Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Dear Friends

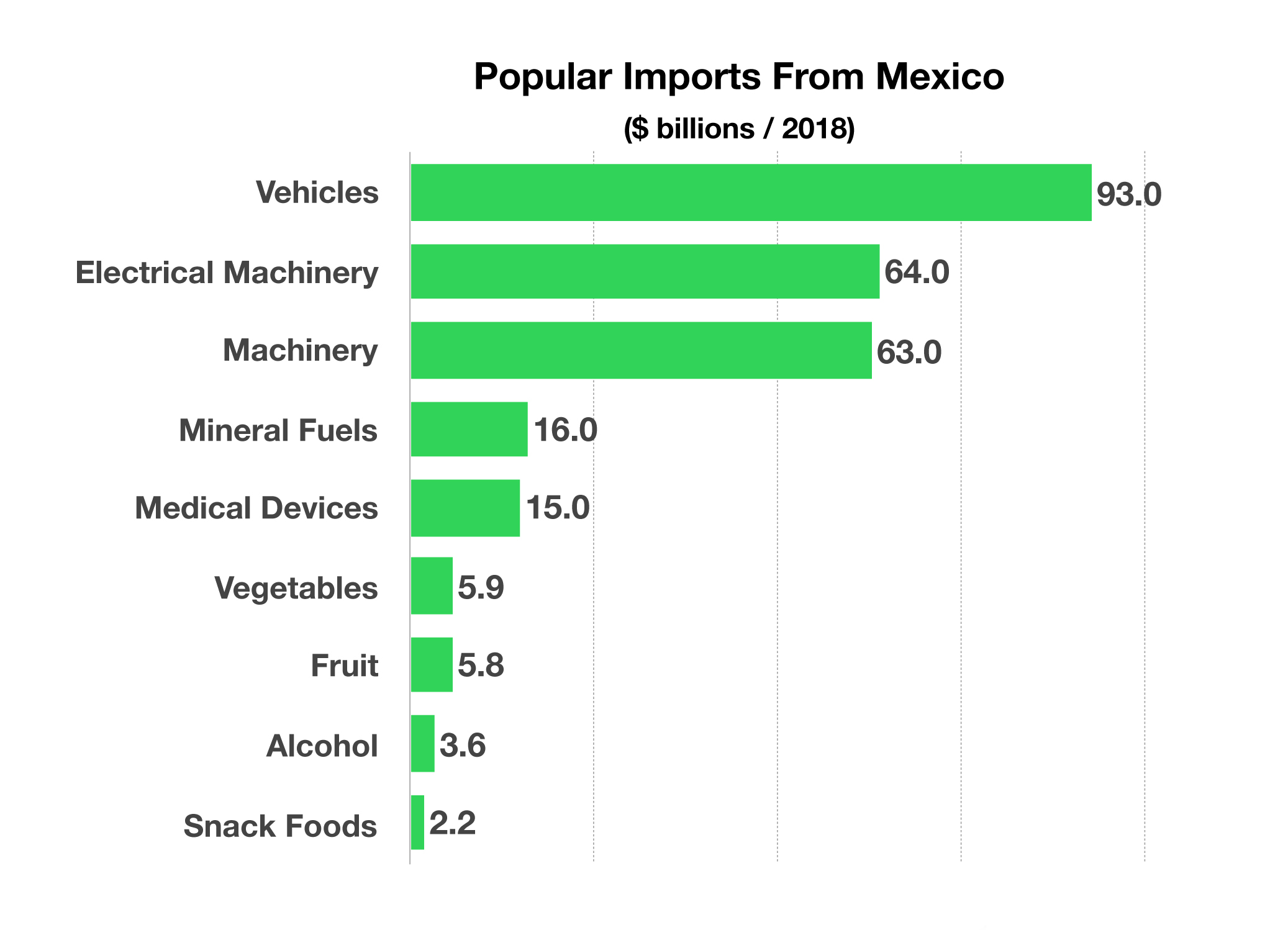

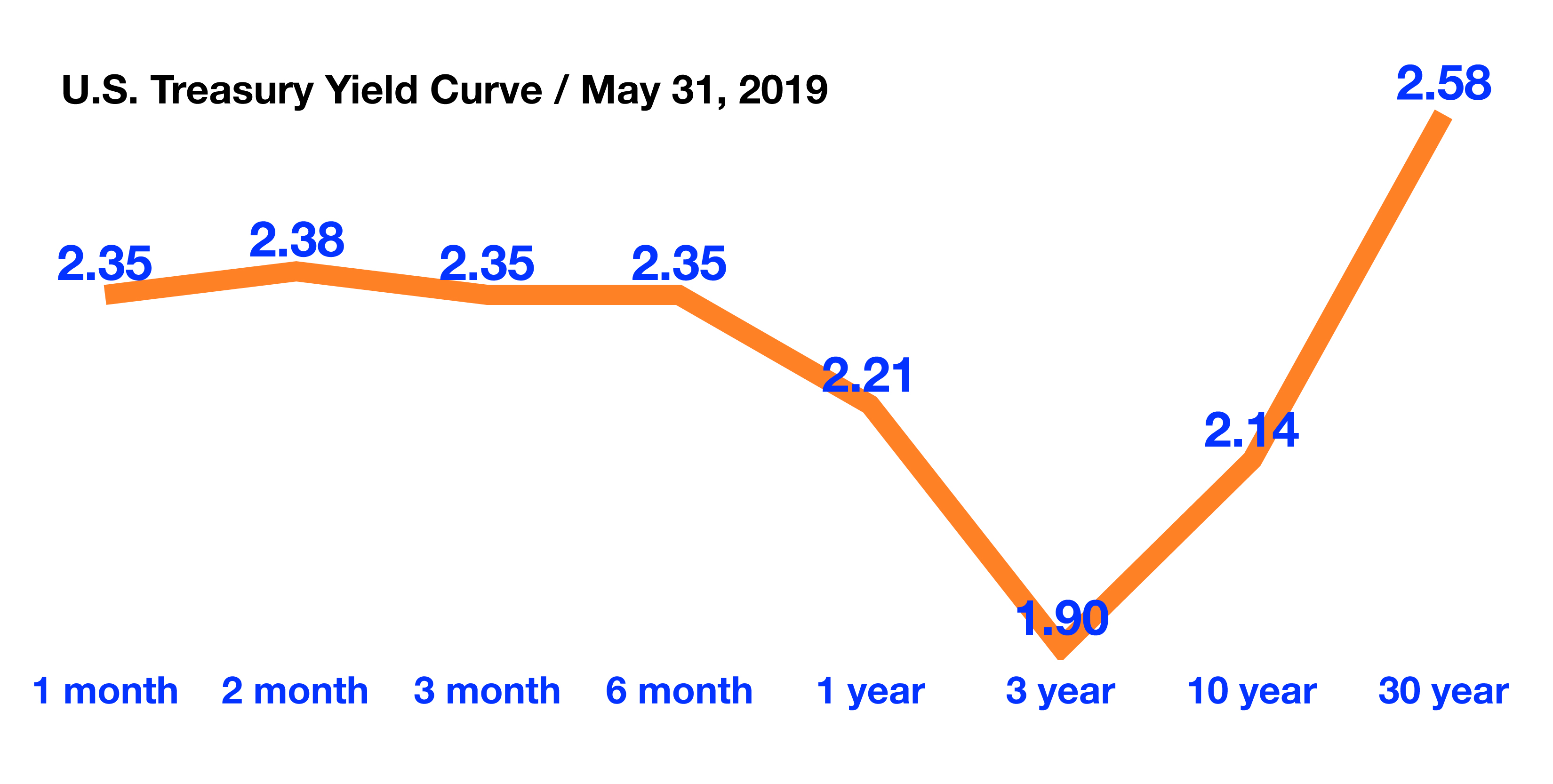

Whether you are climbing Mt Blackmore, Sacajawea, or Triple Tree this summer, the act of arriving at a ‘false summit’ is something that is part of traveling in the hills. It can be very emotional when you realize that there is yet another hill to climb, requiring a bit more resolve and discipline than you expected. The general expectations in today’s economy are that we have more climbing to go, but false summits will be common. The recent market swings have primarily been due to the uncertainty of the trade disputes and the effects of tariffs on the U.S. and international economies. Analysts believe that the equity market pullback along with the pending trade disputes have raised the possibility of an interest rate cut by the Federal Reserve later this year. Recently, the Fed affirmed that they are willing to lower rates if they need to. It’s a tricky time indeed!

We believe that at these valuations, investors should proceed cautiously, and consider shifting investments into areas that have benefited from changing rates.

In this edition, we cover a lot of ground: from trade disputes impact to unusual interest rates, there is a lot of information to process. Remember you can modify your preferences with a simple email to me. I hope your summer is spectacular! The photo is of a recent morning hike on the ‘M’.

Recap: Bozeman 2019 CPA Symposium, presented by McCormick Financial Advisors

This was our 9th year hosting local CPA’s at an afternoon of continuing education. It was also our largest attendance ever! We heard great presentations on wealth management strategies from several local professionals including:

- New estate planning rules and clarifications from the MT Legislature. They accomplished a lot more that you might think. Thank you Justin Bryan!

- A dynamic presentation on Social Security, and services available at our local office near Costco. They are there to help you!

- Reviewed the important features of the MT Charitable Endowment opportunity. In some cases, participants can enjoy significant state tax benefits (up to $10,000). Thank you Bridget Wilkinson and Katy Sparks!

