Robert Jocelyn

Jocelyn Investment Management, LLC

100 Smith Ranch Road, Suite 329

San Rafeal, CA 94903

415.256.1795

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

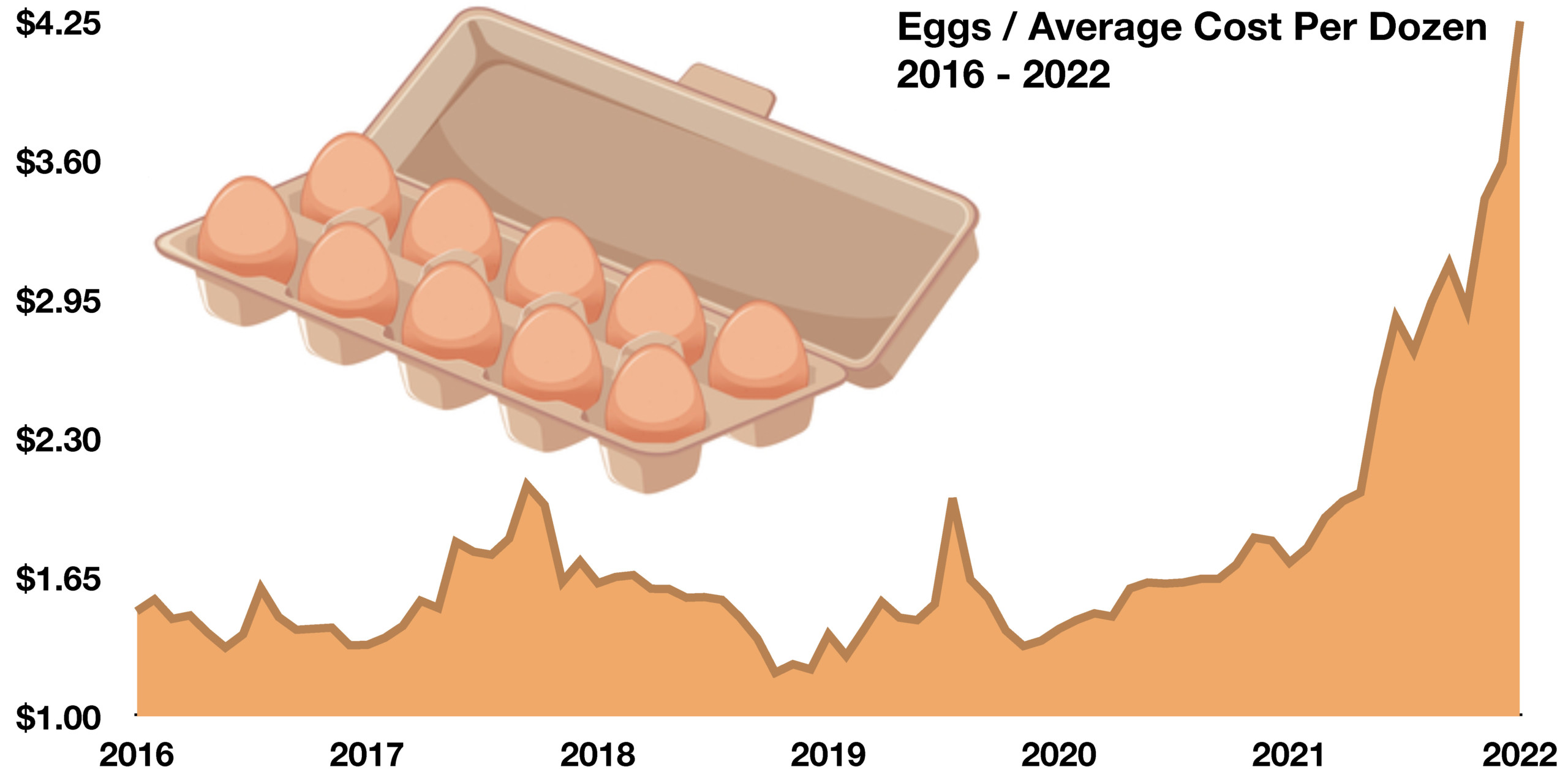

Inflation worries persisted in February as government data revealed stubbornly elevated prices for food and energy. As a result, the Federal Reserve’s policy on additional rate increases continues to bombard the equity and bond markets. The Fed’s concern is that it might relent too soon in combating inflation, so it is expected to continue on its rate increase trajectory until economic data proves otherwise.

