Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

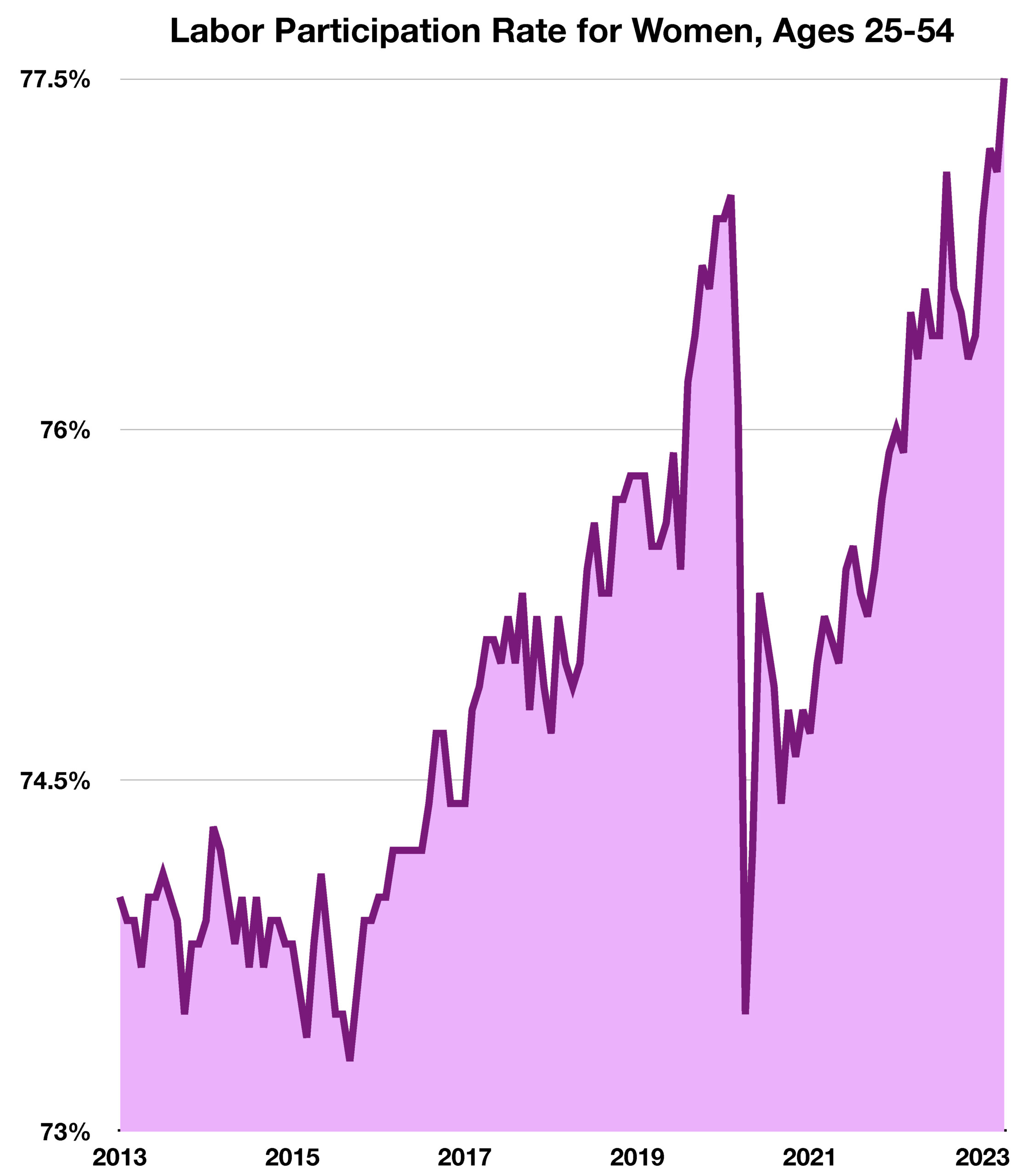

My wife and I recently graduated our youngest child from High School and it was a great milestone for our family! Raising kids sure did fly by in a blink of an eye! Over that time I’ve made good and plenty of bad choices. In retrospect, I believe that it’s the actions that I did regularly, and for a long time, that have made the greatest impact on my quality of life today. Being a consistent parent, exercising a bunch with my wife, working everyday on my business, and investing regularly have made me wealthy in many ways. Historical studies of investment successes agree with what I’ve witnessed, that time in the market is far more important than when you buy. If only we had more time…

Lucky Ridge Run #6 coming up!

For those delaying an investment decision, putting money at risk should always make you nervous. But how long are you going to put life on hold to time things perfectly right?

