KCG Investment Advisory Services

Kimberly Good

315 Commercial Drive, Suite C1

Savannah, GA 31416

912.224.3069

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Consumer Sentiment

There has been great consternation in the markets since April 2, the day President Trump referred to as ‘Liberation Day’. The S&P 500 index immediately lost about 12% between April 2 and April 9. Several companies in the S&P 500 revised earnings and revenue projections down as the negative impact of tariffs became clearer. Technology and consumer discretionary stocks saw the largest pullbacks as investors shifted to consumer essentials and non-tariff threatened holdings. This was an inflection point in Trump’s tariff convictions, allowing some progress to made in earnest. Since that day, the market has recovered most of its ground. While it remains possible that we will test market lows in the second or third quarter, I believe they will not achieve them. We may have seen the worst of negative excursions as a result of tariffs. Rather, KCG is and will continue to buy/rebalance and optimize any opportunities that materialize as a result.

Two principals that matter absolutely, in such volatile markets, are diversification and time. KCG portfolios are well diversified in a risk-appropriate mix of stock v bond. Stocks/equities are strategically weighted across large, small-mid (smid), U.S., and foreign; and further, across 11 sectors. The other principal that matters is time: Specifically, how long it might take stocks to recover from withdrawals and volatility. KCG holds bond ladders for the “safe” portion of our portfolios in order to provide liquidity when needed, without the worry of value depletion if stocks happen to be volatile in the short or intermediate term.

One can reason that it will take so long to feel the impact of re-shoring as a result of tariff negotiations, inflation and supply chain disruptions cannot be overcome; Or that the U.S. does not have a negotiating advantage if we don’t have other goods we can switch to. But so far, trade talks appear to be positioning the U.S. to save money and gain access to new products and markets. In general terms, increased access means new jobs.

There has been a significant de-escalation in our talks with China, with many issues discussed and agreed upon. At its worst point, both China and the U.S. continued to exempt those items from tariffs that the other could not do without. The U.S. has now signaled willingness to lower tariffs on imports from 145% to 80% and China has taken steps to stabilize its own economy with interest rate cuts, reduced reserve requirements, and increased credit supply. This could encourage economic confidence and boost ongoing talks. It creates more financial flexibility and could increase demand for U.S. goods. In short, it improves global market conditions. Additionally, China now has Pakistan and India to distract its attention and energy while strategizing on tariff deals.

The U.S. and U.K. actually reached an historic agreement, reducing tariffs and expanding market U.S. access for key U.K. industries including pharma and aerospace. The U.K. is expected to reduce its tax on U.S. digital services. With the U.K. allowing more access to U.S. beef and ethanol, there is $5 billion opportunity for American farmers.

Sources: BLS, Federal Reserve, Dept of Commerce, Treasury Dept

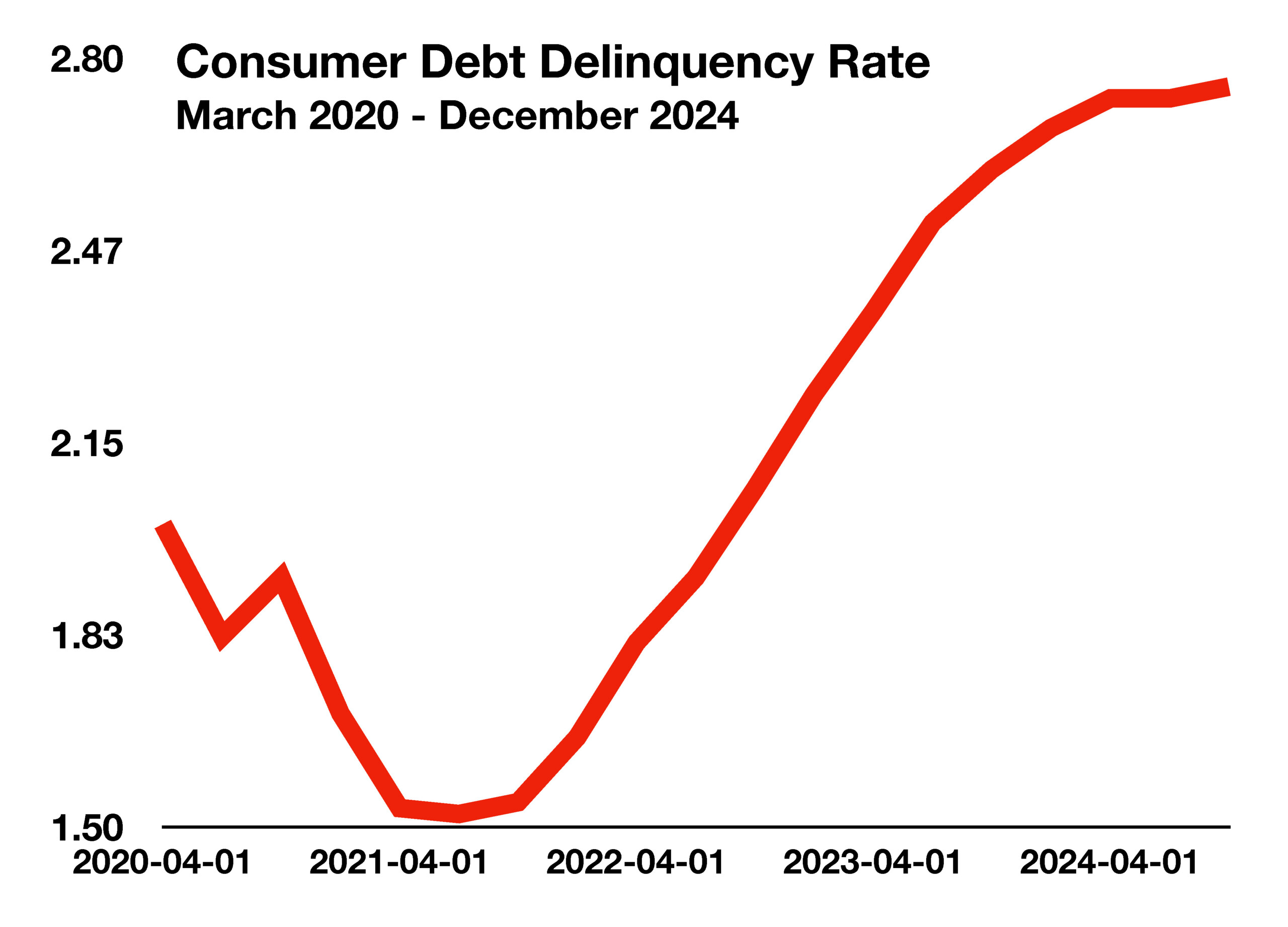

When the Federal Reserve raised interest rates to combat inflation, it resulted in higher borrowing costs for consumers. This has had a direct impact on consumer loan balances, particularly for credit cards and personal loans, which often have variable interest rates. Rising loan rates have placed additional stress on consumers as loan payments have increased, with some leading to delinquencies. Outstanding balances on credit card and auto loans have seen the largest increase in delinquencies of all debt types as of the first quarter of 2025.

When the Federal Reserve raised interest rates to combat inflation, it resulted in higher borrowing costs for consumers. This has had a direct impact on consumer loan balances, particularly for credit cards and personal loans, which often have variable interest rates. Rising loan rates have placed additional stress on consumers as loan payments have increased, with some leading to delinquencies. Outstanding balances on credit card and auto loans have seen the largest increase in delinquencies of all debt types as of the first quarter of 2025.