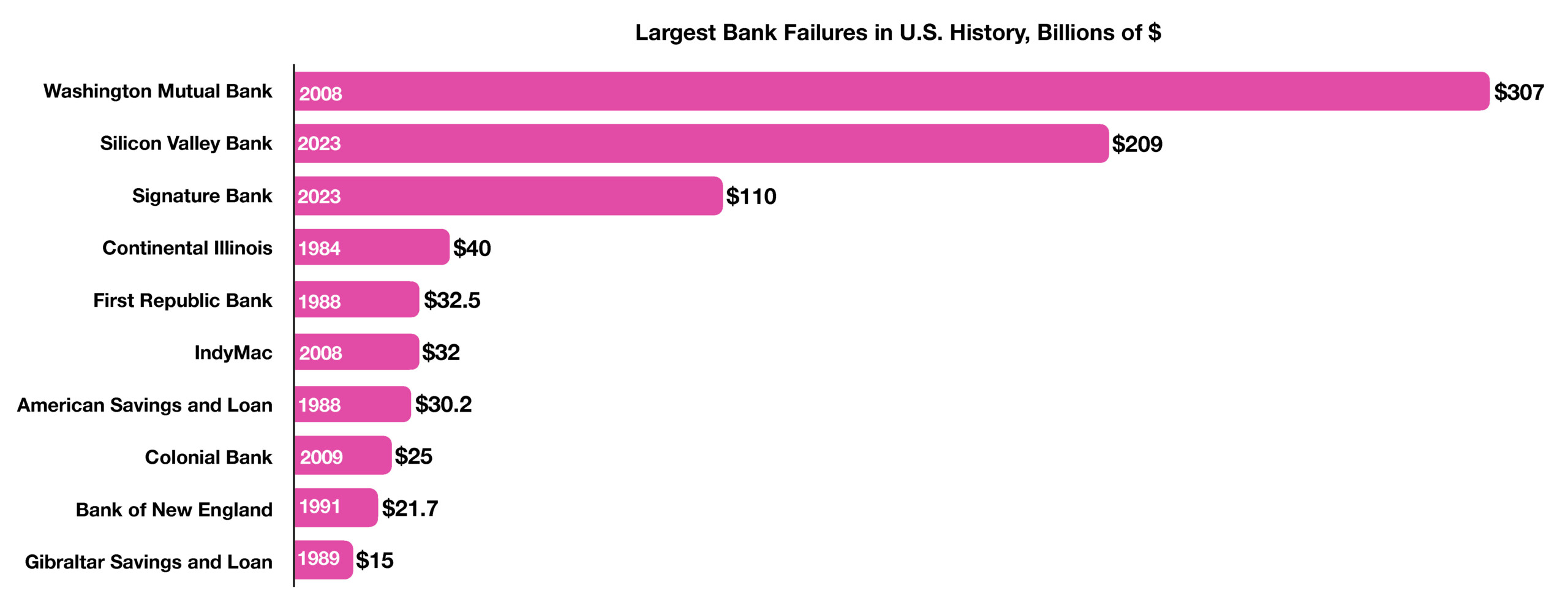

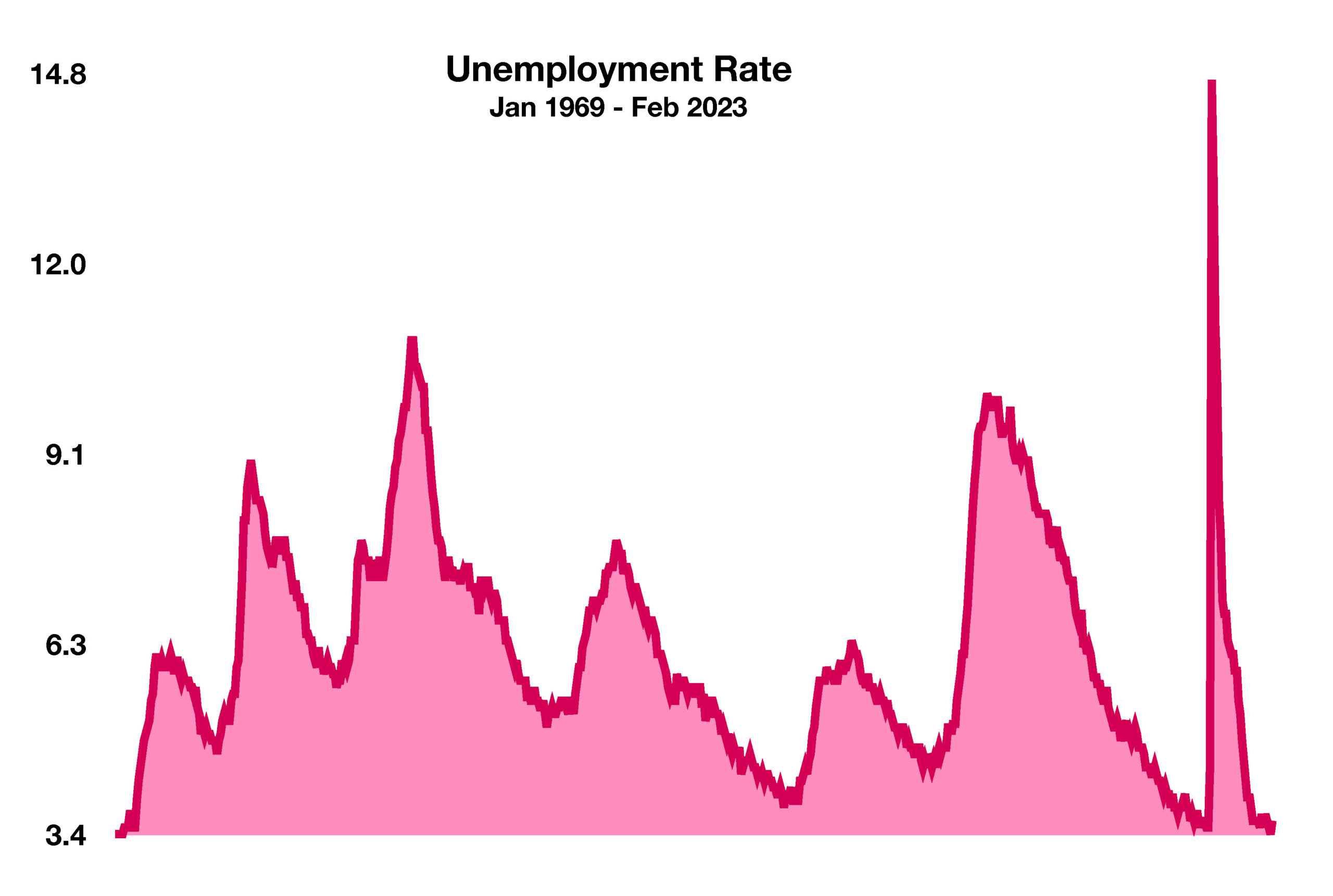

The failure of two regional banks unsettled equity and fixed-income markets globally in March. Financial contagion risks were at the forefront of the financial markets as the closure of Silicon Valley Bank and Signature Bank fostered turmoil throughout the banking sector. The recent banking crisis may alter the Fed’s rate increase trajectory, as various analysts believe that the Fed’s rapid rate increases may have triggered the banking mayhem.

Various bank analysts believe that the recent bank failures are more centralized than widespread in the banking sector, different from the crisis in 2008 when numerous institutions were affected. Some economists are forecasting the likelihood of a heightened recessionary environment should additional banks fail and if the Fed continues to hike rates.

What occurred in 2008/2009 was systemic, which means that there was a broad effect across many institutions with the same exposure, such as Mortgage Backed Securities (MBS). This so far has not been the case and is contained to just a handful of regional banks catering to a select group of depositors and customers.

