Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

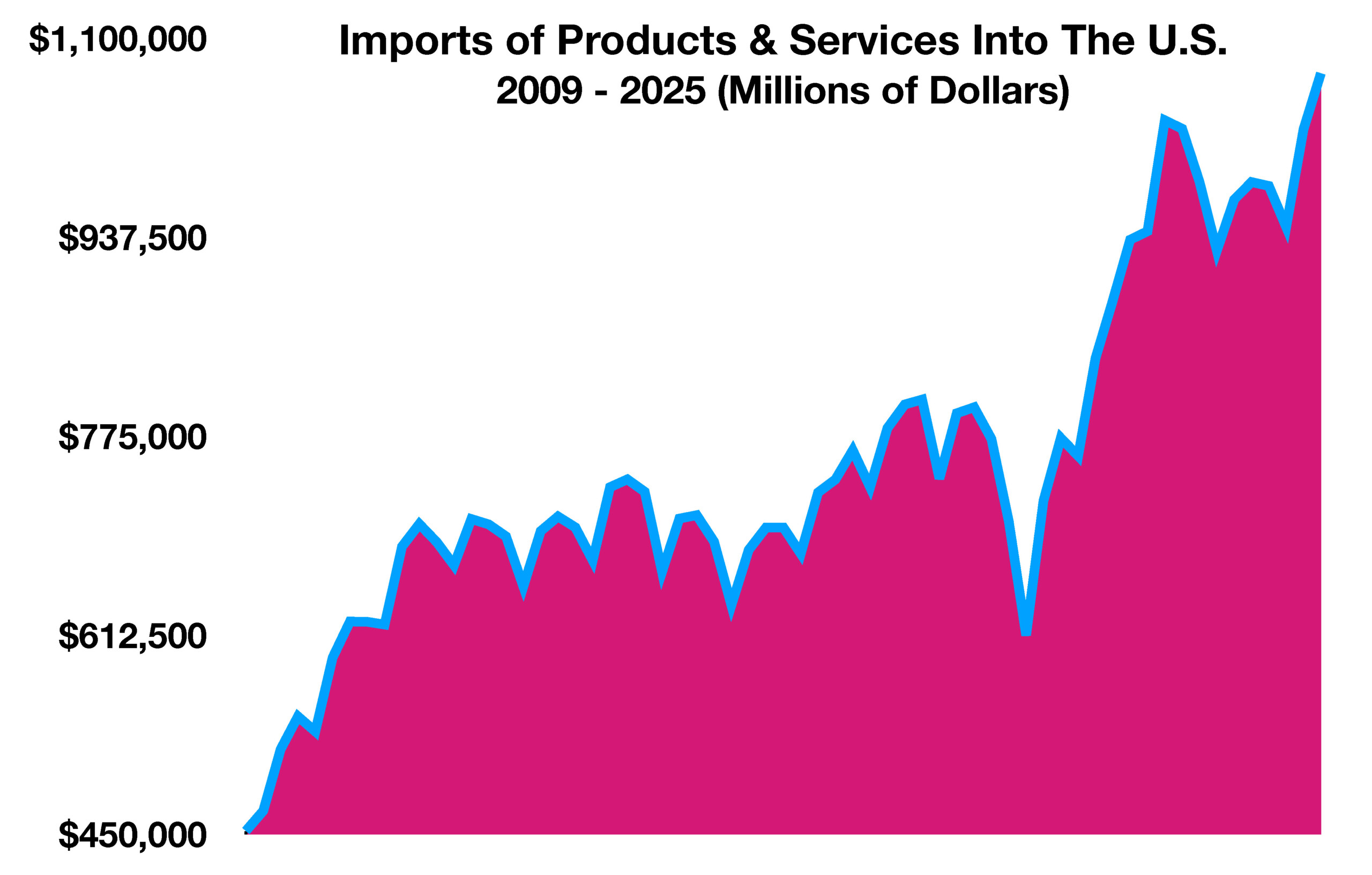

The administration confirmed that the U.S. would impose a 25% tariff on goods and services imported from Canada and Mexico effective early April, including an additional 10% tariff on Chinese imports. The effective date of the new tariffs was announced by the White House as a temporary reprieve following pleas from industry leaders. The implementation of the newly applied tariffs has been extended to April 2nd. Inflation projections have raised renewed concerns as the prospect of the tariffs weigh on the outlook for consumer expenditures.

