Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

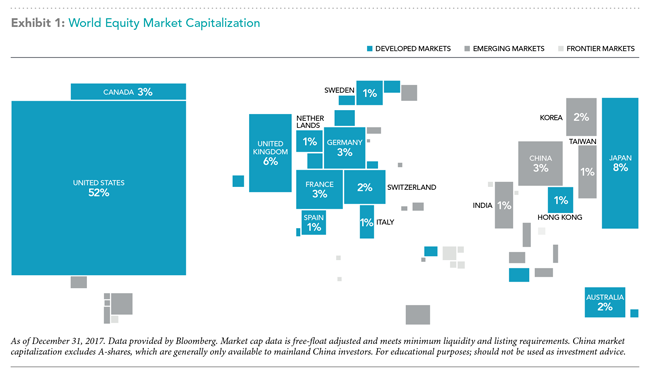

The Group of Twenty (G20) summit in Argentina produced two significant trade deals for the United States, a revised trade agreement with Canada and Mexico as well as a trade tariff truce with China. The trade arrangements were initially received positively by global financial markets alleviating months of uncertainty surrounding trade and international commerce. Skepticism surrounding the trade truce with China has evolved, questioning the extent of a trade agreement and its details.

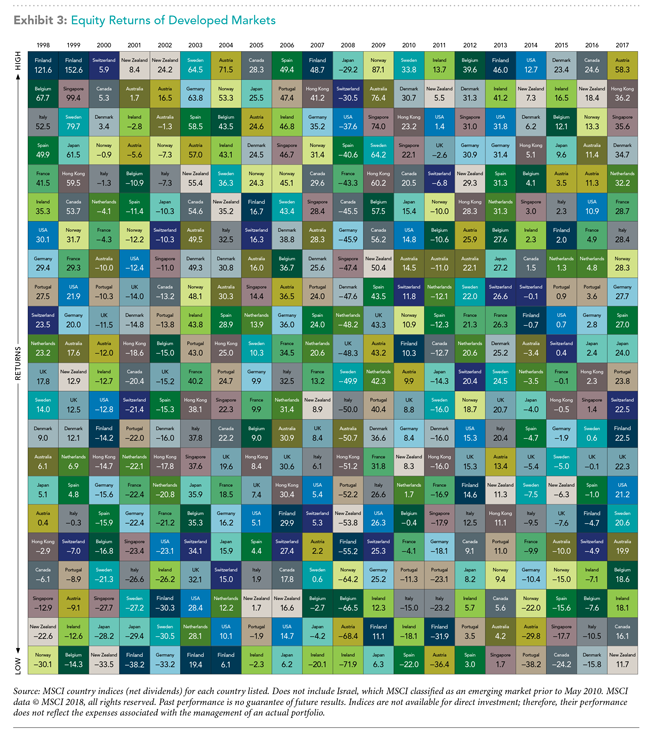

Volatility continued into November spilling over from October’s trading frenzy. All major equity indices saw their gains for the year vanish in mid-November, then rebound at month end to recapture some of those same gains. Many analysts believe that lower stock valuations are posing buying opportunities for domestic and international investors.

Some analysts perceive the latest market pull back as a normal course resulting from transitioning to a higher rate environment and slowing growth prospects. Market pullbacks are common when the market experiences a sentiment shift and tries to decipher which sectors and industries are favored to perform. Market volatility in November has been a result of uncertainty surrounding trade, Fed rate hikes, and economic prospects.

