Estate & Trust Advisors

707 Skokie Blvd Suite 300 Northbrook, IL 60062

Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

One Big Beautiful Bill Act Highlights Estate Tax Exclusion: Increases to $15 million for single filers and $30 million for married filers in 2026, and with further inflation-indexed increases after 2026. Different from prior estate tax exclusion provisions in that the bill made this increase “permanent” in the sense that no automatic sunset or expiration date has been imposed. The current exemption for individuals of $13.61 million and $27.22 million for married couples, was set to be reduced by half at the end of 2025. Interest Deduction On Auto Loans: Interest on auto loans deductible, yet applicable to only new autos with final assembly in the U.S. for tax years 2025 – 2028. Deduction limited to $10,000 and phases out when income exceeds $100,000 for single filers and $200,000 for joint filers. Tax On Overtime Pay: This deduction, capped at $12,500 for individuals and $25,000 for joint filers, phases out for higher earners and is set to expire on December 31, 2028. While it doesn’t eliminate taxes on overtime, it provides a tax break for those working extra hours, potentially increasing take-home pay. Trump Accounts / MAGA Accounts: Tax-deferred investment accounts for newborn American children born in the United States between January 1, 2025 and December 31, 2028. Newborns will be seeded with a one-time government contribution of $1,000. The accounts will track a stock index and allow for parents and families to make additional private contributions of up to $5,000 per year. Account holders will be allowed to make partial withdrawals at age 18, and access the full amount at age 25, but only for specific purposes, such as paying for higher education or taking a loan to start a small business. Account holders gain full access to the funds at age 30 to use it for any purpose. Parents or the child’s legal guardians manage the account until the child reaches 18. To open an account, the child’s guardian or parent must have a Social Security number and be authorized to work in the US. The initial $1,000 provided by the government to fund Trump Accounts is a government contribution, not a tax credit in the traditional sense for taxpayers who contribute to the account. There are no tax deductions for contributions, and earnings are taxed as ordinary income. Expanded 529 Plan Provisions The bill expands the definition of qualified expenses for 529 plans beyond traditional higher education costs and K–12 tuition to include a wider range of educational and career development opportunities such as vocational schools, trade schools, and technical schools. Newly eligible expenses include tuition, books, fees, exam costs, and supplies for workforce, on-the-job training, and continuing education programs. The $10,000 per-year limit for K–12 tuition and the $10,000 lifetime limit for student loan repayments remain in place. Federal tax treatment of 529 plan growth, as well as in-state tax deductions and credits, are unchanged Tax on Social Security The One Big Beautiful Bill (OBBB), also known as the Tax Cuts and Jobs Act of 2025, does not actually eliminate taxes on Social Security benefits, instead, it provides a temporary, income-based deduction for taxpayers aged 65 and older. The deduction is $6,000 per individual and phases out for those with higher incomes over $75,000 for single filers, $150,000 for joint filers. The deduction is not limited to those receiving Social Security benefits, it also applies to all seniors within the specified income limits. The deduction is temporary and set to expire at the end of 2028. The OBBB does not make any changes to the Social Security program itself, such as the benefits structure or eligibility requirements. StableCoins Evolving To Become More Accepted The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025) is landmark legislation aimed at creating the first comprehensive federal regulatory framework for payment via stablecoins in the United States.The GENIUS Act establishes clear rules for the issuance, backing, and supervision of payment via stablecoins and digital assets pegged to a stable value such as the U.S. dollar. Long term, the act seeks to integrate stablecoins into the mainstream banking and payments system, providing legal certainty and consumer protections. Sources: Tax Foundation, SSA.gov, TheWhiteHouse.gov Macro Overview

