Earl R. King Sr., CFP®

Managing Member

1300 Caraway Court, Suite 200

Largo, MD 20774

Tel: 301-364-1617/Cell: 240-472-6570

eking@erogerfinancial.com / www.erogerfinancial.com

Stock Indices:

| Dow Jones | 38,996 |

| S&P 500 | 5,096 |

| Nasdaq | 16,091 |

Bond Sector Yields:

| 2 Yr Treasury | 4.64% |

| 10 Yr Treasury | 4.25% |

| 10 Yr Municipal | 2.53% |

| High Yield | 7.63% |

YTD Market Returns:

| Dow Jones | 3.47% |

| S&P 500 | 6.84% |

| Nasdaq | 7.20% |

| MSCI-EAFE | 2.23% |

| MSCI-Europe | 1.23% |

| MSCI-Pacific | 3.98% |

| MSCI-Emg Mkt | -0.27% |

| US Agg Bond | -1.68% |

| US Corp Bond | -1.67% |

| US Gov’t Bond | -1.59% |

Commodity Prices:

| Gold | 2,051 |

| Silver | 22.87 |

| Oil (WTI) | 78.25 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 150.63 |

| Canadian /Dollar | 0.73 |

Macro Overview

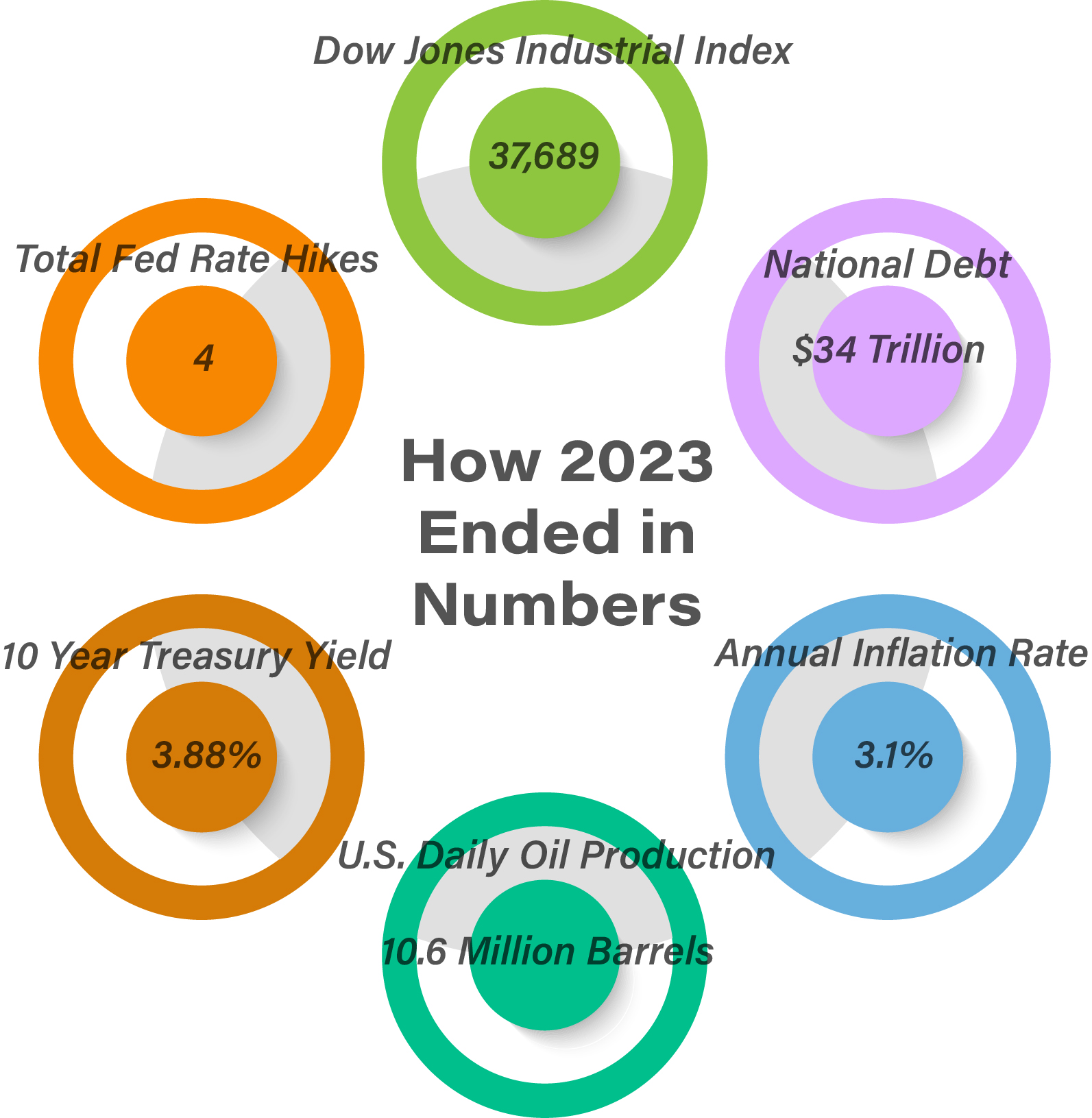

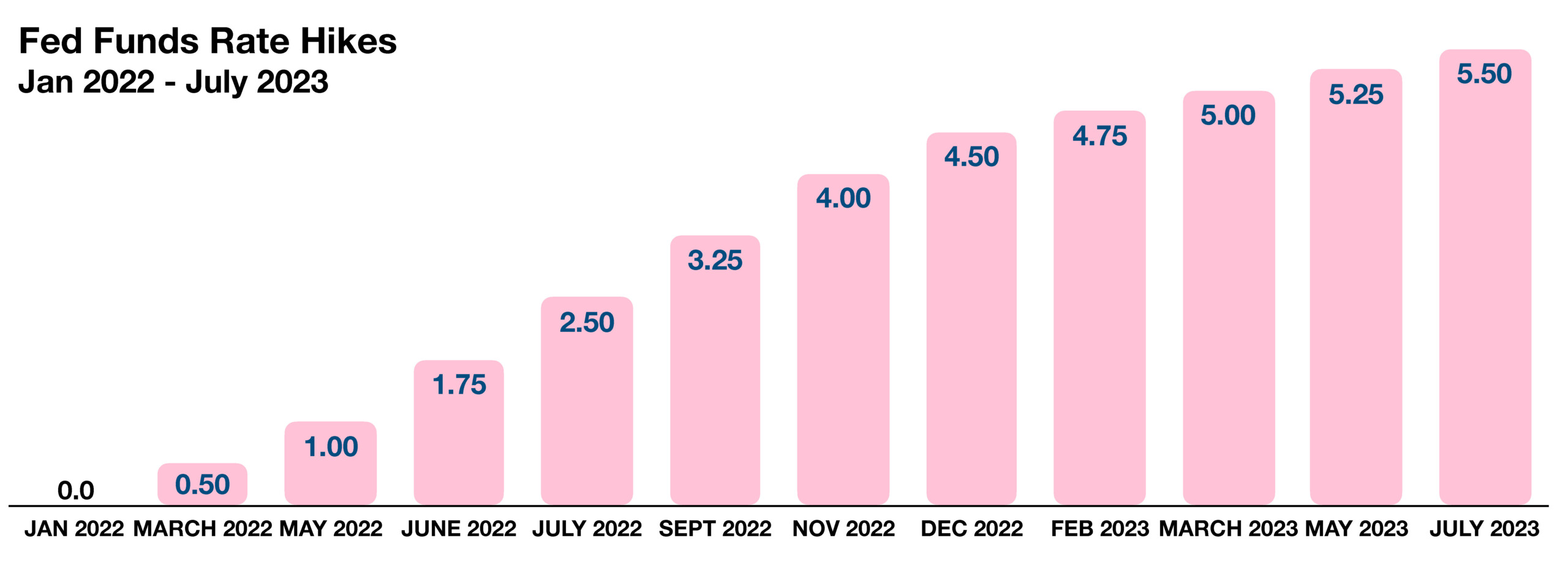

This past year witnessed one of the most ambitious executions of interest rate hikes by the Federal Reserve in recent history, with rates rising four times in 2023. Optimism swarmed throughout the markets as equities and bonds rose in a rare convergence. Stocks and bonds have historically tended to drift in opposite directions.

Inflation-themed concerns during 2023 have led to more deflationary concerns heading into 2024. The Fed’s vigilance in combating inflationary pressures translated into hard-landing concerns as recession fears evolved due to rising rates. A vigorous labor market continues to challenge the Fed’s possible easing rate policy in 2024, as wage pressures continue to abound.