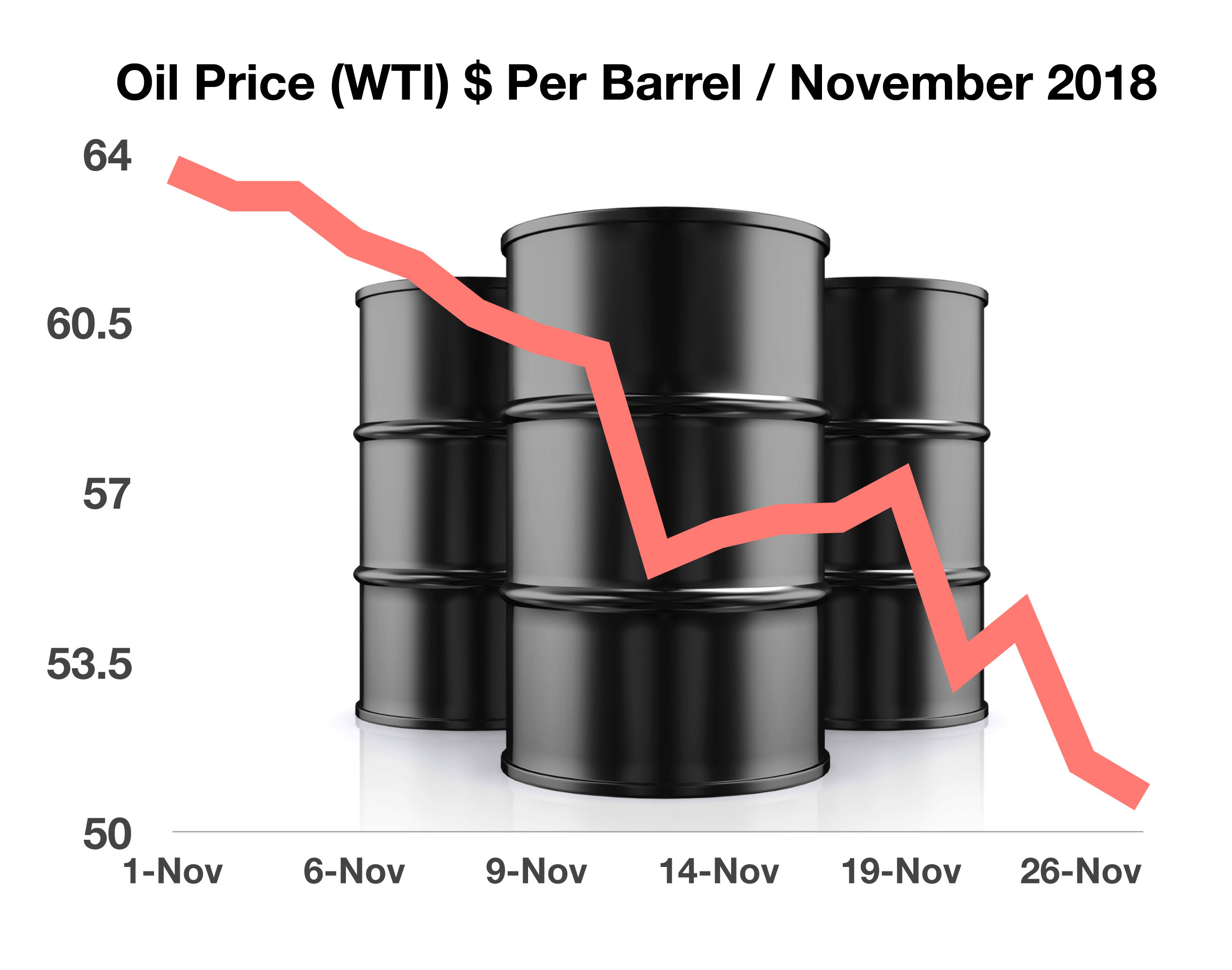

Uneasiness in the markets were amplified by a rapid fall in the price of oil, which declined to levels not reached since late 2017. Analysts attribute the slump to a rising supply of oil as well as a perceived slowdown in the global economy. Oil’s price decline is the latest obstacle for stock indices to recapture recent losses. The demand for oil internationally is seen as an indicator of global economic health.

Rates fell abruptly towards the end of November as the Fed signaled that it may scale back its process of projected rate increases in 2019. The Fed believes that rates are currently at a level just below its neutral stance, which Fed members estimate to be near 2.9 percent to 3 percent.

Data compiled and released by the International Energy Association (IEA) revealed that the United States has officially become the largest producer of oil in the world, surpassing both Russia and Saudi Arabia. As of the end of this summer, U.S. oil production is over 11.5 million barrels per day.

