Aspen Wealth Management, Inc.

9300 W. 110th Street, Suite 680

Overland Park, KS 66210

913.491.0500

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

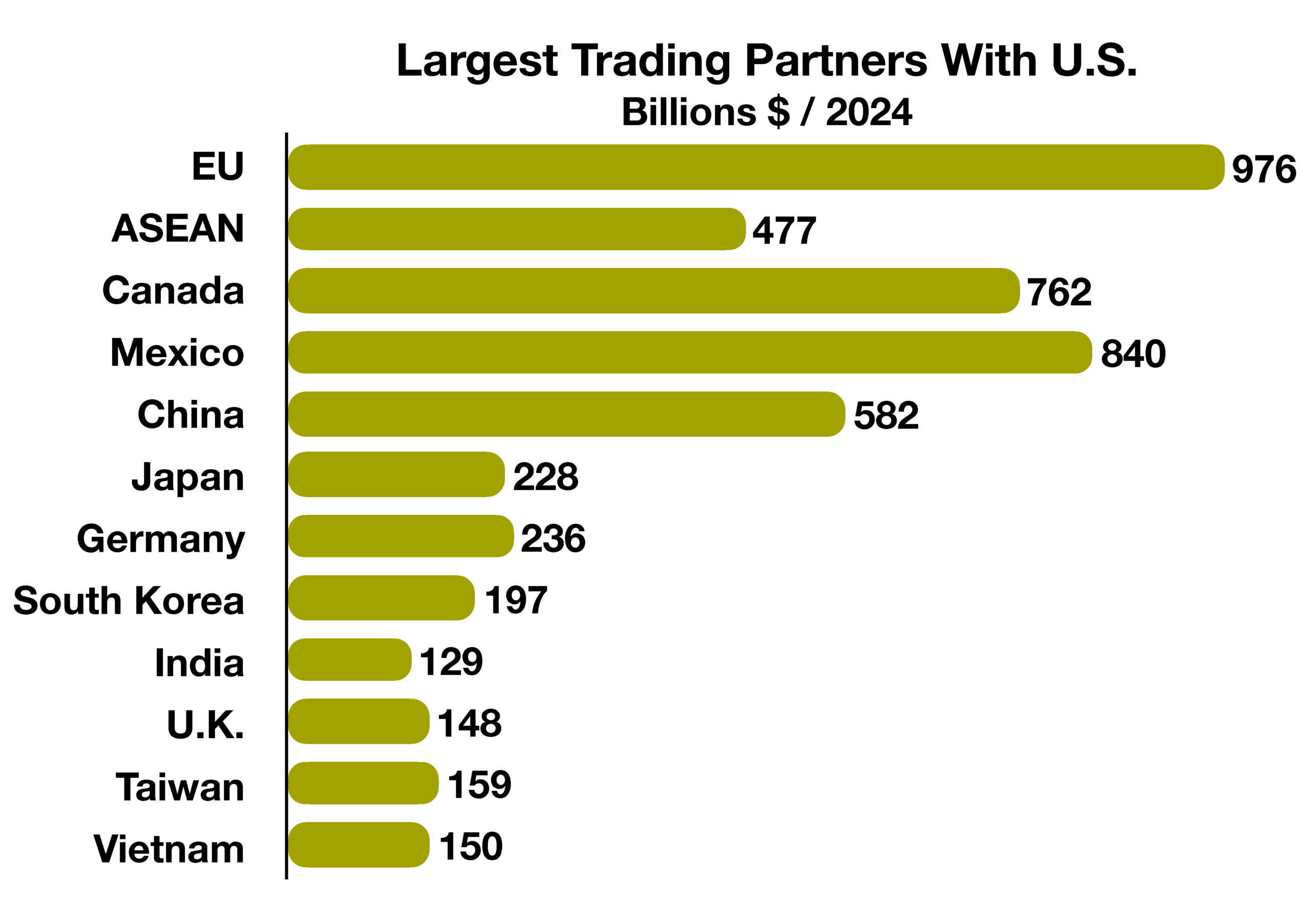

Turmoil swept through the global markets as the recently announced tariffs proved broader and more significant than anticipated. Concerns over economic contraction have now overtaken inflation fears, as the toll on global trade casts doubt on the pace of continued expansion.

Major equity indices around the world lost trillions in market value amid growing uncertainty and fears of retaliation among international trading partners. Commodity prices and cryptocurrency tumbled as volatility gripped both domestic and international financial markets. Cryptocurrencies in particular plunged, while bonds and cash emerged as safe havens amid spontaneous selling pressure and widespread uncertainty.