Recent economic terms highlighted in the media include soft landing and hard landing. A soft landing indicates a non-recessionary outcome after the Fed stops raising rates, while a hard landing denotes a recessionary environment. Many economists believe that it is too soon to determine which may occur, yet believe that an extended period of rate hikes likens the possibility of an eventual hard landing.

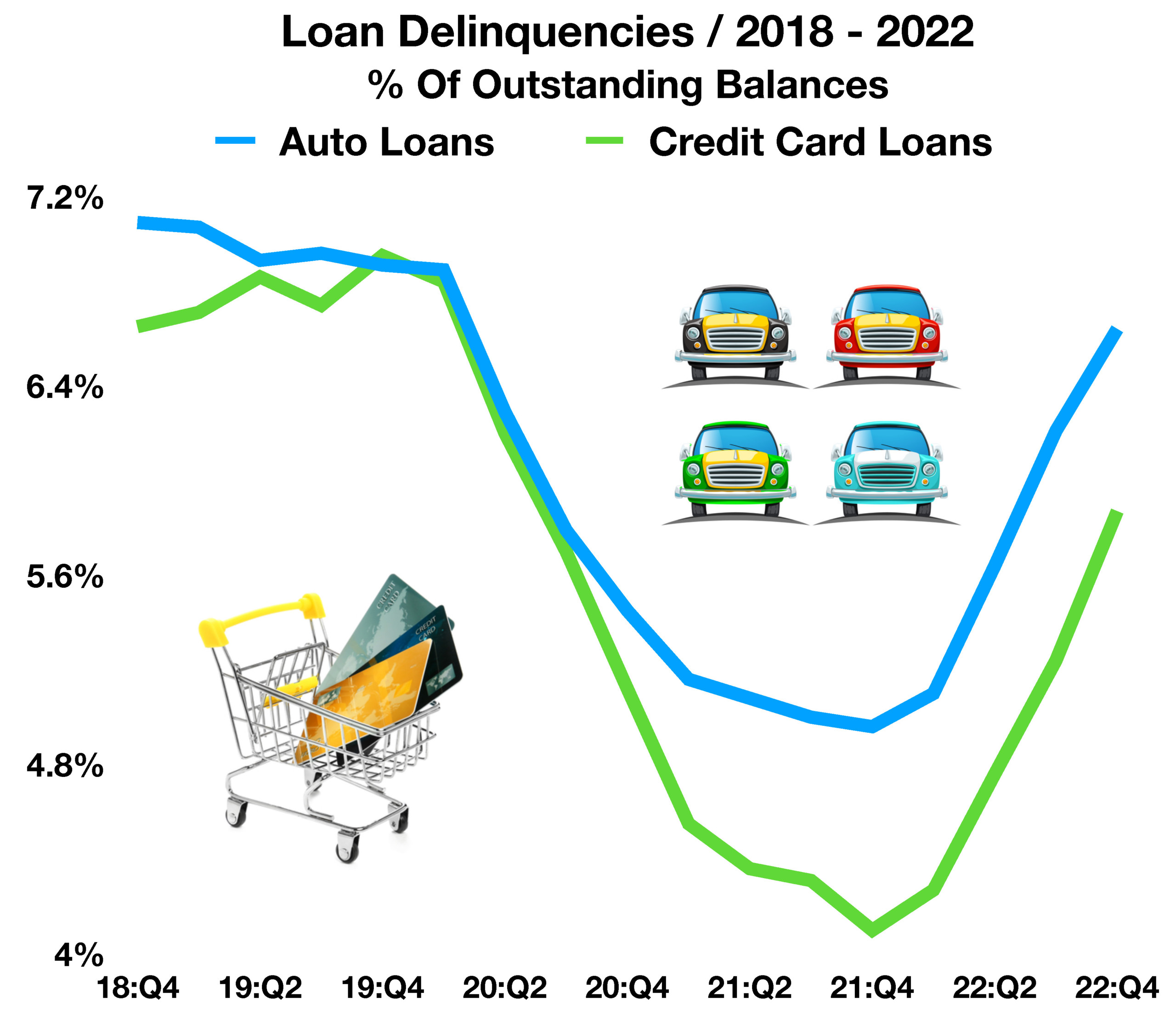

Stronger-than-expected employment data along with surprisingly resilient consumer demand drove the Federal Reserve to raise short-term rates, resulting in rates rising this past month. Mortgage and consumer loan rates rose in February, adversely affecting housing and consumer durables, where interest rates pose a significant factor.

