Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

YTD Market Returns:

| Dow Jones | 5.62% |

| S&P 500 | 10.16% |

| Nasdaq | 9.11% |

| MSCI-EAFE | 5.06% |

| MSCI-Europe | 4.60% |

| MSCI-Pacific | 5.82% |

| MSCI-Emg Mkt | 1.90% |

| US Agg Bond | -0.78% |

| US Corp Bond | -0.40% |

| US Gov’t Bond | -0.72% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Macro Overview

A stronger-than-anticipated jobs report reduced chances of a rate cut by the Federal Open Market Committee in June. Strong labor dynamics tend to foster underlying inflation for longer periods of time, influencing the Federal Reserve’s decision on rate decreases. Yields on short-term U.S. Treasury bonds rose in March as expectations for a spring Fed rate cut dissipated.

The Federal Reserve signaled that it will likely be appropriate to lower rates at some point this year, with some Fed officials expecting at least three rate reductions in 2024. Markets previously expected the first rate cut in March, which did not materialize due to the Fed’s concern regarding continued inflationary pressures.

Inflation angst affected markets in March as inflation remained a concern. Over the past year, prices rose the most for transportation services, dining out, and housing. Stubbornly high prices on certain goods and services have stalled any immediate efforts by the Fed to commence its rate reduction strategy.

A number of central banks across the globe are expected to cut rates starting this summer, before the Fed embarks on its rate reduction plans. Slower economic growth and lessening inflationary pressures are prompting lower rates throughout Europe in order to sustain economic momentum. The European Central Bank, the central banks of England, Canada, Australia, New Zealand, and Switzerland are all anticipated to begin lowering rates this summer and through the end of the year.

The Baltimore bridge collapse highlights the fragility of the nation’s infrastructure and the need for proactive contingency planning and diversified routing options. A critical component of the nation’s shipping transit support, the Baltimore Port is the largest U.S. port by volume in handling farm, construction machinery, and agricultural products. It is also the busiest U.S. port for automobile shipments, moving more than 750,000 vehicles in 2023, according to data from the Maryland Port Administration.

Florida passed a law this past month that prohibits minors under the age of 14 from having social-media accounts, regardless of parental consent. The legislation is aimed at curbing social-media access for minors, and requires social-media platforms to cancel accounts and delete all content on the request of parents and minors. The law is scheduled to become effective and enforceable on January 1, 2025. Should other states adopt similar restrictions, the impact may pose a challenge for social-media platforms.