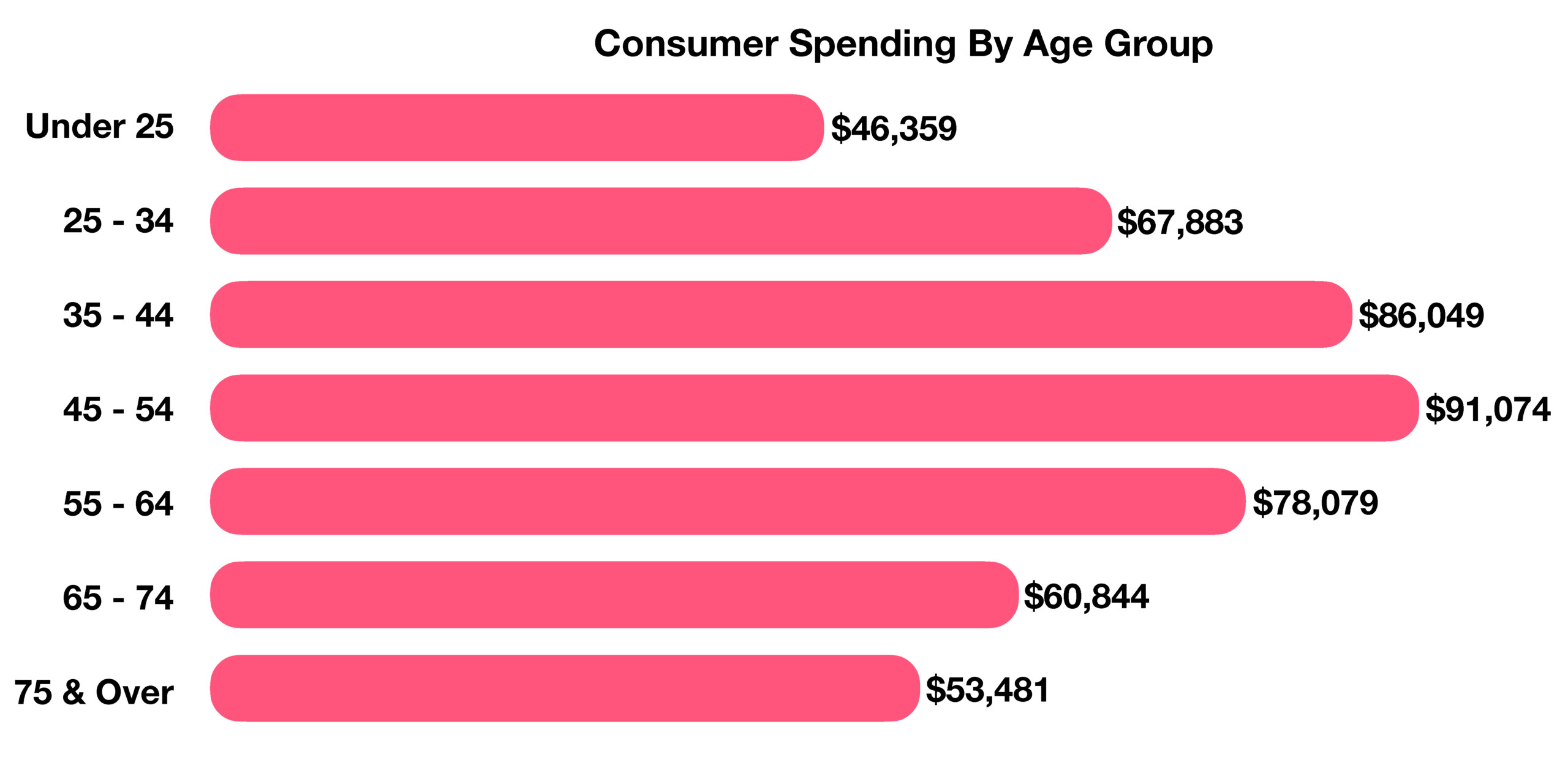

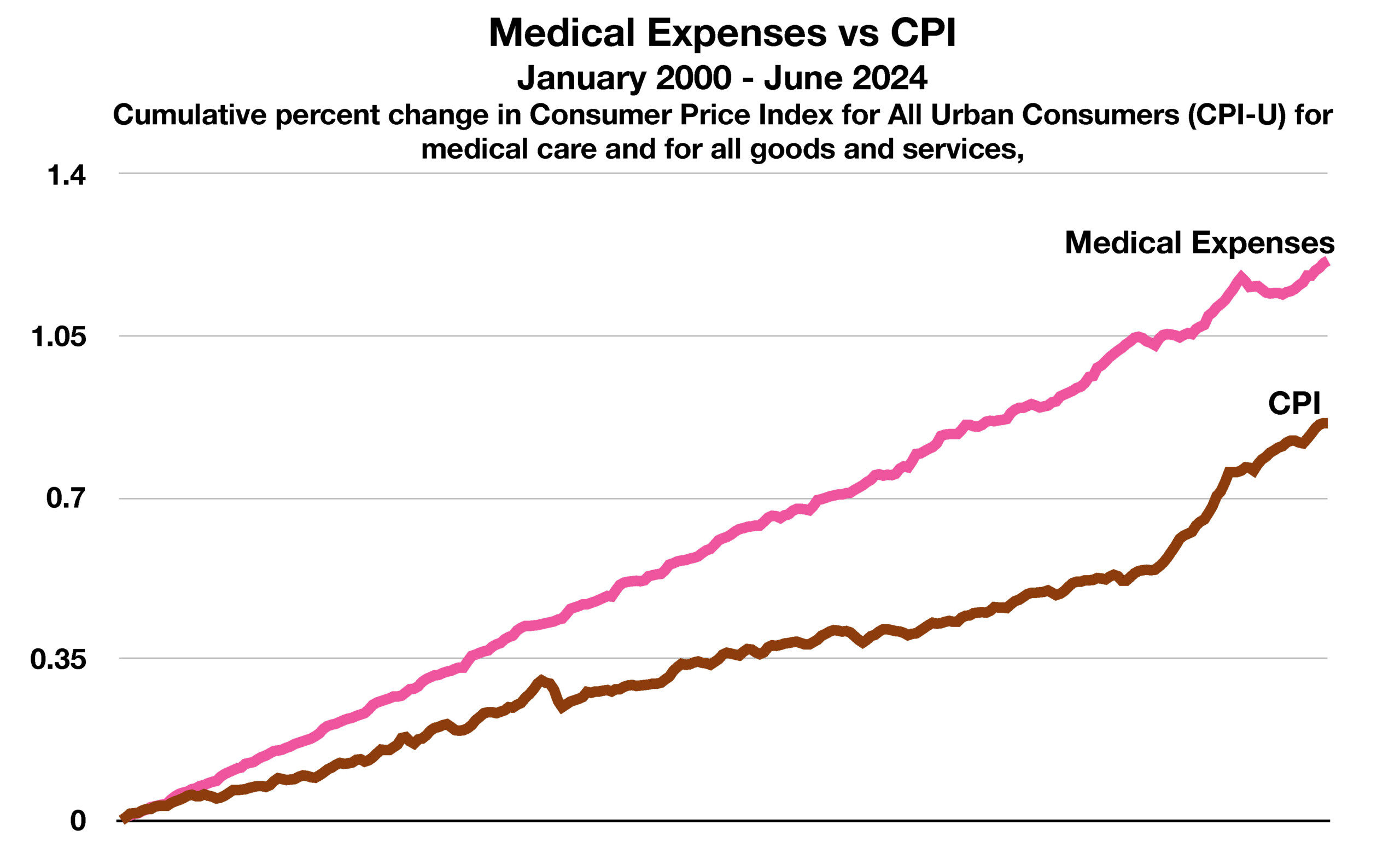

Consumers rushed to stores and auto dealerships across the country in anticipation of rising prices on imported goods. A consumer-driven slowdown in economic growth is now expected, with higher prices resulting from the newly imposed tariffs. Economists and analysts warn that the “wealth effect” could take hold, as sharp declines in equity markets reduce the value of investment portfolios for millions of Americans.

What caught many off guard was the inclusion of numerous smaller exporting nations, which will now also face a minimum 10% tariff on all goods exported to the U.S. These costs are often passed along the supply chain, ultimately burdening consumers. As a result, tariffs are frequently referred to as “taxes on consumers.” The broad scope of these tariffs is likely to drive prices higher and contribute to a potential economic slowdown.

The White House announced that 75 countries have reached out to discuss potential trade agreements with the United States. In response to ongoing volatility in global financial markets—particularly within the U.S. bond market—President Trump has implemented a 90-day pause on most reciprocal tariffs. This temporary suspension is intended to create space for negotiating stronger trade deals, with a primary focus on China. Despite the pause, tariffs on Chinese imports were raised to 125%, while the 10% baseline tariff and existing duties on automobiles, steel, and aluminum remain in place.

Sources: Treasury Dept., WhiteHouse.gov., Federal Reserve