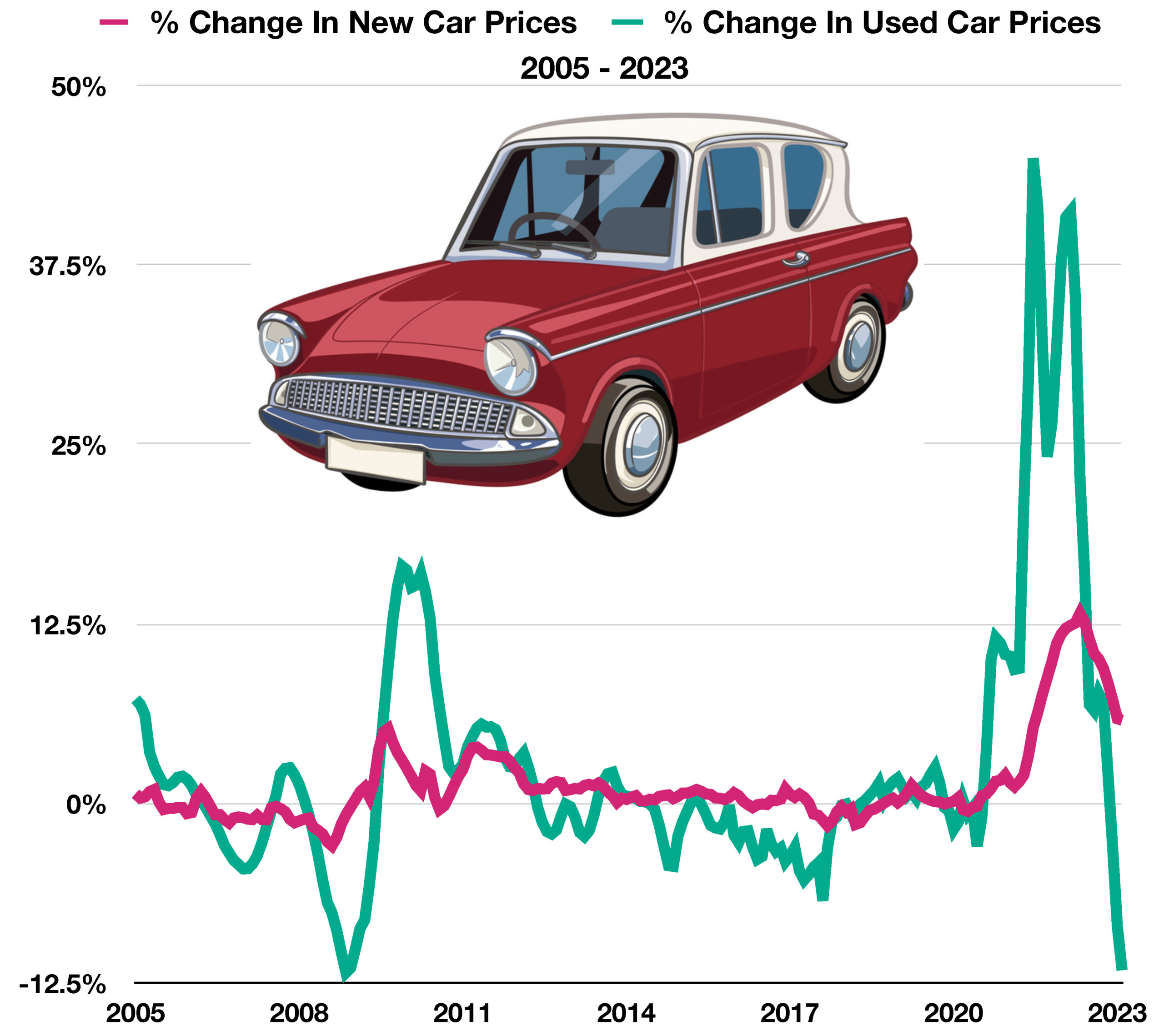

Recently released data from the Bureau of Labor Statistics reveals that consumers are pulling back on cyclical goods such as clothes and electronics while focusing on food and essential products like toilet paper and toothpaste. Larger ticket items, which are more expensive products such as appliances and autos, are seeing a drop in sales as consumers redirect funds.

Internationally, the European Union continues to see inflation at 10% alongside a 6.1% unemployment rate, translating into economic stagnation per the most recent data releases. As in the U.S., stubbornly high food and energy prices continue to divert consumers from buying what they want versus buying what they need. The Russian invasion of Ukraine continues to pose a challenge to global supply chains and inflationary pressures. Reduced trade with Russia has led numerous countries to replace inexpensive Russian imports with other pricier sources.

