Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

Macro Overview

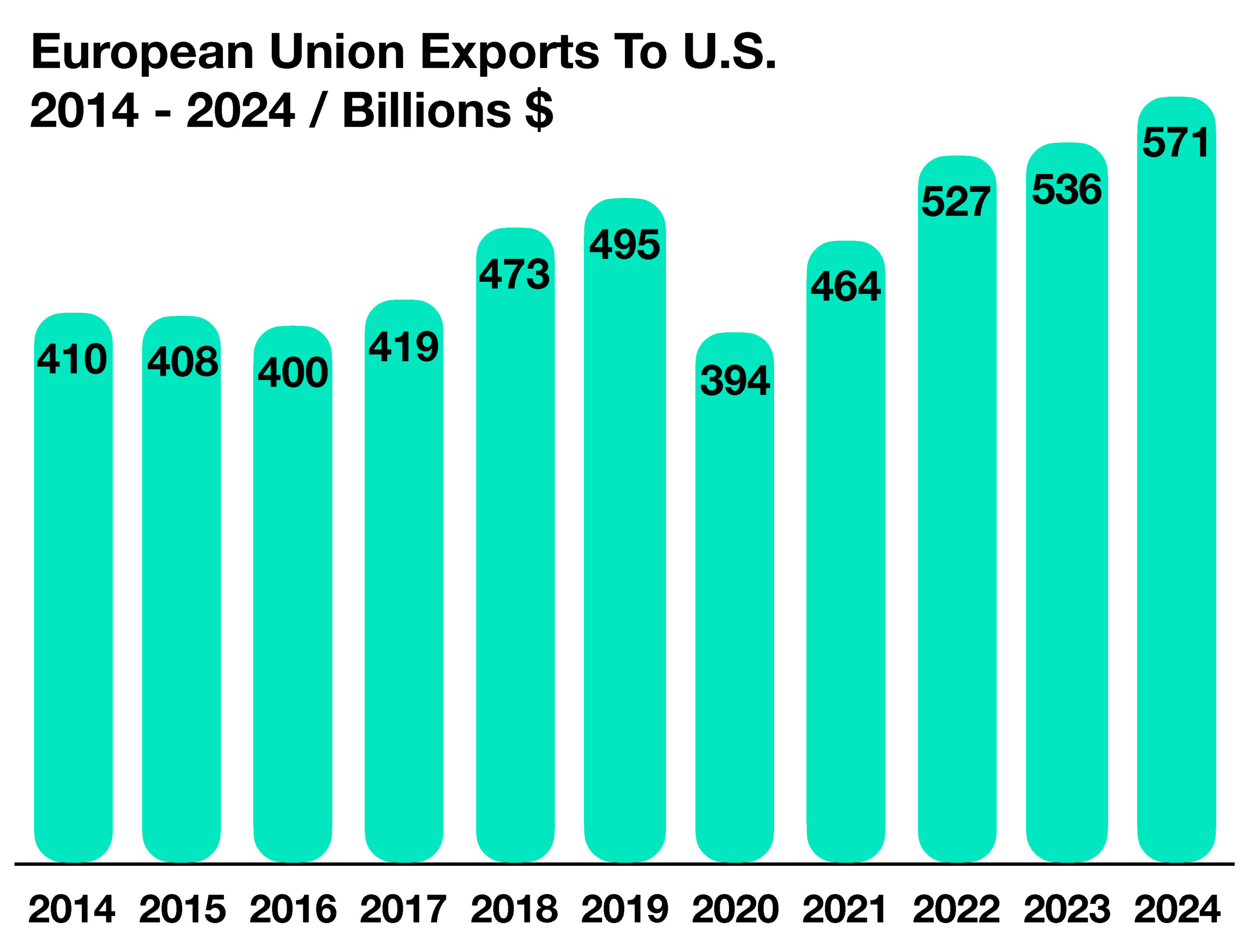

Markets swung as uncertainty deepened over the impact of tariffs on corporate earnings and consumer sentiment. Economists and analysts say it remains difficult to quantify how much tariffs have dented profitability or shifted consumer behavior.

Prices for a range of goods rose in June, a sign some companies may be passing higher tariff costs to consumers. The Consumer Price Index climbed 2.7% from a year earlier, up from May’s 2.4% increase, Labor Department data show. Furniture, toys, and clothing—categories particularly sensitive to tariffs—posted outsized gains.

