Gregory M. Hart, CFP®

Haddon Wealth Management

2 Kings Highway W., Suite 201

Haddonfield, NJ 08033

(856) 888-1744

Stock Indices:

| Dow Jones | 39,118 |

| S&P 500 | 5,460 |

| Nasdaq | 17,732 |

Bond Sector Yields:

| 2 Yr Treasury | 4.71% |

| 10 Yr Treasury | 4.36% |

| 10 Yr Municipal | 2.86% |

| High Yield | 7.58% |

YTD Market Returns:

| Dow Jones | 3.79% |

| S&P 500 | 14.48% |

| Nasdaq | 18.13% |

| MSCI-EAFE | 3.51% |

| MSCI-Europe | 3.72% |

| MSCI-Pacific | 3.05% |

| MSCI-Emg Mkt | 6.11% |

| US Agg Bond | -0.71% |

| US Corp Bond | -0.49% |

| US Gov’t Bond | -0.68% |

Commodity Prices:

| Gold | 2,336 |

| Silver | 29.43 |

| Oil (WTI) | 81.46 |

Currencies:

| Dollar / Euro | 1.06 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 160.56 |

| Canadian /Dollar | 0.73 |

Macro Overview

Markets reacted to indications that the Fed might slow its pace of rate increases heading into the new year. Such a change in monetary policy would be positively received by financial markets with the anticipation of eventual lower rates.

The supply chain constraints that existed this same time last year, have nearly been entirely eliminated. Production, shipping, labor, and material shortage issues were critical concerns during the height of the constraints. The alleviation of supply constraints has led to deep discounts by retailers which were widespread as retailers mark down prices on numerous items heading into the holiday season. Lower prices tend to dampen retail stock margins yet allow stores to reduce inventory and bring in consumer traffic.

The Federal Reserve’s most recent survey of economic activity nationwide, known as the Beige Book, revealed weakening economic growth, tighter bank lending standards, and easing inflation. Slowing wage growth has also become more apparent as some companies announce layoffs and trim positions. Some analysts view these dynamics as deflationary as well as indicative of an ensuing economic slowdown.

A closely followed inflation indicator by the Fed, the Personal Consumer Expenditure Price Index (PCE), has been falling consistently since June. Data released by the BEA revealed a drop from 7 in June to 6 in October, signaling a drop in overall prices and inflation.

