Stock Indices:

| Dow Jones | 39,118 |

| S&P 500 | 5,460 |

| Nasdaq | 17,732 |

Bond Sector Yields:

| 2 Yr Treasury | 4.71% |

| 10 Yr Treasury | 4.36% |

| 10 Yr Municipal | 2.86% |

| High Yield | 7.58% |

YTD Market Returns:

| Dow Jones | 3.79% |

| S&P 500 | 14.48% |

| Nasdaq | 18.13% |

| MSCI-EAFE | 3.51% |

| MSCI-Europe | 3.72% |

| MSCI-Pacific | 3.05% |

| MSCI-Emg Mkt | 6.11% |

| US Agg Bond | -0.71% |

| US Corp Bond | -0.49% |

| US Gov’t Bond | -0.68% |

Commodity Prices:

| Gold | 2,336 |

| Silver | 29.43 |

| Oil (WTI) | 81.46 |

Currencies:

| Dollar / Euro | 1.06 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 160.56 |

| Canadian /Dollar | 0.73 |

Macro Overview

Markets were influenced by election dynamics and economic data in June as equities and bonds responded to uncertainty surrounding the direction of future fiscal policy and when the Fed might commence its rate reduction initiative.

Equity indices ended the second quarter mixed as the S&P 500 Index and the Nasdaq Composite Index outperformed the Dow Jones Industrial Index. Technology related companies advanced during the quarter while energy and industrial companies lagged.

Big banks underwent a stress test, which is imposed by the Federal Reserve to determine financial viability as well as the ability for banks to withstand severe economic and financial shocks. All 31 banks tested remained above their minimum capital requirements during the hypothetical severe recession scenario, and are considered well-positioned to weather a severe recession and continue lending.

The most recent employment report showed that the unemployment rate rose to 4.1%, incentivizing the Federal Reserve to consider lowering rates sooner rather than later. Companies have been slowing their rate of hiring as well as increasing layoffs across various industries. Economists view these dynamics as indicative of decelerating economic activity. Some analysts expect the Fed to initiate rate reductions as early as September should economic data continue to substantiate slowing growth trends.

European central bankers, academics, financial market representatives, and journalists met in Sintra, Portugal in early July to exchange views on current policy issues and discuss long-term economic perspectives affecting European countries and the EU. Primary topics included continued inflationary pressures throughout Europe, the ongoing conflict with the Russian invasion of Ukraine, and employment challenges for the region. Subdued economic activity and slowing industrial production were part of the discussions, as Industrial production in the EU dropped by 5.4% between February 2023 and February 2024. The significant year-over-year decrease indicates a slowdown in industrial activity throughout Europe.

