Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Portfolio Overview

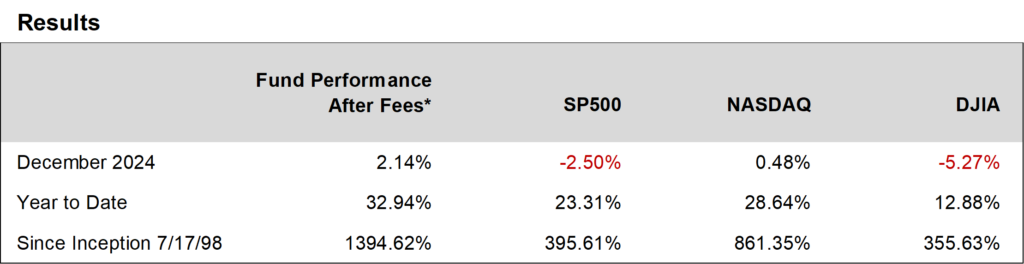

Ocean Park Investors Fund delivered excellent results in 2024, gaining 32.94%* for the year (after a 33.46%* gain in 2023), while the S&P 500 gained 23.31% and the NASDAQ Composite gained 28.64%.

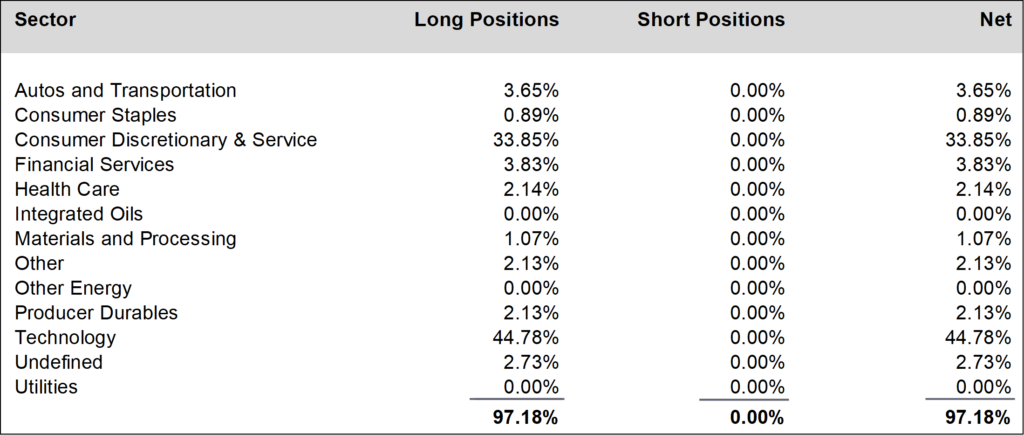

Our investment approach has always focused on identifying companies with earnings potential that exceeds consensus expectations. Historically, this strategy resulted in a portfolio of 60 to 90 positions. However, over the past two years, we have shifted toward concentrating larger investments in a smaller number of high-conviction opportunities, especially in companies which benefit from technological innovation. While maintaining diversification, we’ve reduced the number of holdings from 64 at the end of 2022 to 54 at the end of 2023, and further to 44 by the close of 2024. We believe that this streamlined approach has been a key driver of the fund’s exceptional performance over the past two years—among the strongest since its inception.

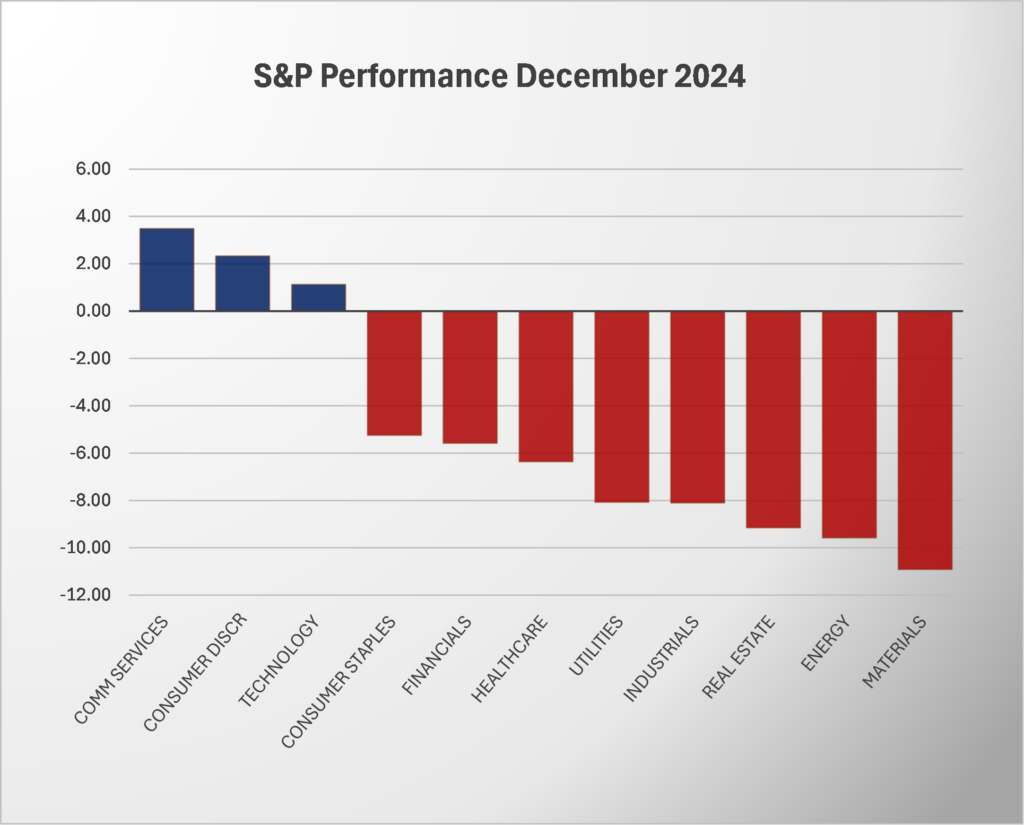

In December, the fund rose 2.14%* while the S&P 500 fell 2.50% and the NASDAQ Composite rose 0.48%. Portfolio holdings in technology stocks led the way, with gains in Broadcom (up 43%) and Astera Labs (up 28%) offsetting a modest decline in Nvidia. During the month we increased positions in the consumer discretionary and service sector and reduced exposure to the IVV ETF. We finished the month at about 96% net long, down from about 97% in November.

We once again thank you for your investment in the Fund, as we strive to build upon our long-term performance and earn your continued confidence.

Daily updates on our activity are available on our Results Line, at 310-281-8577, and current information is also maintained on our website at www.oceanparkcapital.com.

*These results are pro forma. Actual results for most investors will vary. See Asset Allocations and additional disclosures on page 4. Past performance does not guarantee future results.