Geopolitical tensions carried over from 2023, as the invasion of Ukraine and the Middle East conflict continue to weigh on financial markets. The two hostilities continue to hinder supply constraints in various regions as well as provoking uncertainty. Russia’s invasion of Ukraine directly affects Europe while the Middle East conflict is disturbing oil shipping throughout the region.

Bank failures occurring at the beginning of 2023 made it one of the worst years for bank collapses in history. Three of the top five bank failures ever occurred in 2023, as the demise of Silicon Valley Bank, Signature Bank, and First Republic Bank totaled over $350 billion in assets.

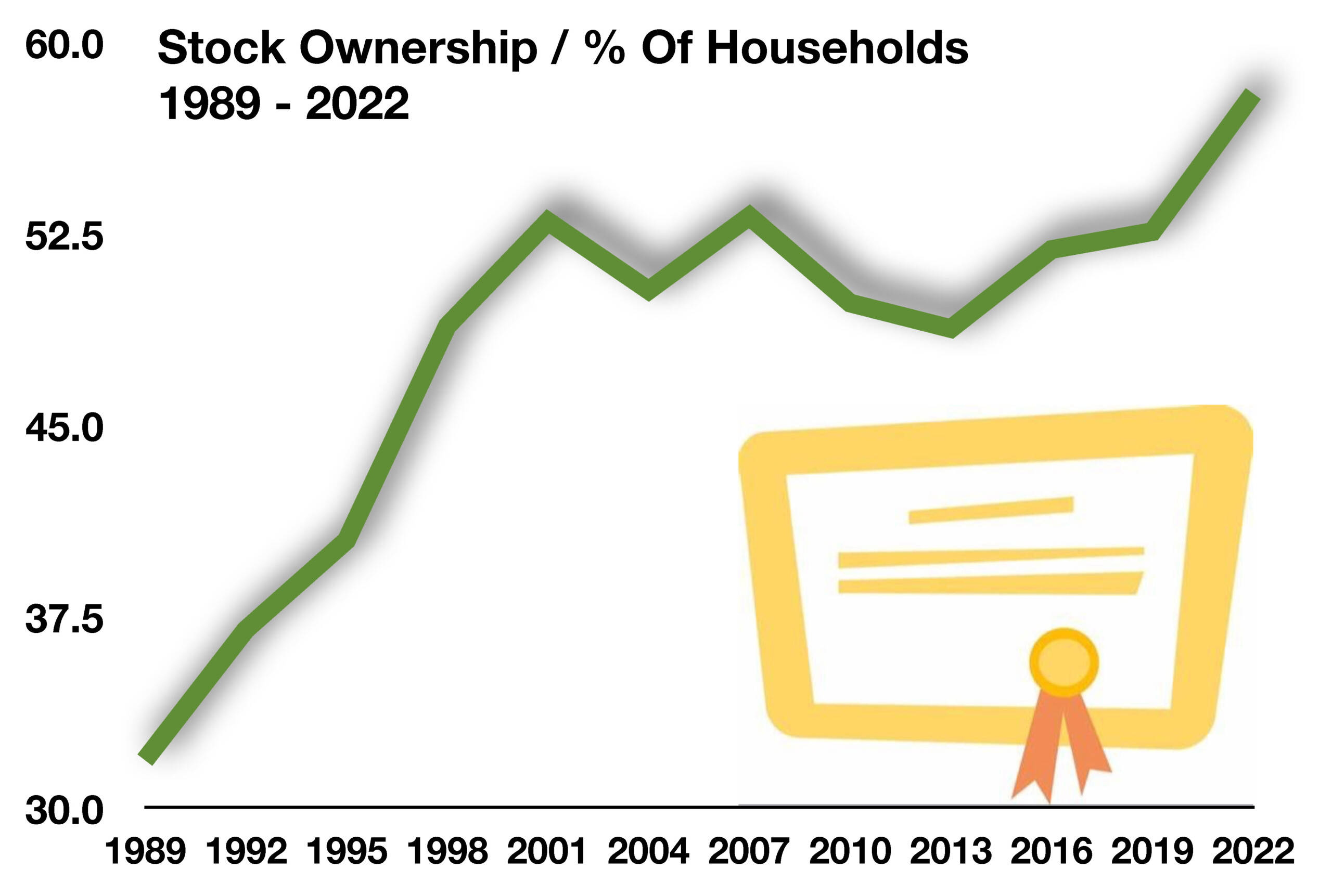

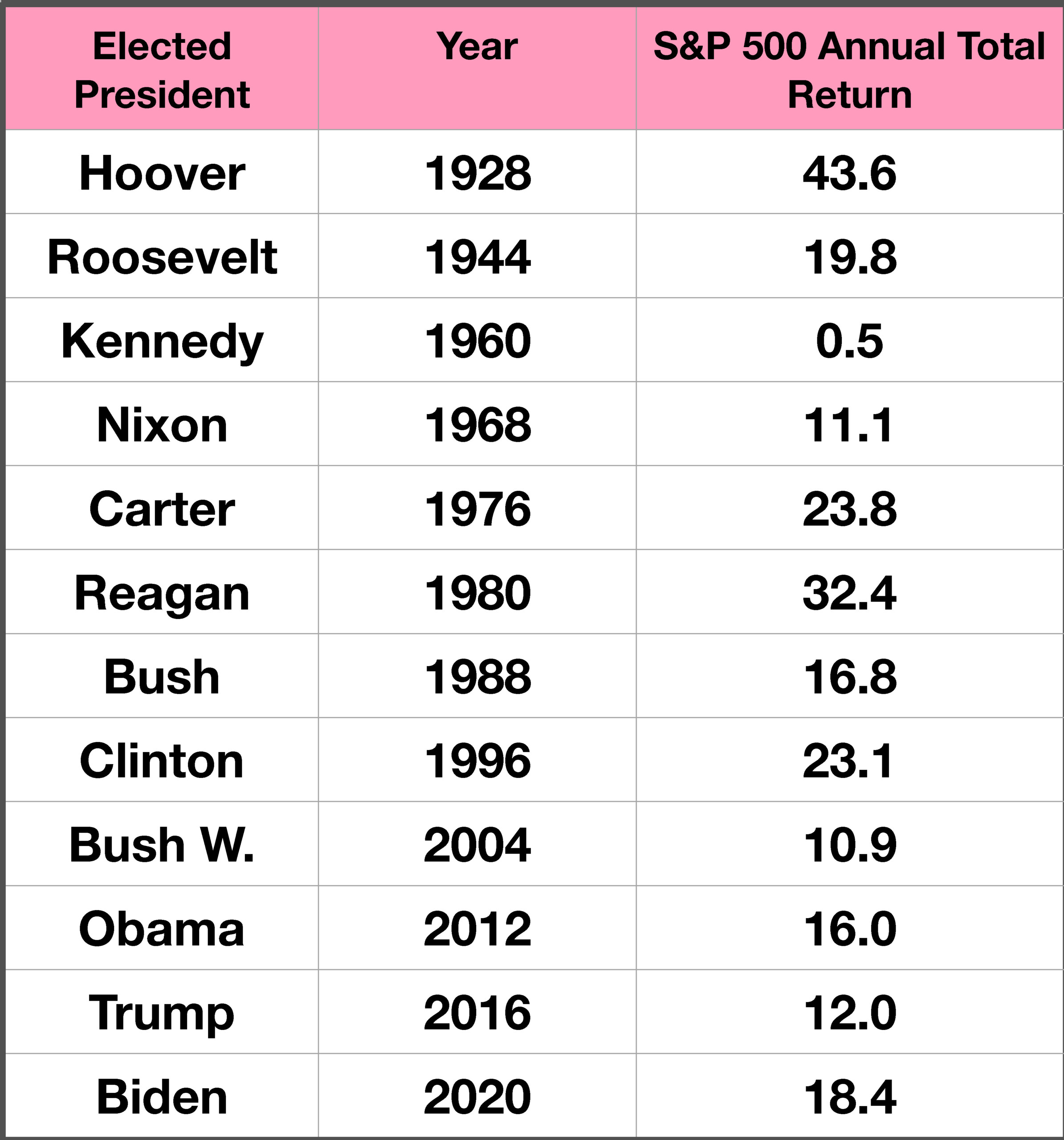

Many analysts believe that the performance of the S&P 500 Index in 2023 was not truly representative of actual market characteristics, due to a concentration in just seven stocks known as the magnificent seven. Roughly half of the performance for the S&P 500 Index in 2023 was attributable to these seven stocks, with the remaining 493 stocks in the index representing the balance of the return for 2023.

