Stock Indices:

| Dow Jones | 39,118 |

| S&P 500 | 5,460 |

| Nasdaq | 17,732 |

Bond Sector Yields:

| 2 Yr Treasury | 4.71% |

| 10 Yr Treasury | 4.36% |

| 10 Yr Municipal | 2.86% |

| High Yield | 7.58% |

YTD Market Returns:

| Dow Jones | 3.79% |

| S&P 500 | 14.48% |

| Nasdaq | 18.13% |

| MSCI-EAFE | 3.51% |

| MSCI-Europe | 3.72% |

| MSCI-Pacific | 3.05% |

| MSCI-Emg Mkt | 6.11% |

| US Agg Bond | -0.71% |

| US Corp Bond | -0.49% |

| US Gov’t Bond | -0.68% |

Commodity Prices:

| Gold | 2,336 |

| Silver | 29.43 |

| Oil (WTI) | 81.46 |

Currencies:

| Dollar / Euro | 1.06 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 160.56 |

| Canadian /Dollar | 0.73 |

Macroeconomic Overview

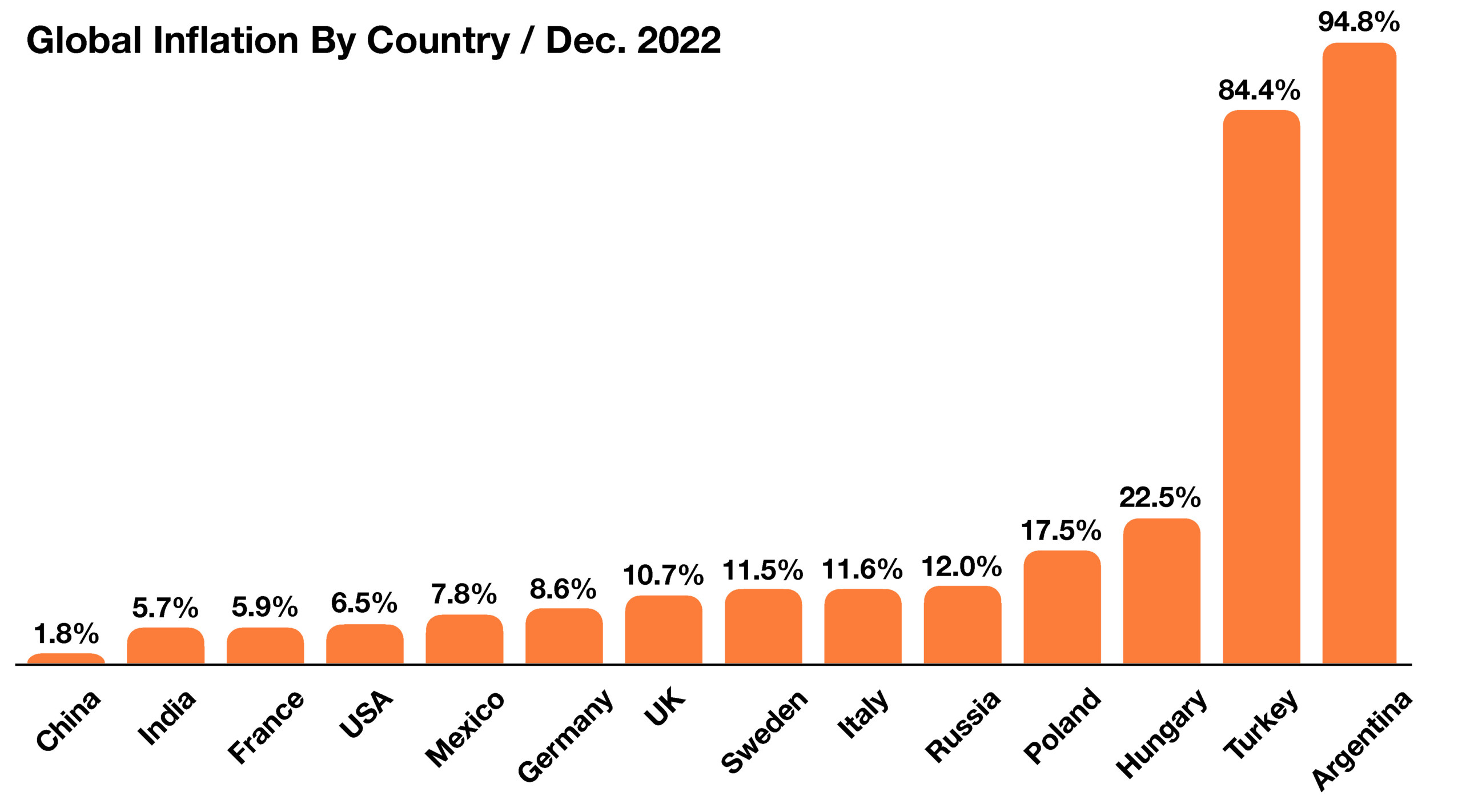

Inflation concerns eased in January, as the most recent data revealed six consecutive months of falling prices. Annualized inflation, as measured by the Consumer Price Index (CPI), fell to 6.5% after reaching 9.1% in June.

