Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

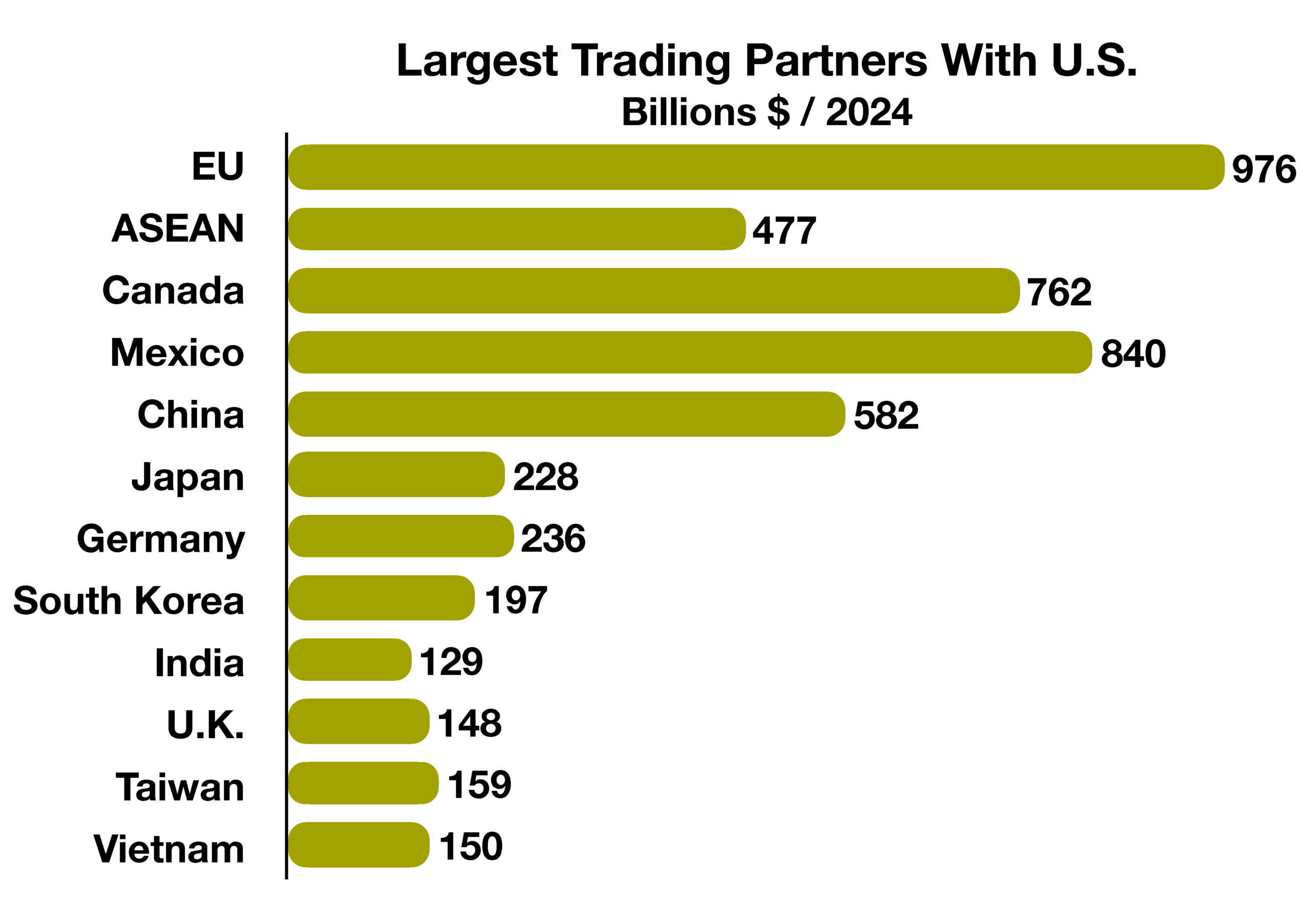

Turmoil swept through global markets as tariffs announced by the Trump administration were broader and steeper than expected. Economic contraction worries surpassed inflation fears as the toll of tariffs on global trade cast doubt on continued expansion.

Major equity indices shed trillions in valuations as the fear of disruption in global trade led to uncertainty and retaliation among international trading partners. Commodity prices tumbled as uncertainty pummeled domestic and international financial markets. Cryptocurrency values plunged as bonds and cash became safe havens amid selling pressures, and uncertainty roiled global markets.