The events in March precipitated a migration to bonds, creating a drop in interest rates which is advantageous to offset inflationary pressures. The concern is that falling rates may also be indicative of a slowing economic environment, with a possible recession should economic activity significantly curtail. The Fed may or may not continue to “fight” inflation by raising rates, depending on economic data and how the bank crisis unfolds. There is a growing consensus that the Fed may be ready to halt raising rates. The Fed’s latest survey on the economy, the Beige Book, reported that overall loan demand is falling, bank credit standards are tightening and delinquency rates are edging higher. The survey also identified rising rates as a factor in diminishing loan quality as well as inhibiting consumer borrower sentiment.

Millions of taxpayers are expected to file for an extension this year. The deadline for 2022 tax filings is April 18th, yet those requesting an extension will have until October 16, 2023. As always, the IRS reminds taxpayers that an extension is for filing and is not an extension to pay taxes owed. (Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Federal Reserve Bank of New York, U.S. Treasury)

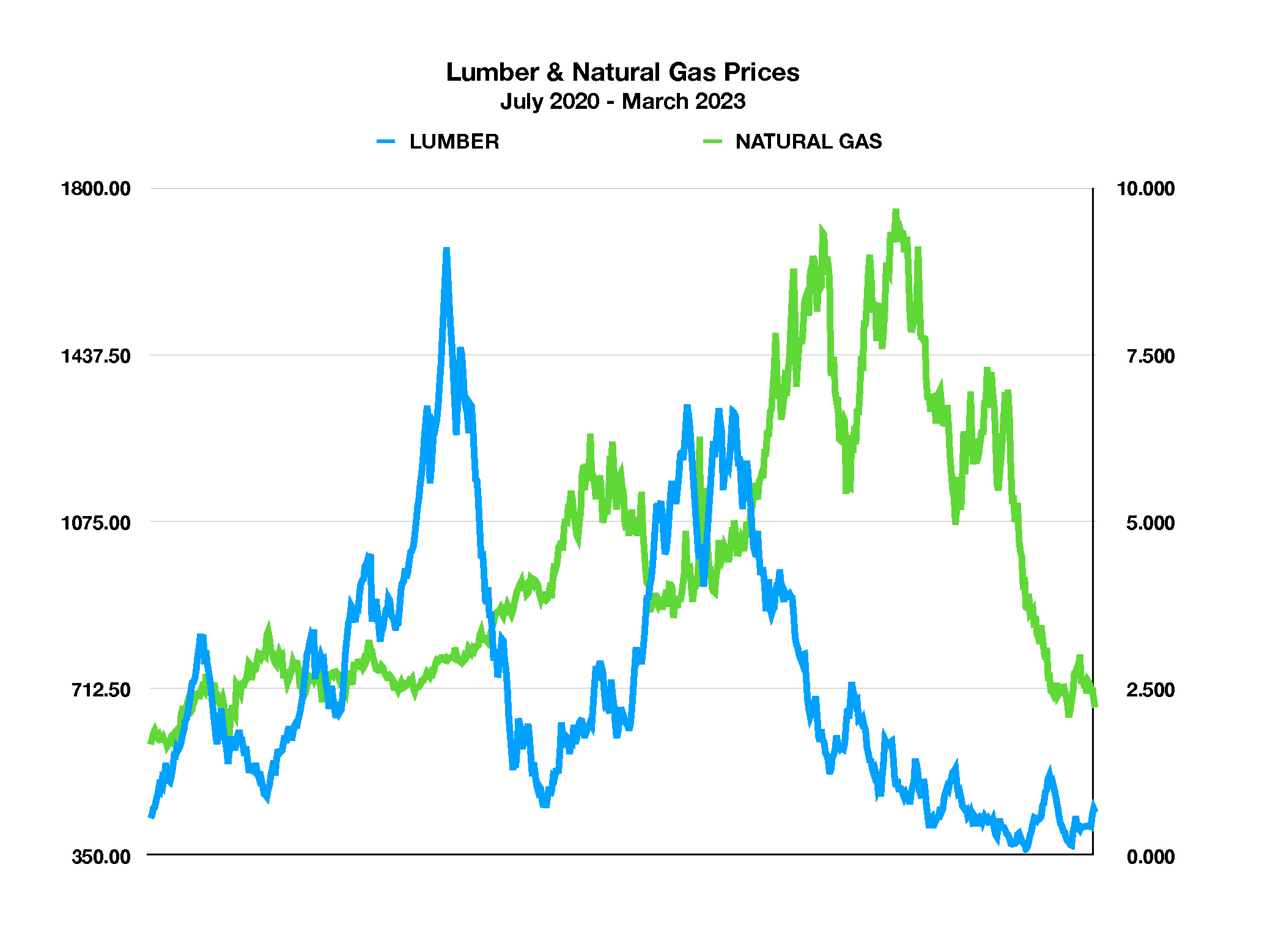

