20860 N. Tatum Blvd Suite 220 / Phoenix, AZ 85050

2021 Midwest Road Suite 200 / Oak Brook, IL 60523

888.494.4440

www.windsoradvisor.com

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

Consumers helped buoy markets in April as shoppers rushed to spend on autos, sports equipment, and electronics in anticipation of rising prices brought about by tariffs. The additional consumer spending in April boosted economic activity throughout the country. Some economists believe that the last minute buying dashes by consumers may be masking a gradual slowdown in consumption that has been lingering for months.

Remarks by Fed Chair Jerome Powell agitated markets as he mentioned that markets and the Federal Reserve were caught off guard by the magnitude of the newly imposed tariffs and the broad scope affecting financial markets and trade.

Shipments from China to the U.S. have fallen since the announcement of the tariffs, as the trade tension has created an uncertain environment. Analysts believe that the drop in shipments may lead to shortages of particular products and goods for American consumers.

Bond markets, including government and corporate bonds, have been advancing ahead of equities as of the end of April. Unexpected volatility in the equity markets and continuous uncertainty surrounding tariffs brought about reallocations to bonds. Analysts will closely be watching earnings results for the second quarter of 2025, which will include indication of any influence by the tariffs. Second quarter earnings are due for release in July and August.

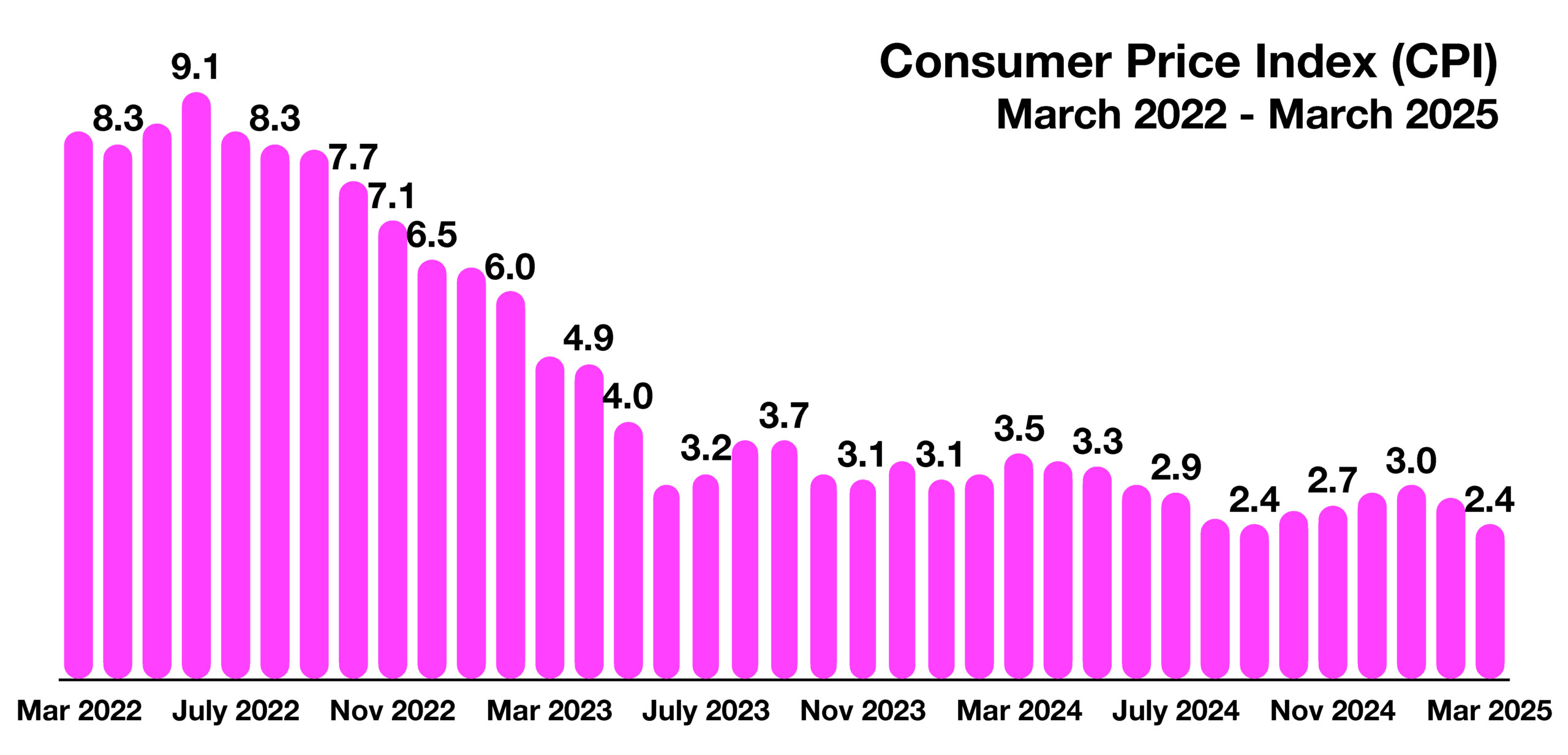

Inflation, as measured by the Consumer Price Index (CPI), fell greater than expected in March, with an increase of 2.4% for the past year, down from 3.5% in March 2024. Some economists attribute the drop to languishing consumer expenditures and slowing wage and employment growth nationwide.