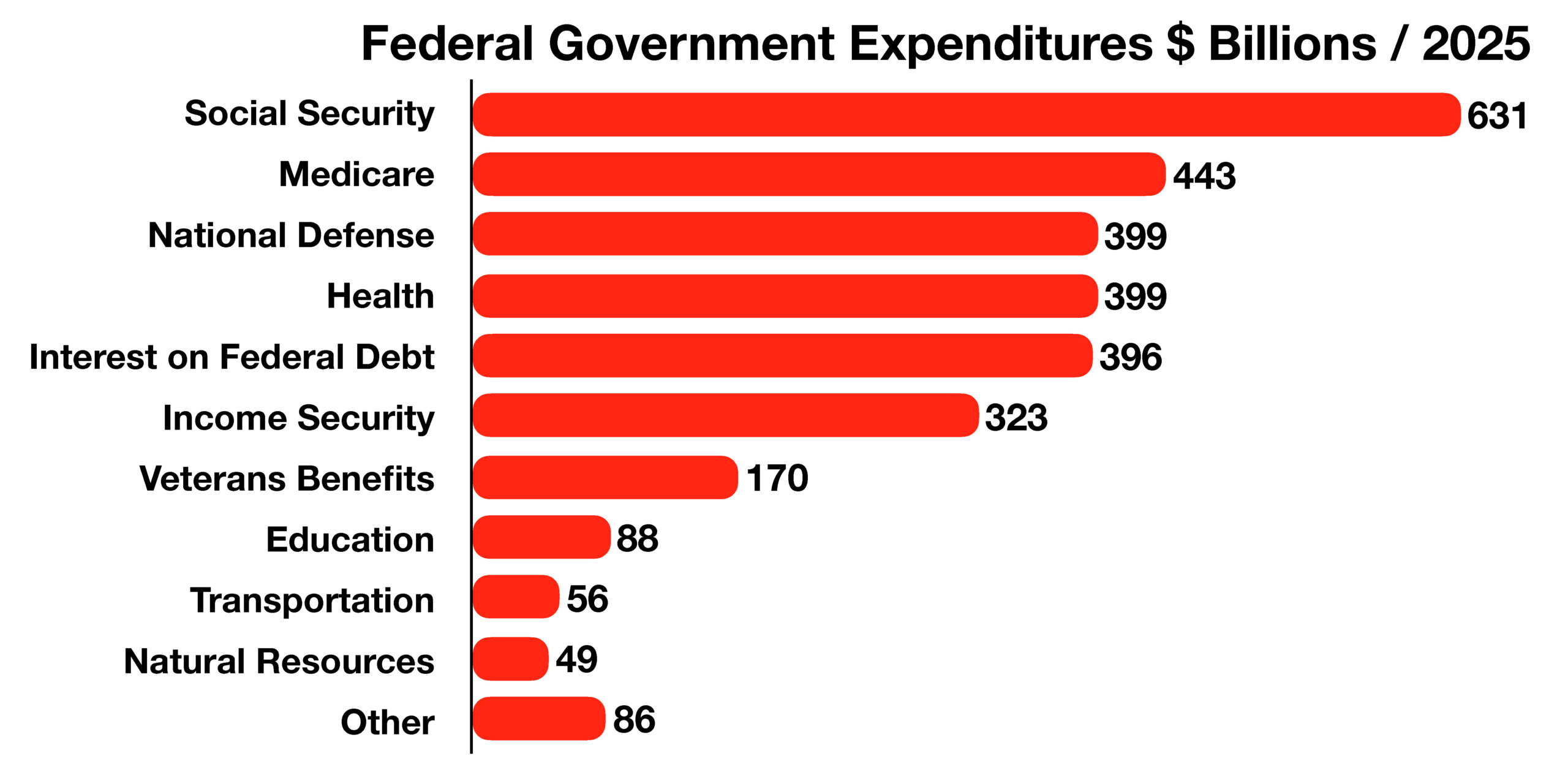

Consumers rushed to stores and auto lots in anticipation of increasing prices for imported products. A consumer-led contraction in economic expansion is widely expected to follow higher prices driven by the new tariffs. Economists note that the wealth effect may influence consumers to spend less as the dramatic pullback in equity markets devalues stock portfolios and retirement investment accounts.

