Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

The ongoing trade dispute between the U.S. and China escalated in May as the U.S. signaled that it had not finalized a deal yet with China. The lack of a deal led to the U.S. announcing an increase in tariffs from 10 percent to 25 percent on $200 billion of Chinese imports.

The U.S. Department of Commerce began assessing Chinese imports arriving at U.S. ports with a 25% tariff at 12:01 AM on June 1st. The tariff increase affects a broad range of imported products, including modems, routers, furniture, and vacuum cleaners. Additional tariffs were also proposed by The Office of the United States Trade Representative on essentially all remaining imports from China, valued at about $300 billion.

The proposed tariff increases by the United States caused China to retaliate against the U.S. with its own tariff proposals on U.S. goods including alcohol, swimsuits, and liquefied natural gas (LNG). The Chinese government may apply additional tariffs to more impactful products including food, energy and aircraft products from the U.S.

The recent market downturn has primarily been due to the uncertainty of the trade disputes and the effects of tariffs on the U.S. and international economies. Analysts believe that the equity market pullback along with the pending trade disputes have raised the possibility of an interest rate cut by the Federal Reserve later this year.

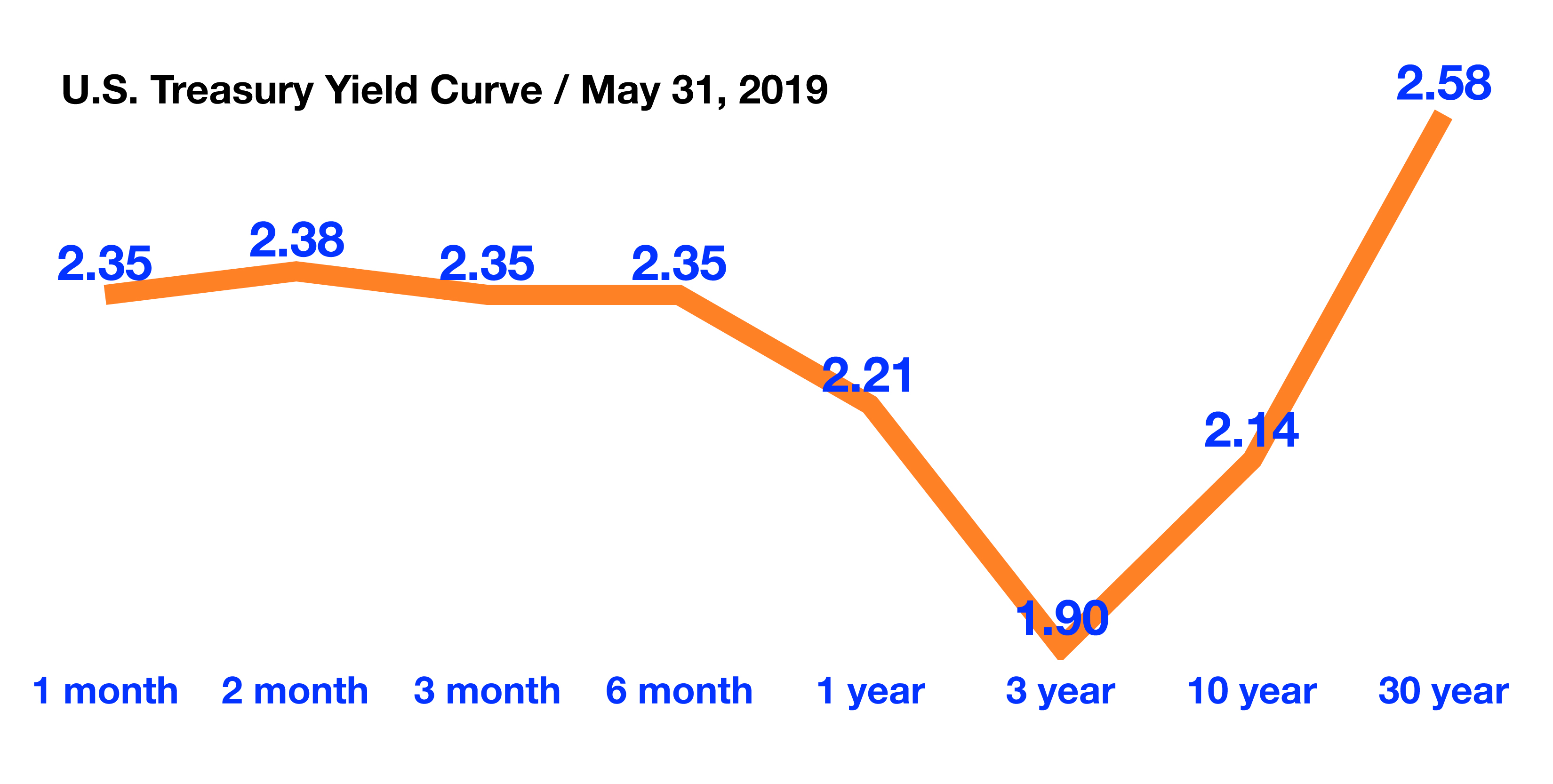

Longer term U.S. Treasury bond yields fell to their lowest levels since 2017. Combined pressures from the trade disputes to the pending Brexit turmoil in Europe has fostered increasing demand for U.S. Treasury bonds, which has resulted in higher bond prices.