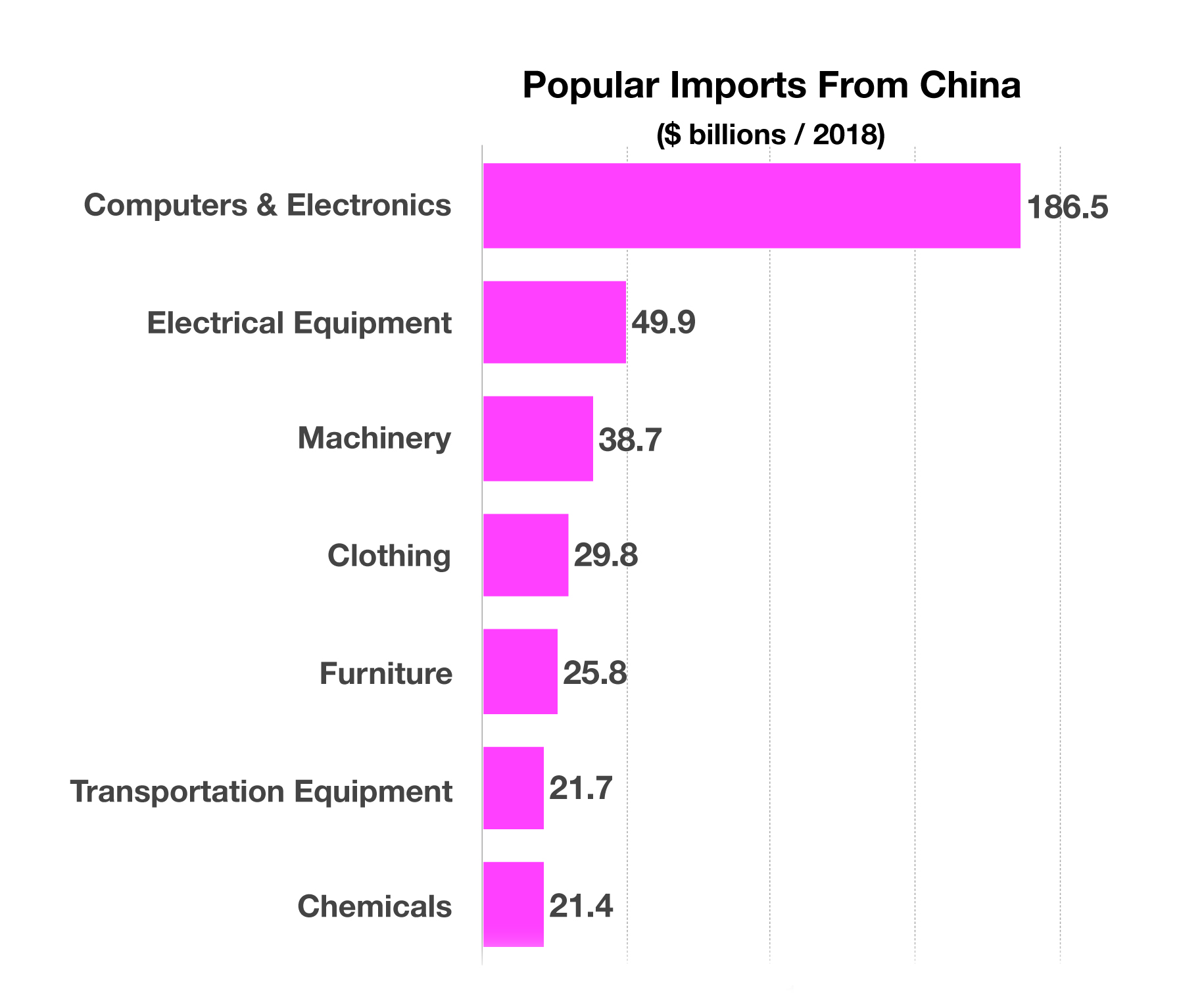

As the world’s appetite for electronic devices has grown, so has China’s ability to manufacture and export these devices. As a product exporter, China is able to manufacture and export finished products worldwide. In addition, China is also an exporter of components, which may be used in the manufacture and assembly of products in other countries, such as the United States. By exporting components in addition to finished products, China is able to hedge against tariff issues and labor costs should they become a factor. (Sources: WTO, IMF, U.S. Dept. of Commerce)

As the world’s appetite for electronic devices has grown, so has China’s ability to manufacture and export these devices. As a product exporter, China is able to manufacture and export finished products worldwide. In addition, China is also an exporter of components, which may be used in the manufacture and assembly of products in other countries, such as the United States. By exporting components in addition to finished products, China is able to hedge against tariff issues and labor costs should they become a factor. (Sources: WTO, IMF, U.S. Dept. of Commerce)