Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

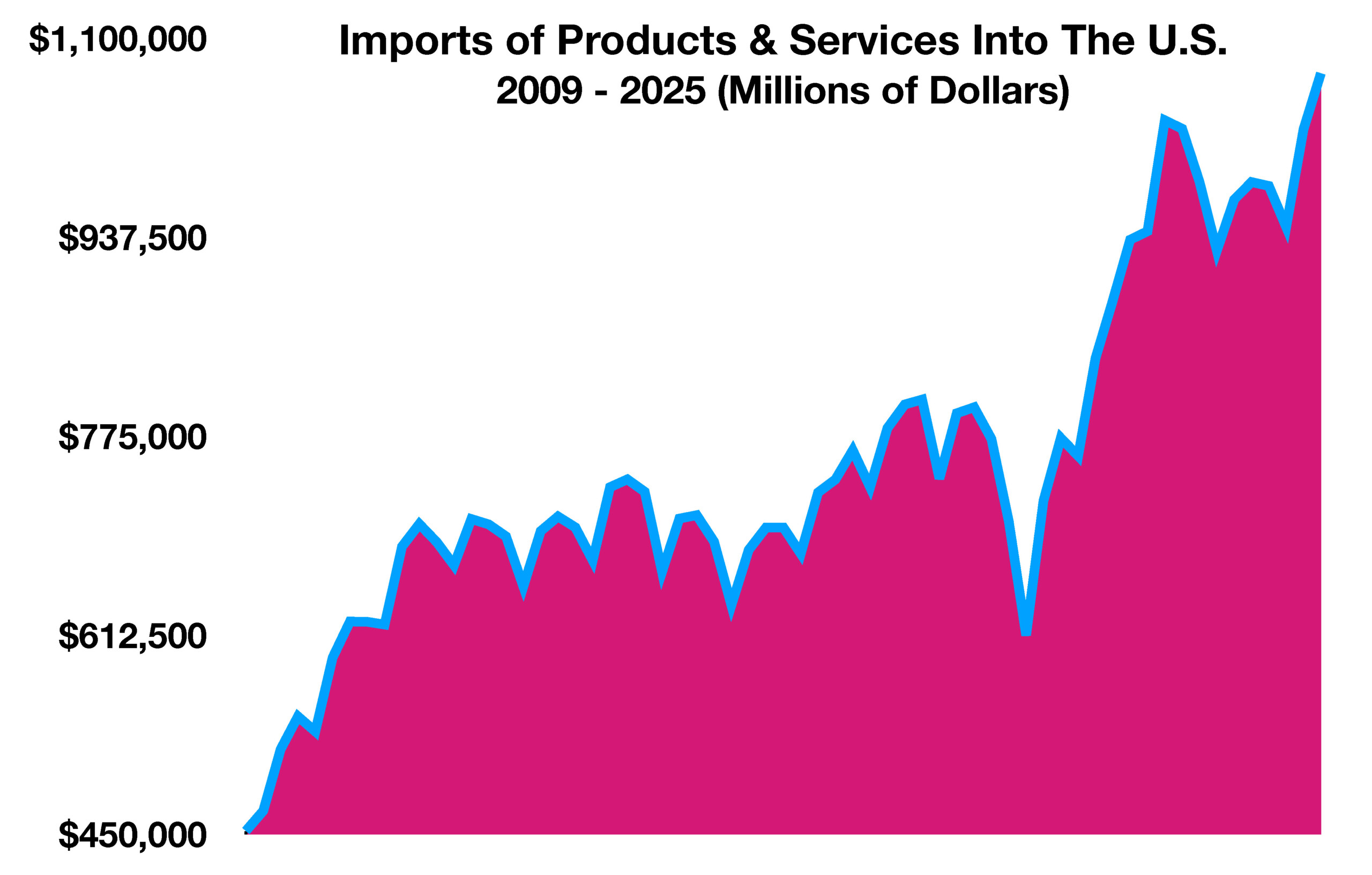

The administration confirmed that the U.S. would impose a 25% tariff on goods and services imported from Canada and Mexico effective early April, including an additional 10% tariff on Chinese imports. The effective date of the newly imposed tariffs was announced by the White House as a temporary reprieve following pleas from industry leaders. The implementation of the newly instituted tariffs has been extended to April 2nd. Inflation expectations have taken on renewed concerns as the prospect of the imposed tariffs weigh on the outlook for consumer expenditures.