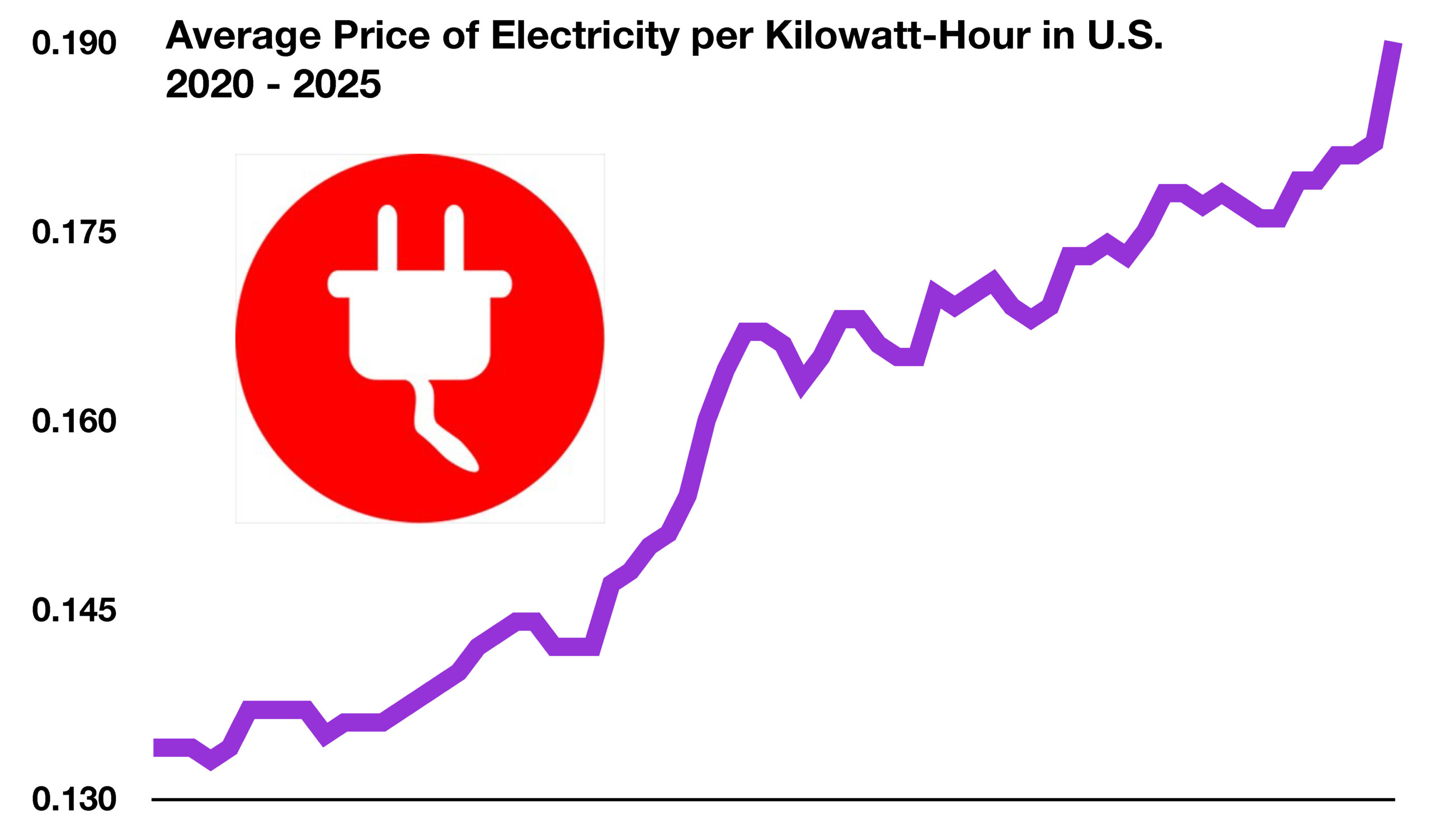

Deregulation and surging demand for electricity and natural gas, fueled by the build-out of artificial-intelligence infrastructure such as data centers, are creating growth prospects for the traditionally slow-growing utility sector.

The U.S. economy expanded at a 1.2% annualized rate in the first half of 2025, while consumer spending rose just 0.9%, pointing to a slowdown across industries.

Equities wavered in July as investors weighed how much of the new tariffs companies are absorbing versus passing through to customers. Corporate earnings reports reveal a split: some firms are swallowing the costs, while others are hiking prices.

Questions over the Bureau of Labor Statistics’ data-collection methods have fueled skepticism about the accuracy of employment and labor-force figures. Since the pandemic, key government indicators have undergone frequent and sometimes dramatic revisions, clouding the economic picture. The integrity of this data remains a cornerstone of the U.S. Treasury market.