China’s government has stopped publishing and releasing several key economic data which reveal the state of the country’s economy. Such data has been questionable for years because of the lack of transparency, accuracy and legitimacy of the data. Central banks, economists and analysts examine the data to determine the condition of China’s economy and health of the country’s financial system. The most recently extracted data exposed a quickly slowing economy, a collapsing real estate market, and excessive consumer debt. Many analysts and economists tracking the data believe that the recent threats of tariffs by the U.S. have heightened the country’s risk to recession and financial duress.

Recent developments regarding Social Security benefits and cuts associated with the agency have triggered some concern among future recipients as to whether to take benefits sooner rather than later. The Social Security Administration reports that age 62 is now the most popular age for Americans to start receiving their benefits, which is also the earliest age that benefits can begin, while age 70 is the least common age to start taking benefits.

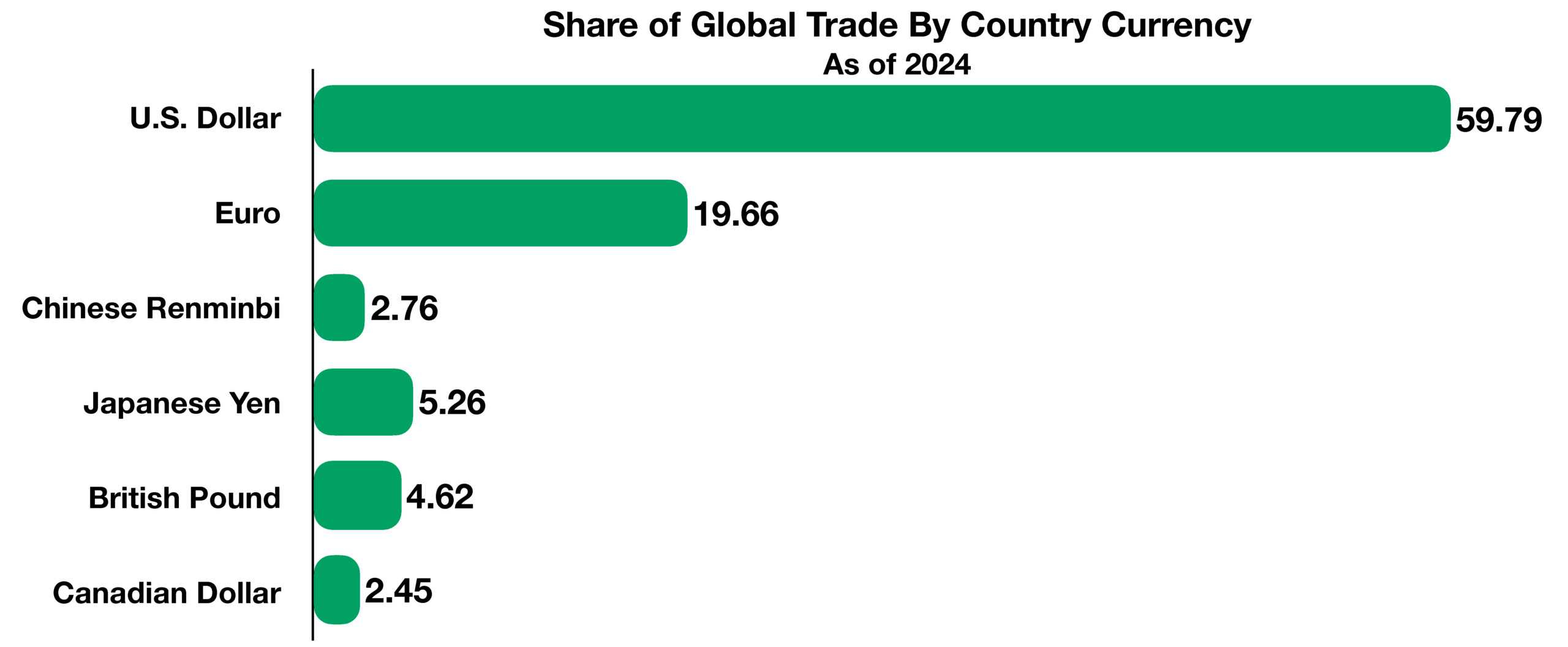

A weaker U.S. dollar is affecting the price of imports & exports, travel abroad by Americans, geopolitical dynamics, interest rates and the status of U.S. federal debt held by foreigners. Regardless, the status of the U.S. dollar has been and remains the dominant currency, with over 50% of global transactions conducted in dollars.