Bank surveys conducted by the Federal Reserve showed that lending slowed down markedly, with banks tightening credit scoring and steadily bolstering their cash reserves. Major banks are building protection against potential upcoming economic woes by means of asset and cash consolidation.

Recent legislation will enable millions of taxpayers the ability to reap tax benefits on electric vehicles and 529 college savings plans. Provisions from the Inflation Act and the SECURE Act will primarily benefit middle-income earners across the country.

Equity markets rebounded with the new year, as major equity indices were positive year-to-date at the end of January. The S&P 500 index was up 6.18% as technology-related companies led the gains, and the Dow Jones Industrial Index gained 2.83% for the month.

Recent comments by Fed Chair Jerome Powell signaled that the Fed intends to continue rate hikes due to a strong labor market. Some economists and analysts differ in their views regarding the strength of the labor market, noting a decreasing hiring trend by companies.

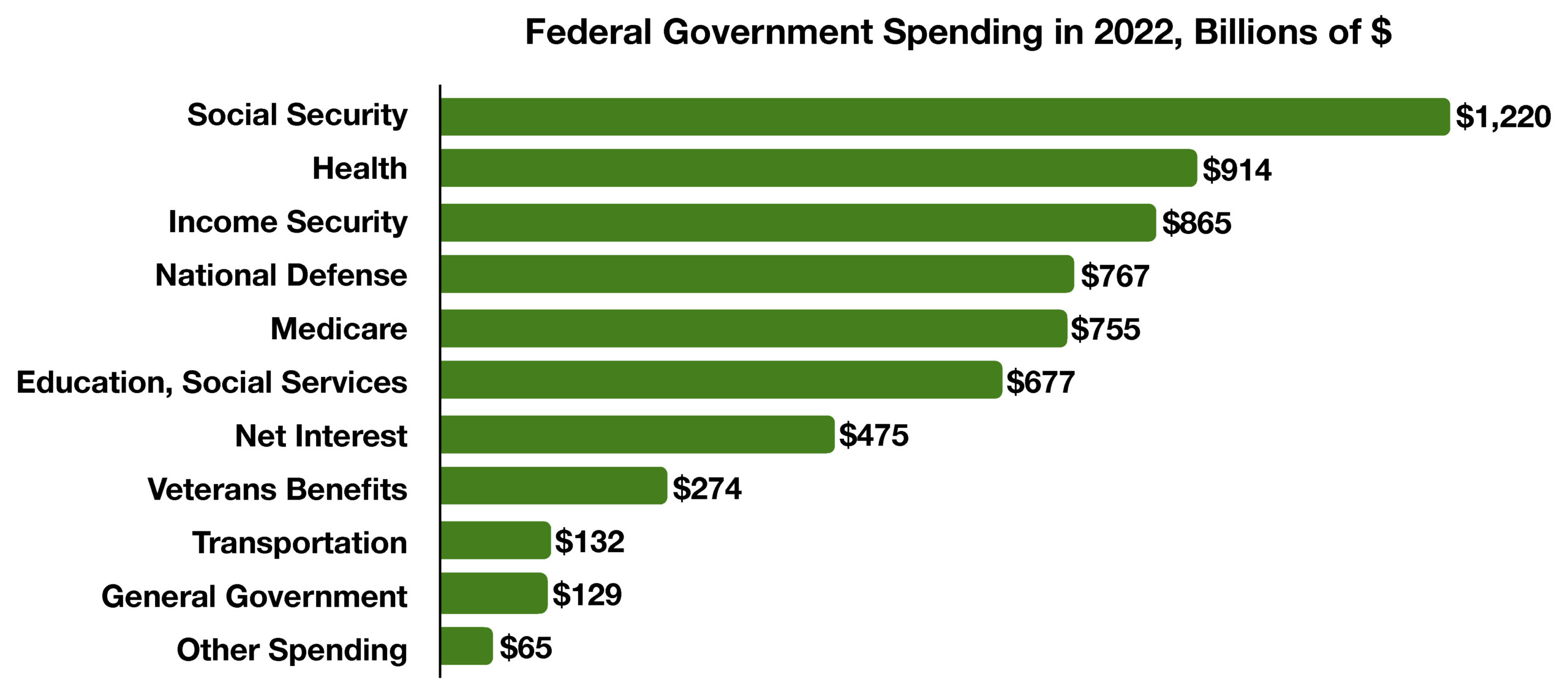

With recent concerns about the debt ceiling and funding for governmental agencies, the Office of Management & Budget identifies where the federal government allocates funds. The biggest expense in 2022 was Social Security, which was the only spending category over $1 trillion. $770 billion was appropriated for national defense, with other notable categories including health, income security, and Medicare. In total, the federal government spent $6.27 trillion throughout 2022, nearly double what it spent a half-decade ago. (Sources: Bureau of Labor Statistics, Board of Governors of the Federal Reserve, IRS, U.S. Congress, U.S. Office of the President, Office of Management & Budget)