Gregory M. Hart, CFP®

Haddon Wealth Management

2 Kings Highway W., Suite 201

Haddonfield, NJ 08033

(856) 888-1744

Stock Indices:

| Dow Jones | 42,001 |

| S&P 500 | 5,611 |

| Nasdaq | 17,299 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.23% |

| 10 Yr Municipal | 3.20% |

| High Yield | 7.53% |

YTD Market Returns:

| Dow Jones | -1.28% |

| S&P 500 | -4.59% |

| Nasdaq | -10.42% |

| MSCI-EAFE | 7.00% |

| MSCI-Europe | 10.10% |

| MSCI-Pacific | 0.90% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 2.78% |

| US Corp Bond | 2.31% |

| US Gov’t Bond | 2.70% |

Commodity Prices:

| Gold | 3,169 |

| Silver | 34.79 |

| Oil (WTI) | 71.64 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.29 |

| Yen / Dollar | 149.77 |

| Canadian /Dollar | 0.69 |

Macro Overview

Financial markets and analysts are anxiously awaiting cabinet and agency appointees by the incoming administration, which shape policy and the possible direction of various sectors. Among pending proposals and legislations are additional tariffs on imports from China, Mexico and Canada, extension of the Tax Cuts and Jobs Act, cryptocurrency, deregulation, and new tax cuts.

Sentiment regarding tariffs and inflationary pressures abated somewhat when the Treasury Secretary nominee was announced, Scott Bessent, who is not an advocate for tariffs. The nomination of Bessent also stoked enthusiasm among the bond market as a proponent of reducing the federal deficit and curtailing government spending.

The digital currency market, also known as the crypto market, responded to the nominee to head the Securities and Exchange Commission (SEC) Paul Adkins, who is an advocate of the crypto evolution. Some analysts see possible implications for the dollar, taxes, federal regulations, Treasury bonds, and gold, as the use of cryptocurrency is introduced to the markets and the economy.

A Federal Reserve survey found that rising personal insolvencies and delinquencies are forcing banks to keep lending standards tight even with rate cuts. Consumers are also taking on debt at a slower rate as the cost of borrowing remains elevated. Economists and analysts are expecting to see changes in lending requirements as proposed deregulation initiatives take affect with the incoming administration.

The Fed is expected to stay on track with its gradual rate reduction trajectory, carefully tracking inflation and the job market. Any uptick in inflation or labor market weakness might prompt the Federal Reserve to slow or pause its rate reduction objectives. Equity indices rallied higher as sentiment and valuations rose in anticipation of broad deregulation and economic stimulus policies. Alleviated corporate taxes as well as initiatives surrounding expansion and domestic capital investment stirred investor confidence.