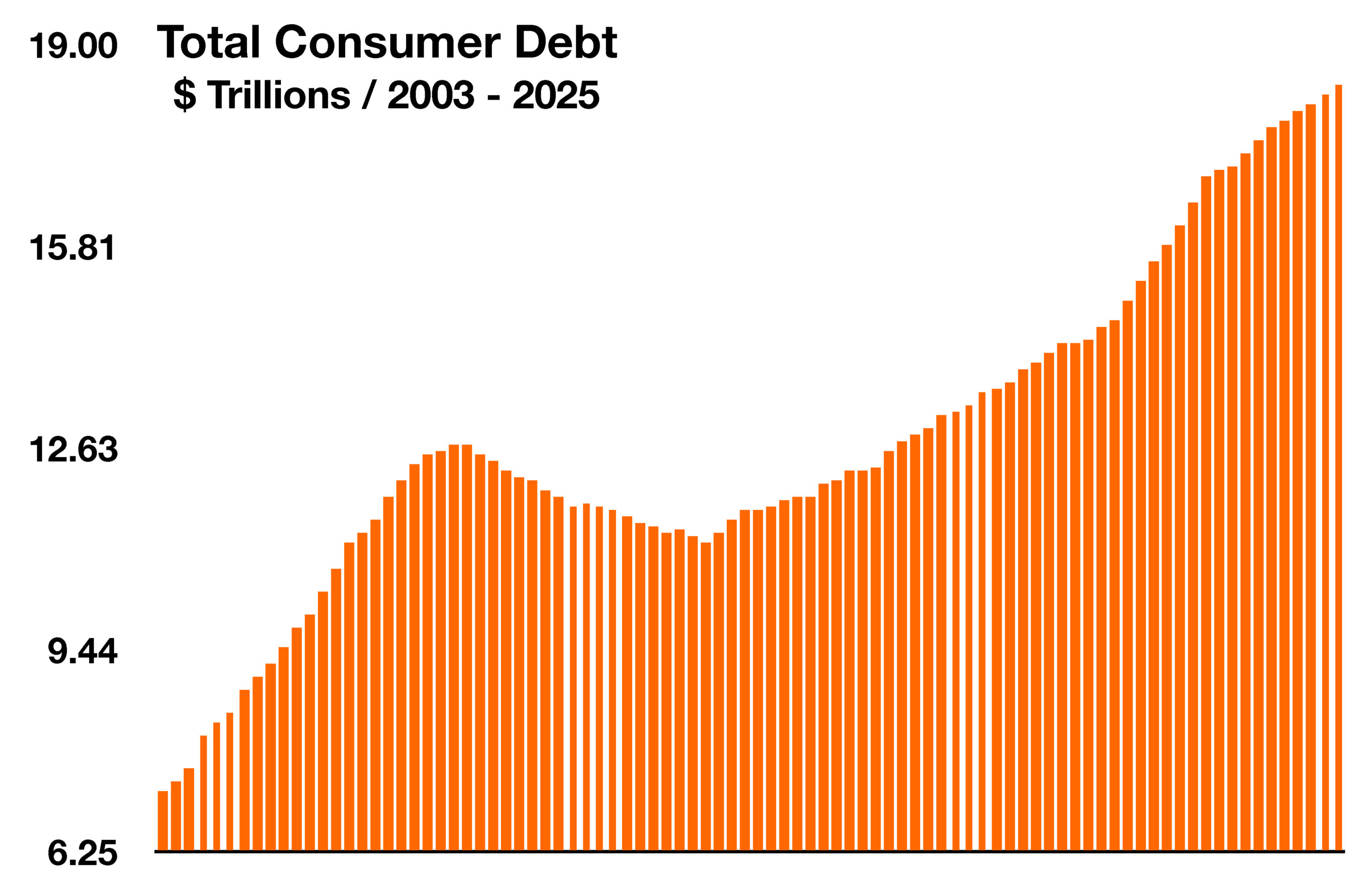

Roughly half of retirees pay taxes on Social Security benefits, which help finance Medicare and future payouts. Lower tax rates and recent provisions are expected to cut revenue to both programs, according to the Committee for a Responsible Federal Budget. The Social Security Trust Fund could be unable to pay full benefits as soon as 2032, a shortfall driven by a declining birthrate and longer life spans, which mean fewer workers are supporting more beneficiaries.

Technology companies have announced more than $1.5 trillion in U.S. investment commitments so far this year, betting on favorable policy outcomes on tariffs and digital-trade rules. The spending spans factory construction, research and development, and hiring.

