Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

YTD Market Returns:

| Dow Jones | 5.62% |

| S&P 500 | 10.16% |

| Nasdaq | 9.11% |

| MSCI-EAFE | 5.06% |

| MSCI-Europe | 4.60% |

| MSCI-Pacific | 5.82% |

| MSCI-Emg Mkt | 1.90% |

| US Agg Bond | -0.78% |

| US Corp Bond | -0.40% |

| US Gov’t Bond | -0.72% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Macro Overview

Financial markets started the year off with an eye on earnings, the upcoming election, and developments in the Middle East and Ukraine. Markets are eagerly awaiting for the Fed to finally commence its rate reduction trajectory. Analysts vary on when it will happen, but are expecting that decreases will start before the middle of the year.

Stock performance was mixed in January, as some sectors lagged while others excelled. Sectors including consumer discretionary, real estate, and utilities lagged in January, while financials, healthcare, and communication stocks rose. Analysts deem such a disparity among sectors as “sector rotation”, which is indicative of a possible change in the economic direction of the nation’s economy.

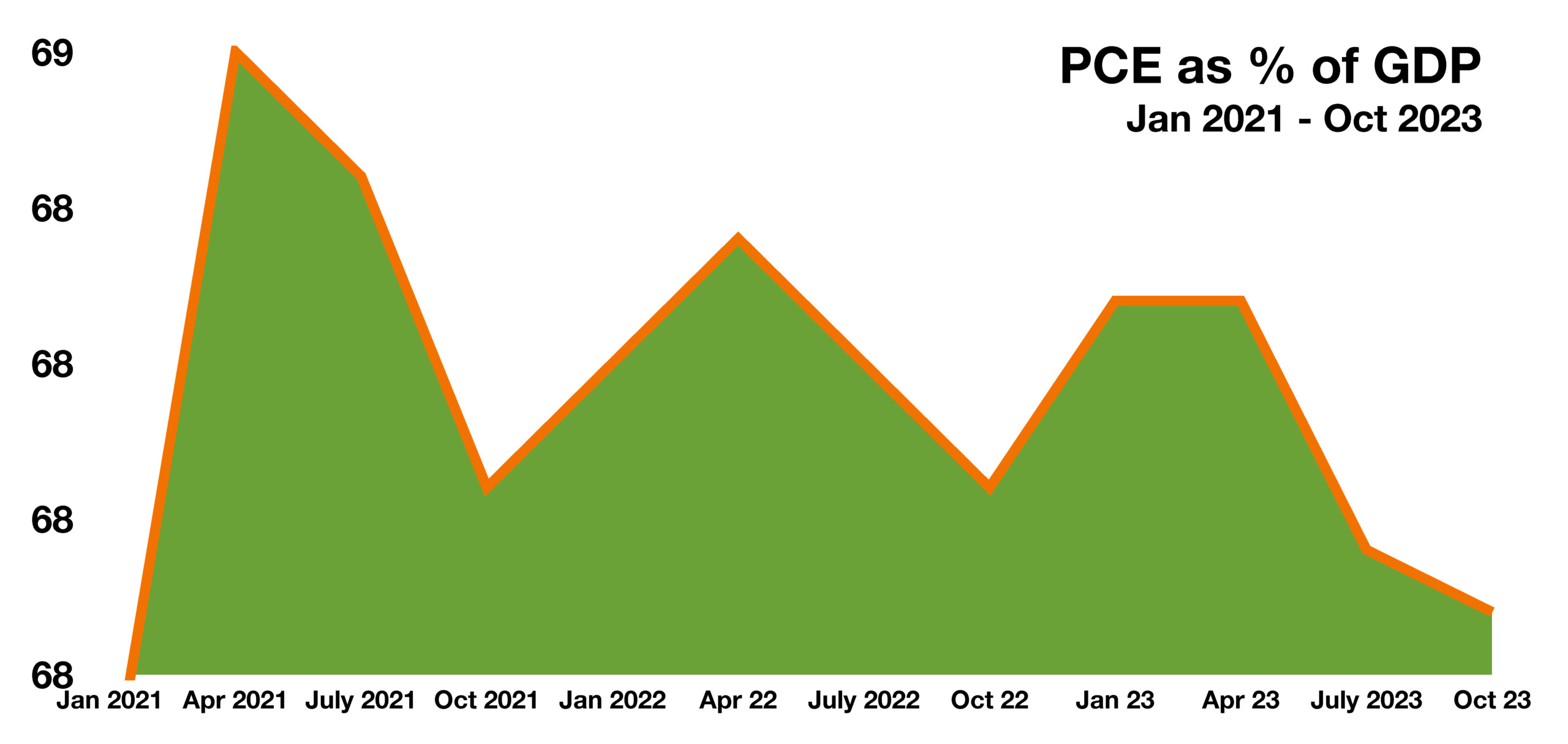

Gross Domestic Production (GDP) for the 4th quarter of 2023 came in at 3.3%, stronger than expected by economists. Concurrently, consumers are contributing less to economic growth as measured by Personal Consumption Expenditures (PCE), representing roughly 67.6% of GDP. Consumers contributed 69% to GDP nearly two years ago, when consumer expenditures were higher. Economists track this dynamic closely since two-thirds of GDP is driven by consumer expenditures.

