KCG Investment Advisory Services

Kimberly Good

315 Commercial Drive, Suite C1

Savannah, GA 31416

912.224.3069

Stock Indices:

| Dow Jones | 48,063 |

| S&P 500 | 6,845 |

| Nasdaq | 23,241 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.18% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.48% |

YTD Market Returns:

| Dow Jones | 13.07% |

| S&P 500 | 16.46% |

| Nasdaq | 20.36% |

| MSCI-EAFE | 27.89% |

| MSCI-Europe | 31.95% |

| MSCI-Pacific | 29.87% |

| MSCI-Emg Mkt | 30.58% |

| US Agg Bond | 7.30% |

| US Corp Bond | 7.77% |

| US Gov’t Bond | 6.88% |

Commodity Prices:

| Gold | 4,325 |

| Silver | 70.34 |

| Oil (WTI) | 57.42 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 156.18 |

| Canadian /Dollar | 0.73 |

I am the Portfolio Manager and Chief Investment Officer for KCG. Sounds pretty fancy!

But it is not just a title but the focus of my world as your Advisor; and it is one that many “advisors” cannot necessarily claim because they are sales and service representatives and not the portfolio decision-makers. It is my job to decide what to buy and sell within your accounts, and I should be able to articulate to you why I make those decisions. That said, one thing I do not do for you is vote regarding corporate actions like proxies on corporate board decisions or deciding whether to accept a tender offer. I am always eager to share my knowledge and insight regarding particular issues, but my clients have a wide range of opinions and personalities and these decisions can be very personal.

For example, the decision-making process has and does include “ESG” standards or Environment, Social and Governance. I am passionate and have been writing about this movement since 2006. It now impacts almost every organization and it has the potential to greatly affect the profitability of most companies – both public and private. The three principles embodied are Environmentalism, Social Justice (DEI), and Corporate Governance. Blackrock and leader Larry Fink had been and continues to approach companies held in Blackrock and iShare funds. (If you have a retirement plan, you probably hold some iShares.) They pressure these companies to follow the ESG standards or be removed from the funds (Read as “Corporate Governance”). Indirectly, this is also having a great impact on the indexes since any company declining to adhere to the ESG standards loses Blackrock shareholder investments.

Currently, I have heard estimates that ~80% of the companies in the S&P 500 have adopted some version of these standards; but adoption often requires a corporate action. When corporate boards vote on these issues, you likely receive a proxy.

You may believe that your investment in any one company is a drop in the bucket and your proxy carries no weight. But just like electing a government official, your vote counts. It is only when we exercise the privilege to vote that our opinions can be considered. Just like the ballot box, it takes each of us and all of us to make a difference.

My services do not include me voting on your behalf because my opinion is not what matters here. If you have assets managed elsewhere, I suggest you take back the right to vote your own proxies. My job is to tell you what you need to know, how it affects your portfolio, and what I’m doing about it. Along those lines…

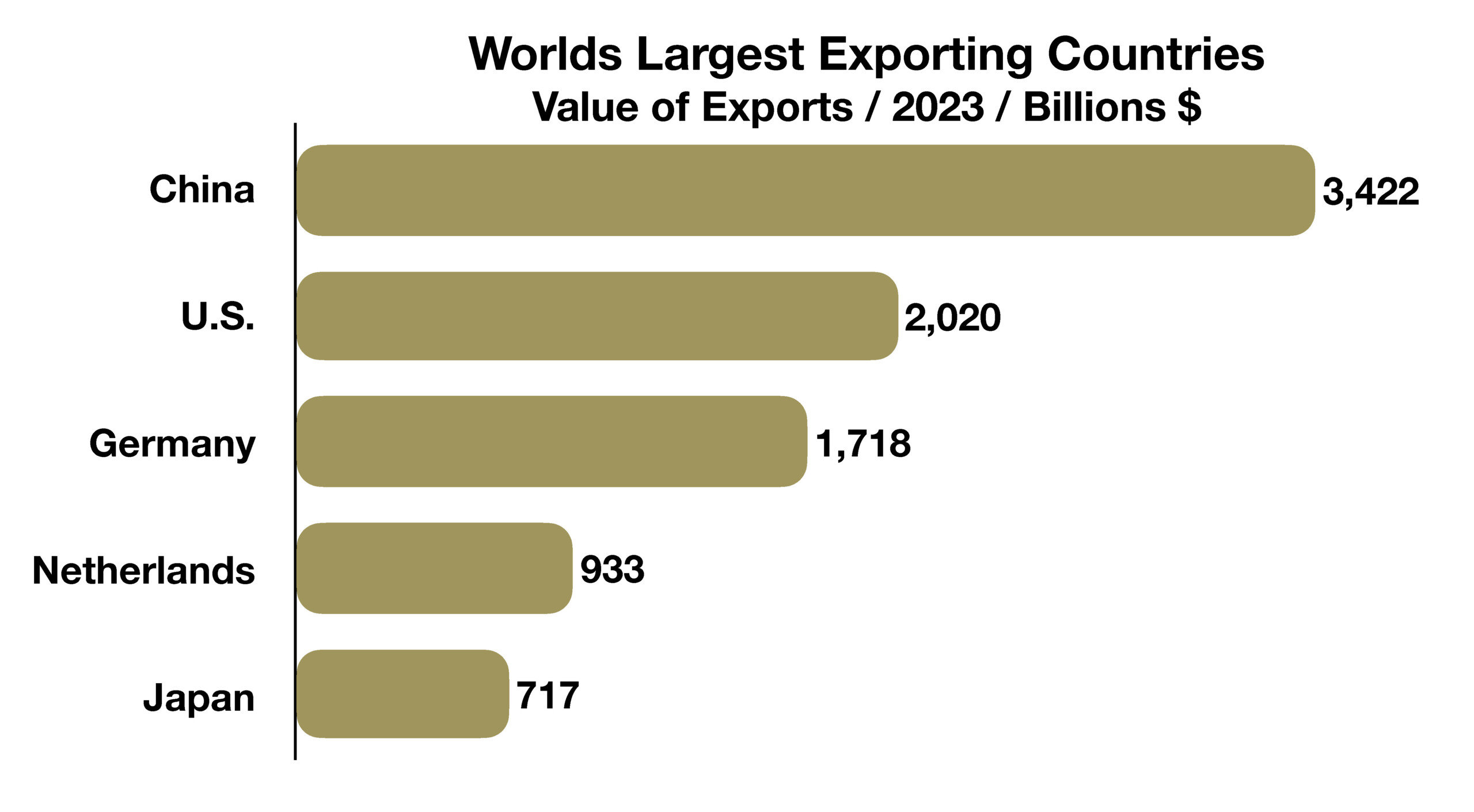

My August newsletter will address the strength of the dollar and the recent failure of Saudi Arabia to renew the Petrodollar agreement. Through our models, constructed and managed personally by me, KCG is developing a global footprint for preserving and stabilizing capital for our clients while enhancing returns through market participation.

I look forward to talking with you in person, again this quarter.

Regards,

Kimberly