Aspen Wealth Management, Inc.

9300 W. 110th Street, Suite 680

Overland Park, KS 66210

913.491.0500

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

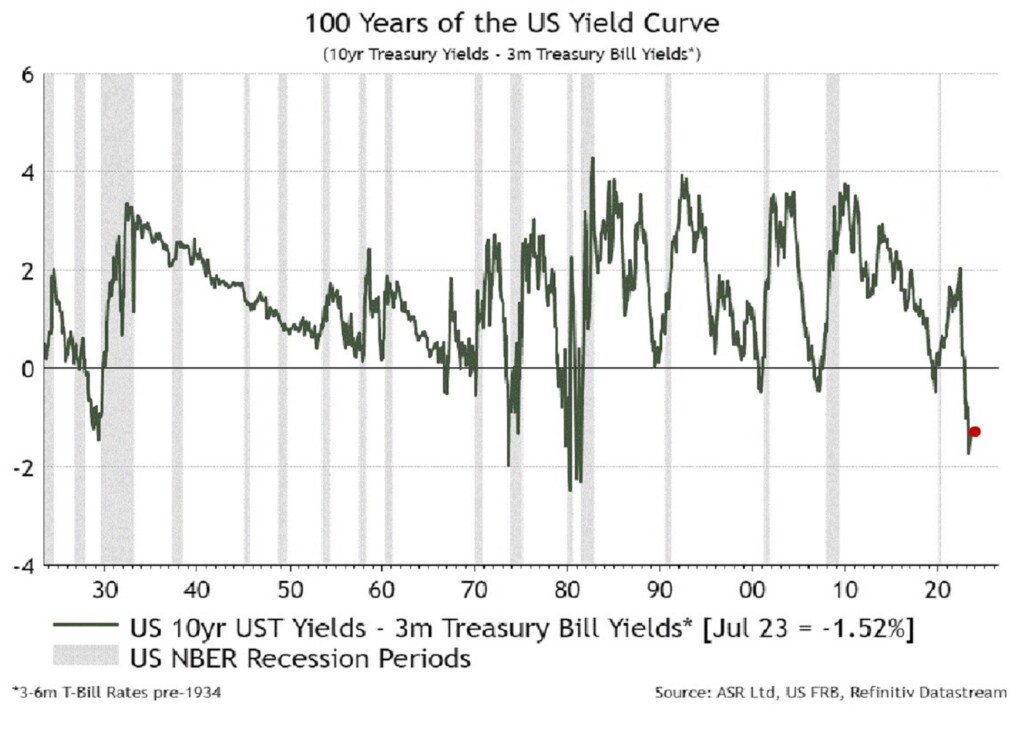

The US debt ceiling resolution in early June aided US equity markets to rally. Recently, the Federal Reserve has essentially signaled that it is more concerned about combating inflation than the negative consequences of continued rising rates on the economy. The Fed indicated that it intends to raise rates at least two more instances this year. As a result, the yield on the benchmark 10-year US Treasury increased from 3.48% to 3.81% (now at 4.06%). This was a headwind for US fixed income/bond prices.

Once each year, the Federal Reserve conducts a test to assess how large banks are likely to perform under hypothetical economic conditions. The results of the most recent tests revealed that all the major banking institutions passed this year’s stress test. The tests assumed a hypothetical 10% unemployment rate and a 40% drop in commercial real estate prices.

US Equities Rally

The S&P 500 delivered attractive returns for the first six months of the year, achieving a commendable increase of 15.91%. It is important to note that these gains were largely concentrated in a few very large companies often called megacaps. In fact, the dominance of the top five stocks, namely Apple, Microsoft, Alphabet-Google, Amazon, and Nvidia, significantly influenced the benchmark index’s performance. Despite comprising just 22% of the index’s allocation, these five stocks accounted for over 80% of the overall index return. In contrast, the Dow Jones Industrial Average lagged behind, exhibiting a modest advance (+3.80% year-to-date). The remarkable surge witnessed in the SP500 benchmark index during the first half of the year can be attributed to a confluence of factors, with the foremost among them being the phenomenal progress made by technology-led growth stocks. The prevailing optimism was further bolstered by indications that the Federal Reserve’s aggressive stance on interest rate hikes was indeed achieving the desired deceleration effect on the economy, prompting market participants to escalate their expectations of the central bank curtailing its monetary policy tightening before year-end.

However, the primary impetus behind the formidable gains observed in the initial six months primarily stems from the exceptional performance exhibited by growth-oriented industries, driven by the fervor surrounding artificial intelligence and a notable upswing in earnings trajectory. Notably, outpacing the S&P 500 are solely three sectors, all of which fall under the purview of growth sectors. Information Technology jumped 42.06% year-to-date, boosted by chipmakers (Nvidia – NVDA) and some behemoths such as Apple (APPL) and Microsoft (MSFT). Communications Services, which include Alphabet (GOOG) and Meta Platforms (META), gained 35.58%, and Consumer Discretionary, which holds Amazon (AMZN) and Tesla (TSLA), was up 32.33%. Combined, these three sectors account for about 47% of the overall market weighting and 112% of the YTD performance of the S&P 500. All the other sectors significantly underperformed the benchmark index over the last six months. The S&P 500 gains aren’t broad across all sectors as the financial (-1.5%), utilities (-7.16%), health care (-2.33%), and energy (-7.26%) sectors all experience first half losses.

