Derek J. Sinani

Founder/Managing Partner

derek@ironwoodwealth.com

7047 E. Greenway Parkway, Ste. 250

Scottsdale, AZ 85254

480.473.3455

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

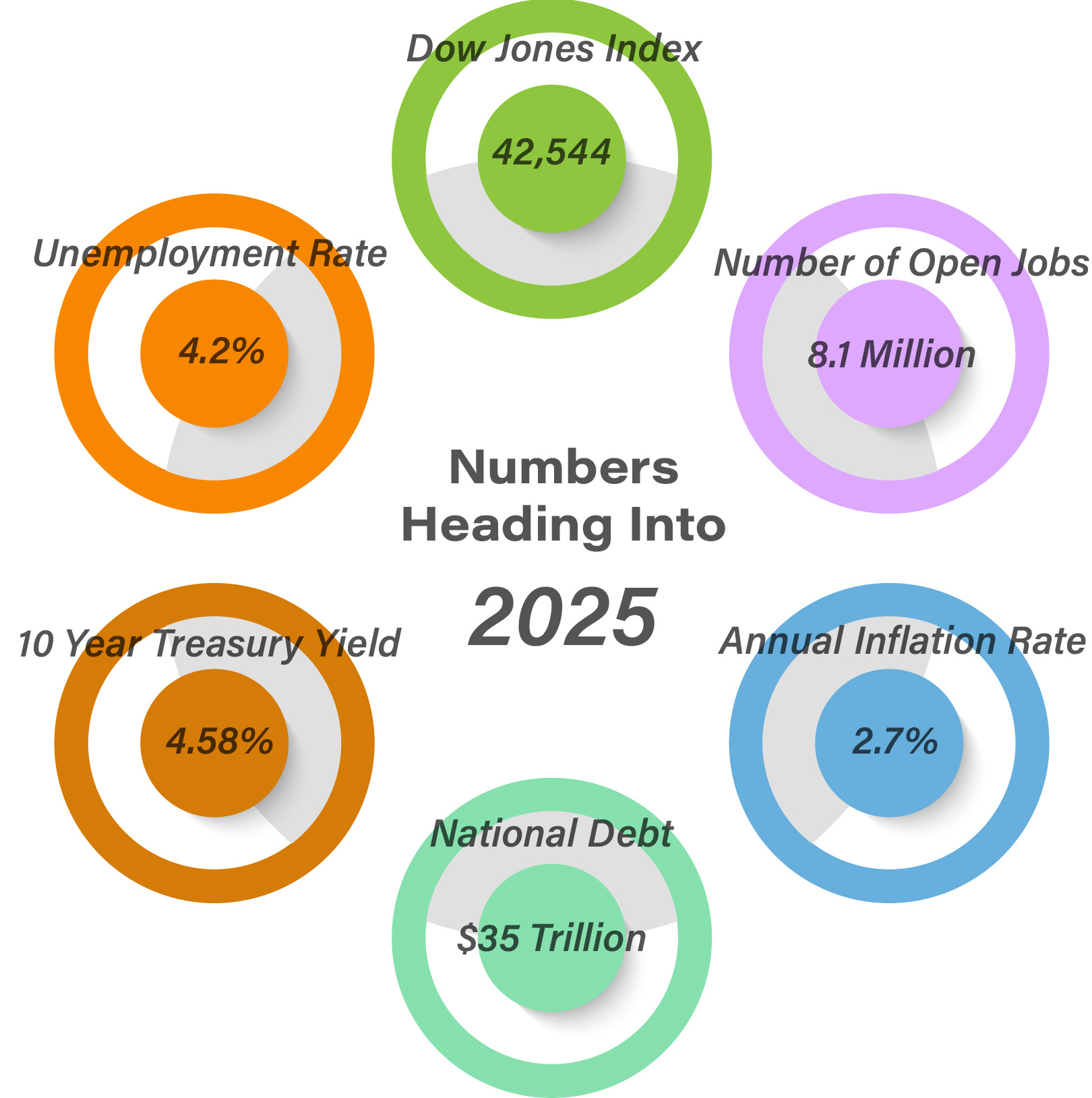

Macro Overview: Presidential campaigning and expectations about the Federal Reserve’s interest rate policy enthralled markets throughout 2024. Equity indices finished the year positively, yet demonstrated hesitation throughout the year by climbing a wall of worry. Expectations surrounding the depth of Fed easing differed as inflation data and a strong economy hindered the perceived trajectory of future cuts. Since the mid-2024, I’ve been suggesting that the Fed did not need to aggressively cut rates. During the fall of 2024, I wrote that it was prudent for the Fed to consider pausing/slowing their pace of monetary easing. At the December FOMC meeting they came around to this thinking and signaled a slowing/reduction of their previously projected pace of cuts. The markets reacted negatively to this news – sending markets broadly lower into year-end, which has carried over into the new year. I welcome the Fed’s policy shift as it will lengthen the overall easing cycle into 2026 – while reducing the risk of overstimulating the economy and stock market. Once digested, I strongly believe the markets will embrace this thinking and it will become a positive narrative for 2025.

