Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Mr. Toad, Market Volatility, and What It Means for Your Financial Plan

Dear Friends,

This year, watching the stock market has felt a lot like that: unpredictable twists, sudden turns, and a feeling that we’re somehow back where we started—just a little more battered.

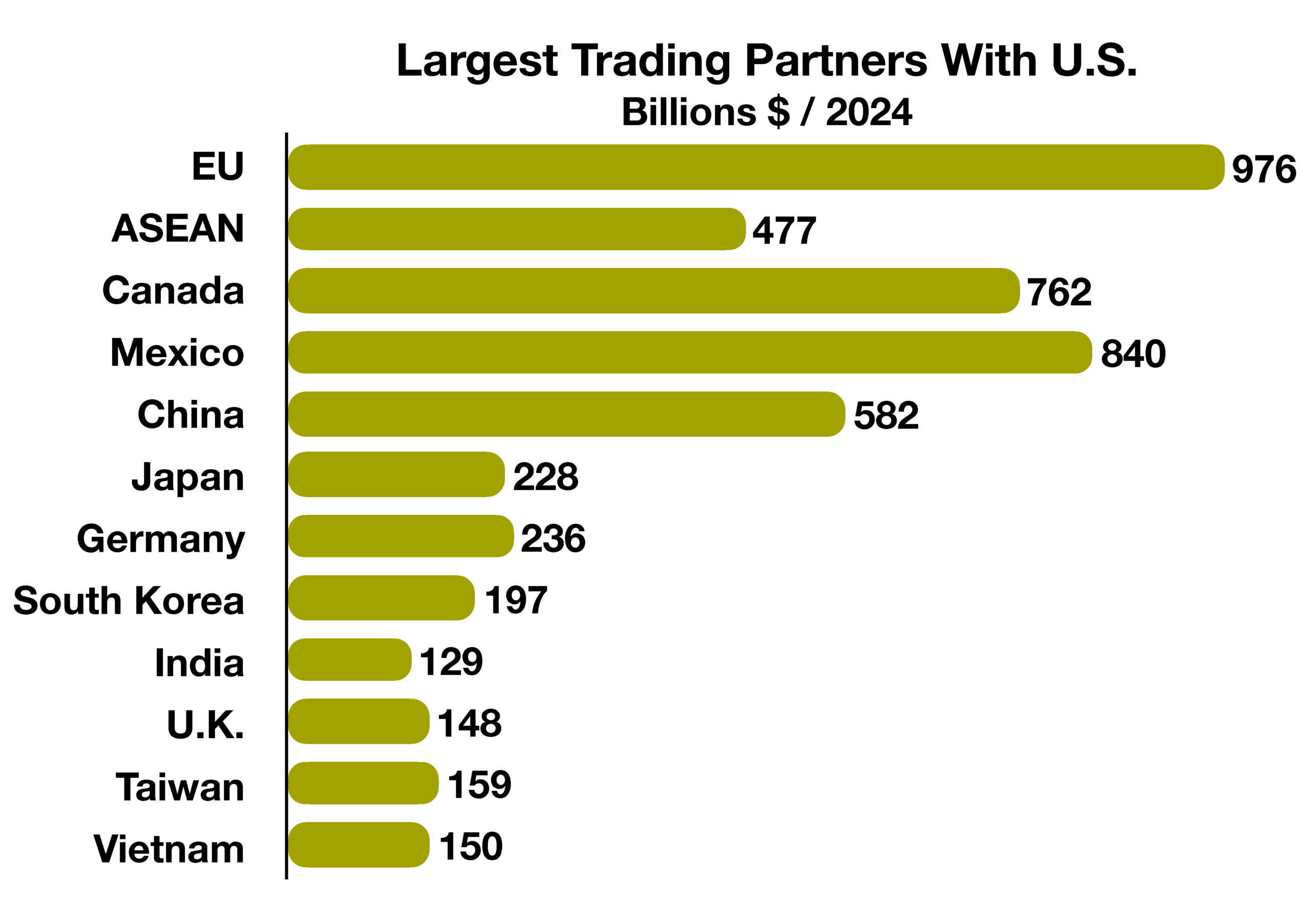

Market volatility like this is not unusual. After a long stretch of steady gains, it was inevitable that some sort of disruption—unseen by most—would return a sense of fear to the investing world. That disruption has been driven by self-imposed geopolitical and trade-related uncertainties. And while we may now better understand the causes, we remain deep in the fog when it comes to knowing how or when it will clear.

Frankly, in my career, I’ve never felt less certain about the short-term direction of the market. But that’s not a reason to panic—it’s a reminder of why long-term discipline matters more than ever.

The strongest strategy remains unchanged:

-

Diversify consistently with simple investments that are not binding

-

Stay invested over time regardless of the news

-

Keep enough cash available to weather short-term storms

These principles aren’t flashy, but they work.

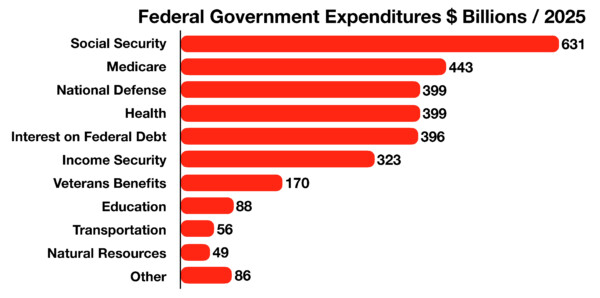

In this issue we talk about things that have a big impact on your financial life including creeping taxes that you might not expect, like property taxes and tariffs. We also remind ourselves how most of these taxes are ultimately going towards Social Security and Medicare, two expenses that are also creeping higher.

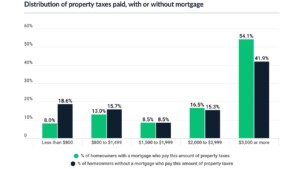

Becoming a homeowner is an exciting milestone, but it comes with less glamorous baggage: property taxes. According to a LendingTree analysis, median property taxes in the U.S. rose by an average of 10.4% between 2021 and 2023 (the latest year of available data). Property taxes vary significantly across the 50 largest metros, ranging from $1,091 to $9,937. Across the U.S., homeowners pay a median property tax of $2,969 annually. That’s $247 a month. Here in Bozeman, I bet it’s a fair bit higher.

Becoming a homeowner is an exciting milestone, but it comes with less glamorous baggage: property taxes. According to a LendingTree analysis, median property taxes in the U.S. rose by an average of 10.4% between 2021 and 2023 (the latest year of available data). Property taxes vary significantly across the 50 largest metros, ranging from $1,091 to $9,937. Across the U.S., homeowners pay a median property tax of $2,969 annually. That’s $247 a month. Here in Bozeman, I bet it’s a fair bit higher.