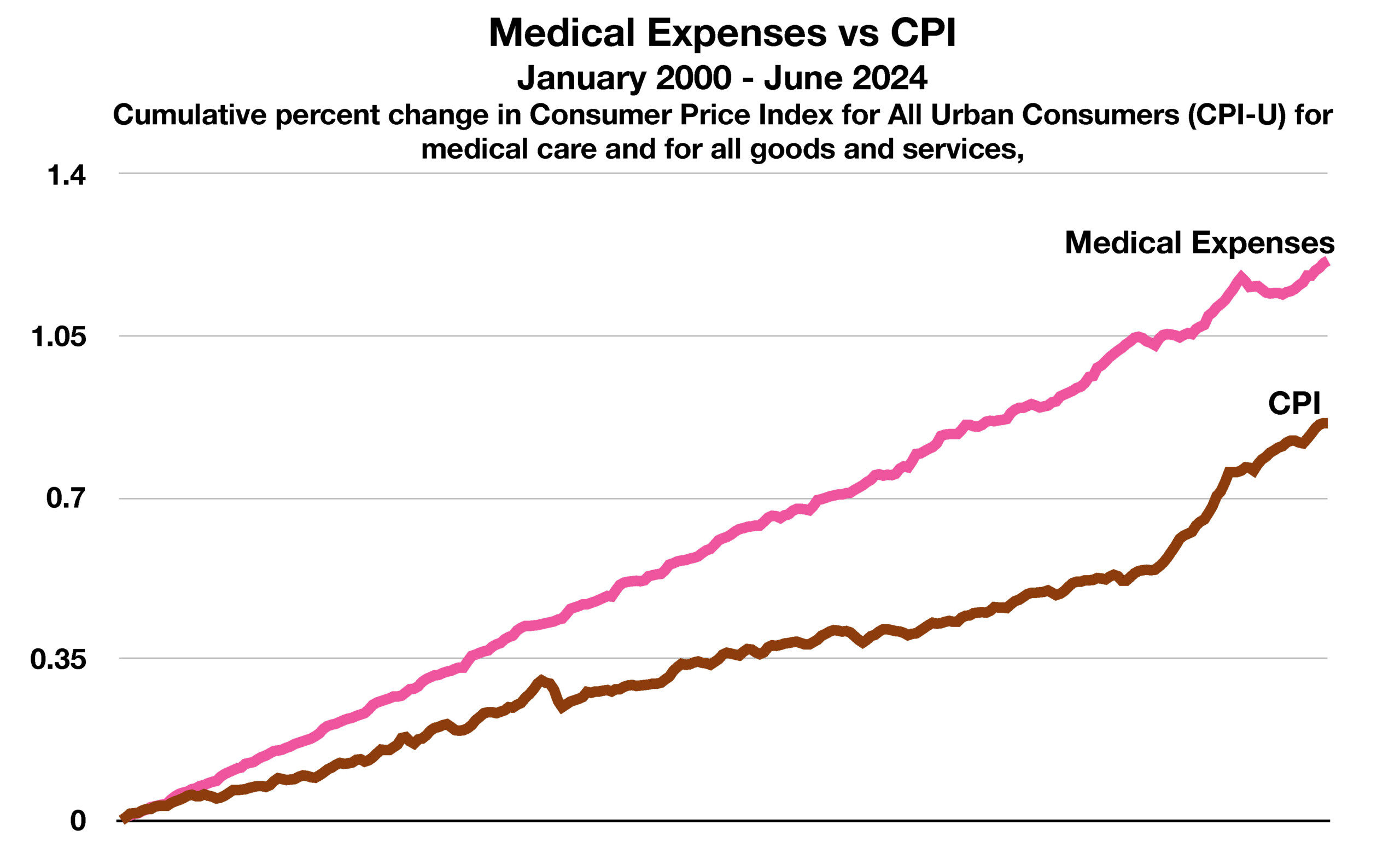

Some economists believe that higher prices paid by consumers due to tariffs, might actually become deflationary since consumers may pullback spending on higher priced tariffed products. Even a slight pullback would be consequential on the U.S. economy since nearly 70% of Gross Domestic Production (GDP) is driven by how much consumers spend. Less spending could lead to an economic slowdown, eventually bringing down interest rates and inflationary pressures.

Treasury Secretary Scott Bessent said that the market selloff would be temporary and that Chinese manufacturers would absorb the newly imposed tariffs. The Treasury Secretary also said that a transition period regarding trade policy is underway with Canada and Mexico. There are mixed opinions regarding the consequences of the newly proposed tariffs, some differing within and outside the administration.

Applications for unemployment benefits rose to the highest level this year amid an increase in company firings across the country. Initial claims increased by 22,000 to 242,000 in late February, the highest level since October. The pickup in new applications coincides with a number of mass terminations and layoffs at numerous companies.

