Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

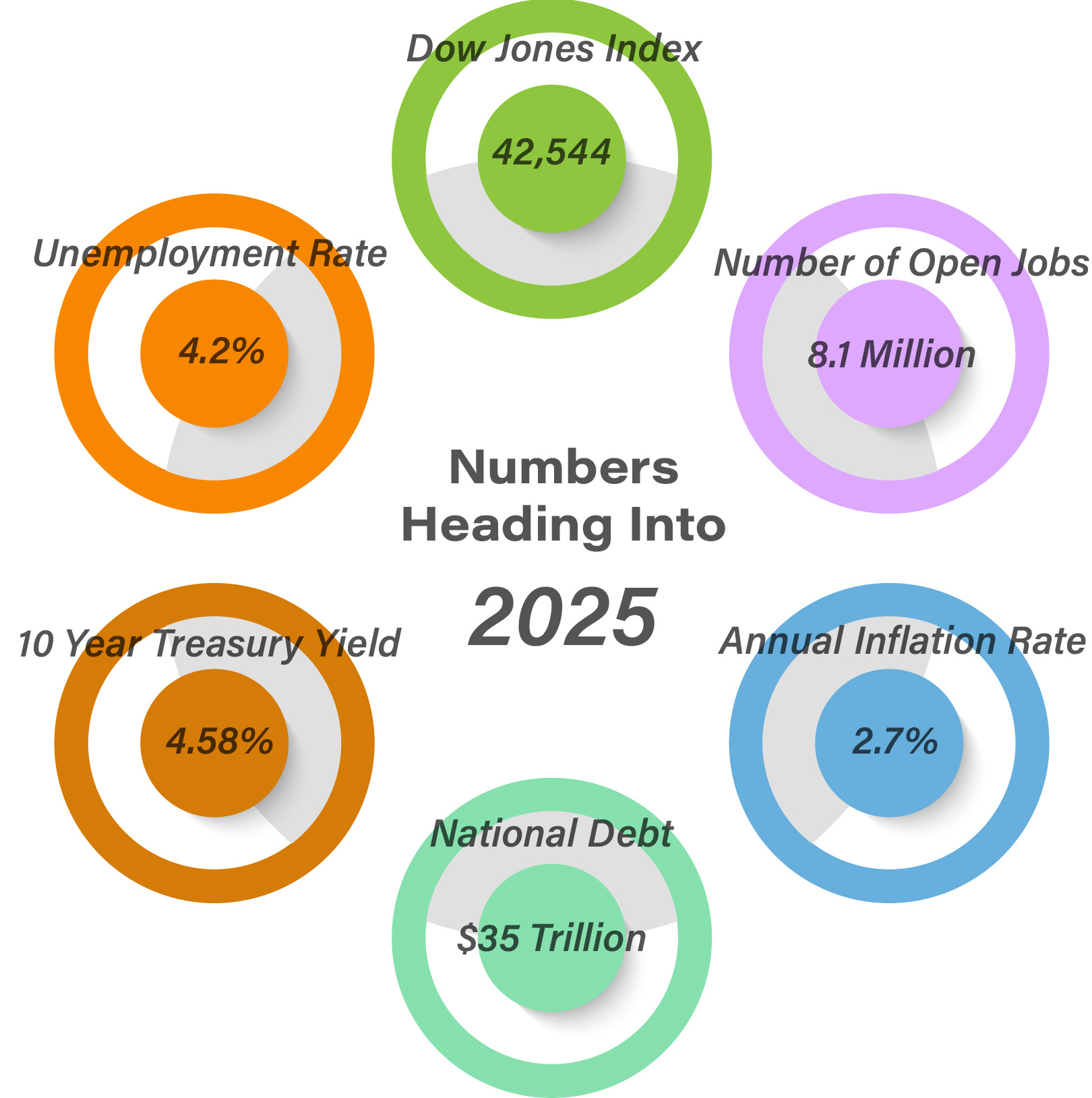

Presidential campaigning and expectations about the Fed’s direction with rates enthralled the markets in 2024. Equity indices finished the year positively, yet demonstrated hesitation throughout the year. Expectations surrounding the depth of interest rate decreases by the Fed differed as inflation data continued to hinder the trajectory of reductions.

Cryptocurrency and AI were all the rage in 2024, as enthusiasm and speculation surrounding the future of both garnered investor attention. Cryptocurrency has surged on speculation that perhaps digital money might become a form of legitimate global currency in the future and even replacing currencies from certain countries.

