W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

YTD Market Returns:

| Dow Jones | 5.62% |

| S&P 500 | 10.16% |

| Nasdaq | 9.11% |

| MSCI-EAFE | 5.06% |

| MSCI-Europe | 4.60% |

| MSCI-Pacific | 5.82% |

| MSCI-Emg Mkt | 1.90% |

| US Agg Bond | -0.78% |

| US Corp Bond | -0.40% |

| US Gov’t Bond | -0.72% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Macro Overview

A stronger-than-anticipated jobs report reduced the chances of a Fed rate cut in June, as projected by analysts. In the mind of the Fed, strong labor dynamics tend to foster underlying inflation for longer periods of time, thus influencing its decision on rate decreases. Yields on shorter-term U.S. Treasury bonds rose in March as expectations for a spring or summer Fed rate cut dissipated.

The Federal Reserve signaled that it would likely be appropriate to lower rates at some point this year, with some Fed officials expecting at least three rate reductions in 2024. Markets were anticipating the first rate cut in March, yet that did not materialize due to the Fed’s concern surrounding continued inflationary pressures.

Inflation angst affected markets in March as inflation remained a concern, hindering the Fed from executing a rate cut expected earlier in the year. Over the past year, prices rose the most for transportation services, eating out, and housing. Stubbornly high prices on certain goods and services have stalled any immediate efforts by the Fed to commence its rate reduction strategy.

Several central banks worldwide are expected to cut rates this summer before the Fed embarks on its rate reduction plans. Slower economic growth and lessening inflationary pressures are prompting lower rates throughout Europe to sustain economic momentum. The European Central Bank and the central banks of England, Canada, Australia, New Zealand, and Switzerland are all anticipated to begin lowering rates this summer and through the end of the year.

The collapse of the Baltimore Bridge highlights the fragility of the nation’s infrastructure and the need for proactive contingency planning and the maintenance of diversified routing options. A critical component of the nation’s shipping transit, the Baltimore Port is the largest U.S. port by volume in handling farm, construction machinery, and agricultural products. It is also the busiest U.S. port for automobile shipments, moving more than 750,000 vehicles in 2023, according to data from the Maryland Port Administration.

Florida passed a law this past month that prohibits minors under 14 from having social media accounts, regardless of parental consent. The legislation is aimed at curbing social media access for minors and requires social media platforms to cancel accounts and delete all content at the request of parents and minors. The law will become effective and enforceable on January 1, 2025. Should other states adopt similar restrictions, the impact on social-media platforms may pose a challenge.