Sources: BLS, U.S. Treasury, Bloomberg, SS.gov, CRFB, WhiteHouse.gov

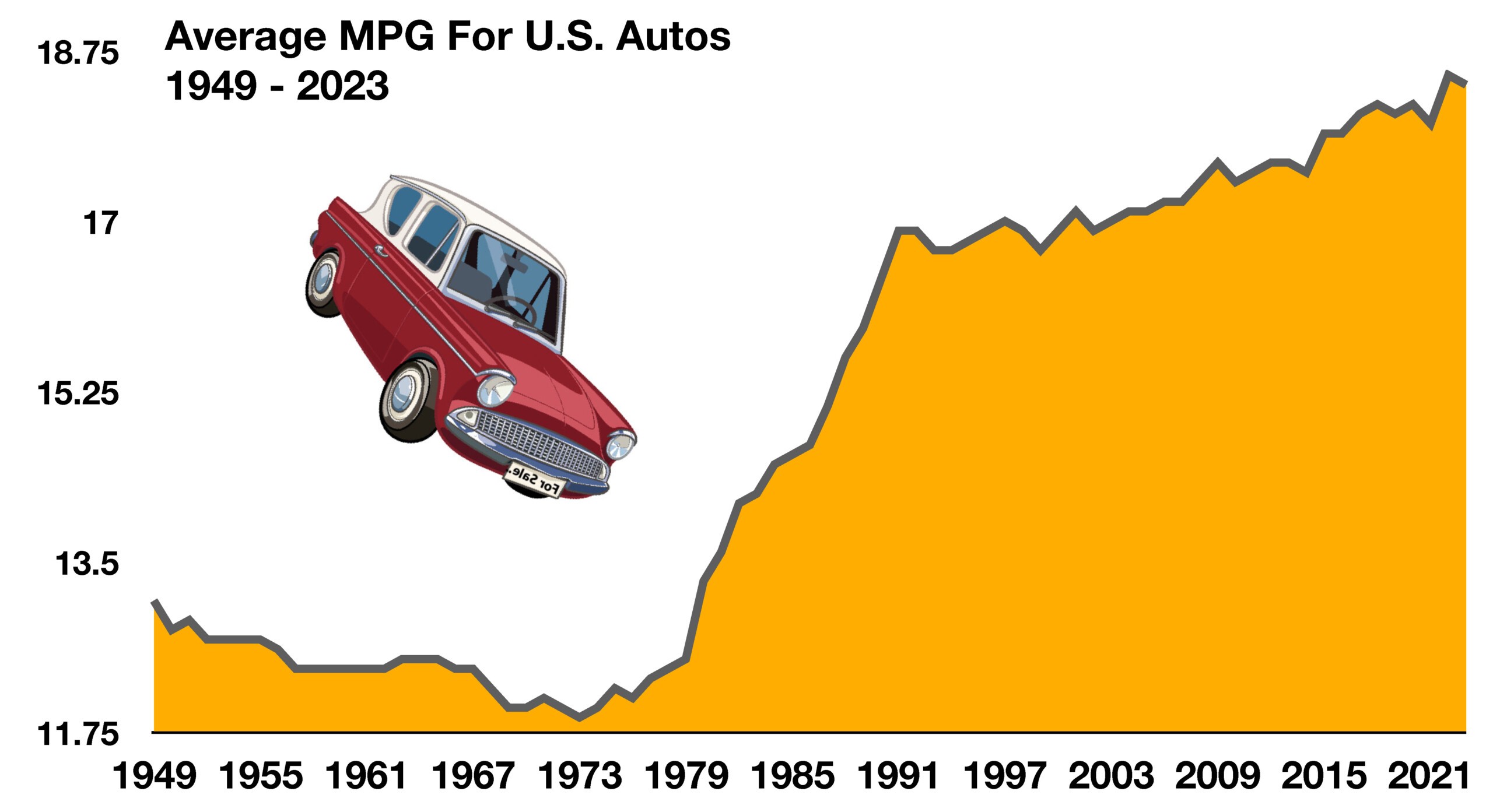

Data from the U.S. Energy Information Administration, which has tracked fuel use since 1949, shows a steady decline in consumption per vehicle, translating into improved miles per gallon. The average vehicle achieved roughly 13 MPG in 1949; the most recent data puts that figure at 18.4 MPG. (Sources: U.S. EIA)

Data from the U.S. Energy Information Administration, which has tracked fuel use since 1949, shows a steady decline in consumption per vehicle, translating into improved miles per gallon. The average vehicle achieved roughly 13 MPG in 1949; the most recent data puts that figure at 18.4 MPG. (Sources: U.S. EIA)