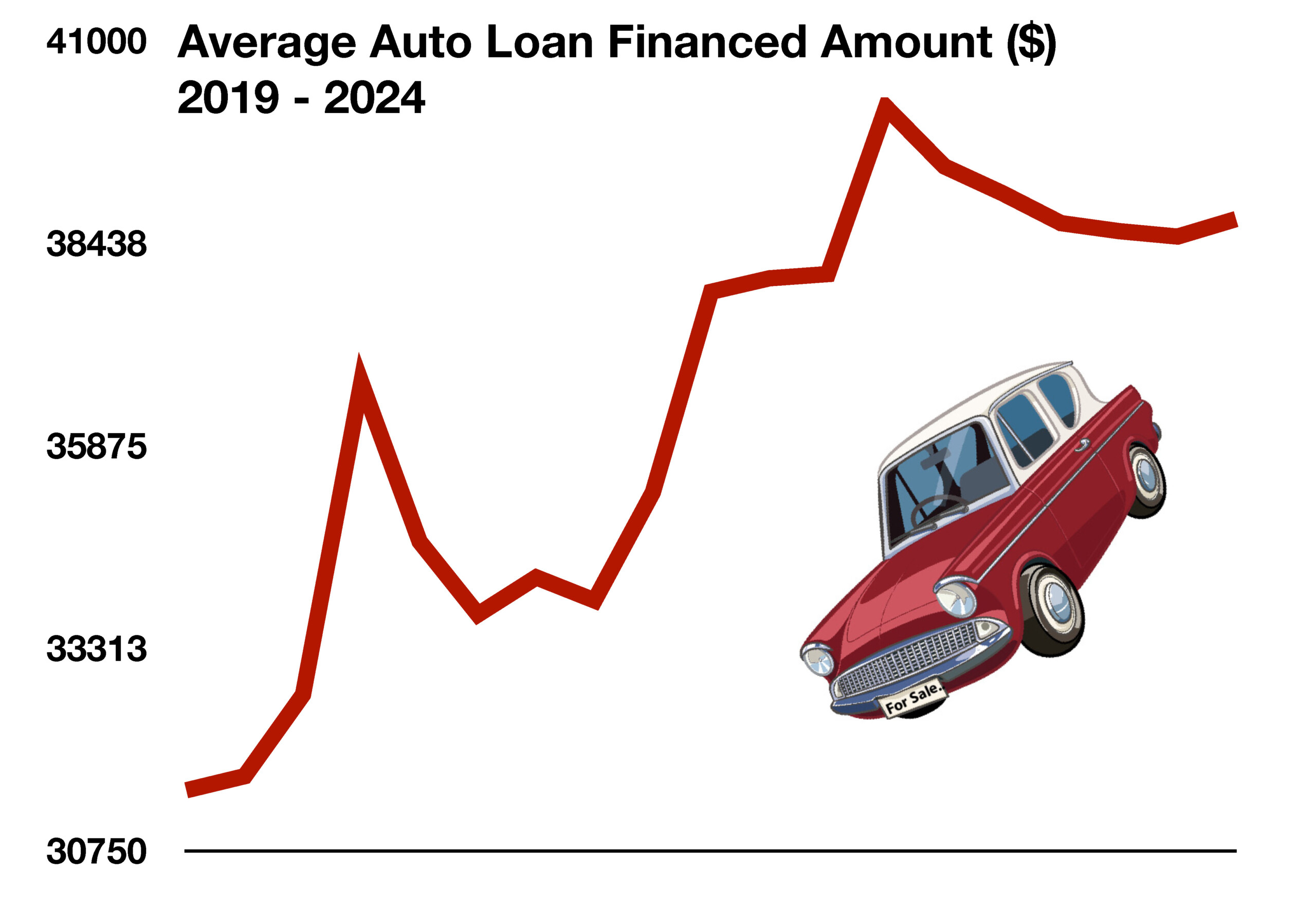

Financing costs for new autos remained relatively high in June, even though auto prices have been dropping. The typical monthly payment for a new auto loan set a record high of $740 this quarter, thus reducing consumer demand even as the average price on autos continue to drop due to easing supply chains and ample inventory.

Technology is advancing as companies are reconfiguring their computing infrastructure from information retrieval to an A.I. approach. The changes and advancement are anticipated to take years and are expected to affect nearly every sector and industry.