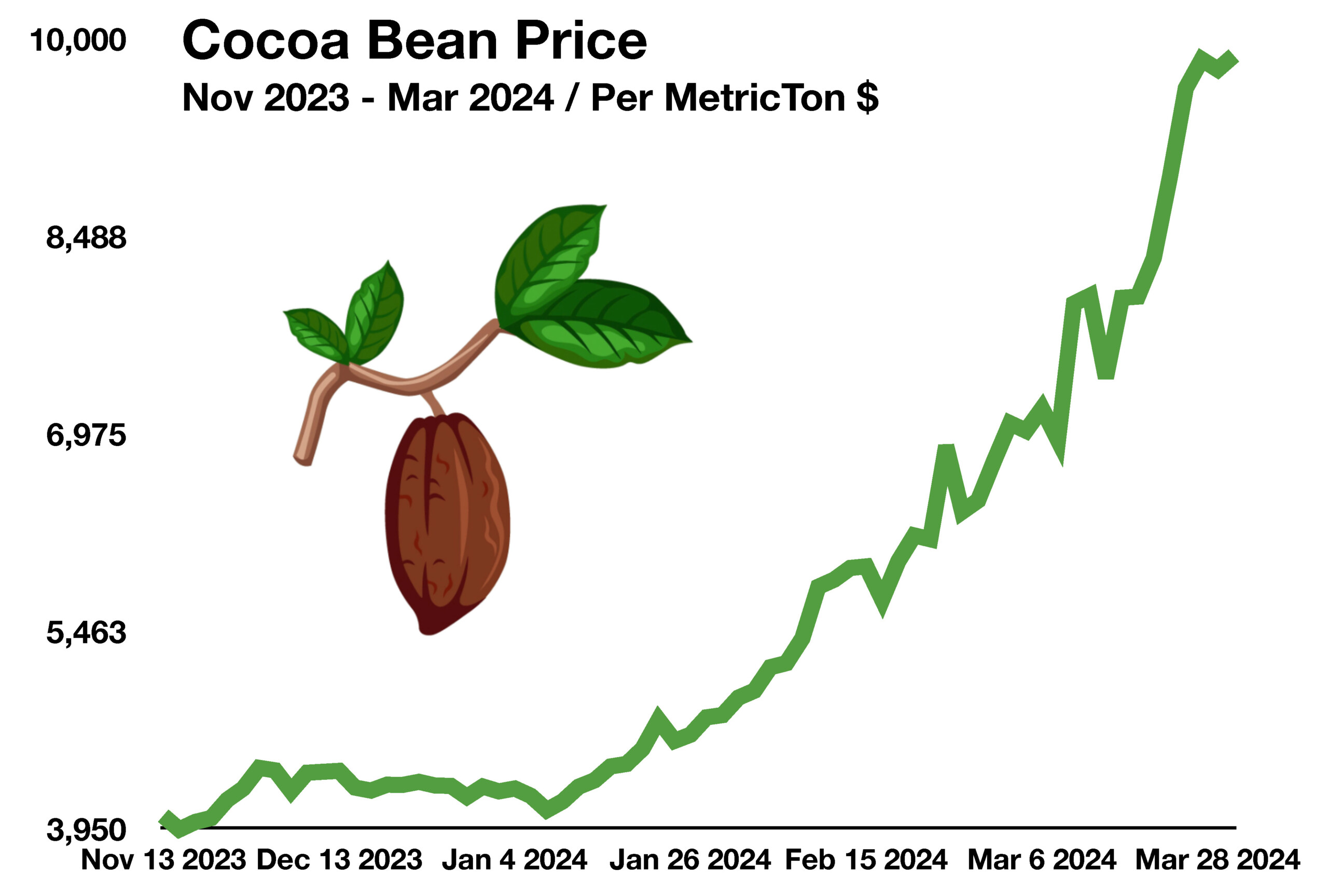

Shrinkflation, a term being used more frequently in the press, is when companies sell a smaller or lesser amount of a product but for the same price. The dynamic has become common, from food products to cars, where consumers are getting less yet still spending the same. Higher production costs, including raw materials and labor, have forced companies to raise prices or shrink product portions to maintain profitable margins.

Sources: Maryland Port Administration, ECB, Federal Reserve, Labor Dept., EuroStat, U.S. Treasury

