Stock Indices:

| Dow Jones | 44,130 |

| S&P 500 | 6,339 |

| Nasdaq | 21,122 |

Bond Sector Yields:

| 2 Yr Treasury | 3.94% |

| 10 Yr Treasury | 4.37% |

| 10 Yr Municipal | 3.27% |

| High Yield | 6.86% |

YTD Market Returns:

| Dow Jones | 3.73% |

| S&P 500 | 7.78% |

| Nasdaq | 9.38% |

| MSCI-EAFE | 15.67% |

| MSCI-Europe | 18.44% |

| MSCI-Pacific | 10.55% |

| MSCI-Emg Mkt | 15.60% |

| US Agg Bond | 3.75% |

| US Corp Bond | 4.24% |

| US Gov’t Bond | 3.72% |

Commodity Prices:

| Gold | 3,346 |

| Silver | 36.79 |

| Oil (WTI) | 69.38 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.33 |

| Yen / Dollar | 148.58 |

| Canadian /Dollar | 0.72 |

Macro Overview

Some economists believe that the Fed’s reluctance to lower rates may jeopardize economic momentum as consumer expenditures continue to be sensitive to elevated interest rates. The most recent Consumer Price Index (CPI) data released confirms that inflation has been continuously falling for the past year as unemployment has been slowly increasing since the beginning of 2024. The Federal Reserve determines any adjustment in rates based on inflation and employment data.

Many economists and analysts believe that consumers could possibly see higher prices as the tariffs work through inventory as some companies begin to pass along the cost of tariffs on to consumers. It is expected that inventories with assessed tariffs will reach consumers in the summer if not the fall of this year. Certain retailers have thus far absorbed most of the costs from tariffs which have resulted in smaller profit margins for companies, helping to alleviate inflationary concerns.