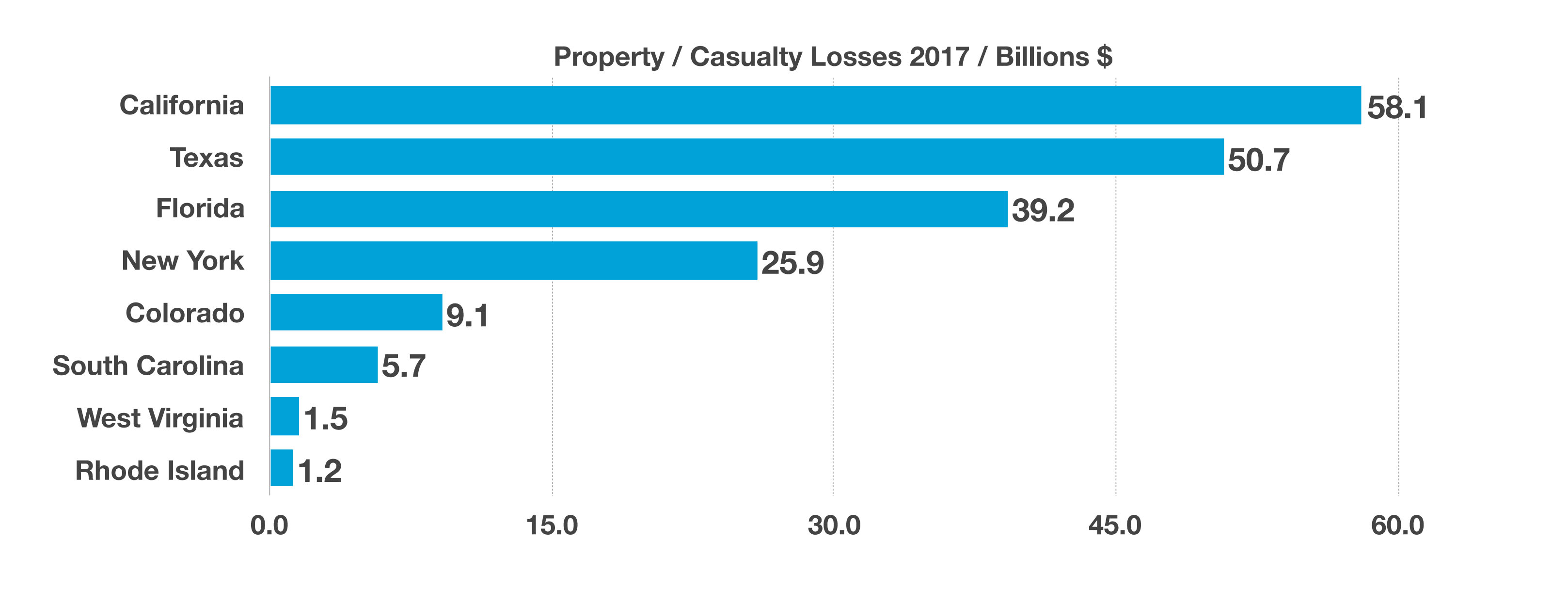

Real estate values in storm and fire ravaged areas of the country are coming under pressure as potential buyers reassess the environmental risks that have become increasingly apparent.

According to the National Retail Federation (NRF), there were roughly 165 million Black Friday Weekend store and online shoppers this year, less than the 174 million from last year’s. The NRF found that the average shopper spent $313 during the Black Friday sales days, down from the $335 figure in 2017. The NRF suspects that shoppers are starting their spending earlier in the season, now immediately after Halloween, rather than waiting until Thanksgiving. (Sources: g20.org, Federal Reserve, NFR, IEA, Commerce Department)

U.S. producers as well as Saudi Arabia, Russia, and OPEC. The recent price decline is of grave concern to OPEC, Russia, and Saudi Arabia, whose breakeven cost for oil production is estimated to be higher than U.S. production. The rapid expansion of supply in the U.S. has resulted in large amounts of unrefined oil in storage, which must then reach refineries for the final transformation into gasoline. Construction of new pipelines and transportation infrastructure in the U.S. will facilitate the shipment of crude oil much more rapidly and efficiently over the next few years. The United States is currently exporting more oil than it is importing, which helps insulate the country from global price swings and adds leverage for U.S. producers competing with foreign producers. U.S. exports of crude oil and petroleum products have more than doubled since 2010 according to the Department of Energy. (Sources: Department of Energy, IEA)

U.S. producers as well as Saudi Arabia, Russia, and OPEC. The recent price decline is of grave concern to OPEC, Russia, and Saudi Arabia, whose breakeven cost for oil production is estimated to be higher than U.S. production. The rapid expansion of supply in the U.S. has resulted in large amounts of unrefined oil in storage, which must then reach refineries for the final transformation into gasoline. Construction of new pipelines and transportation infrastructure in the U.S. will facilitate the shipment of crude oil much more rapidly and efficiently over the next few years. The United States is currently exporting more oil than it is importing, which helps insulate the country from global price swings and adds leverage for U.S. producers competing with foreign producers. U.S. exports of crude oil and petroleum products have more than doubled since 2010 according to the Department of Energy. (Sources: Department of Energy, IEA)