Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

Portfolio Overview

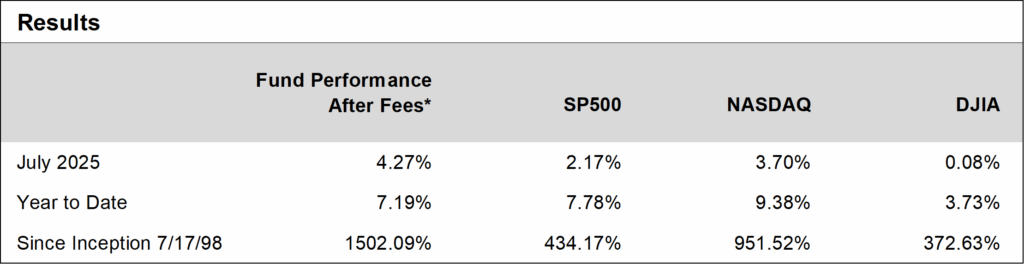

Ocean Park Investors Fund delivered a strong performance in July, advancing 4.27%* for the month, while the S&P 500 gained 2.17% and the NASDAQ Composite gained 3.70%. The fund’s gain reflected notable moves across individual stocks and key industries.

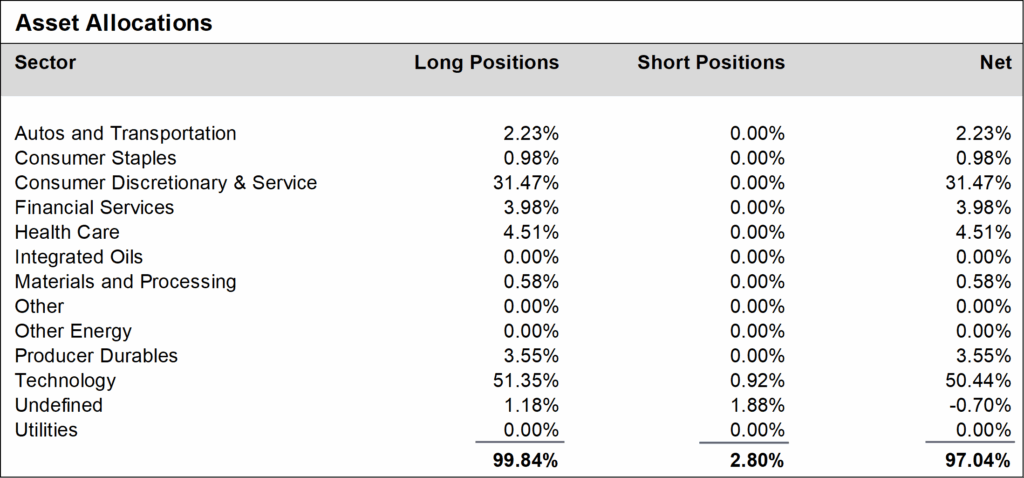

Strength during July was led by the technology sector, which remained a centerpiece of the fund’s strategy. Microsoft stood out, as robust cloud growth and AI-driven optimism propelled the stock to a new all-time high and briefly to the first $4-trillion valuation. Advanced Micro Devices also contributed, rising 24% on strong demand for its data center and AI chips, as did Astera Labs which surged 51%. In the consumer discretionary sector, Carvana gained 16% amid better-than-expected retail demand and strong execution, while Dollar Tree and Tapestry rose 20% and 23% respectively.

In July, the fund exited positions in Visa, Carpenter Technology, Coca-Cola, and Seagate Technology (which was replaced by Western Digital), as well as Camtek, AT&T, Honeywell, and Byrna Technologies. New positions included Celsius Holdings, eBay, Mosaic, and Wayfair, each selected for unique growth attributes—such as Celsius’ rapid share gains in the performance beverage market and eBay’s value-driven e-commerce exposure as consumer behavior shifts.

*These results are pro forma. Actual results for most investors will vary. For daily updates on our activity, call our Results Line at 310-281-8577. Current information is also available at oceanparkcapital.com; enter password opcap. Additional disclosures on page four. Past performance does not guarantee future results.