Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

“Few topics offer a more powerful magnifying glass that explain why people behave the way they do more than money. It is one of the greatest shows on Earth” – The Psychology of Money by Morgan Housel

Dear Friends,

When I was beginning my financial services profession I was lucky enough to be able to spend time with some of Bozeman’s most experienced and renowned financial advisors. During a period of unusual ‘volatility’ (jargon for people losing money), I asked one of them what he thought about it. His reply was sage advice – “This is just noise and should be ignored for long term investors”. It’s the best answer, it’s the only answer, it’s what we should always do! Well, the date was March of 2008 and the market proceeded to go straight down for a year and destroy the fortunes of millions of people. It just goes to show you, investing is not a science. Instead perhaps it is more of a ‘soft skill’, as author Morgan Housel describes it, one greatly shaped by our personal experiences and governed by our unique behavior.

I just read ‘The Psychology of Money’ and it’s a fantastic read! Housel’s book tells stories about money that illustrate 20 separate lessons we can all relate to. But at the heart of it, he eloquently describes something that we are all wise to recognize: while the average market return is important, it rarely describes our own individual experience because we are humans, caught in our own lives and times. Keeping that in mind helps us make prudent investment decisions, not those based in greed or fear.

Community Type II Fun!

Speaking of fear, there has not been a significant and sustained correction in the market since COVID. Crypto dollars, hedge funds in 401k’s, and Fed Rates being set by politicians are all things that could spell real trouble down the road. It’s a risky thing to invest in the stock market at new highs and it should feel scary to commit significant portions of your net worth to something so esoteric and out of your control. There are no guarantees that the music won’t stop tomorrow!

However, if there were no risk, there would be no reward. And to us, things look pretty good as of now. Currently, we have a pro-growth government, very low unemployment, manageable inflation, and household net worth has grown by $50T since the pandemic and consumers have $9 in assets for every $1 in liabilities. The club of ultrahigh net worth individuals with more than $30 million in assets hit a record in 2024. The U.S. added more than 1,000 millionaires every day last year on average. And the billionaire club grew more than 50% between 2015 and 2024. We recognize that these are the salad days and now is a great time to prepare for rain, the bad kind. Use extra money to reduce debt, bolster emergency funds, and diversify. But after that, we think the markets have more to give. Call us if you or someone you care about could use a hand.

BLS, U.S. Treasury, Bloomberg, SS.gov, CRFB, WhiteHouse.gov, UBS, Altra, JP Morgan

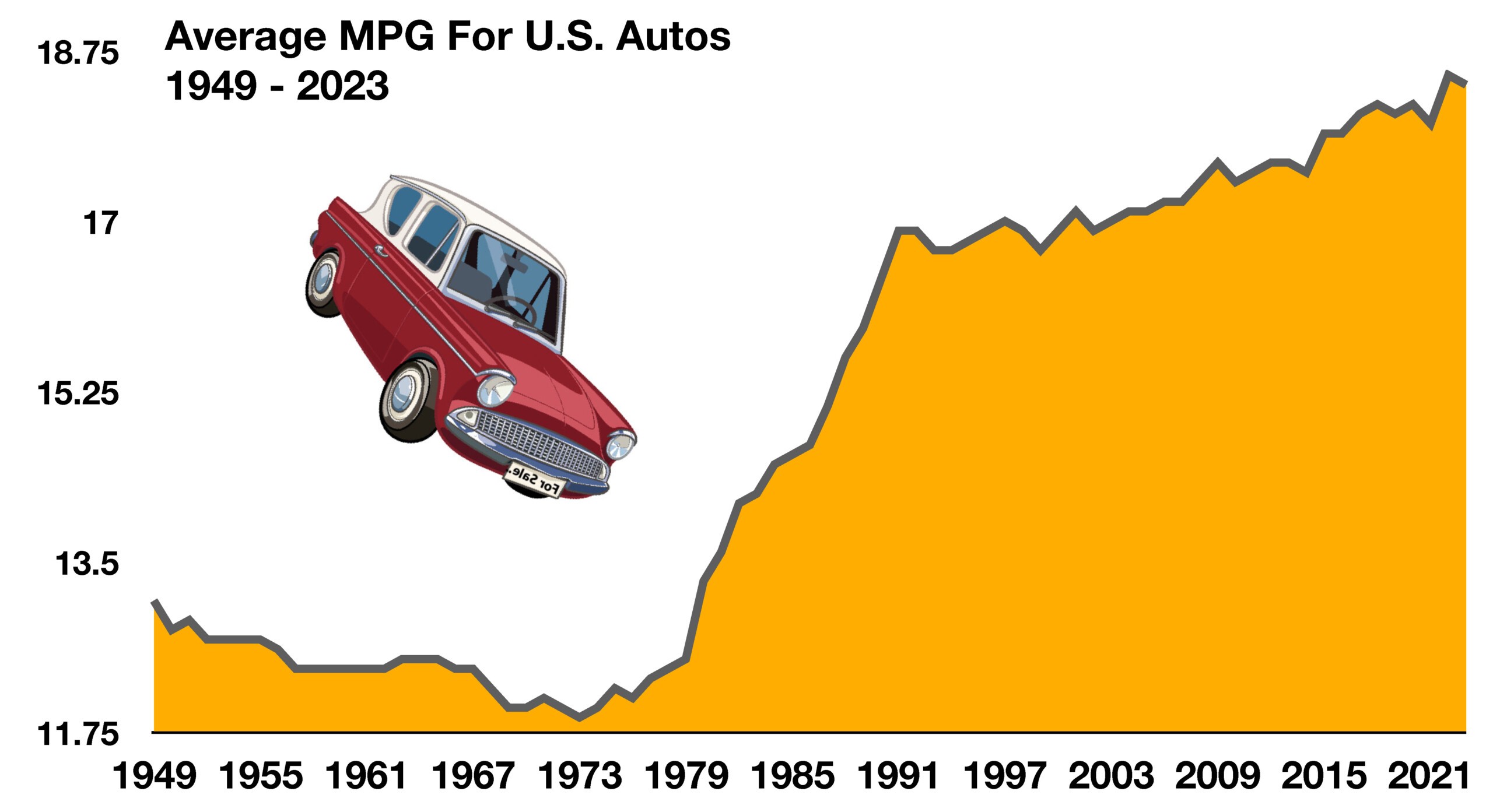

Smaller, more efficient 4 cylinder engines now produce the same amount of power as earlier V8 engines from the 70s and 80s that were known as “fuel hogs”. Data collected by the U.S. Energy Information Administration as early as 1949, has shown a gradual decrease in fuel consumption per vehicle, translating into higher miles per gallon (MPG). The average vehicle in 1949 achieved roughly 13 MPG, while the average vehicle as of the most recent data was 18.4 MPG. (Sources: U.S. Energy Information Administration)

Smaller, more efficient 4 cylinder engines now produce the same amount of power as earlier V8 engines from the 70s and 80s that were known as “fuel hogs”. Data collected by the U.S. Energy Information Administration as early as 1949, has shown a gradual decrease in fuel consumption per vehicle, translating into higher miles per gallon (MPG). The average vehicle in 1949 achieved roughly 13 MPG, while the average vehicle as of the most recent data was 18.4 MPG. (Sources: U.S. Energy Information Administration)