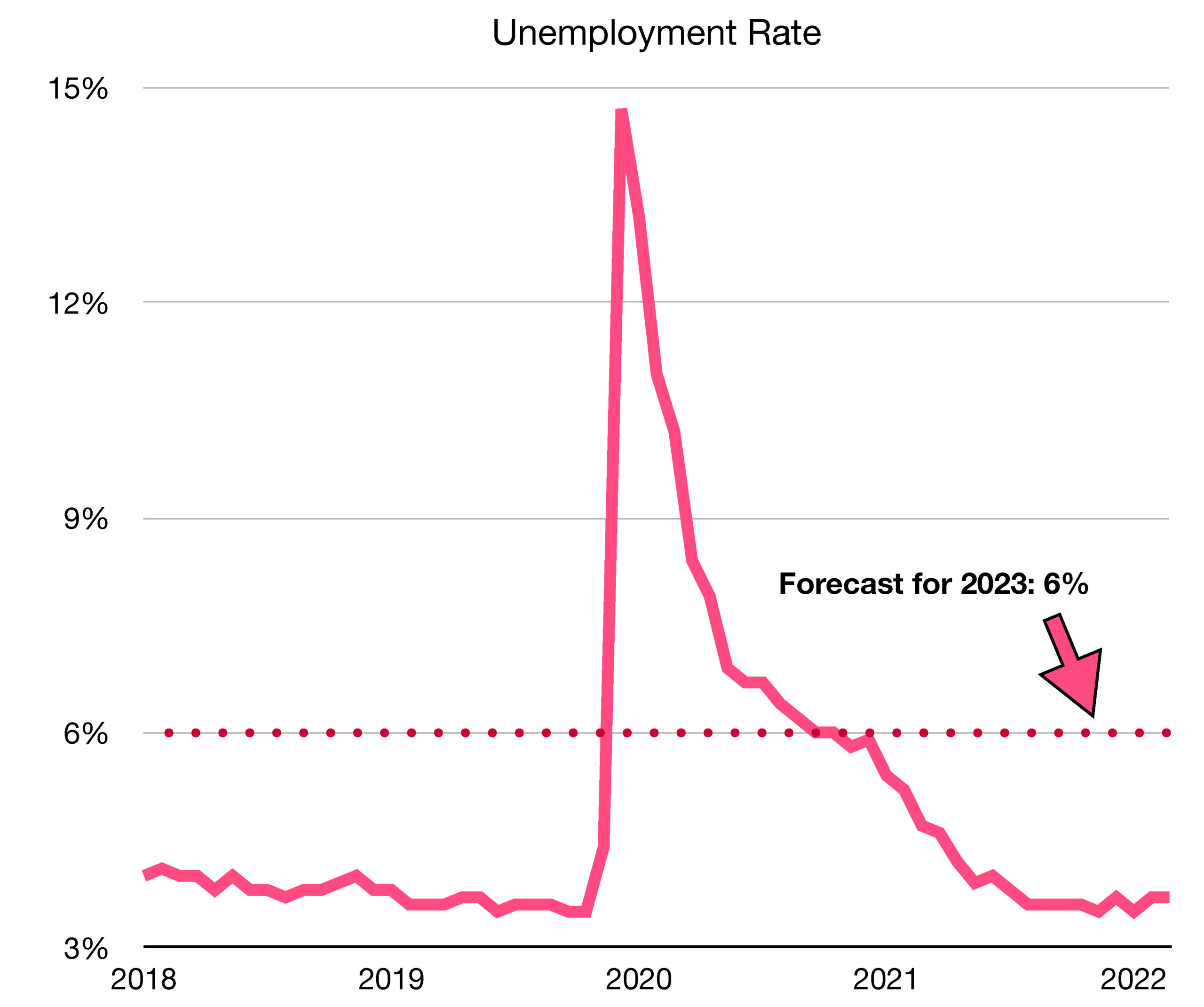

Recession fears continued to hinder markets from additional expansion, with growing concerns surrounding the labor market. John Williams, Federal Reserve President from the New York district, said that unemployment could reach 5% in 2023, up from 3.7% this past month. Regardless, the Fed’s primary objective of stamping out inflation remains key, meaning any further rate increases could slow hiring and raise unemployment even more.

