Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

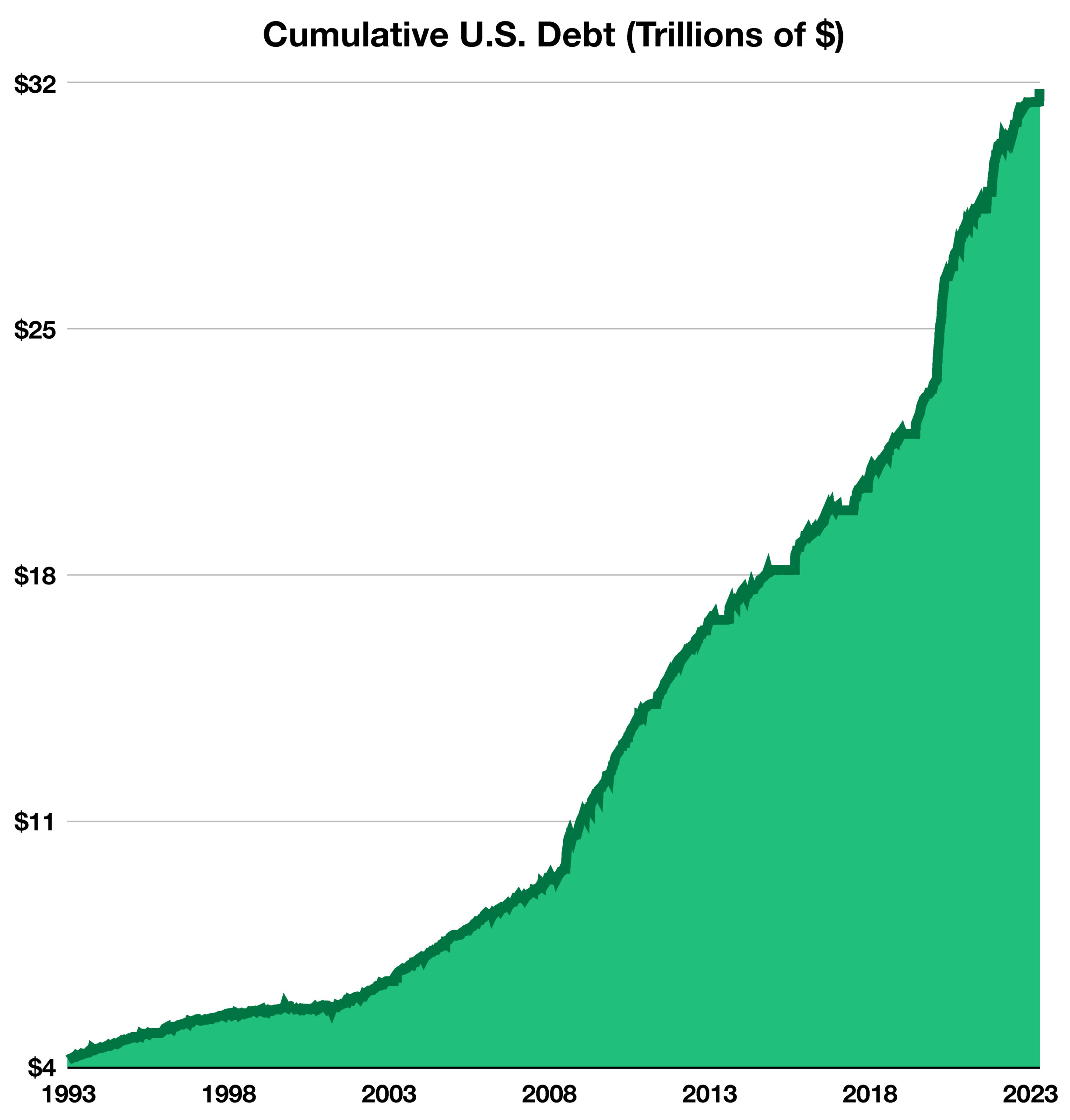

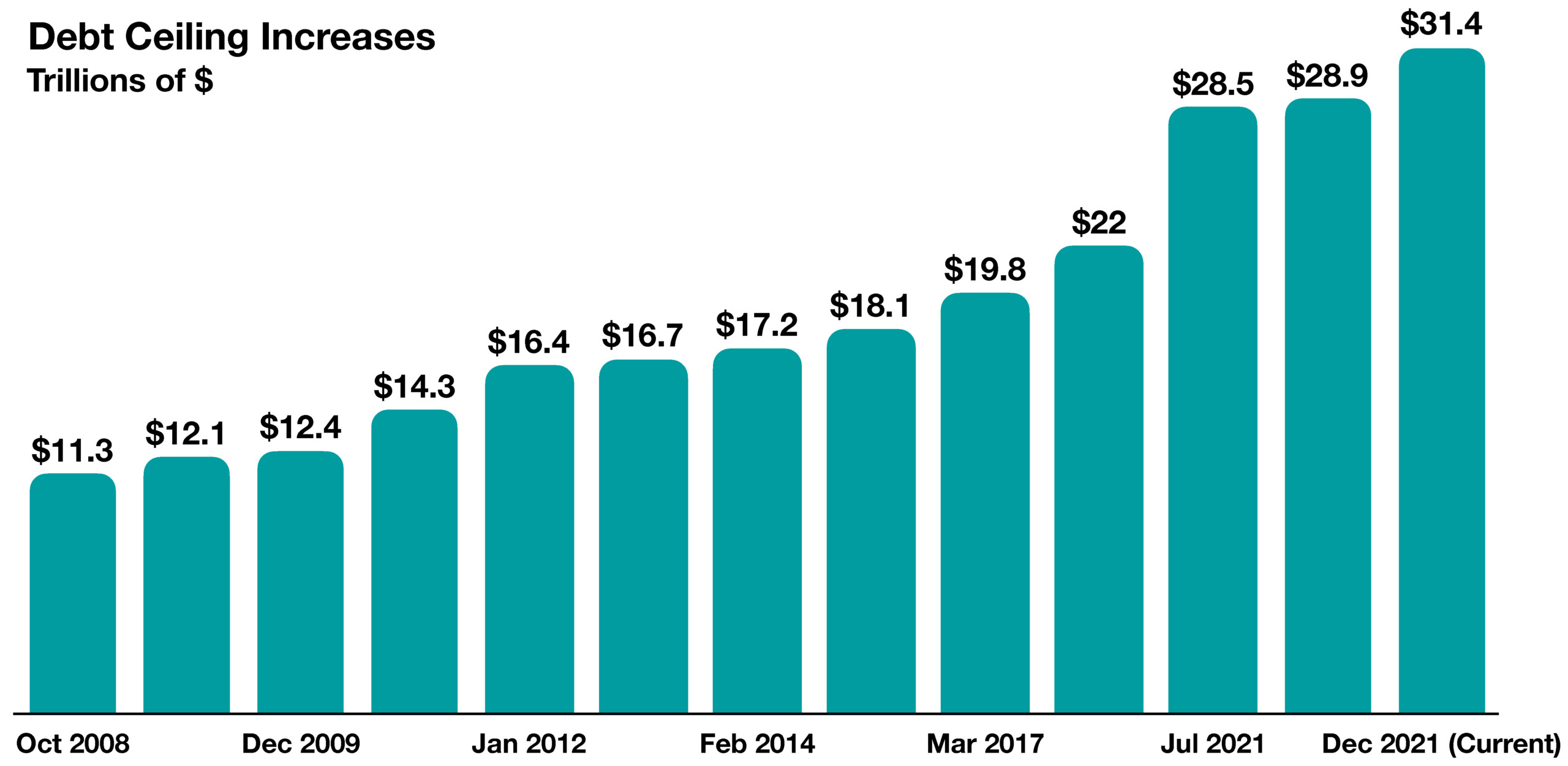

Congress passed legislation during last-minute negotiations to avert a default on the nation’s debt. The suspension on the U.S. government’s $31.4 trillion debt ceiling is temporary until lawmakers finalize legislation to fund ongoing federal obligations.

The impasse on the debt ceiling added strain to bond and equity markets in May. Treasury bond yields rose as national debt concerns put downward pressure on bond prices, which move inversely to yields. Debt ceiling concerns, in addition to the uncertainty surrounding regional banks’ exposure to commercial real estate, contributed to a volatile environment throughout the month.

The Treasury Department plans to issue additional short-term debt to fund immediate federal expenses, with $61 billion in 6-month bills and $68 billion in three-month bills already issued as of June 1st. Treasury issuances, also known as auctions, are part of the government’s ongoing cash management process.

The 49th summit of the G7 was held in Hiroshima, Japan in late May. The G7, which includes leaders from seven developed countries, gathered to discuss the Russian invasion of Ukraine, the climate crisis, and global geopolitical tensions. The G7 summit participants also noted concern regarding China’s economic coercion and its stance on Taiwan.

The Fed’s most recent Beige Book survey found that demand for domestic transportation services including trucking and rail has been decreasing. The survey also found that commercial construction and real estate activity has been decreasing overall. (Sources: U.S. Congress, Treasury Dept., G7, Federal Reserve)