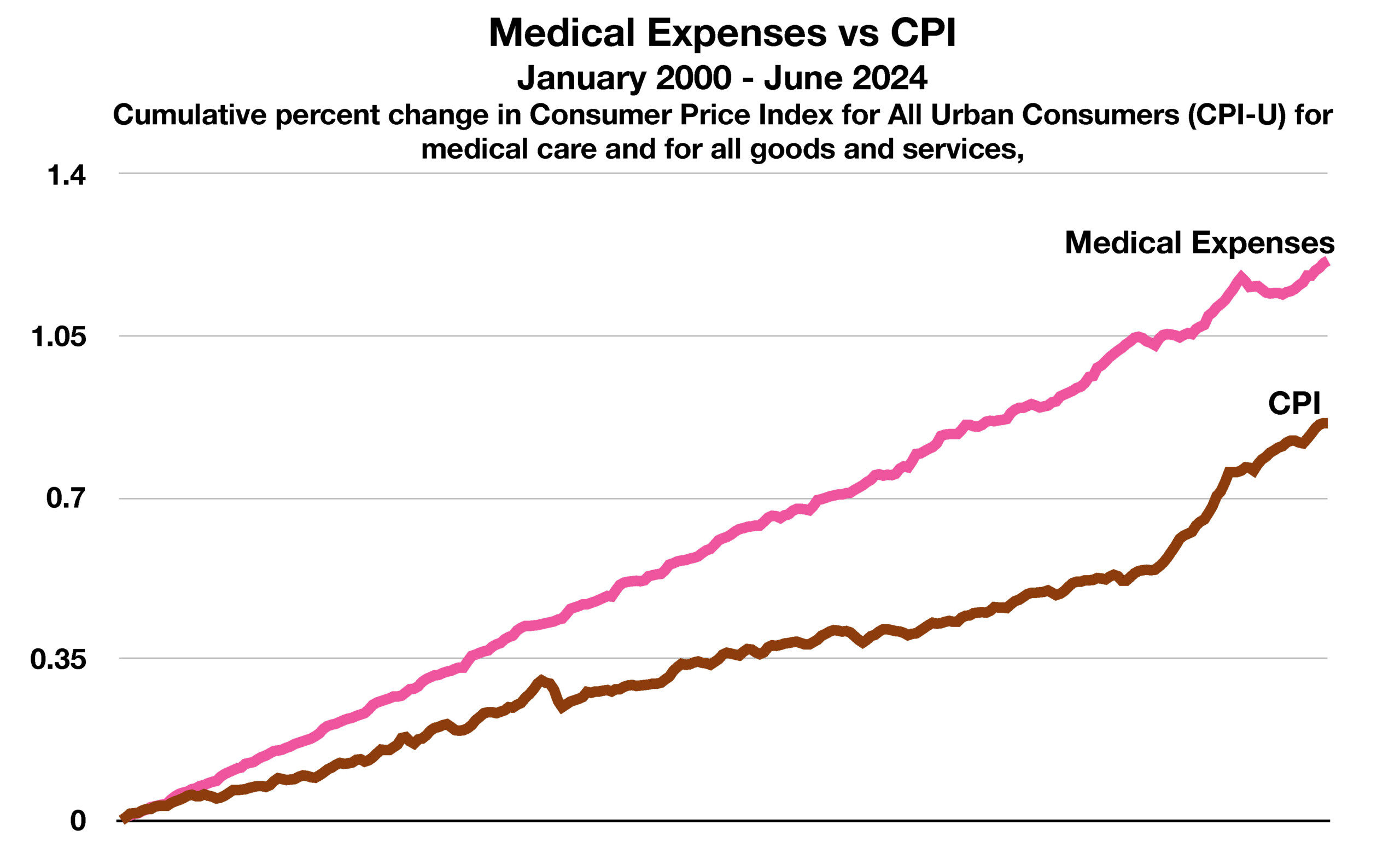

Some economists project that higher prices paid by consumers due to tariffs might actually become deflationary since consumers may pull back spending on higher-priced products. Even a slight pullback would be consequential for the U.S. economy since nearly 70% of Gross Domestic Product (GDP) comprises consumer spending. Lower spending could lead to an economic slowdown, eventually bringing down inflationary pressures and interest rates.

Treasury Secretary Scott Bessent said that the market selloff would be temporary and that Chinese manufacturers would absorb the newly-imposed tariffs. The Treasury Secretary also noted that a transition period regarding trade policy is underway with Canada and Mexico. There are mixed opinions regarding the consequences of the tariffs, differing within and outside the administration.

Applications for unemployment benefits rose amid an increase in company layoffs across the country. Initial claims increased by 22,000 to 242,000 in late February, the highest level since October 2024. The pickup in new applications coincides with a number of mass terminations and layoffs at numerous companies in various industries.

