Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 44,130 |

| S&P 500 | 6,339 |

| Nasdaq | 21,122 |

Bond Sector Yields:

| 2 Yr Treasury | 3.94% |

| 10 Yr Treasury | 4.37% |

| 10 Yr Municipal | 3.27% |

| High Yield | 6.86% |

YTD Market Returns:

| Dow Jones | 3.73% |

| S&P 500 | 7.78% |

| Nasdaq | 9.38% |

| MSCI-EAFE | 15.67% |

| MSCI-Europe | 18.44% |

| MSCI-Pacific | 10.55% |

| MSCI-Emg Mkt | 15.60% |

| US Agg Bond | 3.75% |

| US Corp Bond | 4.24% |

| US Gov’t Bond | 3.72% |

Commodity Prices:

| Gold | 3,346 |

| Silver | 36.79 |

| Oil (WTI) | 69.38 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.33 |

| Yen / Dollar | 148.58 |

| Canadian /Dollar | 0.72 |

Portfolio Overview

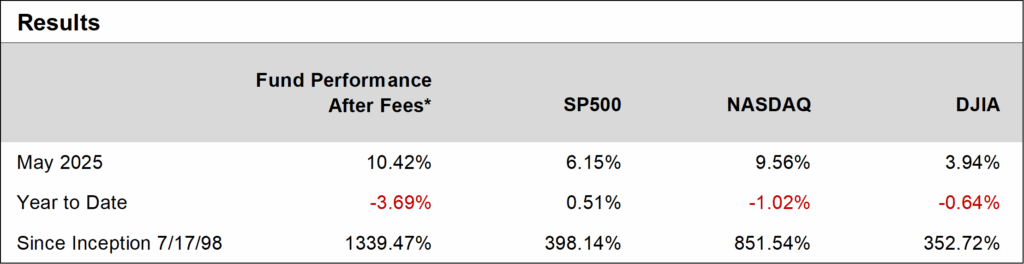

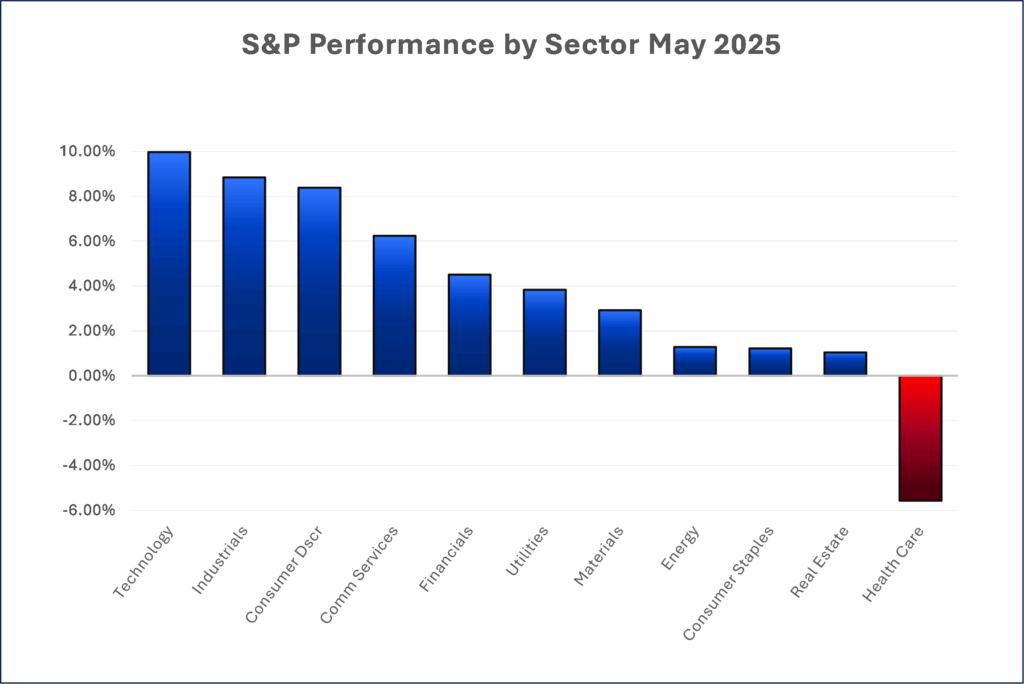

Ocean Park Investors Fund delivered strong performance in May, gaining 10.42%*, and outpacing the S&P 500 and NASDAQ Composite, which rose 6.15% and 9.56%, respectively. The fund’s results were driven primarily by continued strength in technology holdings, led by notable gains in Nvidia (+24%), Broadcom (+26%), and Astera Labs (+39%).

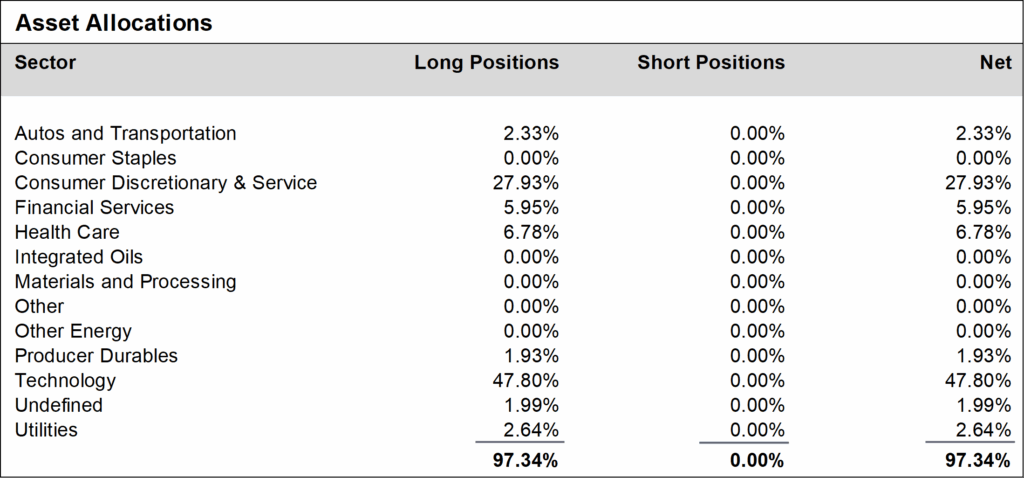

During May, we increased our exposure to the technology sector and reduced allocations to consumer discretionary and service-oriented holdings. Notable portfolio adjustments included the sale of Apple, Gap, and McDonald’s, and the addition of Disney, Intuit, and Palo Alto Networks. We ended the month approximately 97% net long, a slight increase from 96% in April.

Daily updates on our activity are available on our Results Line, at 310-281-8577, and current information is also maintained on our website at www.oceanparkcapital.com. To gain access to the site enter password opcap.

*These results are pro forma. Actual results for most investors will vary. See additional disclosures on page 4. Past performance does not guarantee future results.