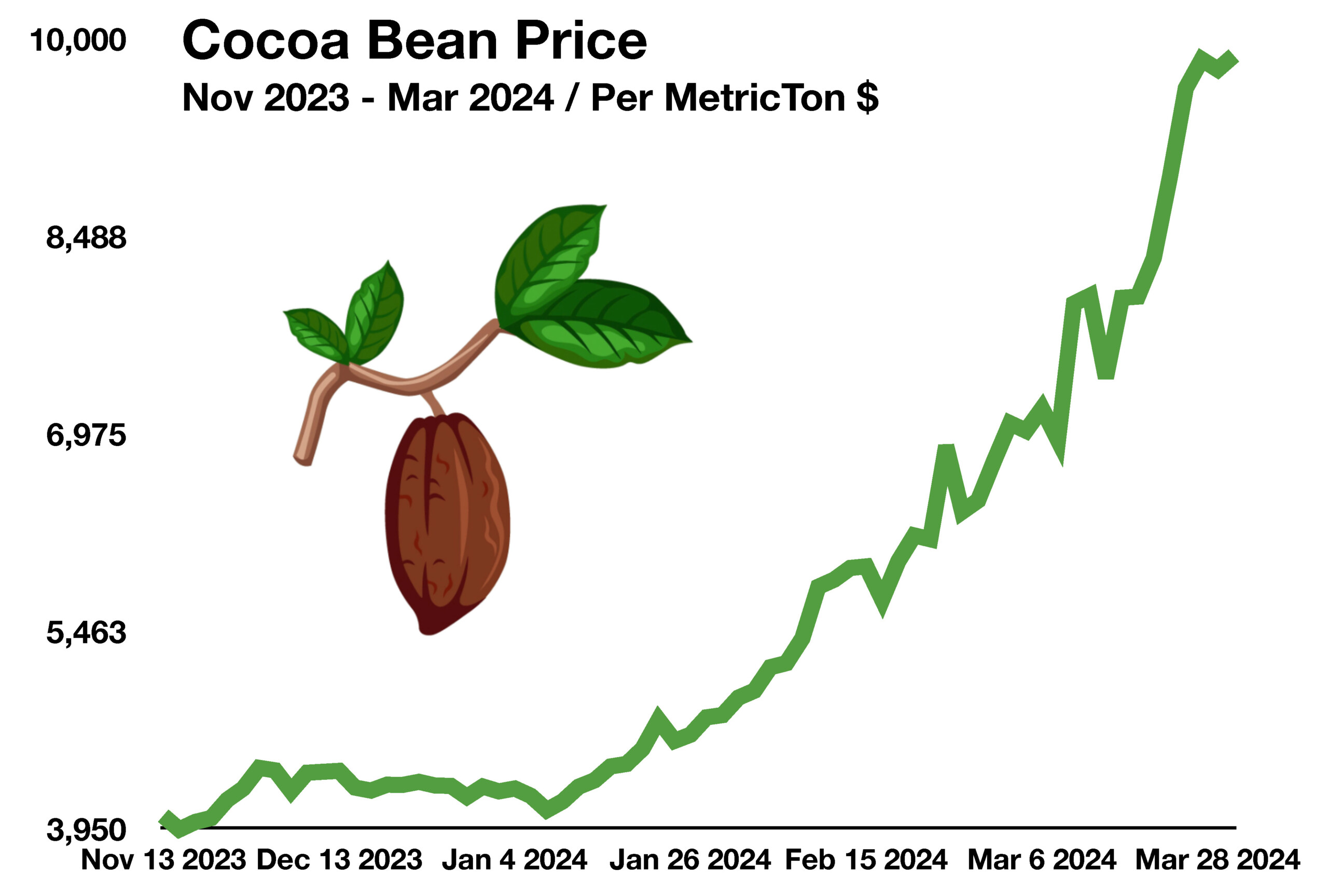

Shrinkflation is when companies sell a smaller or lesser amount of a product, but for the same price. The trend has become common from food products to cars, where consumers are getting less yet still spending the same. Higher production costs, including raw materials and labor, have forced companies to either raise prices or shrink product portions in order to maintain profit margins.

Sources: Maryland Port Administration, ECB, Federal Reserve, Labor Dept., EuroStat, U.S. Treasury