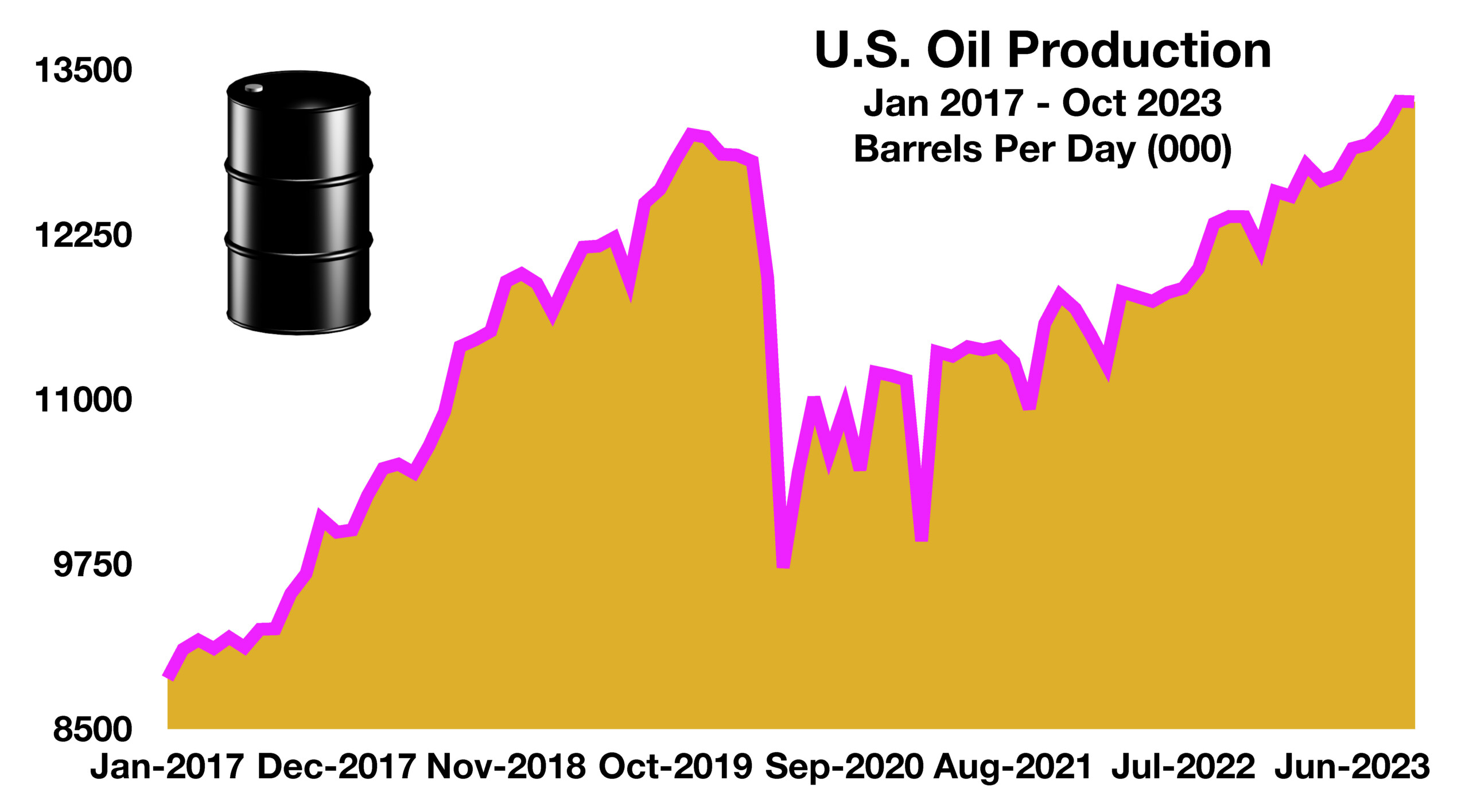

The U.S. exported approximately 75% of total domestic oil production in 2023, supplying both developed and emerging countries worldwide. Supply constraints for oil may pose a challenge as a result of worsening shipping disruptions in the Middle East, affecting prices globally.

Total Federal Debt for the U.S. reached $34 trillion at the end of 2023, up from $27.6 trillion at the beginning of 2021. Rising rates this past year have added additional debt costs for the U.S. government as interest expenses on outstanding U.S. debt has risen substantially. (Sources: Fed, BEA, Treasury Dept., EIA)