The Federal Reserve continues to struggle with the threat of lingering inflation. Fed officials are mixed about when the Fed will begin to reduce rates and how much the initial reductions will be. For now, the Federal Reserve has held rates steady but may change course should economic data and the economy prove otherwise.

Federal government bank regulators, such as the FDIC, the Office of the Comptroller of the Currency and, the Federal Financial Institutions Examination Council have been increasingly focused on the liquidity of smaller banking institutions. Last year’s bank failures prompted an increase of surveillance on various banking institutions and their financial integrity.

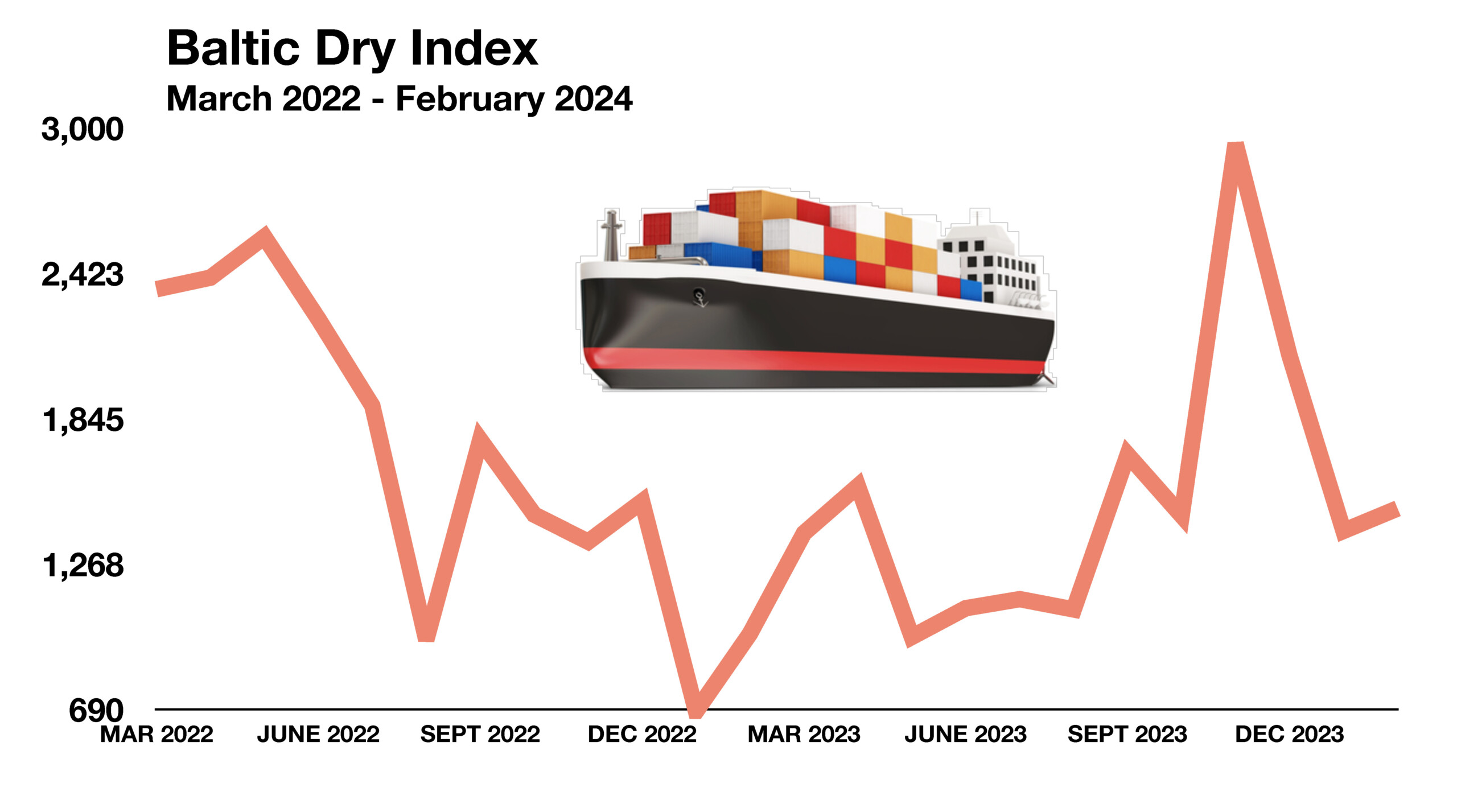

The Baltic Dry Index, which measures the cost of transporting commodities and essential goods globally, has fallen back to pre-pandemic levels. Shipping costs and transportation rates rose sharply during the pandemic, causing price increases from commodities to finished products worldwide. Many economists believe that the drop in shipping and commodity prices is indicative of lower inflation and a possible global slowdown of commerce activity.

Sources: Federal Reserve, Labor Dept., FDIC, OCC, FFIEC, Baltic Dry Index