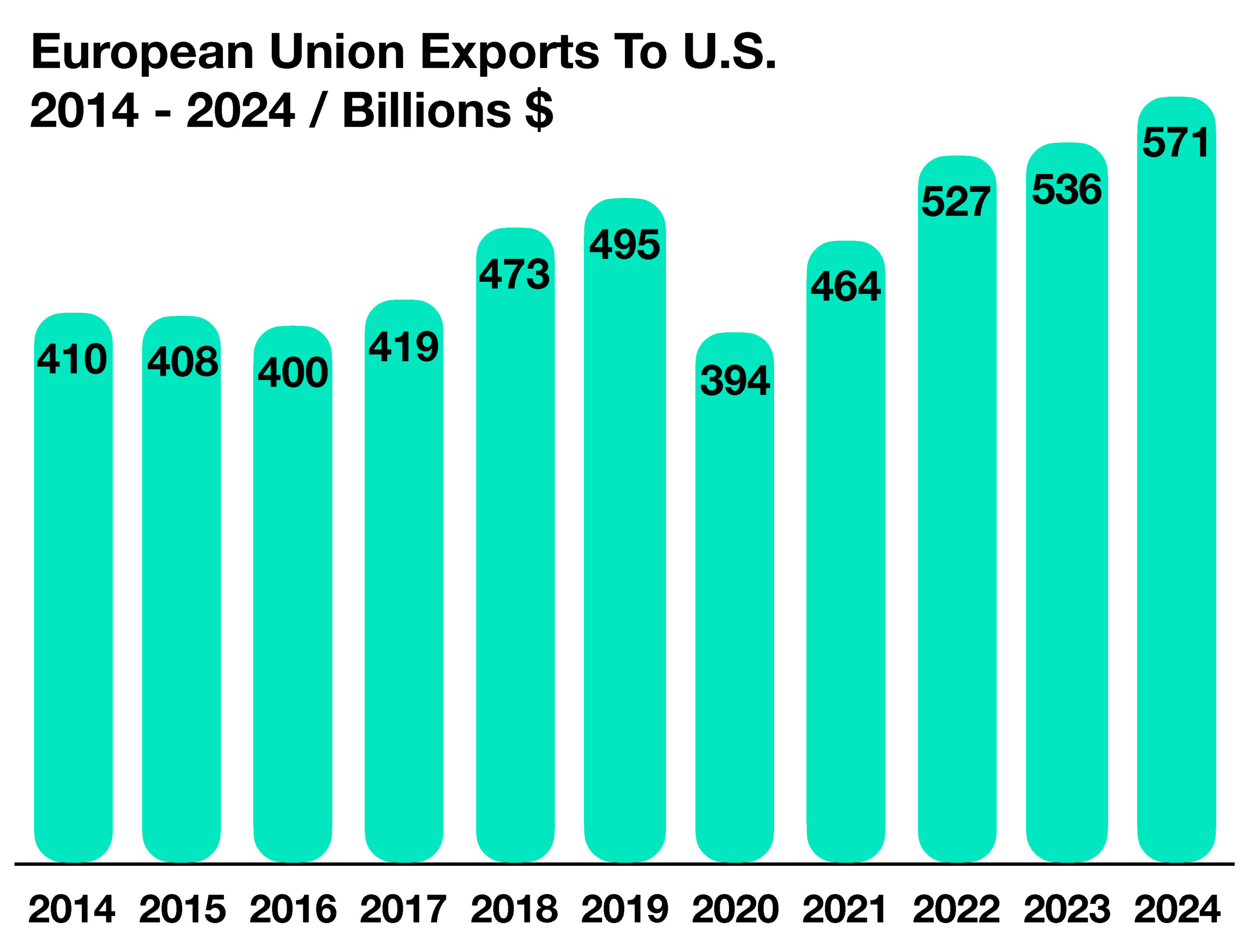

Markets reacted to uncertainty surrounding the effect of tariffs on corporate earnings and consumer sentiment, as economists and analysts have found it difficult to determine how much of an influence tariffs have had on profitability and consumers thus far.

