Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

Trade tensions continued as uncertainty surrounding the implementation of tariffs in early July drove volatility higher. Developed and emerging market trading partners including Japan, South Korea, Malaysia and South Africa were part of the most recent trade negotiations. An executive order was signed in early July that will hold off new tariff rates until August 1st for all nations facing reciprocal tariffs.

Duties on imports generated $37.8 billion in revenue for the U.S. in April and May, after newly imposed tariffs became effective on steel, aluminum, cars and numerous goods from China, Mexico and Canada. Duties collected in May made up 6% of the government’s monthly income and increased 42% from the $15.6 billion the U.S. received in April and $22 billion collected in May.

Some economists perceive any inflationary effects from tariffs to bring about a one time increase in prices, as opposed to a continual increase in prices. Some retailers and importers are absorbing newly imposed tariff costs, while others are passing along the tariffs in the form of higher prices to consumers.

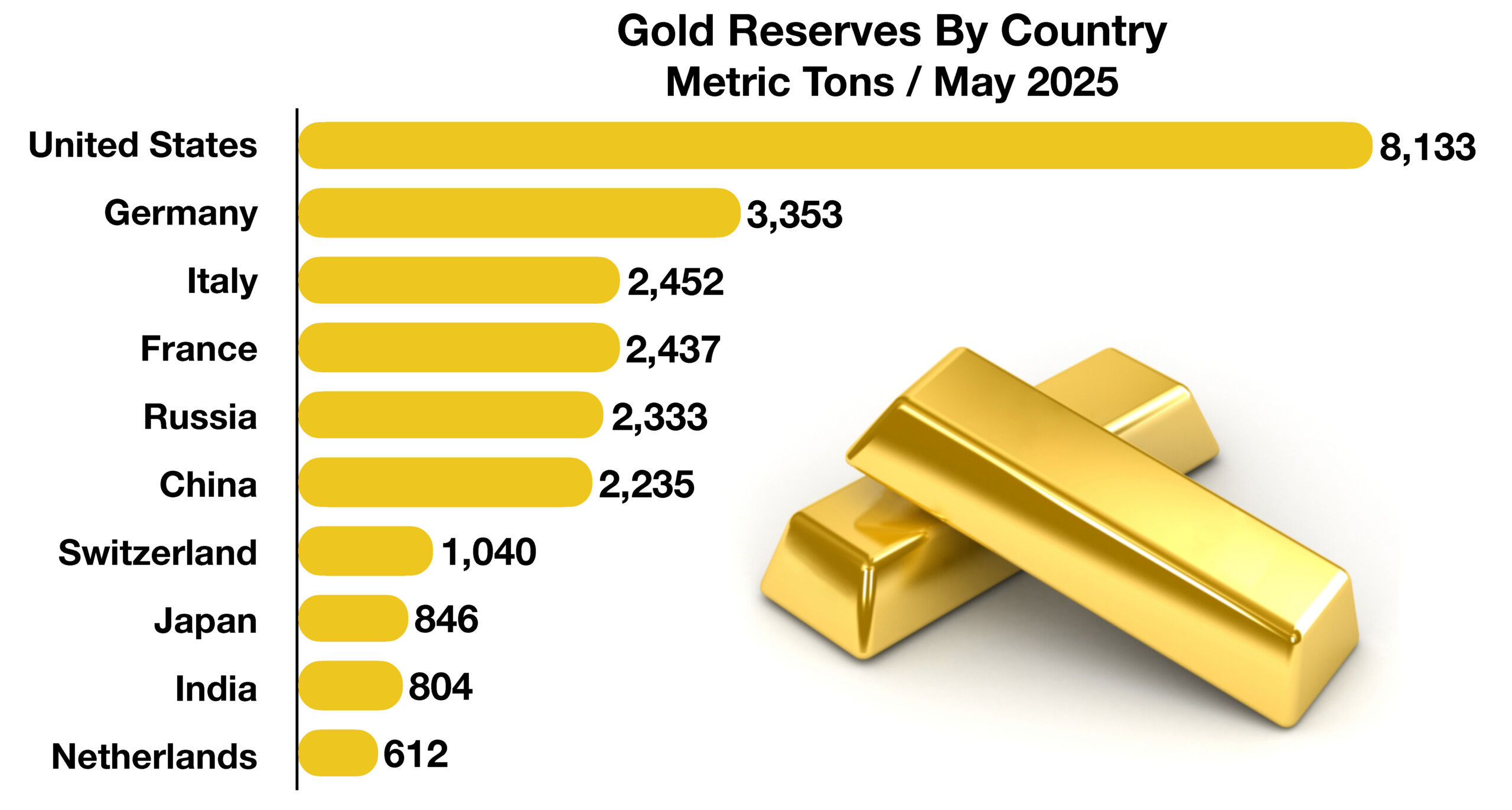

Geopolitical tensions in June elevated financial market volatility resulting in a demand for gold and foreign currencies. The dollar and treasuries have seen less demand recently, yet demand has been increasing for foreign currencies and other investment vehicles.

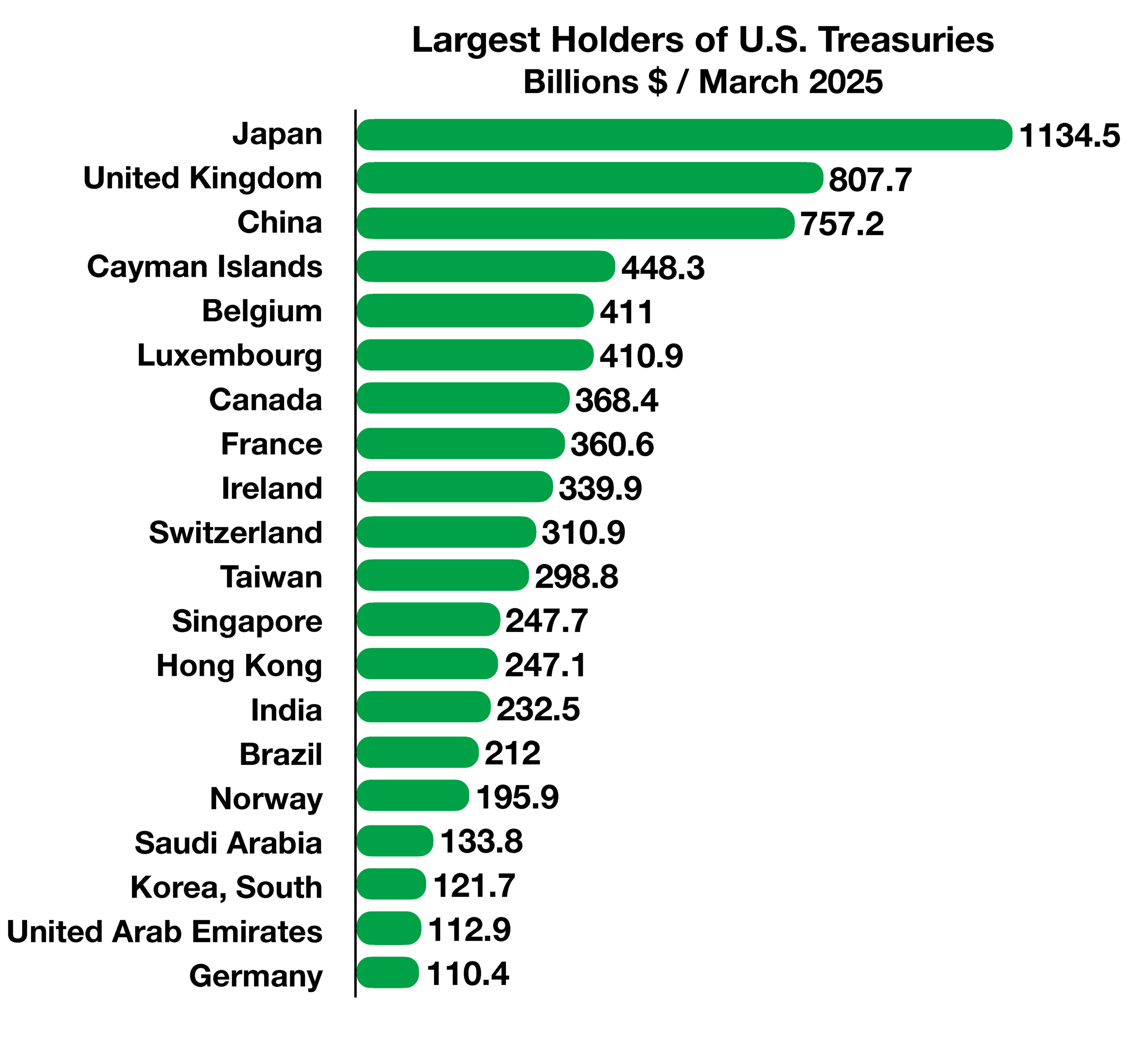

Recent trade tensions have shifted holdings of U.S. Treasuries as large trading partners such as Canada and China have shed positions while Japan and Norway have accumulated positions. The Treasury market has become a focal point as trade negotiations continue and countries adjust holdings based on exposure to U.S. debt and currency fluctuations.