Cryptocurrency and AI were all the rage in 2024, as enthusiasm and speculation surrounding the future of both garnered investor attention. Cryptocurrency has surged on speculation that digital money might become a form of legitimate global currency in the future. The new administration’s talk of creating a strategic government bitcoin reserve certainly legitimizes the asset class. Blackrock, one of the world’s preeminent asset managers suggests interested investors hold 2% of their portfolio in bitcoin, the world’s largest cryptocurrency.

Among the focal factors for the incoming presidential administration are deregulation, lower corporate and individual taxes, immigration, reduced government spending and expanding U.S. manufacturing. Markets are anxiously awaiting final confirmation of cabinet appointments, whose influence can affect the direction of companies and industries. Deregulation and lower corporate/individual taxes are very pro-business, as such, are very pro-economy and pro-stock market.

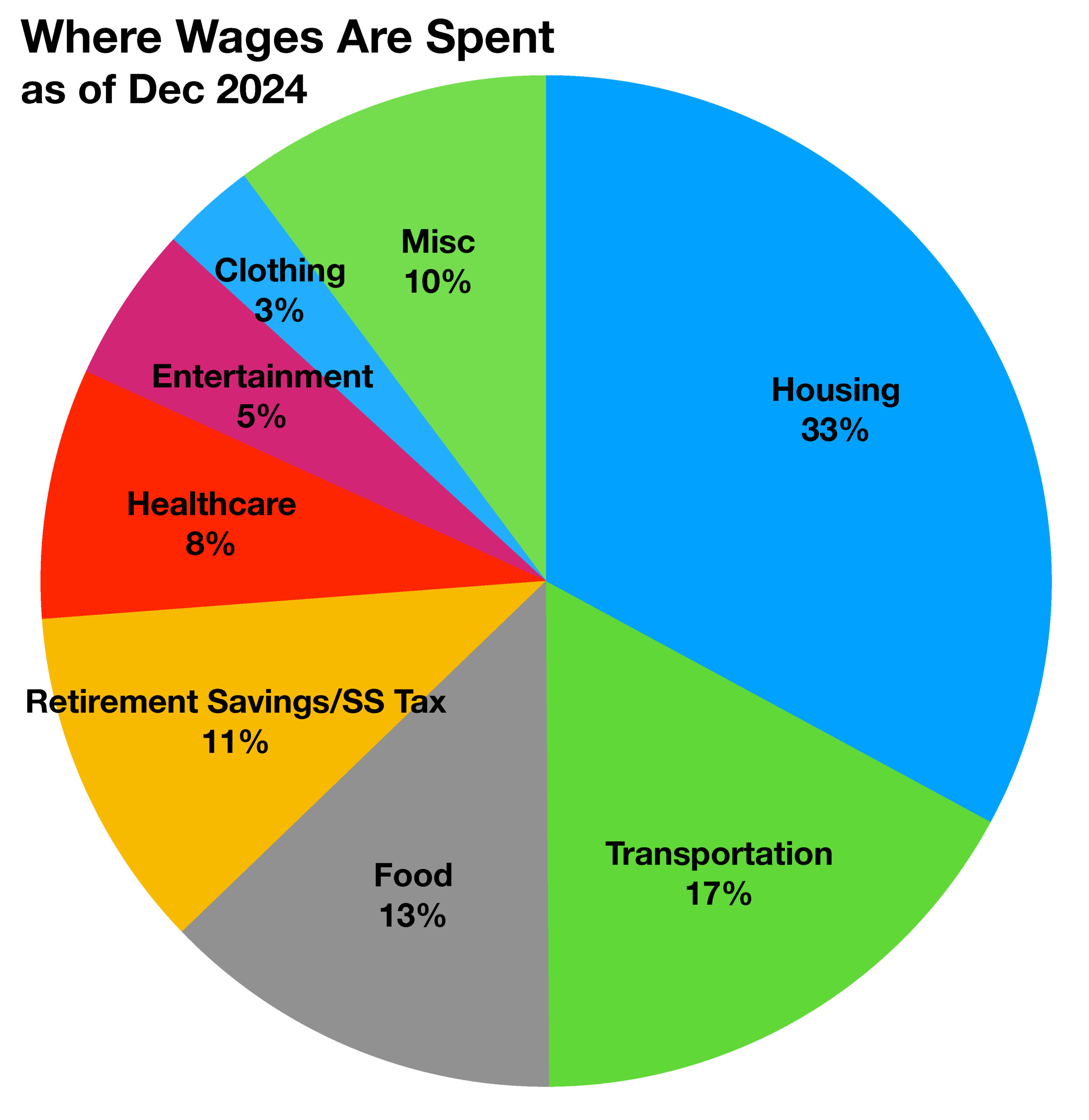

Social Security and Supplemental Security Income (SSI) benefits for more than 72.5 million Americans will experience a 2.5 percent cost-of-living adjustment (COLA) for 2025.

Escalating federal deficits and expanding government debt issuance rattled the U.S. Treasury debt market, sending Treasury yields higher towards the end of 2024. The benchmark 10-year Treasury bond ending 2024 at 4.58%, up from 3.95% at the beginning of 2024.