The price of various goods picked up in June, a possible indication that companies may be starting to pass tariff costs on to consumers in the form of higher prices. The Consumer Price Index (CPI) rose 2.7% in June from a year earlier, as reported by Labor Department, faster than the prior month’s increase of 2.4%. The price of furniture, toys and clothes, which tend to be sensitive to tariffs, posted larger increases in June.

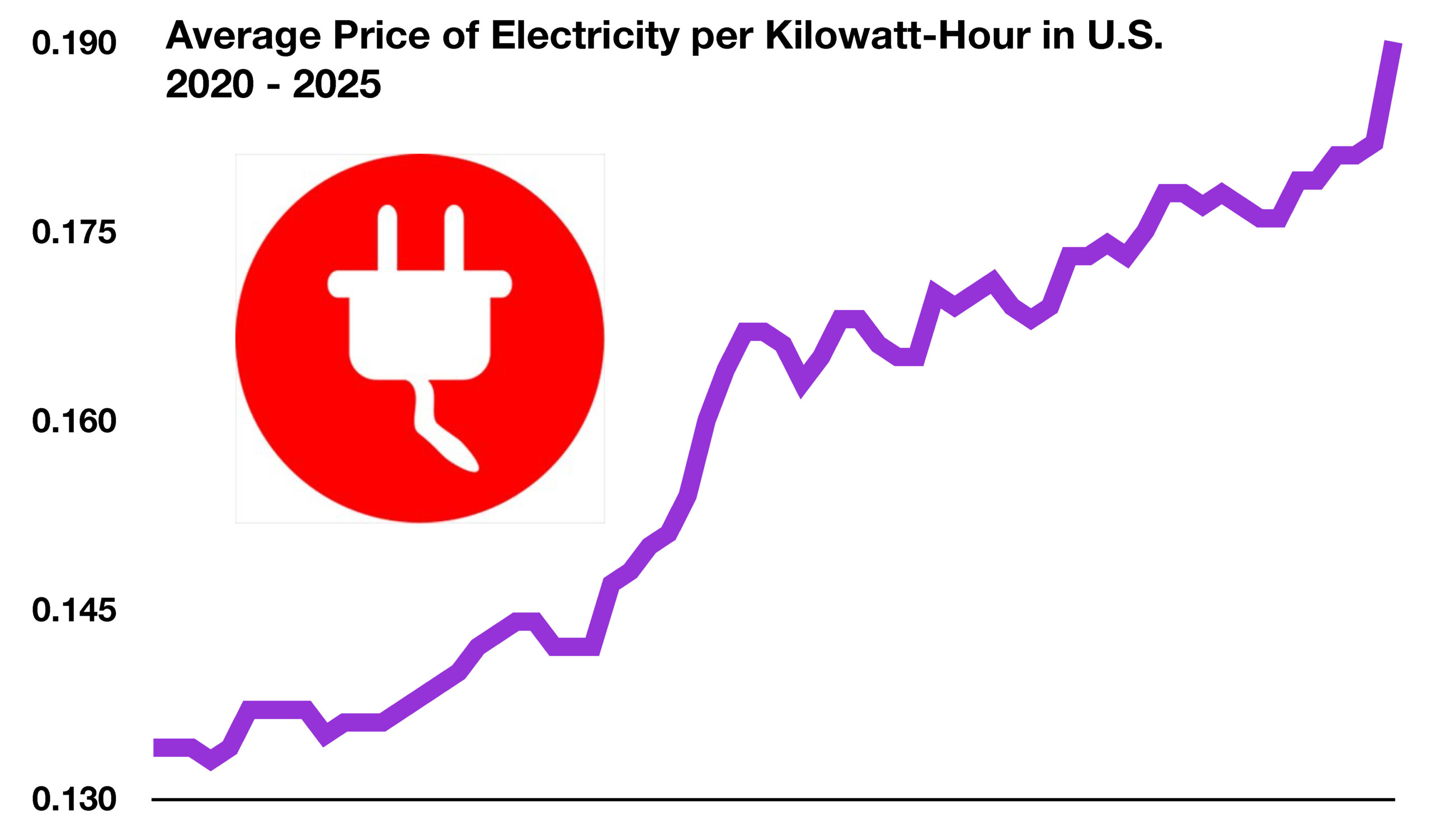

Progressive deregulation as well as the burgeoning demand for electricity and natural gas driven by the expansion of AI infrastructure (eg. data centers), is creating long term growth dynamics for the utility sector, which has historically never demonstrated growth characteristics.