The fixed income market is looking at the probability that economic weakness will lead to the Federal Reserve to actually cut interest rates sometime this year in order to bolster the U.S. economy. Many believe that the Fed needs to move quickly in order to shore up growth at the first sign of any economic contraction.

Mortgage rates fell below 4% for the first time since early last year helping to stabilize housing market activity. The average mortgage rate on a 30-year fixed conforming loan was 3.99% at the end of May, as tracked by Freddie Mac, the lowest since January 2018. Falling mortgage rates tend to entice buyers to sell their homes and trade up to larger homes with bigger mortgage balances, a boom for the housing market.

The most recent unemployment data revealed that unemployment unexpectedly fell to a 50 year low this past month to 3.6 percent, the lowest since 1969. Historically, a low unemployment rate tends to drive consumer confidence higher and act as a buffer during economic uncertainty.

Canada, Mexico, and the United States introduced legislation that would replace the North American Free Trade Agreement (NAFTA) and establish a new trade treaty among the three countries to be referred as the U.S.-Mexico-Canada Agreement (USMCA). Existing tariffs on steel and aluminum imports from Canada would be eradicated. Canada is the second largest foreign supplier of steel and aluminum to the United States.

Sources: Dept. of Commerce, Treasury Dept., Freddie Mac, IMF

The majority of yield curve steepener notes use the 2’s to 30’s or the 5’s to 30’s curves (#’s 15 and 20 in the table) and as you can see they are not only the widest curves but also both are currently the furthest outside their 1 year average. When we published our special report last year the 5-30 curve was 12bps and was -2.13 standard deviations its historic average. As you can see in the table above (second to last column on right) this has completely reversed and it is now +2.08 standard deviations its 1 year average. At the time we issued the report we took a 10-15% allocation in client accounts and the bonds have since increased in value 10% -25% depending on the issuer, formula and maturity. We are still holding our original position but are remaining cautious due to our negative view on credit spreads and the corporate bond market (discussed on the next page).

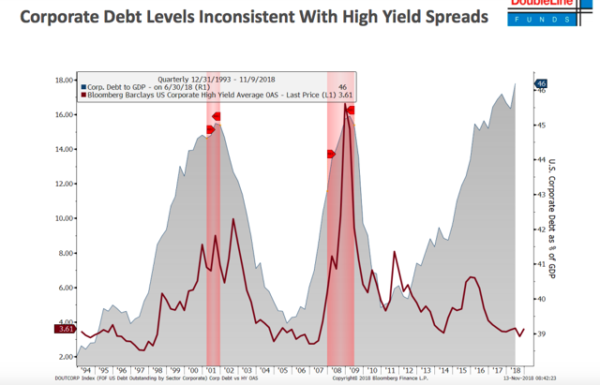

The majority of yield curve steepener notes use the 2’s to 30’s or the 5’s to 30’s curves (#’s 15 and 20 in the table) and as you can see they are not only the widest curves but also both are currently the furthest outside their 1 year average. When we published our special report last year the 5-30 curve was 12bps and was -2.13 standard deviations its historic average. As you can see in the table above (second to last column on right) this has completely reversed and it is now +2.08 standard deviations its 1 year average. At the time we issued the report we took a 10-15% allocation in client accounts and the bonds have since increased in value 10% -25% depending on the issuer, formula and maturity. We are still holding our original position but are remaining cautious due to our negative view on credit spreads and the corporate bond market (discussed on the next page). This chart clearly shows spreads (the risk premium investor receive for buying corporate bonds) is not only historically low but that given the massive amount of corporate debt spreads are reaching stratospheric levels which are not sustainable. The small stock market sell-off in the last quarter of 2018 gave us a glimpse into how quickly liquidity can dry up and bond spreads can dramatically widen in a high volatility environment and that was not even a major event. We have written extensively in previous newsletters and illustrated how quickly bond prices can spiral downward in a high volatility environment. In 2008 it was sub-prime mortgage’s that sent the markets reeling, the next crisis will almost certainly be caused by this combination of massive corporate debt and historically tight spread levels.

This chart clearly shows spreads (the risk premium investor receive for buying corporate bonds) is not only historically low but that given the massive amount of corporate debt spreads are reaching stratospheric levels which are not sustainable. The small stock market sell-off in the last quarter of 2018 gave us a glimpse into how quickly liquidity can dry up and bond spreads can dramatically widen in a high volatility environment and that was not even a major event. We have written extensively in previous newsletters and illustrated how quickly bond prices can spiral downward in a high volatility environment. In 2008 it was sub-prime mortgage’s that sent the markets reeling, the next crisis will almost certainly be caused by this combination of massive corporate debt and historically tight spread levels.