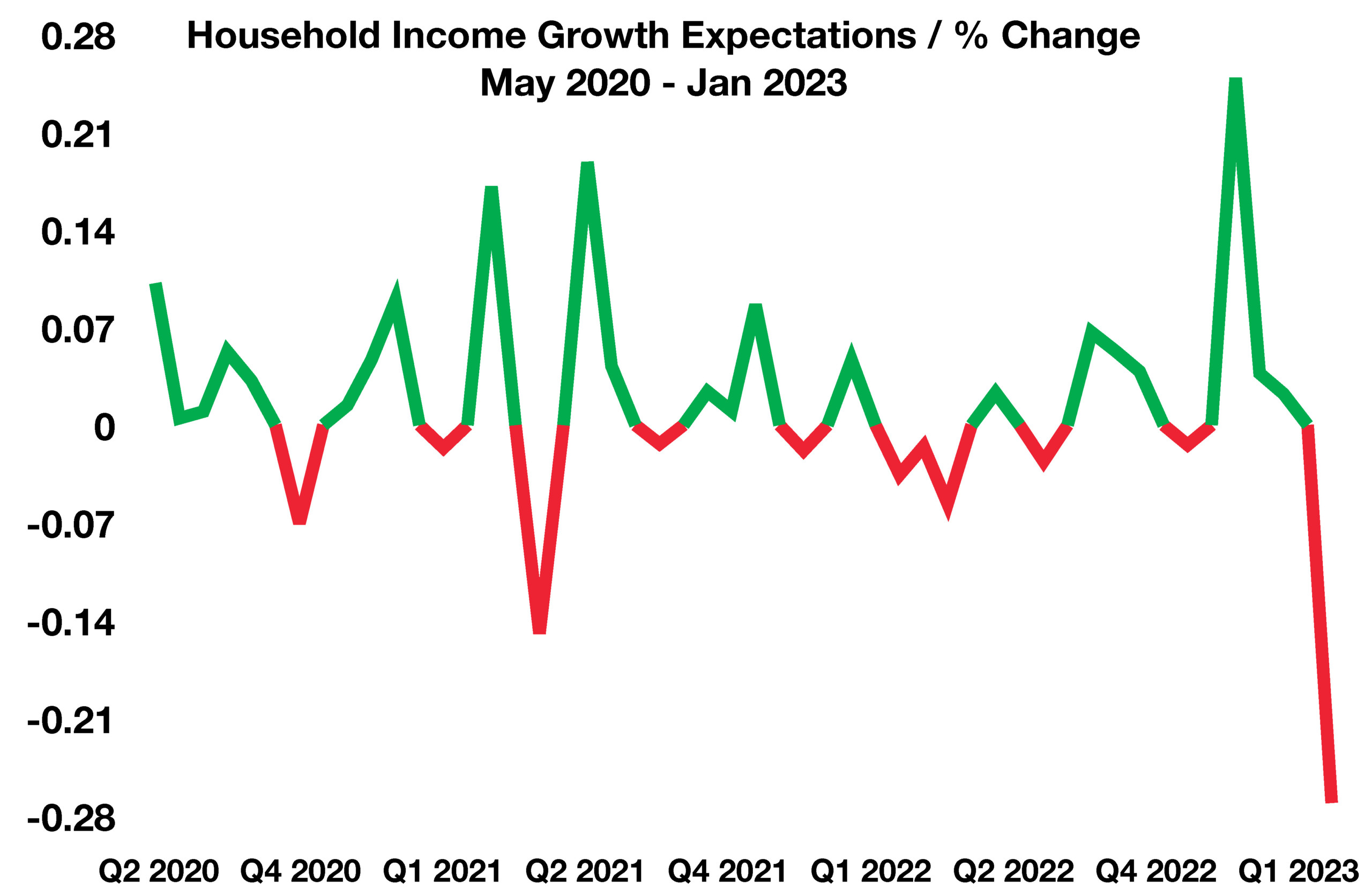

A renewed concentration on consumer incomes and inflation is materializing, as average income growth continues to fall behind inflation, meaning that consumers are struggling to maintain regular spending habits without an immediate pay raise. A Federal Reserve Bank of New York survey showed that households expect income growth to drop, creating additional uncertainty for consumers as well as creating a detrimental impact on consumer confidence.

