W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Equity Indices Have a Rough First Half – Equity indices have had a difficult first half of the year, their worst in decades. The S&P 500 Index had its worst first half in over five decades, the Dow Jones Index suffered its worst six months since 1962, and the Nasdaq had its worst first six months ever. Energy was the only positive sector in the S&P 500 for the first six months, while the other ten sectors, including health care, financials, communications, and real estate, were negative. Consumer discretionary and technology sector stocks were among the worst-performing sectors, with consumer staple stocks among the better performers. Second-quarter earnings, due for release in July, are expected to reveal how company profits fared with exceptionally elevated material and labor costs earlier in the year. Analysts are also sensitive to a growing consensus expecting a recessionary environment before the end of the year. On the fixed side, the yield on the 2-year Treasury bond fell to 2.84% on July 1st, the biggest drop since March 2020. Yields on the 5, 10, and 30-year Treasury bonds also fell, indicative of deflationary trends. Many analysts expect the Fed to raise short-term rates at least once more by 75bps in July, with a possible pause thereafter. Some are even projecting the Fed to reverse course and start easing rates in 2023 should the economy fall into a recession. (Sources: Bloomberg, S&P, Reuters, Dow Jones, Treasury Dept., Federal Reserve)

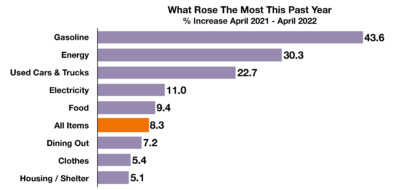

What’s Risen the Most – Tracking Inflation

Compare that with the Federal government making $.18 (3.4%) per gallon, and some state governments make much more, like Pennsylvania ($0.57 per gallon), California ($0.51 per gallon), Washington ($0.49 per gallon), New Jersey ($0.42 per gallon), and Illinois ($0.39 cents per gallon). (Sources: EIA, BLS, Labor Dept.The Federal Reserve Bank of Atlanta, EuroStat, Dept. of Energy, S&P, UN World Food Programme, AIER – Leave the Gas Station Owners Out of It | AIER)

So, the minimum distribution rules discussed below apply to: traditional IRAs, SEP IRAs, SIMPLE IRAs, 401(k) plans, 403(b) plans, 457(b) plans, profit-sharing plans, and other defined-contribution plans.

So, the minimum distribution rules discussed below apply to: traditional IRAs, SEP IRAs, SIMPLE IRAs, 401(k) plans, 403(b) plans, 457(b) plans, profit-sharing plans, and other defined-contribution plans.