Another resource exhibiting similar trends is natural gas, with increasing supplies along with falling demand. As European nations cut off Russian gas as a result of the war in Ukraine, the export of U.S. natural gas rose significantly and raised prices for natural gas domestically. In the U.S., natural gas consumption fell throughout March, with diminishing demand for natural gas expected to continue to drive a return to normal prices, following similar trends as lumber. (Sources: U.S. Energy Information Administration, NASDAQ, S&P Global Commodity Insights)

Another resource exhibiting similar trends is natural gas, with increasing supplies along with falling demand. As European nations cut off Russian gas as a result of the war in Ukraine, the export of U.S. natural gas rose significantly and raised prices for natural gas domestically. In the U.S., natural gas consumption fell throughout March, with diminishing demand for natural gas expected to continue to drive a return to normal prices, following similar trends as lumber. (Sources: U.S. Energy Information Administration, NASDAQ, S&P Global Commodity Insights)

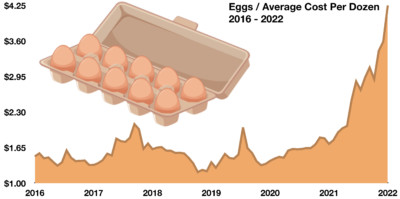

Amidst high food inflation throughout 2022, eggs have emerged as particularly costly goods at the grocery store in recent months. Egg consumption has been rising in recent years as compared to other protein sources, yet production has recently fallen due to an ongoing bird flu epidemic.