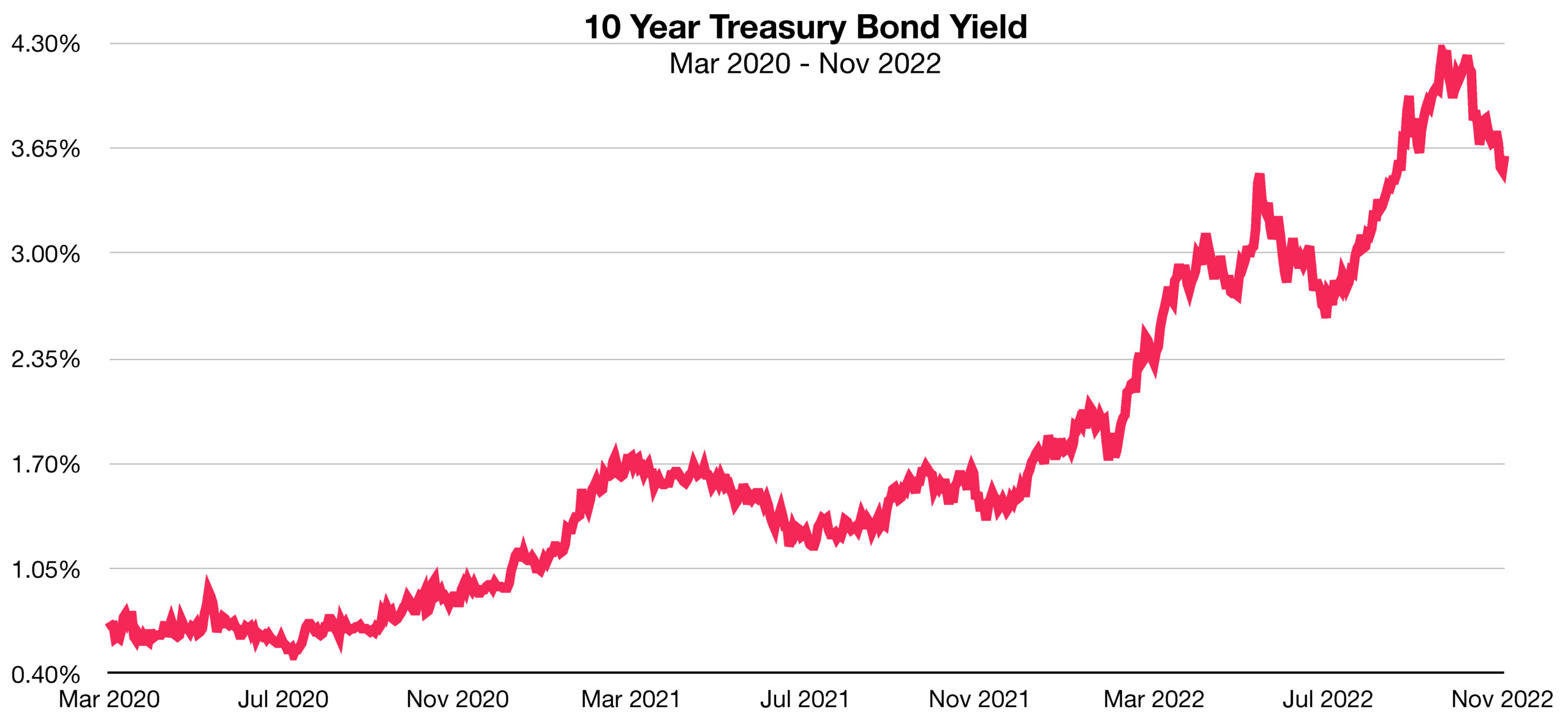

Yields on U.S. Treasury bonds fell modestly in November, a vital benchmark for mortgage and consumer loan rates. The 10 Year Treasury bond yield fell to 3.68% in November, down from 4.10% at the end of October. Lower yields tend to offer a reprieve for consumers and businesses nationwide.

Sources: U.S. Department of the Treasury, U.S. Federal Reserve Bank of New York, U.S. Bureau of Economic Analysis, U.S. Federal Reserve Bank of St. Louis