The U.S. economy grew at an annualized rate of 1.2% in the first half of 2025, while consumer spending grew by 0.9% for the same period. The data is indicating slowing activity and decelerating expansion among various sectors.

Stocks wavered in July due to the challenge of determining how much of the newly imposed tariffs are being absorbed by U.S. companies and consumers. Recent company earnings have revealed that a portion of U.S. companies are absorbing tariff costs while others are passing tariffs along to consumers in the form of higher prices.

Questions surrounding the collection of data by the Bureau of Labor Statistics (BLS), has raised doubt about the accuracy of data revealing employment and labor force statistics. The government’s economic data has been less reliable than usual since the pandemic, undergoing constant revisions that in some cases have dramatically altered perceptions of the economy. The integrity and reliability of U.S. government data is also a critical component of the dynamics and function of the U.S. Treasury market.

Approximately half of retired seniors pay tax on Social Security benefits, which help fund Medicare and future Social Security benefits. Lower tax rates and new tax provisions are expected to reduce revenue into the Social Security Trust Fund and Medicare as estimated by the The Committee for a Responsible Federal Budget (CRFB). Regardless, it is projected that the Social Security Trust Fund will not be able to pay full scheduled benefits as early as 2032. The primary reason for the trust fund’s depletion is a declining birth rate and increasing life expectancy which translates into fewer workers contributing to Social Security relative to the number of beneficiaries receiving benefits.

The technology sector has announced more than $1.5 trillion in commitments to investing in the U.S. since the beginning of the year, hoping for favorable policies on tariffs and digital-trade barriers. The investments include the construction of factories, research & development, and employee hiring.

