Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

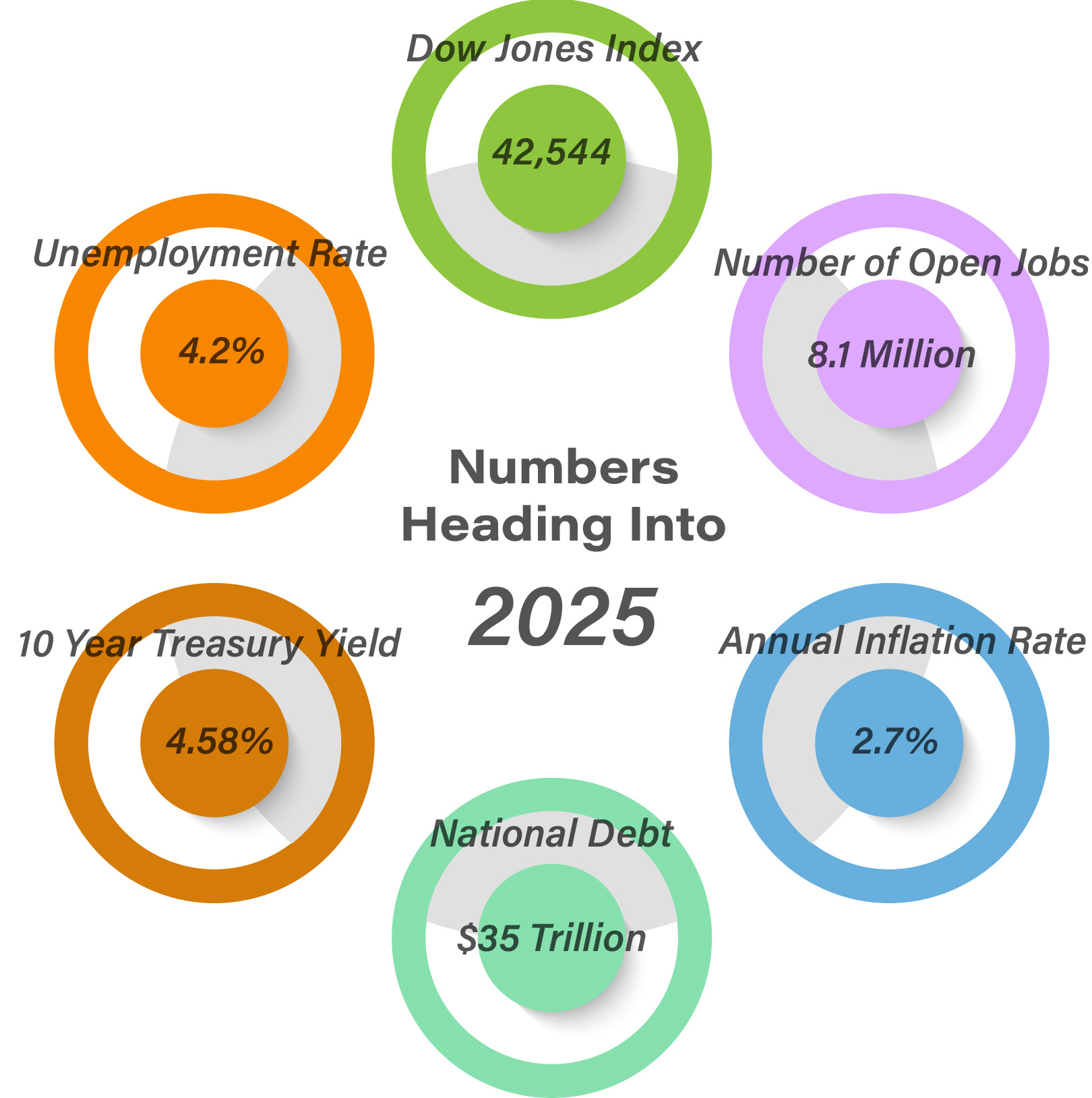

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

I’m going to start with a few predictions. I’m sure I’ll be wrong in many ways.