Data released by the National Association of Realtors revealed that pending sales of existing U.S. homes slumped to a record low in January as severe winter weather slowed transaction activity. Consumers also balked at high prices and elevated mortgage rates ahead of the vital spring selling season. Home prices continue to rise preventing home buyers from committing to purchase. National home prices rose 3.9% in December from a year earlier, up from the 3.7% annual gain seen a month earlier, according to data from S&P CoreLogic Case-Shiller. The median sale price of a previously owned home in the U.S. was $396,900 last month, according to NAR data, up 49% from five years earlier.

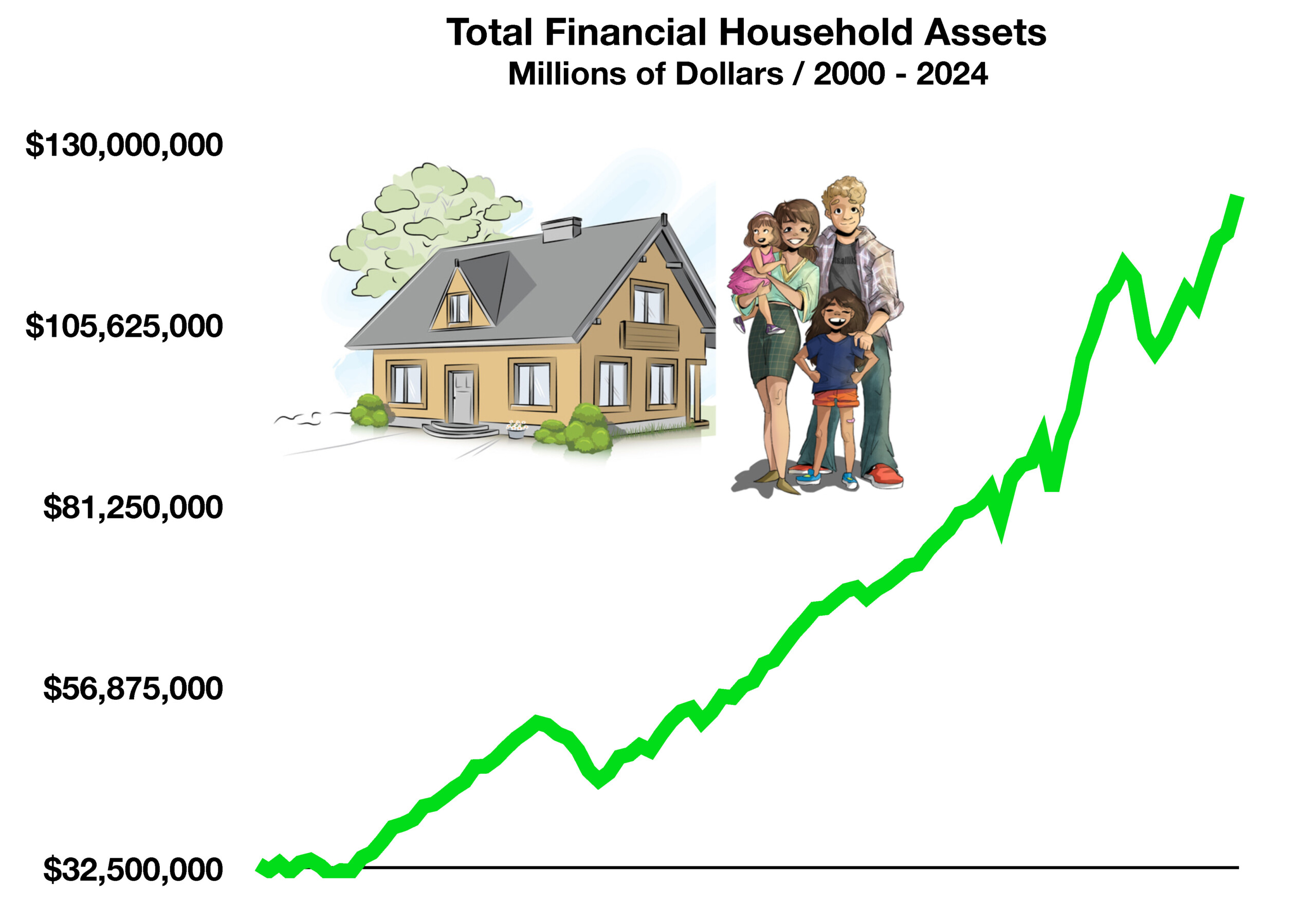

Those earning $250,000 and more now account for nearly half of all consumer spending. Rising home values and elevated stock portfolios over the past few years have helped propel spending among higher income earners. Economists attribute this to what is known as the wealth effect, essentially the confidence among consumers to spend more as asset values rise.

The President signed an executive order designating English as the official language of the United States. Establishing English as the official language may streamline communication in business and government, potentially reducing costs and improving efficiency.

Sources: U.S. Treasury, Dept.. of Commerce, NAR, S&P, Fed, BEA