Sources: BLS, U.S. Treasury, Bloomberg, SS.gov, CRFB, WhiteHouse.gov

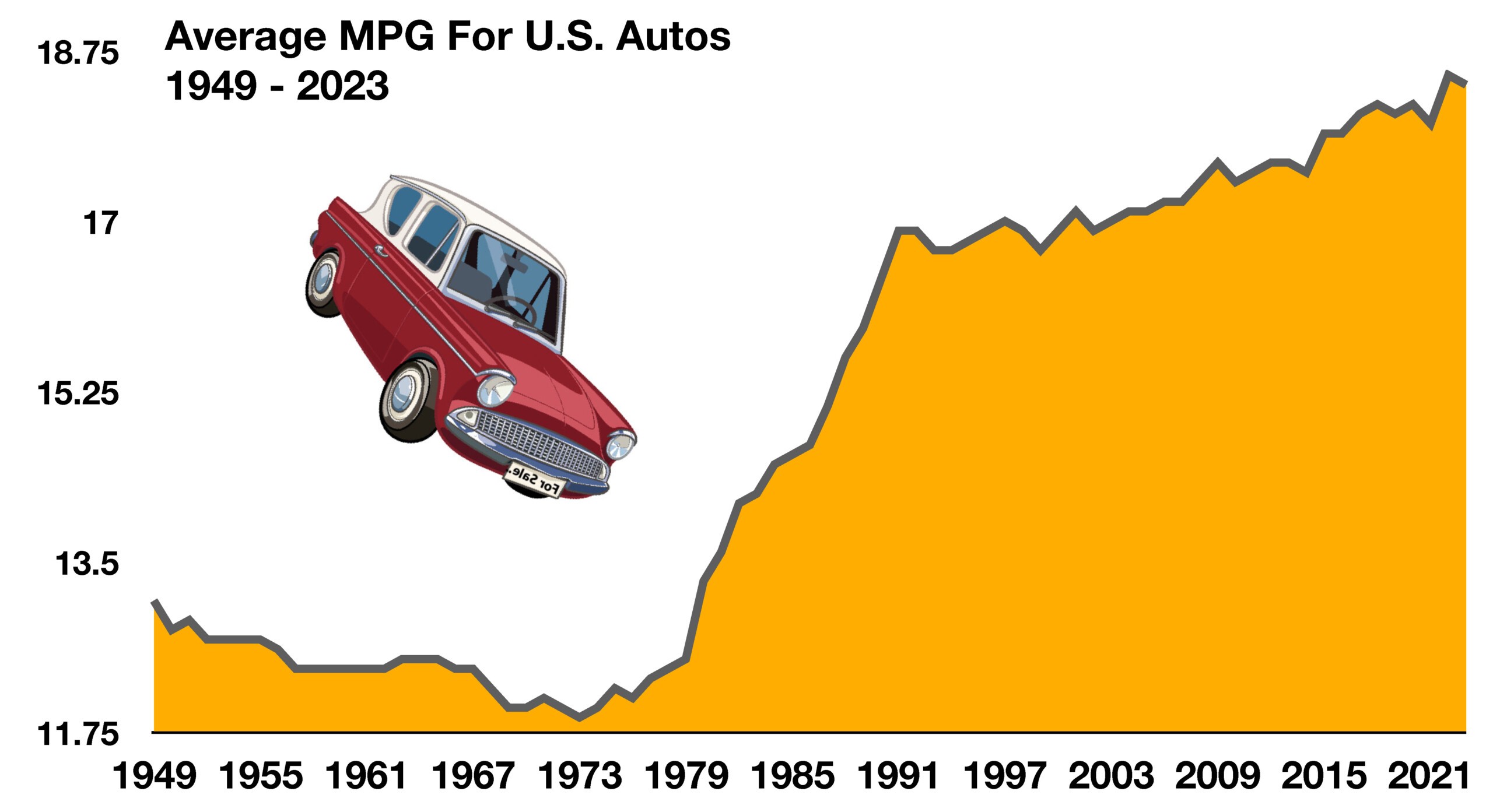

Smaller, more efficient 4 cylinder engines now produce the same amount of power as earlier V8 engines from the 70s and 80s that were known as “fuel hogs”. Data collected by the U.S. Energy Information Administration as early as 1949, has shown a gradual decrease in fuel consumption per vehicle, translating into higher miles per gallon (MPG). The average vehicle in 1949 achieved roughly 13 MPG, while the average vehicle as of the most recent data was 18.4 MPG. (Sources: U.S. Energy Information Administration)

Smaller, more efficient 4 cylinder engines now produce the same amount of power as earlier V8 engines from the 70s and 80s that were known as “fuel hogs”. Data collected by the U.S. Energy Information Administration as early as 1949, has shown a gradual decrease in fuel consumption per vehicle, translating into higher miles per gallon (MPG). The average vehicle in 1949 achieved roughly 13 MPG, while the average vehicle as of the most recent data was 18.4 MPG. (Sources: U.S. Energy Information Administration)