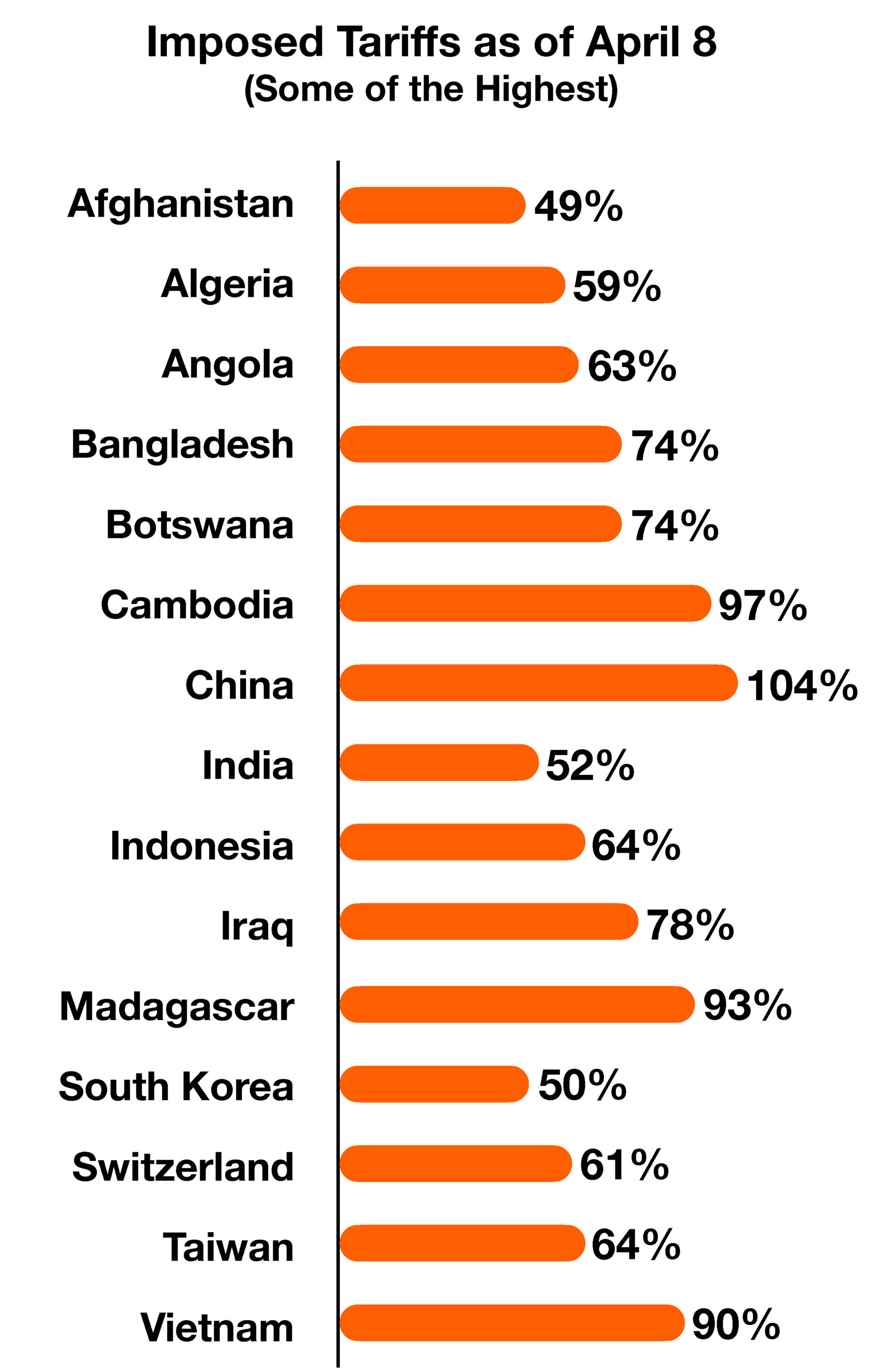

Unexpected was the inclusion of numerous smaller exporting countries, which will also see a minimum 10% tariff on all goods exported to the U.S. Most businesses are forced pass on much of the cost through higher prices to suppliers and consumers. This is why tariffs are often described as “taxes on consumers.” The tariffs will have a broad impact on consumers, who will likely bear the cost of the tariffs, leading to higher prices and a potential economic slowdown.

The White House communicated that the tariffs that became effective on April 5 & 9th will remain in effect until such a time that the President determines that the perceived threat posed by the trade deficit and underlying nonreciprocal treatment is satisfied, resolved, or mitigated. Treasury Secretary Scott Bessent said on Sunday April 6th that more than 50 countries had called the administration seeking negotiations on tariffs.

Sources: Treasury Dept., WhiteHouse.gov., Federal Reserve