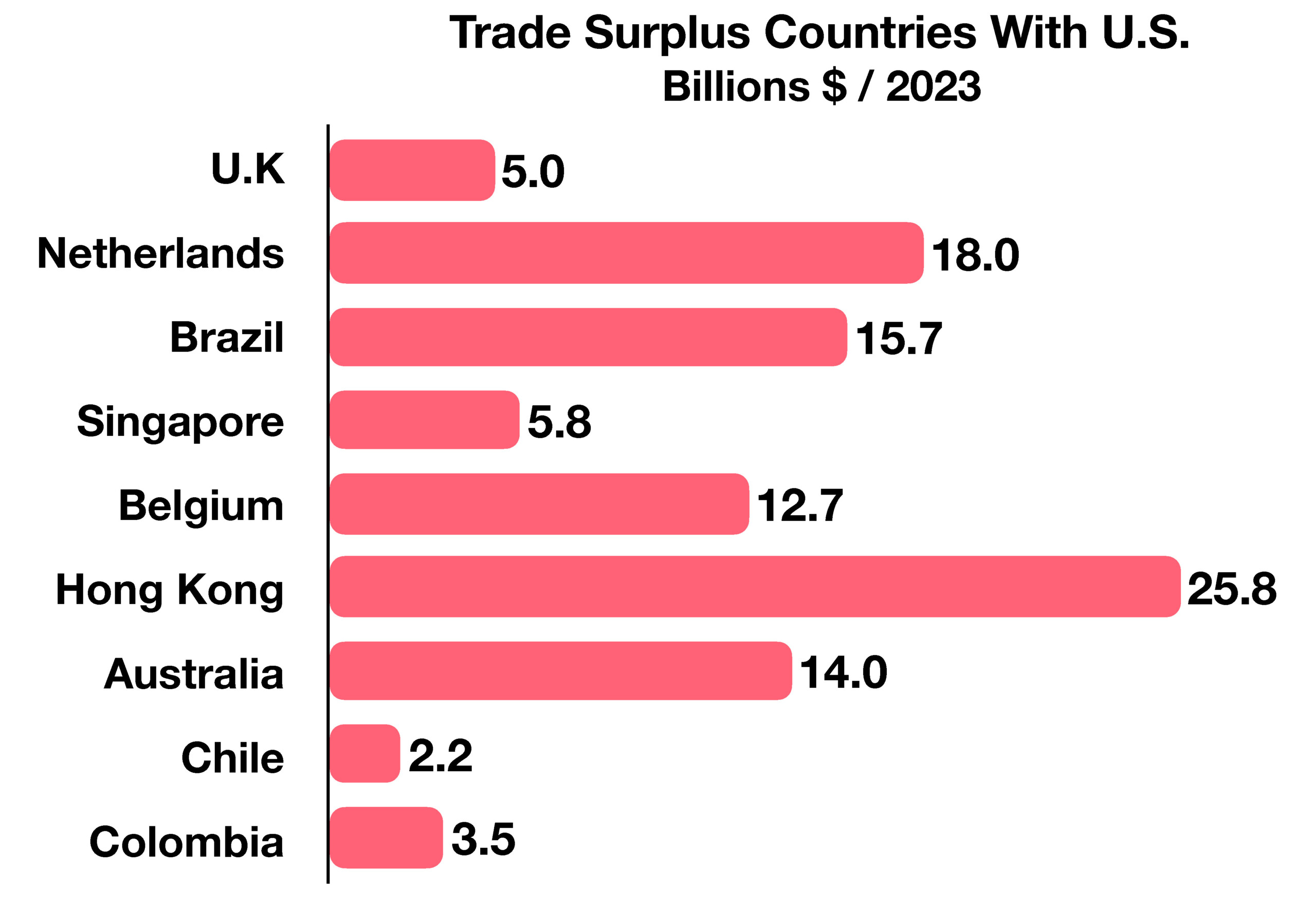

Proposed new tariffs on imports from Mexico and Canada, might amount to the unraveling of the North American Free Trade Agreement (NAFTA), which was created in 1992. Since its establishment, products from Canada and Mexico have entered the U.S. completely free of any tariffs. Proposed tariffs are increasingly becoming an apparent negotiating tactic with countries that have a trade deficit with the United States.

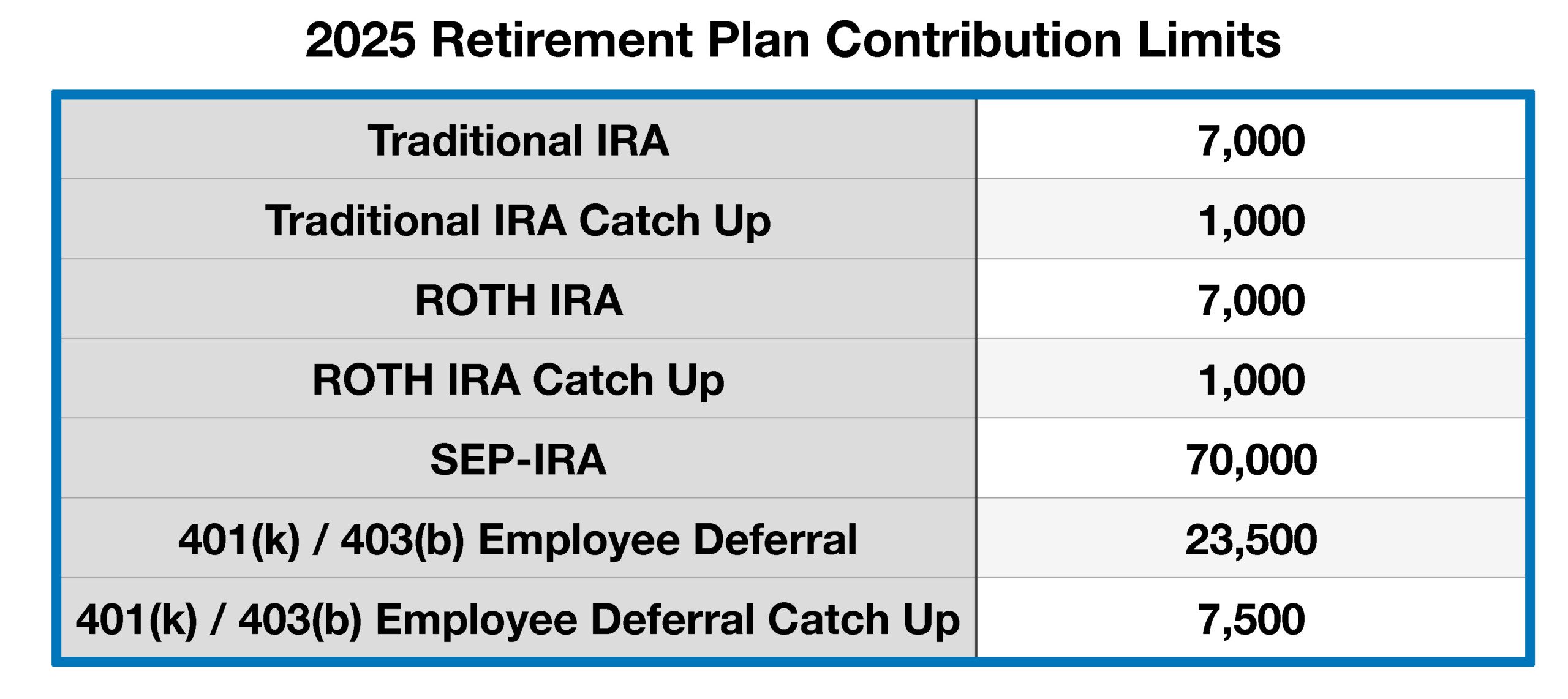

The IRS announced new limits for 2025, including contribution limits for retirement accounts and standard deductions for taxpayers.The revised limits will become effective January 1, 2025 and applicable for the 2025 tax year. (Sources: Fed, SEC, International Trade Administration)