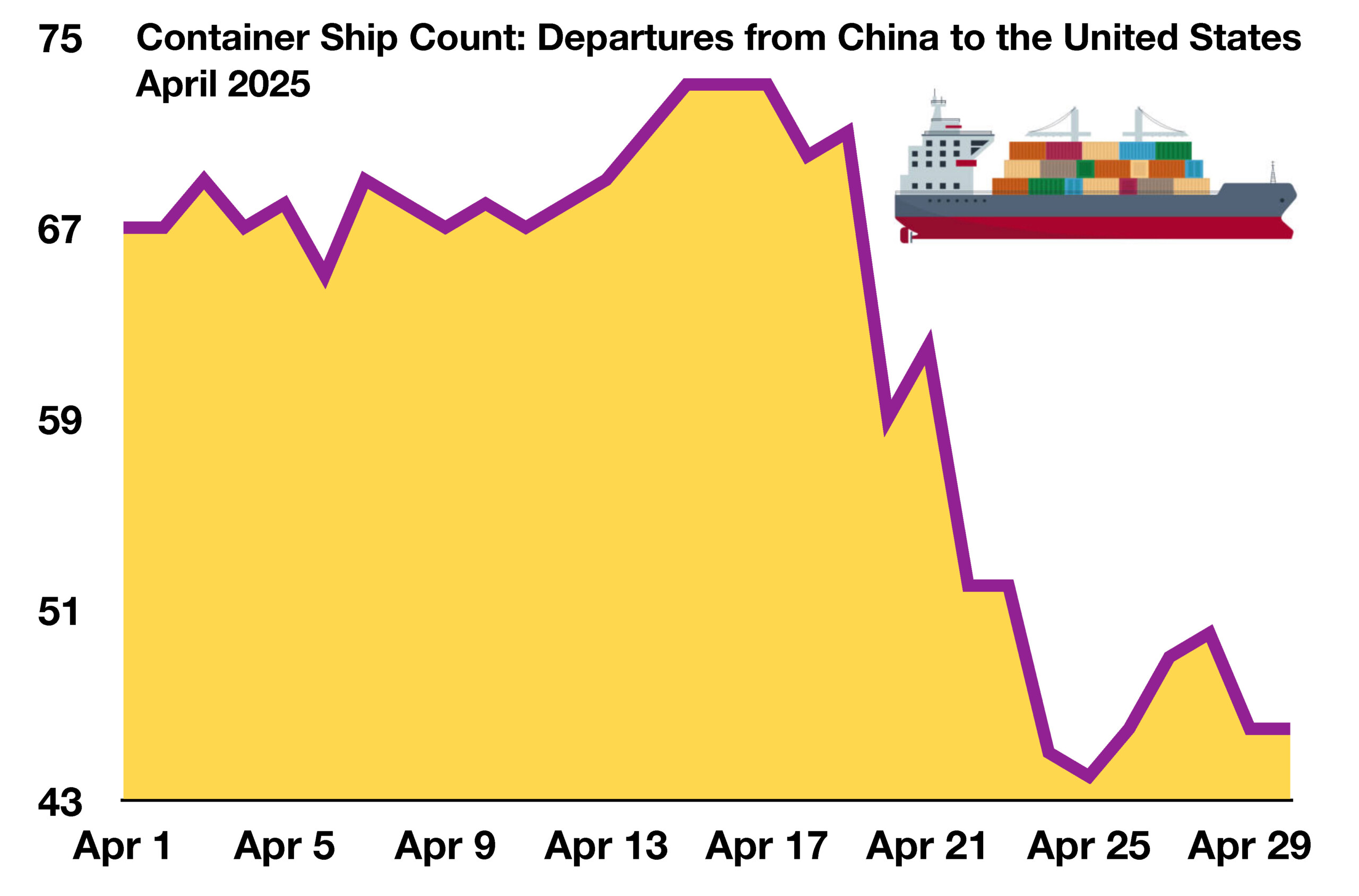

Equity markets received some reprieve in May as a provisional trade deal was agreed upon with China and the implementation of numerous tariffs were postponed for 90 days. Because of volatile markets and unnerved allies, the President is expected to extend tariff negotiations as the administration searches for trade deals with allies and adversaries alike.

U.S. government debt was downgraded by credit-rating agency Moody’s, stripping the U.S. of its last remaining triple-A credit rating from a major rating firm. The downgrade follows similar downgrades by Fitch in 2023 and S&P in 2011. The downgrade is expected to possibly raise the cost of borrowing for the U.S. federal government.

Labor department data revealed that consumer spending advanced 1.2%, down from an initial estimate of 1.8%, the weakest pace in almost two years. Major retailers reported that consumers have become more price sensitive and value oriented over the past few months. Several analysts and economists believe that the Federal Reserve’s stance to hold rates steady is a deterrent to already strained consumer expenditures.