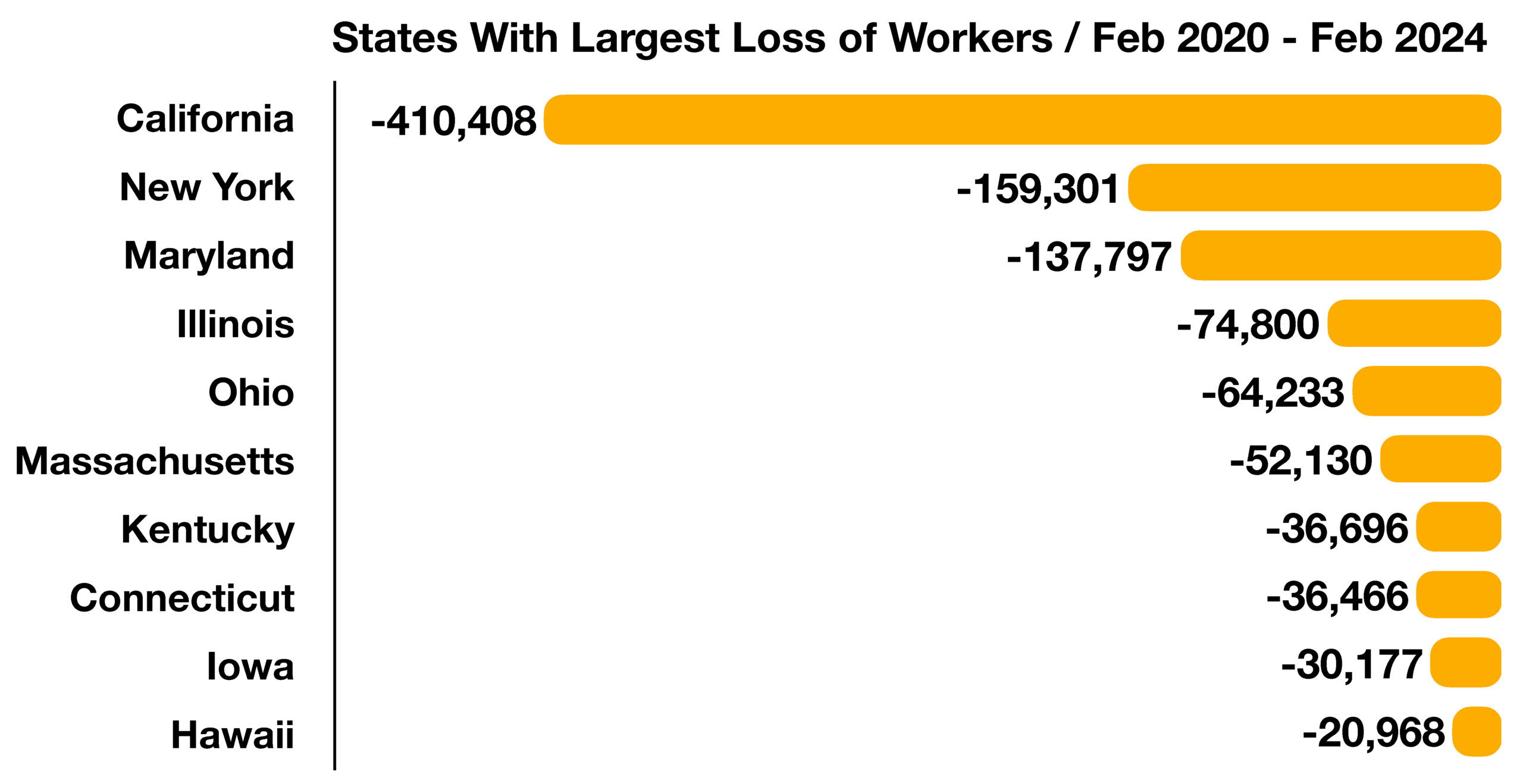

Nearly five years after the pandemic, migration from various states has been consistent. California and New York combined lost over half a million workers to other states from 2020 to 2024, while Texas took in one million new workers during the same period. Florida also saw a dramatic increase, with over 750,000 new workers flooding the state. Cost of living, taxes, and housing are reasons for migration.

Nearly five years after the pandemic, migration from various states has been consistent. California and New York combined lost over half a million workers to other states from 2020 to 2024, while Texas took in one million new workers during the same period. Florida also saw a dramatic increase, with over 750,000 new workers flooding the state. Cost of living, taxes, and housing are reasons for migration. There is also the prospect of lower fuel prices. Historically, rising fuel prices eventually hinder economic growth, thus slowing industrial and consumer activity and lessening demand for fuel. Many economists believe that a recession would also curtail fuel demand, thus lowering fuel prices. (Sources: U.S. Energy Information Administration (EIA)

There is also the prospect of lower fuel prices. Historically, rising fuel prices eventually hinder economic growth, thus slowing industrial and consumer activity and lessening demand for fuel. Many economists believe that a recession would also curtail fuel demand, thus lowering fuel prices. (Sources: U.S. Energy Information Administration (EIA)