Gregory M. Hart, CFP®

Haddon Wealth Management

2 Kings Highway W., Suite 201

Haddonfield, NJ 08033

(856) 888-1744

Stock Indices:

| Dow Jones | 46,397 |

| S&P 500 | 6,688 |

| Nasdaq | 22,660 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.16% |

| 10 Yr Municipal | 2.92% |

| High Yield | 6.56% |

YTD Market Returns:

| Dow Jones | 9.06% |

| S&P 500 | 13.72% |

| Nasdaq | 17.34% |

| MSCI-EAFE | 22.34% |

| MSCI-Europe | 24.64% |

| MSCI-Pacific | 17.97% |

| MSCI-Emg Mkt | 25.16% |

| US Agg Bond | 6.13% |

| US Corp Bond | 6.88% |

| US Gov’t Bond | 5.93% |

Commodity Prices:

| Gold | 3,882 |

| Silver | 46.77 |

| Oil (WTI) | 62.52 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 148.71 |

| Canadian /Dollar | 0.71 |

Macro Overview

Geopolitical tensions in the Middle East along with the ongoing invasion of Ukraine in Europe, is escalating defensive positioning in the markets as funds are being diverted to less volatile asset classes. Domestic and international equity indices retracted in April, as markets reacted to the tensive environment.

Irans’ attack on Israel prompted a recalibration among financial markets worldwide as the demand for government bonds, gold, the dollar and cash all rose. Shipping and transportation routes may become broadly affected as conflict in the region spreads to other geographic areas.

Many analysts believe that inflation is being kept elevated not by consumer demand, but by price increases as companies struggle to maintain margins. Consumers meanwhile are finding it more difficult to identify less expensive substitutes. The Fed has nearly no influence on easing non consumer driven inflation since its main policy tools, such as the Fed Funds rate which affects short term interest rates, targets consumer expenditures. Three areas are seeing the most inflationary pressures, auto insurance, rents, and health care premiums.

Stronger than expected employment data has led the Federal Reserve to wait on cutting rates until data proves otherwise. Economists view resilient labor conditions as inflationary because it allows consumers to continue to spend throughout the economy. A slow down in hiring and employment gains is signaling a cooling labor market, which is what the Fed is ideally seeking in order to start cutting rates.

The Federal Reserve carefully tracks lending activity and releases its finding via the Loan Officer Opinion Survey each month. April’s release revealed that banks and lenders continue to tighten on credit lending, making it more difficult for consumers to borrow on mortgages, credit cards, automobiles, and lines of credit. The tighter lending environment is also affecting small and mid size businesses that require credit for ongoing operations.

Of all of the developed country central banks worldwide, the Federal Reserve is the only one yet to embark on lowering rates. Japan, Germany, the U.K and the European Union, have all initiated rate reduction policies. Many analysts believe that the Fed is very close to start reducing rates, especially as other central banks have already done so.