Data released by the National Association of Realtors showed that pending sales of existing U.S. homes slumped to a record low in January, as severe winter weather slowed transaction activity. Consumers also balked at high prices and elevated mortgage rates ahead of the spring selling season. Home prices continue to present an affordability obstacle preventing home buyers from committing to purchase. National home prices rose 3.9% in December from a year earlier, up from the 3.7% annual gain seen a month earlier, according to data from S&P CoreLogic Case-Shiller. The median sale price of a previously owned home in the U.S. was $396,900 last month, according to NAR data, up 49% from five years earlier.

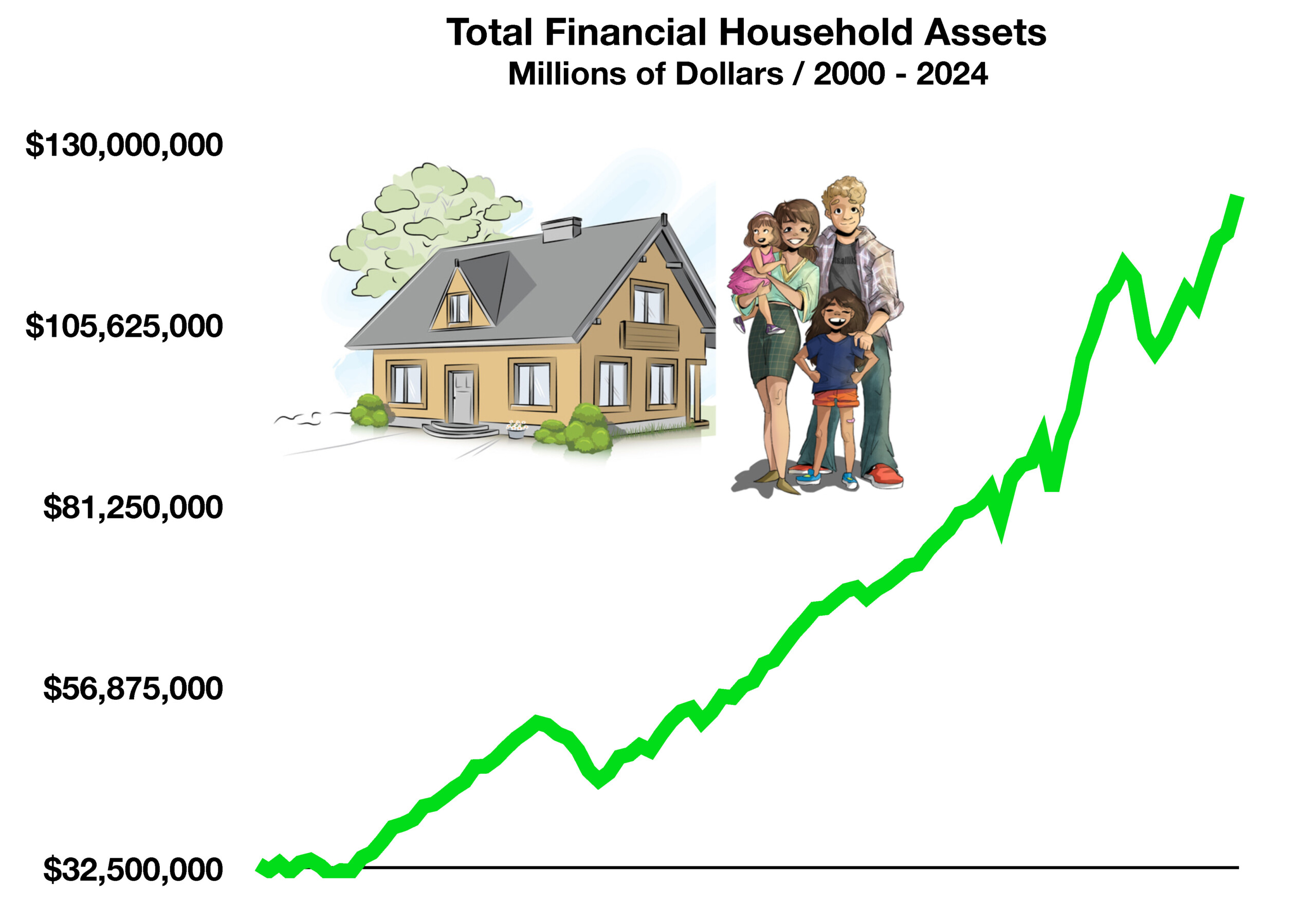

Those earning $250,000 and above now account for nearly half of all consumer spending. Rising home values and elevated stock portfolios over the past few years have helped propel spending among higher-income earners. Economists attribute this to what is known as the wealth effect, essentially the confidence among consumers to spend more as asset values rise.

Sources: U.S. Treasury, Dept.. of Commerce, NAR, S&P, Fed, BEA