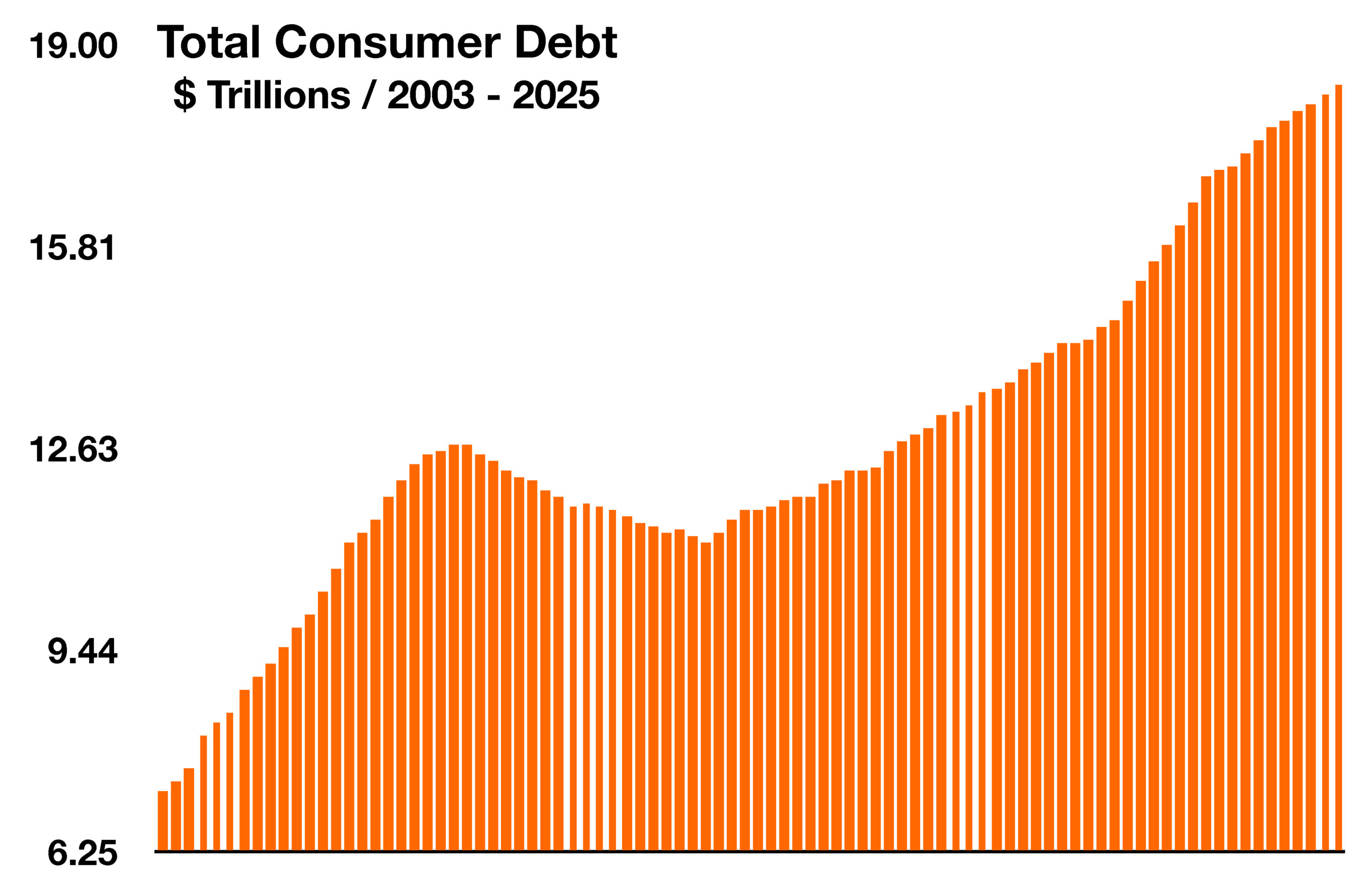

Total consumer debt includes mortgages, credit card balances, home equity lines of credit and student loans. Credit card debt accounted for 6.5% of total consumer debt in the second quarter of 2025, up from 5.3% three years ago in 2022. Economists closely watch rising consumer debt as an indicator of any financial strain on household spending. (Source: Federal Reserve Bank of St. Louis)

Total consumer debt includes mortgages, credit card balances, home equity lines of credit and student loans. Credit card debt accounted for 6.5% of total consumer debt in the second quarter of 2025, up from 5.3% three years ago in 2022. Economists closely watch rising consumer debt as an indicator of any financial strain on household spending. (Source: Federal Reserve Bank of St. Louis)