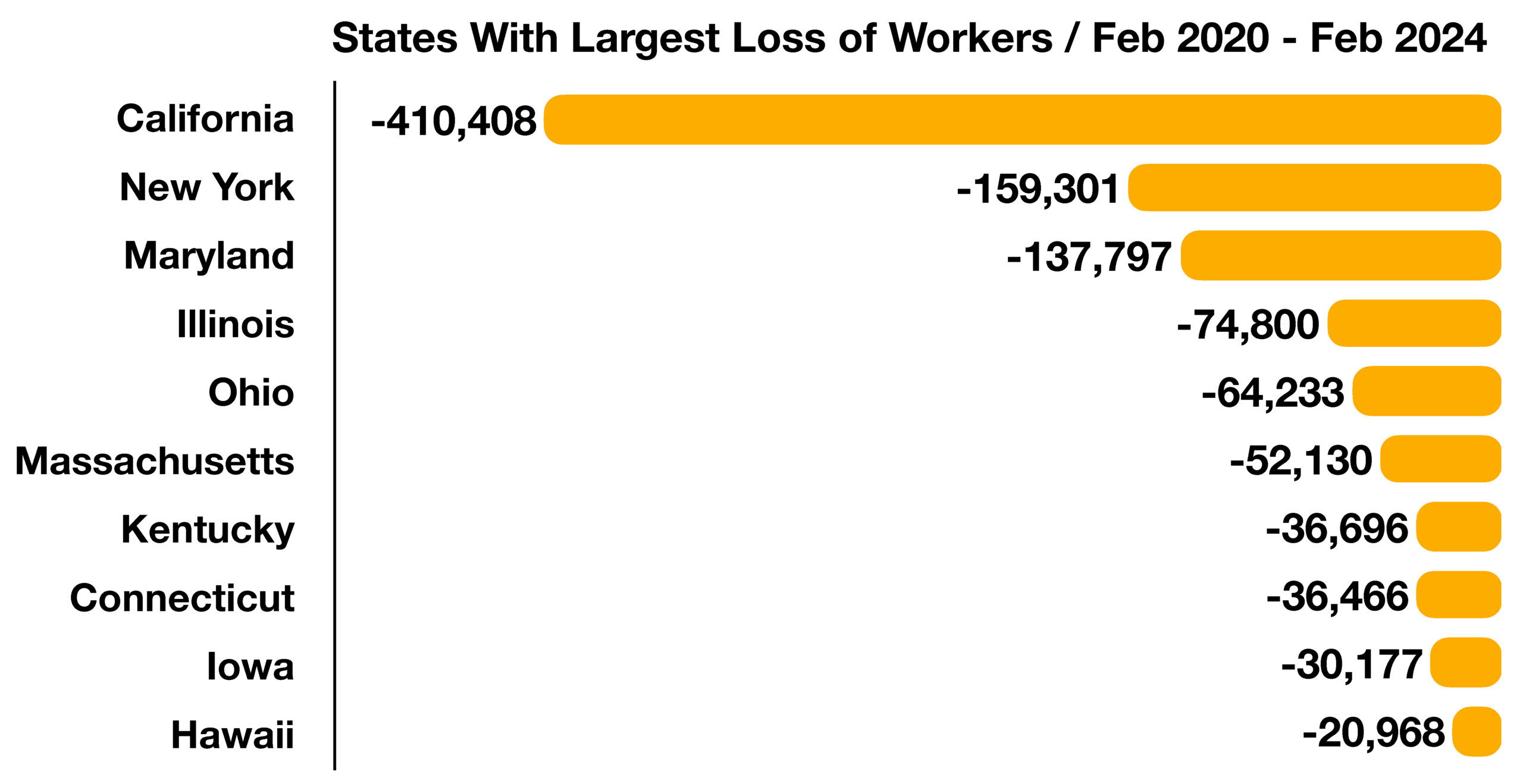

Nearly five years after the pandemic, migration from various states has been consistent. California and New York combined lost over half a million workers to other states from 2020 to 2024, while Texas took in one million new workers during the same period. Florida also saw a dramatic increase with over 750,000 new workers flooding into the state. Cost of living, taxes, and housing are among some of the reasons for the migrations.

Nearly five years after the pandemic, migration from various states has been consistent. California and New York combined lost over half a million workers to other states from 2020 to 2024, while Texas took in one million new workers during the same period. Florida also saw a dramatic increase with over 750,000 new workers flooding into the state. Cost of living, taxes, and housing are among some of the reasons for the migrations. Historically, rising fuel prices eventually hinder economic growth, thus slowing industrial and consumer activity and lessening demand for fuel. Economists note that a recession would likely curtail demand for fuel, bringing fuel prices lower. (Sources: U.S. Energy Information Administration)

Historically, rising fuel prices eventually hinder economic growth, thus slowing industrial and consumer activity and lessening demand for fuel. Economists note that a recession would likely curtail demand for fuel, bringing fuel prices lower. (Sources: U.S. Energy Information Administration)