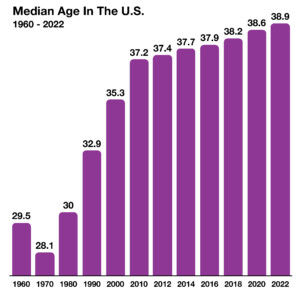

Americans’ median age reached 30 years old in 1980 and rose to 35 years old in 2000. In the past 22 years, the average age has risen by 3.6 years. America has been steadily aging over the past 50 years, with the median age rising 10.8 years since 1970.

Americans’ median age reached 30 years old in 1980 and rose to 35 years old in 2000. In the past 22 years, the average age has risen by 3.6 years. America has been steadily aging over the past 50 years, with the median age rising 10.8 years since 1970.

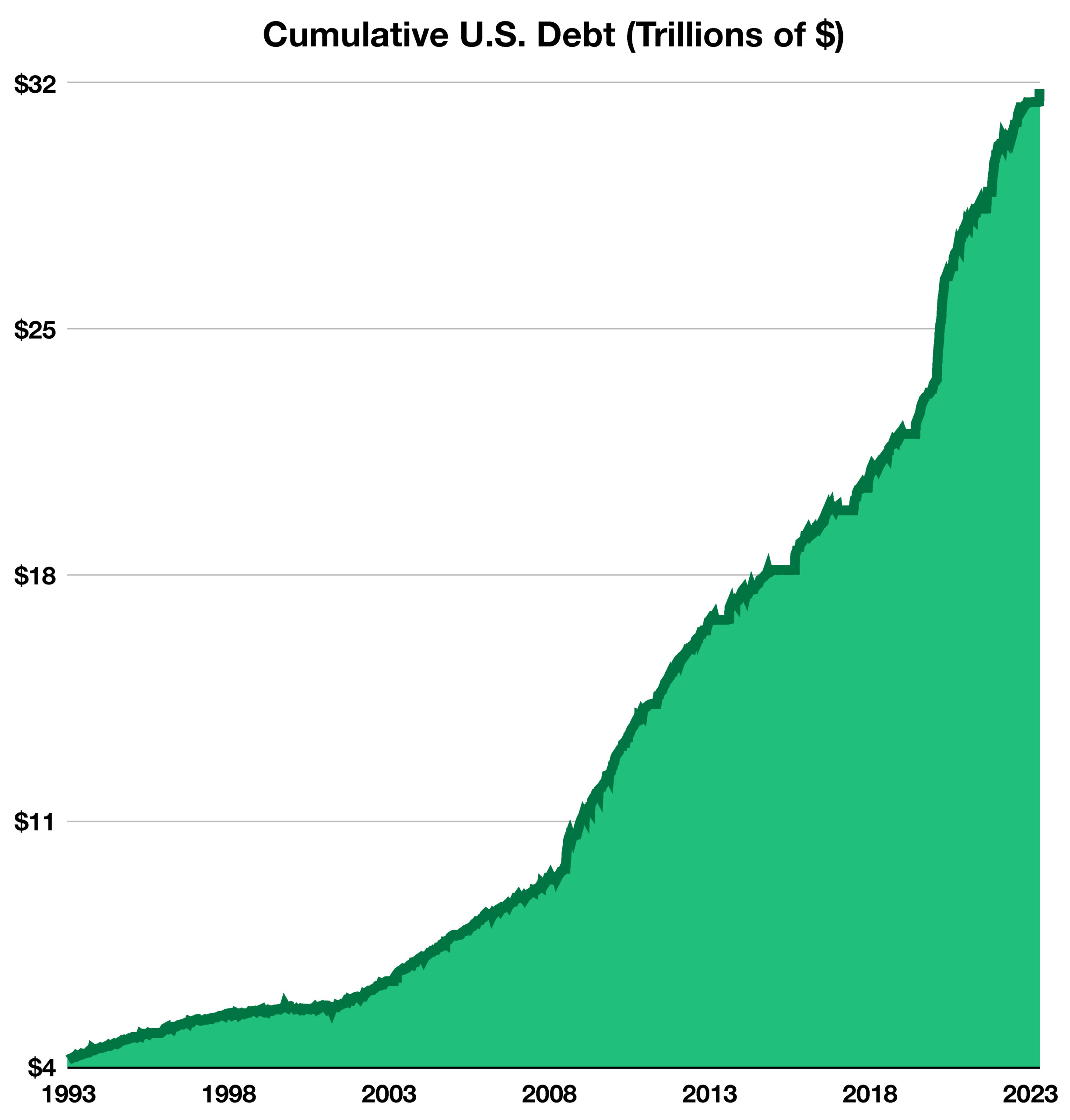

993. The level of debt is increasing so quickly, the chart may soon need to be illustrated in logarithmic scale.

993. The level of debt is increasing so quickly, the chart may soon need to be illustrated in logarithmic scale.