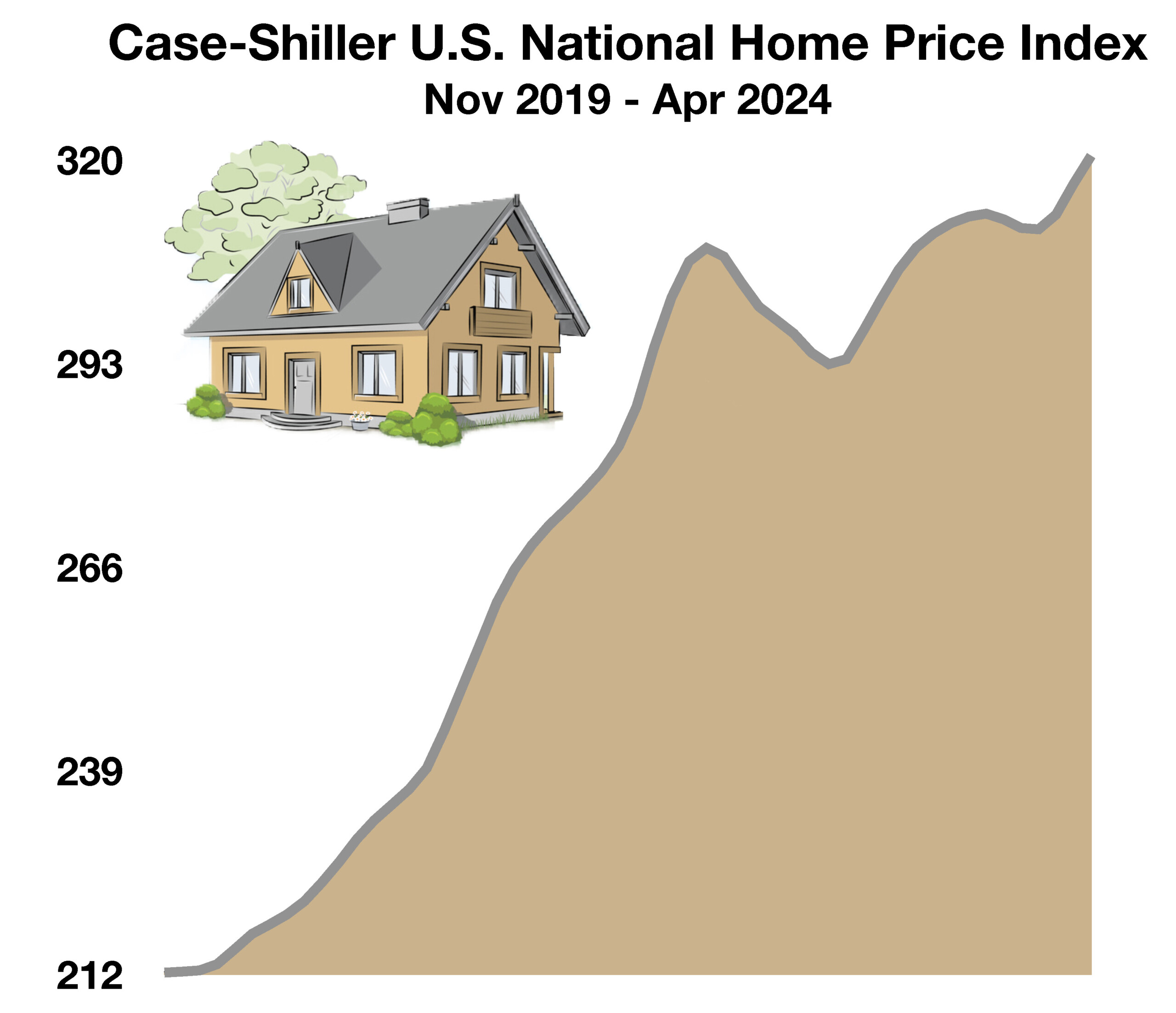

A model used by the Federal Reserve in valuing residential home values found that homes are now 25% overvalued, just below the 28% peak in 2007. Using the Labor Department’s measure of rent, home prices are 19% overvalued using private measures of market rents. The Fed also follows the S&P CoreLogic Case-Shiller U.S. national home price index, which is up 51% since the end of 2019. (Sources: U.S. Treasury, Federal Reserve, S&P, Eurostat, Labor Dept., ECB, Dow Jones, Nasdaq, Case-Schiller)

A model used in valuing residential home values found that homes are now 25% overvalued, just below the 28% peak in 2007. Using the Labor Department’s measure of rent, home prices are 19% overvalued using private measures of market rents.The Fed also follows the S&P CoreLogic Case-Shiller U.S. national home price index, which tracks U.S. home prices nationwide. The index is up 51% since the end of 2019, an extraordinary rise relative to historical data. Another factor that is closely followed is the cost to rent versus owning. According to the Labor Department, the owner-equivalent rent is up 24% since 2019, meaning that the cost to purchase a home has risen more than the cost to rent since 2019. (Source: Federal Reserve Board of Governors)

A model used in valuing residential home values found that homes are now 25% overvalued, just below the 28% peak in 2007. Using the Labor Department’s measure of rent, home prices are 19% overvalued using private measures of market rents.The Fed also follows the S&P CoreLogic Case-Shiller U.S. national home price index, which tracks U.S. home prices nationwide. The index is up 51% since the end of 2019, an extraordinary rise relative to historical data. Another factor that is closely followed is the cost to rent versus owning. According to the Labor Department, the owner-equivalent rent is up 24% since 2019, meaning that the cost to purchase a home has risen more than the cost to rent since 2019. (Source: Federal Reserve Board of Governors)