Powder is more fun with friends.

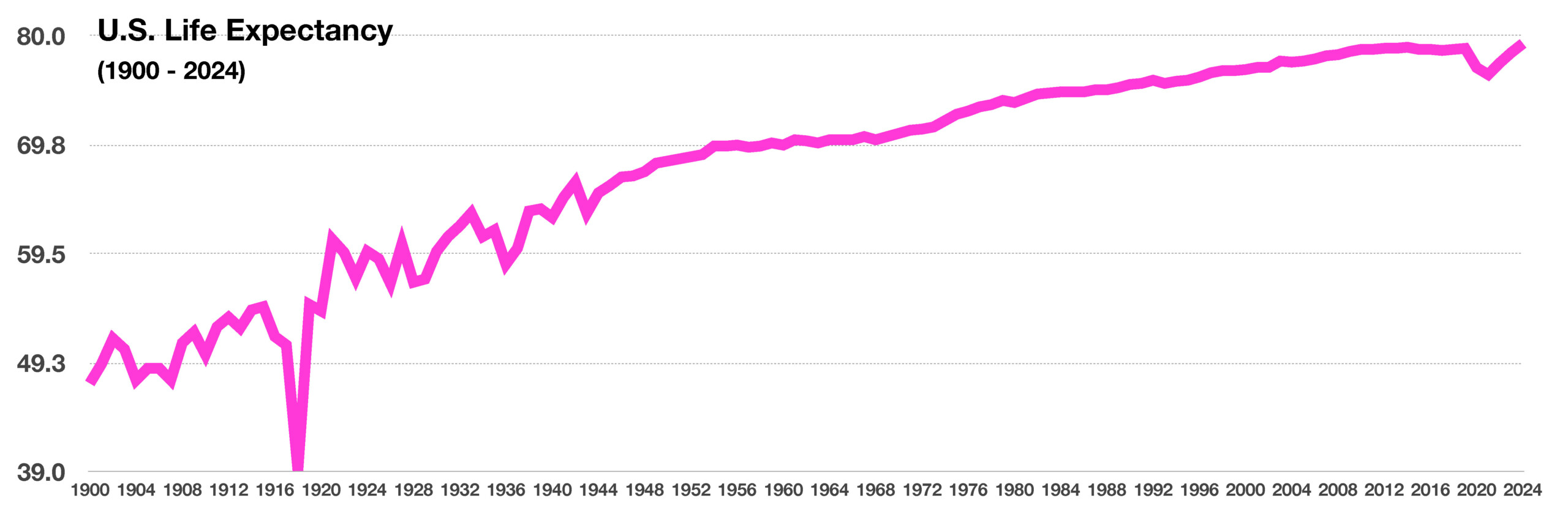

- The US Economy will continue to grow, which will provide support to risk assets like stocks and real estate. Whatever you may think of Trump as a person, Wall Street analysts are convinced he will be great for stocks over the next 12 months.

- Financial Flexibility will become the new buzzword in retirement planning. It means having access to your money when you want it without sacrificing your goals or incurring penalties. It’s what we do and it is what creates happy clients.