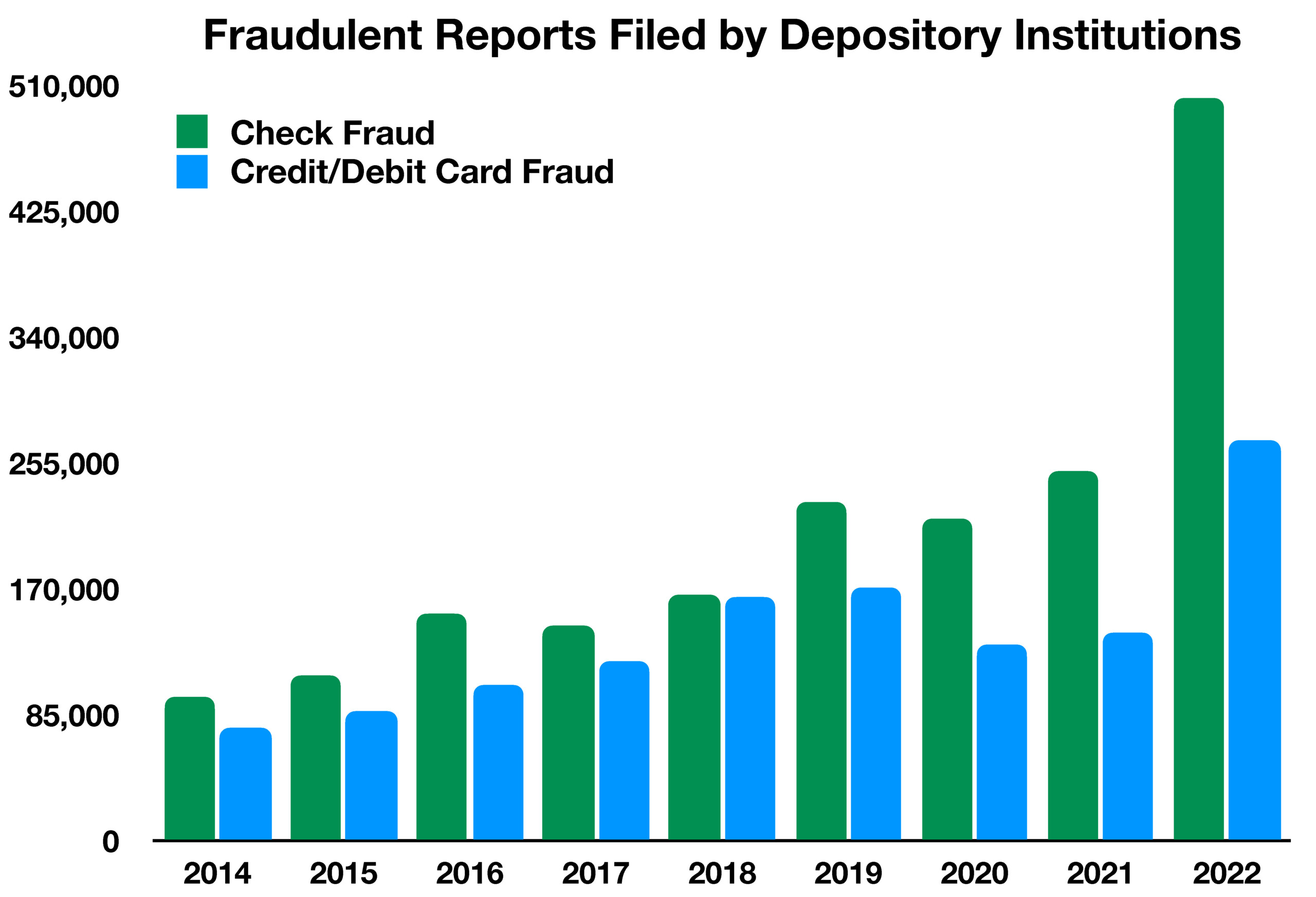

As always, the fears of today are different than yesterday. The list of recent market terrors that your portfolios have endured is substantial: pandemic, banking crisis (ongoing), a huge bond selloff (ongoing), a war in Ukraine (ongoing), and a political system with suspect morals. But In hindsight, most of these headline stories actually don’t have much of an impact on your financial future. The US consumer and business owners are resilient, and the Federal Reserve continues to engineer a soft landing to our inflation problem.

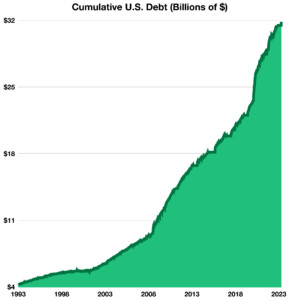

Living on borrowed time – the Scary Chart