Sources: BLS, Federal Reserve, Dept of Commerce, Treasury Dept

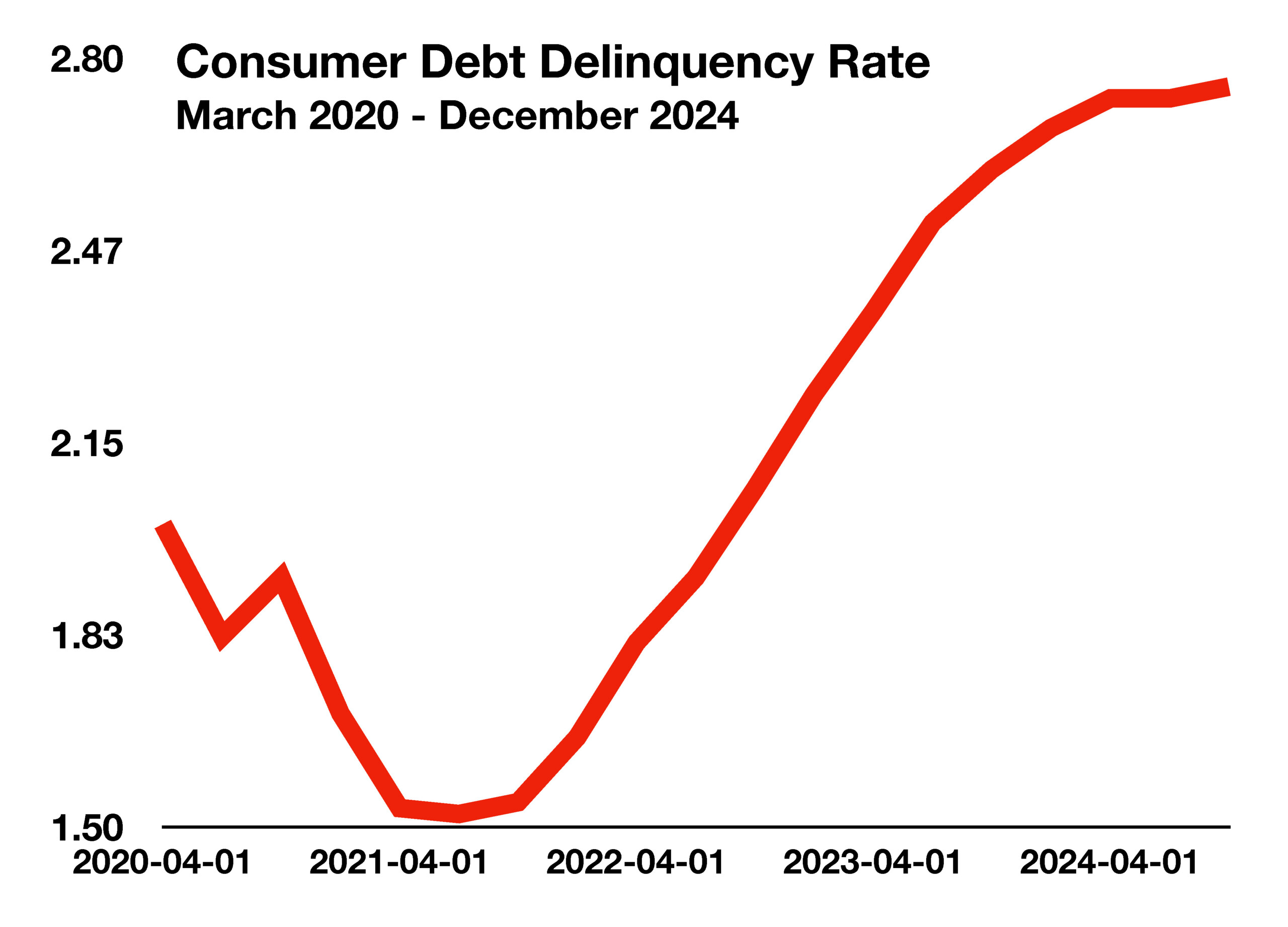

When the Federal Reserve raised interest rates to combat inflation, it resulted in higher borrowing costs for consumers. This has had a direct impact on consumer loan balances, particularly for credit cards and personal loans, which often have variable interest rates. Rising loan rates have placed additional stress on consumers as loan payments have increased, with some leading to delinquencies. Outstanding balances on credit card and auto loans have seen the largest increase in delinquencies of all debt types as of the first quarter of 2025.

When the Federal Reserve raised interest rates to combat inflation, it resulted in higher borrowing costs for consumers. This has had a direct impact on consumer loan balances, particularly for credit cards and personal loans, which often have variable interest rates. Rising loan rates have placed additional stress on consumers as loan payments have increased, with some leading to delinquencies. Outstanding balances on credit card and auto loans have seen the largest increase in delinquencies of all debt types as of the first quarter of 2025.