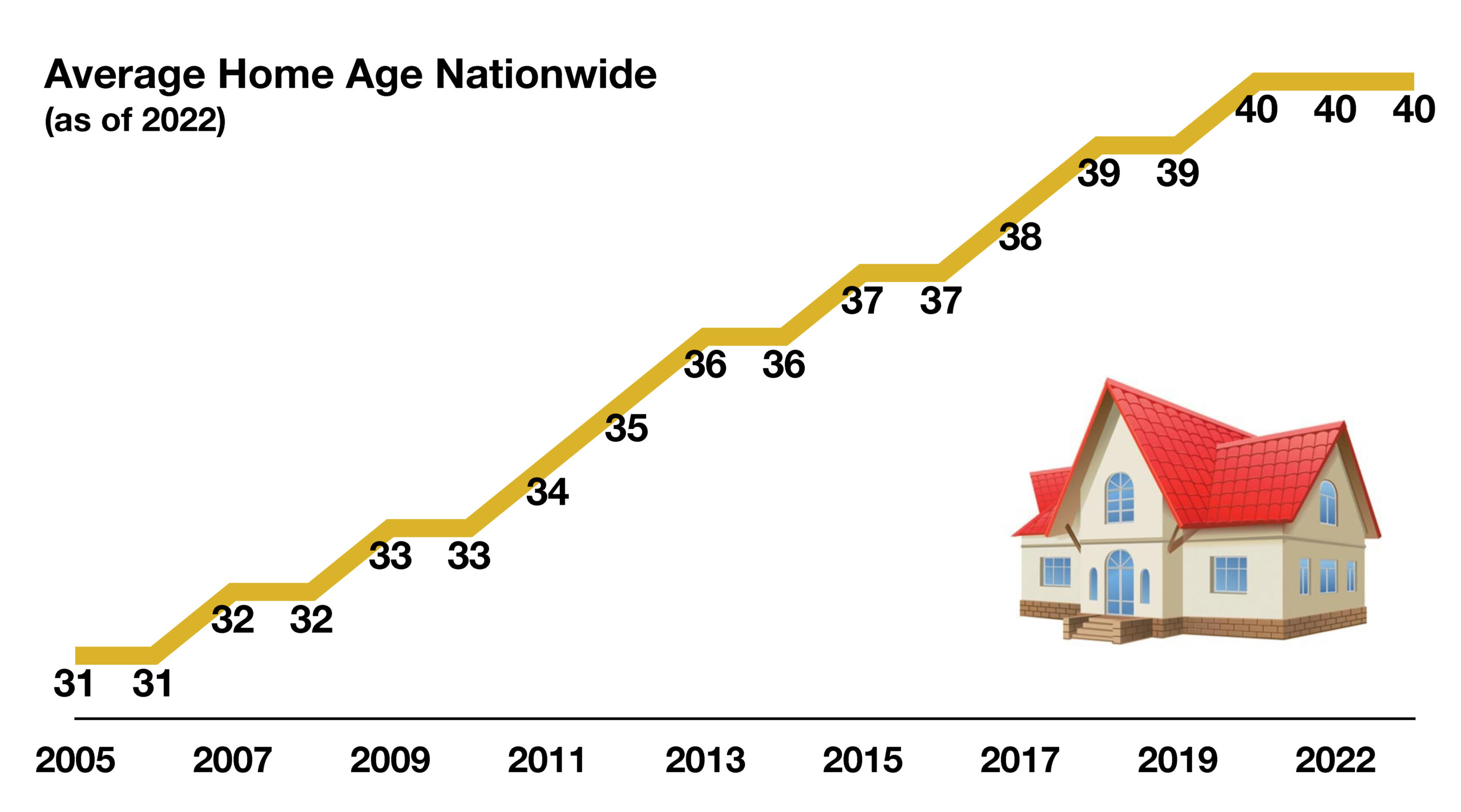

The lack of supply of new homes across the country along with ongoing demand for existing homes has contributed to the average age of a residential home in the U.S. to be 40 years old. Home buyers are spending more on updating and modernizing older homes as newer homes have become increasingly difficult to find.

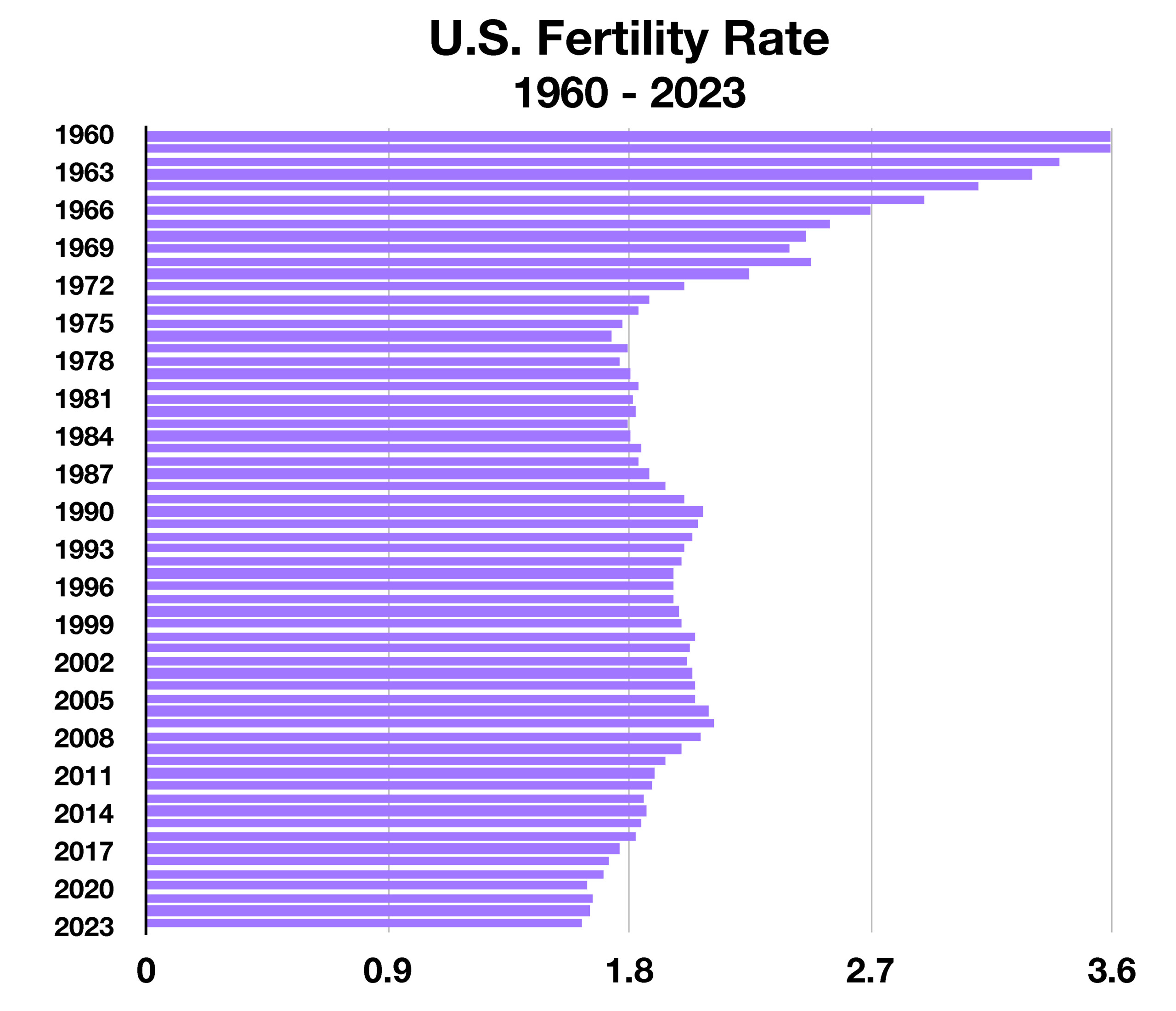

The fertility rate in the United States fell to 1.62 births per woman in 2023, a 2% decline from a year earlier, according to data from the U.S. Department of Health and Human Services. The current fertility rate is the lowest rate recorded since the U.S. government began tracking the data in the 1930s. The U.S. fertility average is below the global average of 2.3 births per woman as of 2023 data.

Sources: U.S. Dept. of Health, Federal Reserve, Treasury Dept., S&P, Bloomberg