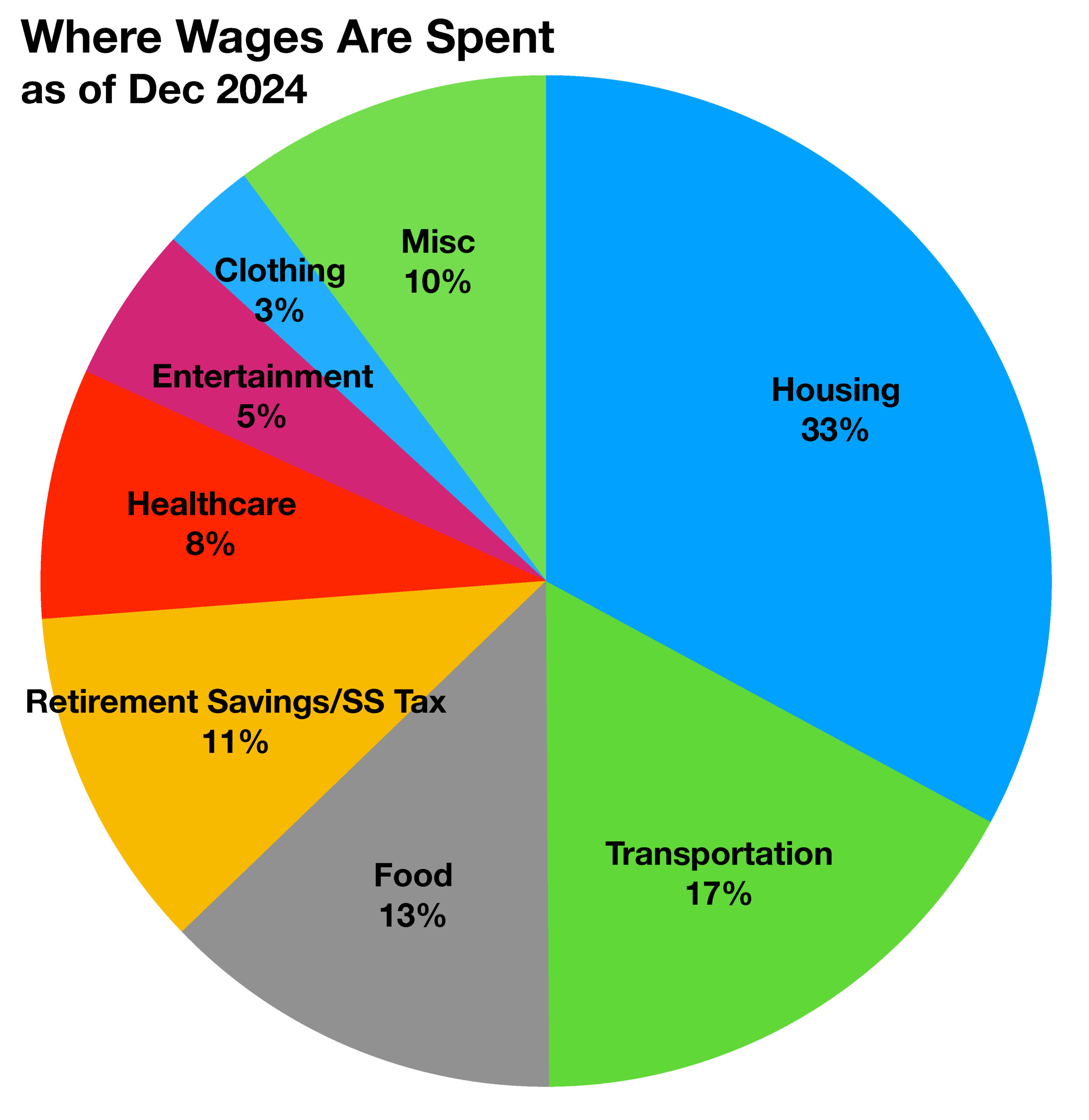

Lingering inflation worries weighed on markets as data revealed that prices remained stubbornly elevated, particularly with food and housing expenses. Consumers became more selective in 2024 as the costs for essential goods and services rose, leaving less to spend on discretionary items.

The Treasury Department confirmed reports that it was hacked by a China backed hacker in late December. Several Treasury employee workstations and unspecified documents were accessed after a key from a third-party software service provider was stolen. The agency disclosed the breach in a letter to the Senate Banking Committee.

Social Security and Supplemental Security Income (SSI) benefits for more than 72.5 million Americans will increase 2.5 percent in 2025. The 2.5 percent cost-of-living adjustment (COLA) will begin with benefits payable to nearly 68 million Social Security beneficiaries in January 2025. Increased payments to nearly 7.5 million SSI recipients began on December 31, 2024.

Escalating federal deficits and expanding government debt issuance rattled the U.S. Treasury debt market, sending Treasury yields higher towards the end of 2024. Weakening demand for newly issued Treasury bonds also placed pressure on bond prices, with the yield on the benchmark 10-year Treasury bond ending 2024 at 4.58%, up from 3.95% at the beginning of 2024. (Sources: Fed, Treasury Dept., SS Admin., Labor Dept.)