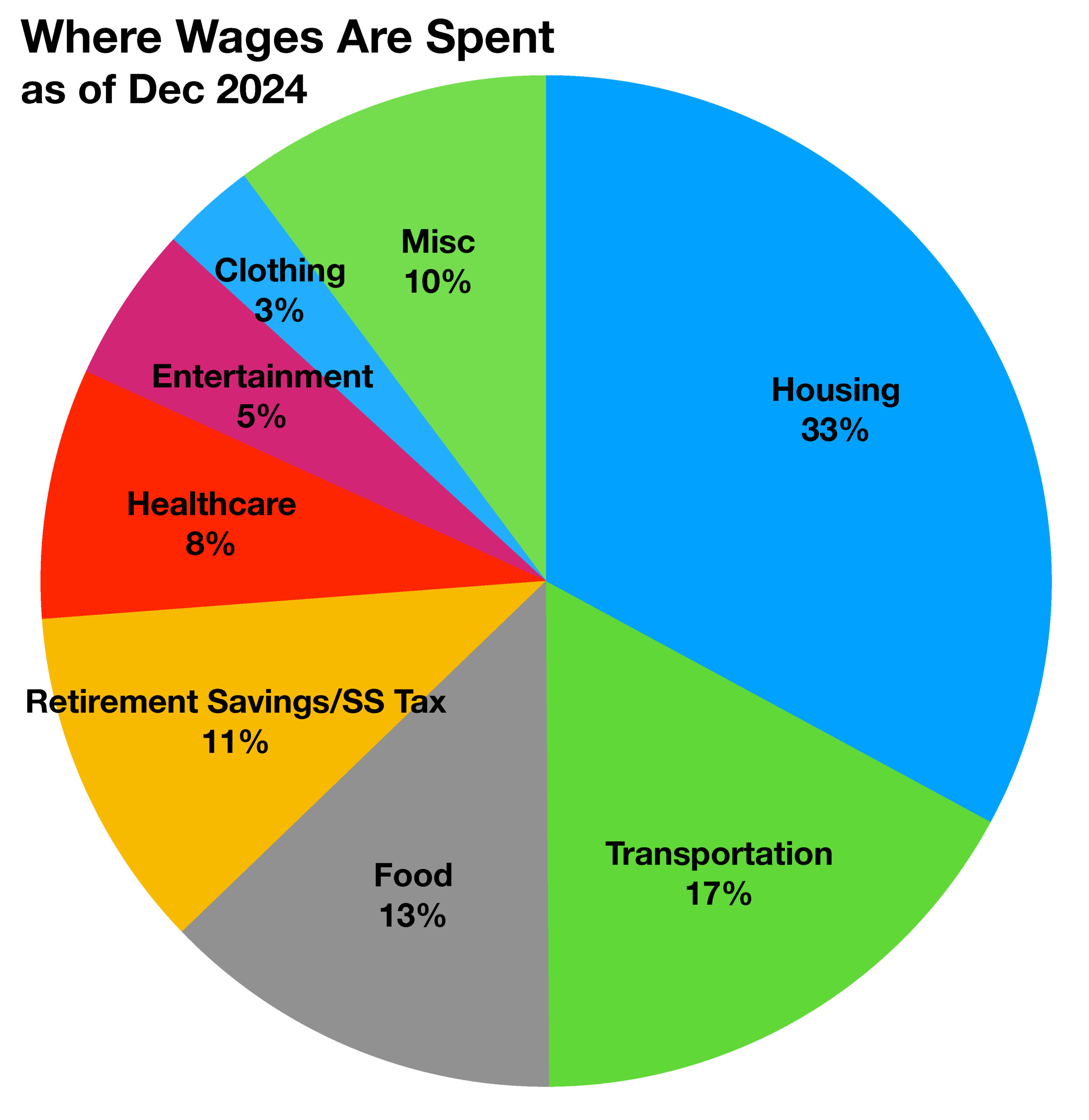

- Inflation will not come down on the things you want it to. This is the new normal and we need to plan for it.

- Using social media or otherwise letting a computer decide what you see online will generally not make you happier or smarter. Free speech is important, and fake news is here to stay.

- Cybercrime will be the greatest threat to your money and time. The Treasury Department confirmed reports that it was hacked by China last December and you could be next! Install a Password Manager today! Dashlane, 1Password, and Lastpass are the most popular and reliable. Call me if you ever suspect you are being scammed.

- Rates will continue to be high and periodically cause sell-offs in the market. Last year, escalating federal deficits and expanding government debt issuance rattled the U.S. Treasury debt market, sending Treasury yields higher. This drama will continue.

Happy 2025! I hope to help make it a great one for you.