Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Dear Friends,

Last quarter Mr. Buffett sold a 10 million shares of Apple, one of it’s best long time holdings. This means that Warren Buffet, one of the largest investors of all time, decided that it’s time to sell ~$1.8B of the stalwart of our economy! Why now and what did he choose to do with the money? There is much so fear and risk out there today that it’s natural to look to the Oracle of Omaha as someone who would only make a significant change when something really important is happening. What secret information is he acting on? The influencers want to know! We want to know.

Unfortunately for those looking for the key to the markets, Mr. Buffet’s behavior is nothing more than routine rebalancing of his portfolio and the sale was only 1% of his total AAPL holdings. This is no story worth attention on social media, this is simply good investing 101. And yet it was a story somehow, designed to provoke a response. We all should be more like Warren and stick to our plan, even when times are changing all around us. The economy is just numbers, and they continue to paint a picture of a very healthy USA. Keep calm and invest on.

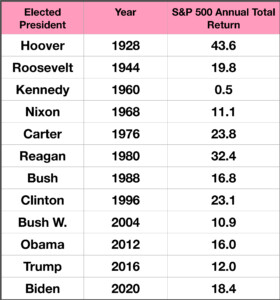

Election year markets are always a quandary, as candidates propose economic and fiscal plans in order to boost the nation’s economy. Interestingly enough, political parties have had nearly no bearing on market performance during election years as far back as 1928.

Sources: Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500