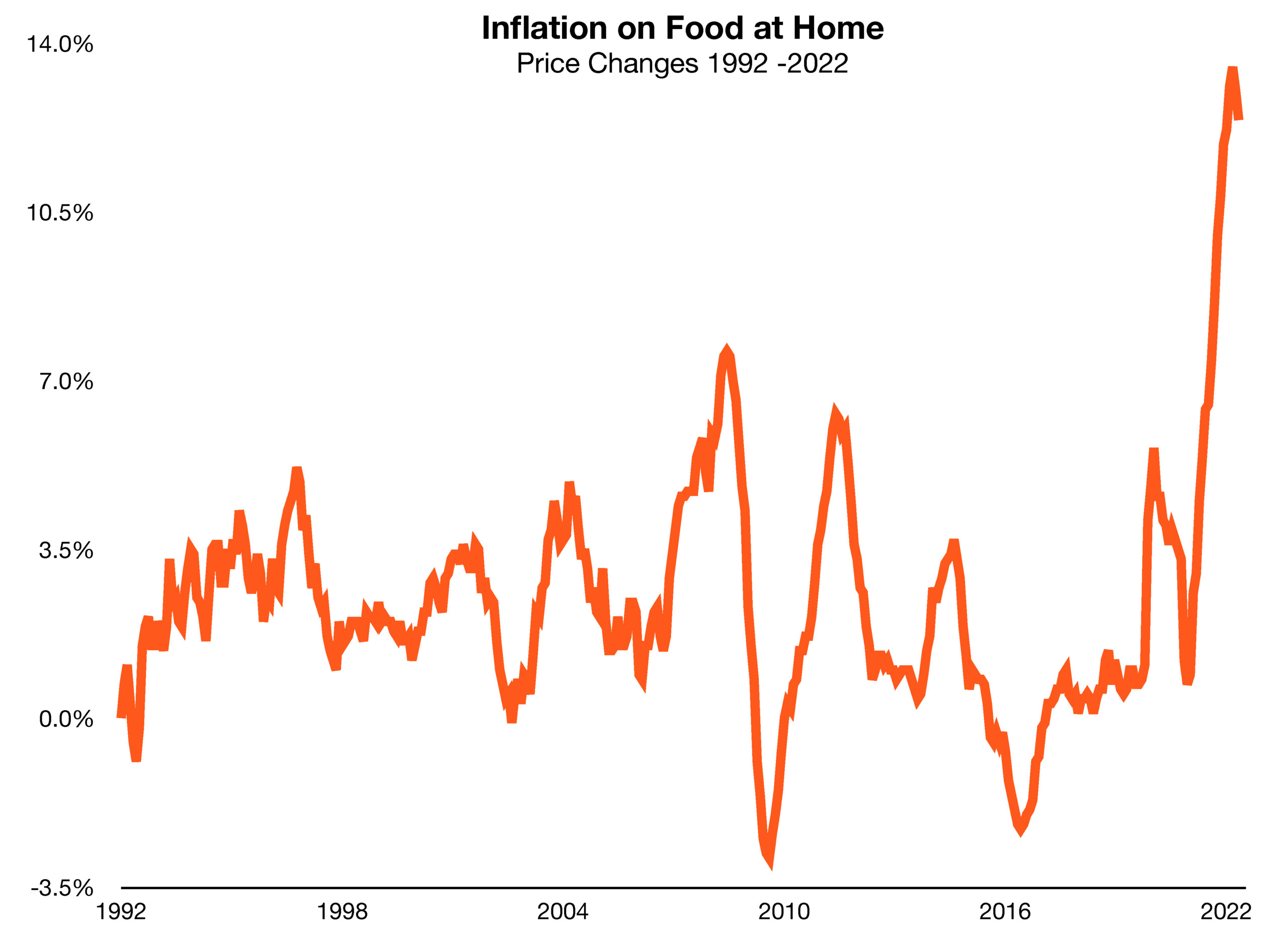

These all-time high increases in food were a major factor of inflation measuring higher than expected. All of these common groceries have major effects on the decision-making of consumers. Due to inflation, consumers are increasingly only buying necessities and can be expected to ever further limit their purchases. Consumer spending makes up nearly 70% of GDP, so when consumer spending falls due to high prices, GDP can also be expected to fall. (Sources: U.S. Bureau of Labor Statistics, Bureau of Economic Analysis, Federal Reserve Bank of St. Louis)

These all-time high increases in food were a major factor of inflation measuring higher than expected. All of these common groceries have major effects on the decision-making of consumers. Due to inflation, consumers are increasingly only buying necessities and can be expected to ever further limit their purchases. Consumer spending makes up nearly 70% of GDP, so when consumer spending falls due to high prices, GDP can also be expected to fall. (Sources: U.S. Bureau of Labor Statistics, Bureau of Economic Analysis, Federal Reserve Bank of St. Louis)