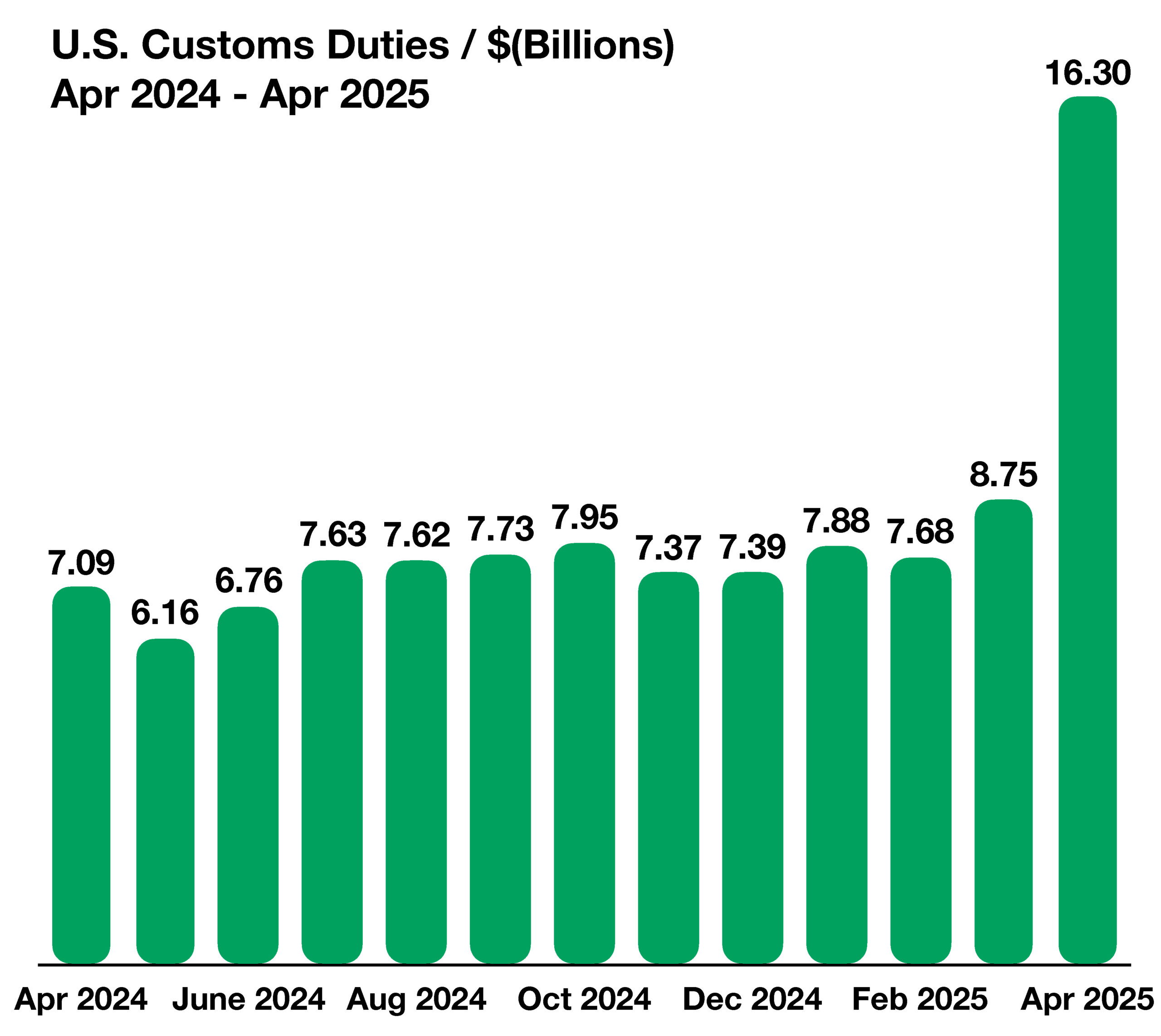

Revenue from newly imposed tariffs in early April nearly doubled to $16.3 billion, up from $8.75 billion in March. Duties collected were imposed on a wide range of products including raw and finished products from a multitude of countries. Monthly tariff revenue has been averaging roughly $7.5 billion for the past twelve months.

Sources: U.S. Depart. of Labor, Federal Reserve, Treasury Depart., U.S. Commerce Depart., Moody’s