A stronger than expected employment market is weighing on the Fed’s decision to lower rates. The unemployment rate fell to 4.1% from 4.2% in June, as jobs in healthcare and education rose and manufacturing jobs fell. The Fed’s hesitancy stems from the threat of higher wages which can be considered inflationary as workers spend more throughout the economy.

Passage of The One Big Beautiful Bill (OBBB), also known as the Tax Cuts and Jobs Act of 2025, will permanently extend the individual tax rates signed into law in 2017, which were originally set to expire at the end of 2025. It also raises the cap on the state and local tax deduction to $40,000 for taxpayers making less than $500,000. Numerous government programs as well as Medicaid will see the implementation of new provisions, such as the requirement for individuals aged 19-64 enrolled in Medicaid to demonstrate they are working or participating in qualifying activities for at least 80 hours per month. Certain groups are exempt from these requirements, including parents of dependent children and those with disabilities, substance use disorder, or serious medical conditions.

The administration is seeking to ban certain foreign entities from buying farmland in the United States as a precaution, in order to avoid any national-security risk. Chinese owned entities currently own approximately 300,000 acres of U.S. farmland in over 12 states. (Sources: Federal Reserve, Treasury Dept., Labor Dept., USDA)

Foreign countries hold U.S. government debt in the form of Treasury bonds for various reasons, including trade, currency hedging and for investment. At one point, China was the largest holder of U.S. Treasuries as trade between the two countries expanded throughout the 1990s and 2000s. Eventually Japan became the largest holder of Treasuries in 2017, as trade expanded with Japan and as China began to limit its holdings of U.S. debt. As of March 2025, China’s holdings dropped to $757.2 billion, down from $784.3 billion the previous month and significantly lower than the $901.7 billion held in September 2022, validating a continuation of a multi-year trend. Analysts attribute this reduction to a combination of trade tensions, diversification of reserves, and possibly reallocating to other markets such as Europe where trade for China has grown. Japan is currently the largest foreign holder of U.S. Treasuries, with holdings rising to $1.13 trillion in March 2025, up from $1.059 trillion in December 2024. Japan’s purchases have increased for at least two consecutive months, signaling continued confidence in U.S. debt and its long term trading relationship. The U.K. has also increased its holdings, surpassing China as the second-largest non-U.S. holder with $807.7 billion in March 2025. The U.K. is often considered a custodial center, with much of the activity reflecting hedge fund and institutional flows. (Source: U.S. Treasury Dept.)

Foreign countries hold U.S. government debt in the form of Treasury bonds for various reasons, including trade, currency hedging and for investment. At one point, China was the largest holder of U.S. Treasuries as trade between the two countries expanded throughout the 1990s and 2000s. Eventually Japan became the largest holder of Treasuries in 2017, as trade expanded with Japan and as China began to limit its holdings of U.S. debt. As of March 2025, China’s holdings dropped to $757.2 billion, down from $784.3 billion the previous month and significantly lower than the $901.7 billion held in September 2022, validating a continuation of a multi-year trend. Analysts attribute this reduction to a combination of trade tensions, diversification of reserves, and possibly reallocating to other markets such as Europe where trade for China has grown. Japan is currently the largest foreign holder of U.S. Treasuries, with holdings rising to $1.13 trillion in March 2025, up from $1.059 trillion in December 2024. Japan’s purchases have increased for at least two consecutive months, signaling continued confidence in U.S. debt and its long term trading relationship. The U.K. has also increased its holdings, surpassing China as the second-largest non-U.S. holder with $807.7 billion in March 2025. The U.K. is often considered a custodial center, with much of the activity reflecting hedge fund and institutional flows. (Source: U.S. Treasury Dept.)