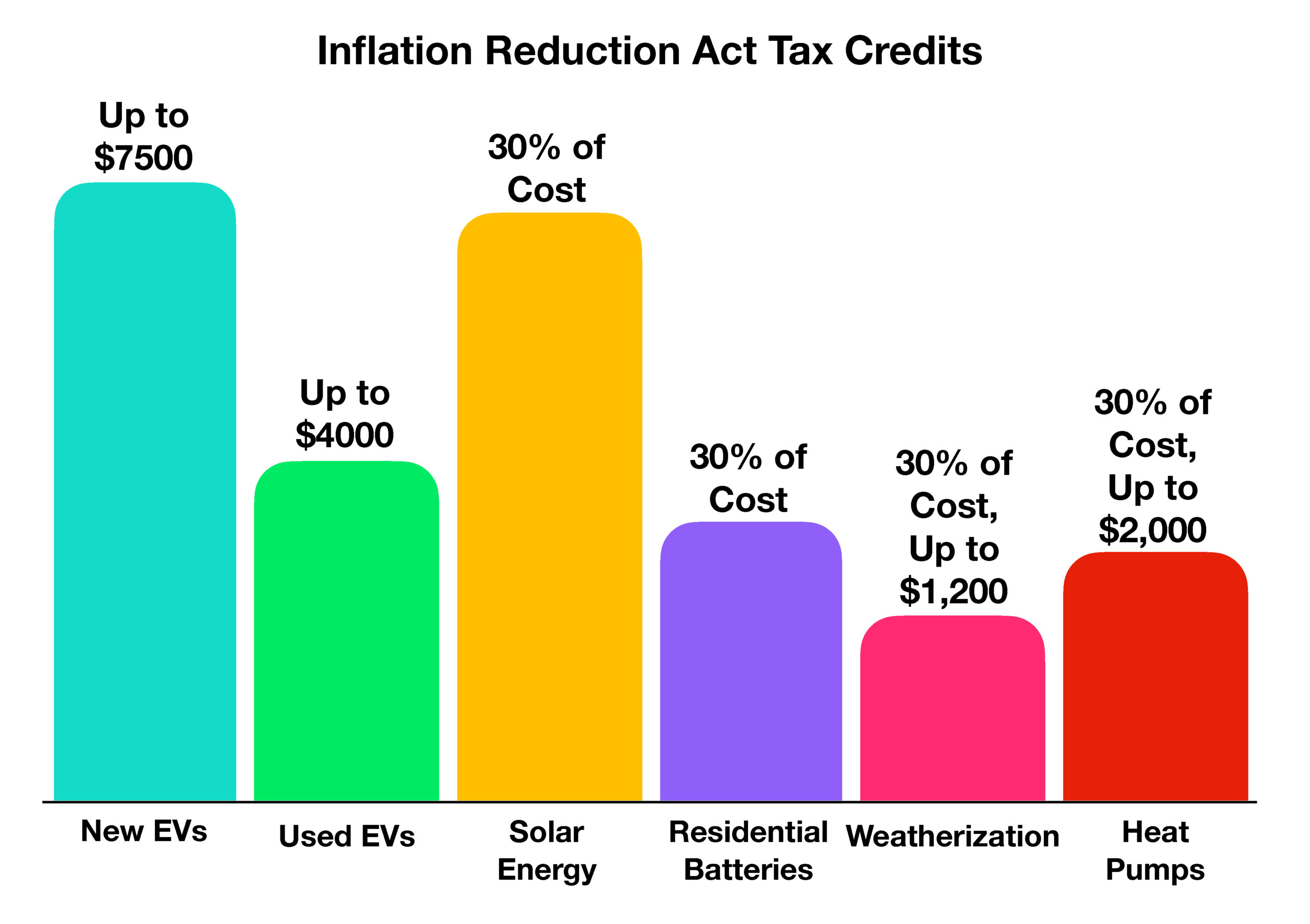

Amidst high food inflation throughout 2022, eggs have emerged as particularly costly goods at the grocery store in recent months. Egg consumption has been rising in recent years as compared to other protein sources, yet production has recently fallen due to an ongoing bird flu epidemic. Heat pumps are also receiving sizable incentives through the act. Low-income households will receive a rebate of 100% for the cost of a heat pump, while moderate-income households will receive 50% of the heat pump expense. Homeowners can qualify for a 30% tax credit up to $2,000 for home energy efficiency projects, which covers heat pumps. For weatherization, homeowners can receive a tax credit of 30% for up to $1,200 per year. For households installing residential batteries, a tax credit of 30% is available for the equipment and installation cost. (Sources: U.S. Congress, Internal Revenue Service, U.S. Department of Energy)

Heat pumps are also receiving sizable incentives through the act. Low-income households will receive a rebate of 100% for the cost of a heat pump, while moderate-income households will receive 50% of the heat pump expense. Homeowners can qualify for a 30% tax credit up to $2,000 for home energy efficiency projects, which covers heat pumps. For weatherization, homeowners can receive a tax credit of 30% for up to $1,200 per year. For households installing residential batteries, a tax credit of 30% is available for the equipment and installation cost. (Sources: U.S. Congress, Internal Revenue Service, U.S. Department of Energy)