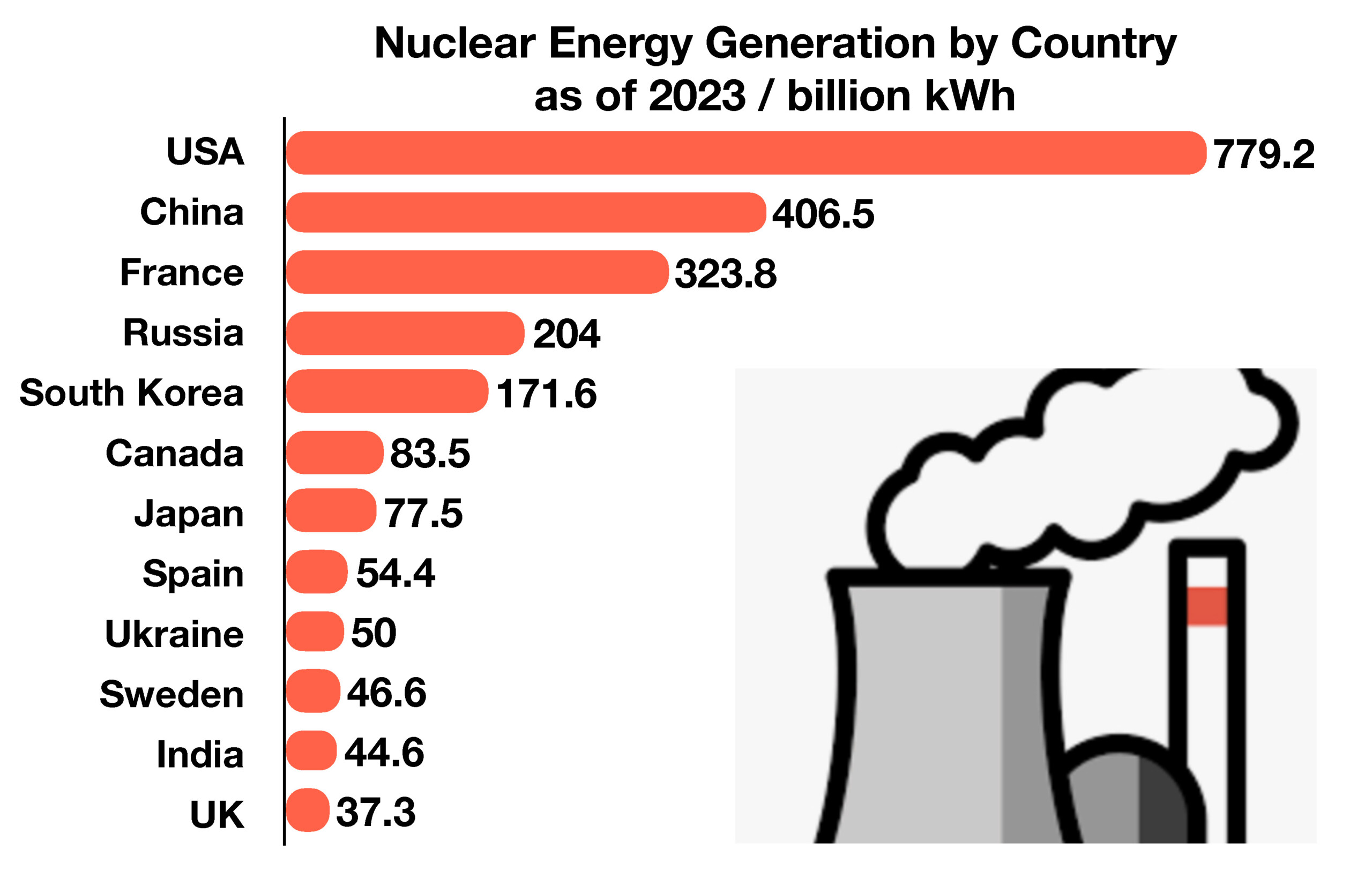

Power generation from a total of nearly 420 active nuclear reactors worldwide is set to reach a record high in 2025, as Japan restarts production, maintenance items are completed in France, and new reactors begin commercial operations in various regions, including China, Europe, India and Korea. In addition, more than 60 nuclear reactors are currently under construction, representing over 70 gigawatts (GW) of capacity, and governments’ interest in nuclear power is at its highest level since the oil crisis in the 1970s, in order to meet the rising demand for electricity. (Sources: International Energy Agency, World Nuclear Association)

Power generation from a total of nearly 420 active nuclear reactors worldwide is set to reach a record high in 2025, as Japan restarts production, maintenance items are completed in France, and new reactors begin commercial operations in various regions, including China, Europe, India and Korea. In addition, more than 60 nuclear reactors are currently under construction, representing over 70 gigawatts (GW) of capacity, and governments’ interest in nuclear power is at its highest level since the oil crisis in the 1970s, in order to meet the rising demand for electricity. (Sources: International Energy Agency, World Nuclear Association)