Sources: Eurostat, U.S. Treasury, Federal Reserve, BLS, Labor Department

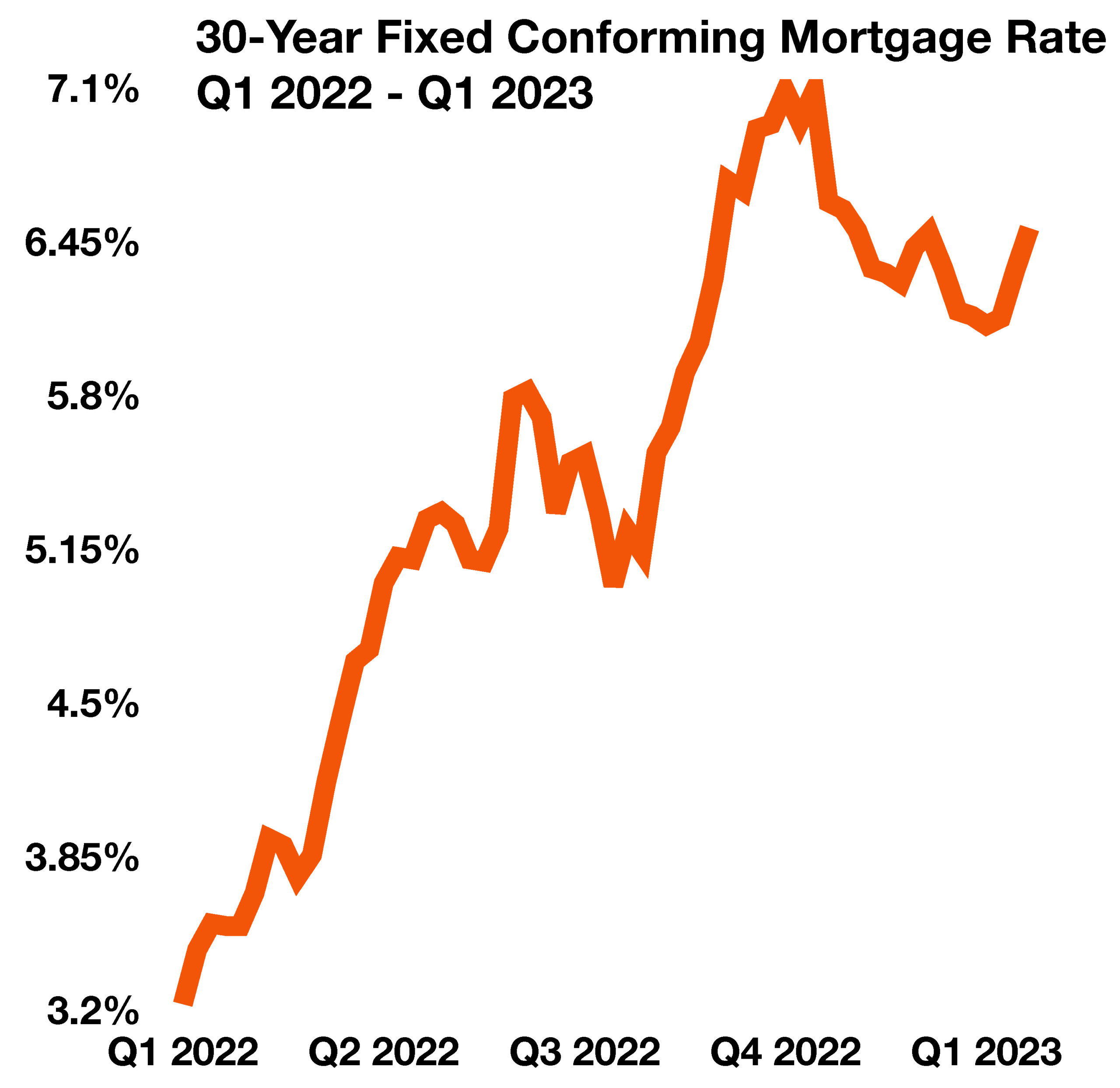

With interest rates breaching higher levels, mortgages are becoming less affordable for millions of Americans. As a result, demand for new mortgages continues to reach decades-long lows, influencing homebuyers to either wait for rates to fall or for home prices to drop significantly. The 30-year fixed mortgage rate reached 6.65% in early March, its highest point since November of last year. This comes amidst continuously higher mortgage loan rates that reached as high as 7.08% in October and November of 2022, a 20-year high that the housing market last saw in 2002. (Sources: Federal Reserve of St. Louis, Freddie Mac)

With interest rates breaching higher levels, mortgages are becoming less affordable for millions of Americans. As a result, demand for new mortgages continues to reach decades-long lows, influencing homebuyers to either wait for rates to fall or for home prices to drop significantly. The 30-year fixed mortgage rate reached 6.65% in early March, its highest point since November of last year. This comes amidst continuously higher mortgage loan rates that reached as high as 7.08% in October and November of 2022, a 20-year high that the housing market last saw in 2002. (Sources: Federal Reserve of St. Louis, Freddie Mac)