Peter Kisver

Kiaros Advisors, LLC

234A NW Broad Street

Southern Pines, NC 28387

910.420.0352

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

The Fed continued on its steepest rate increase since the early 1980s. Political pushback against the Federal Reserve has been building as criticism surrounding the rate hikes has become a focal issue. October saw a weaker U.S. dollar helping to propel stocks higher as multi-national U.S. companies benefit due to overseas sales.

Third Quarter results for real GDP were released, showing a 2.6% annualized growth rate that followed two consecutive quarters of negative growth, which by many economists’ standards is the official definition of a recession. The recent growth numbers are not expected to mean that the nation has rebounded, and rather GDP is simply treading water. With consumer spending accounting for nearly 70% of GDP, inflation is placing additional pressure on American consumers.

Recent comments by the Federal Reserve indicate that it may consider a more cautious pace of rate hikes as economic activity begins to react to the rapid rise in interest rates. With uncertainty regarding the Fed’s raising of interest rates and the growing expectation for them to pivot, the dollar has slightly fallen from all-time highs versus the euro and pound.

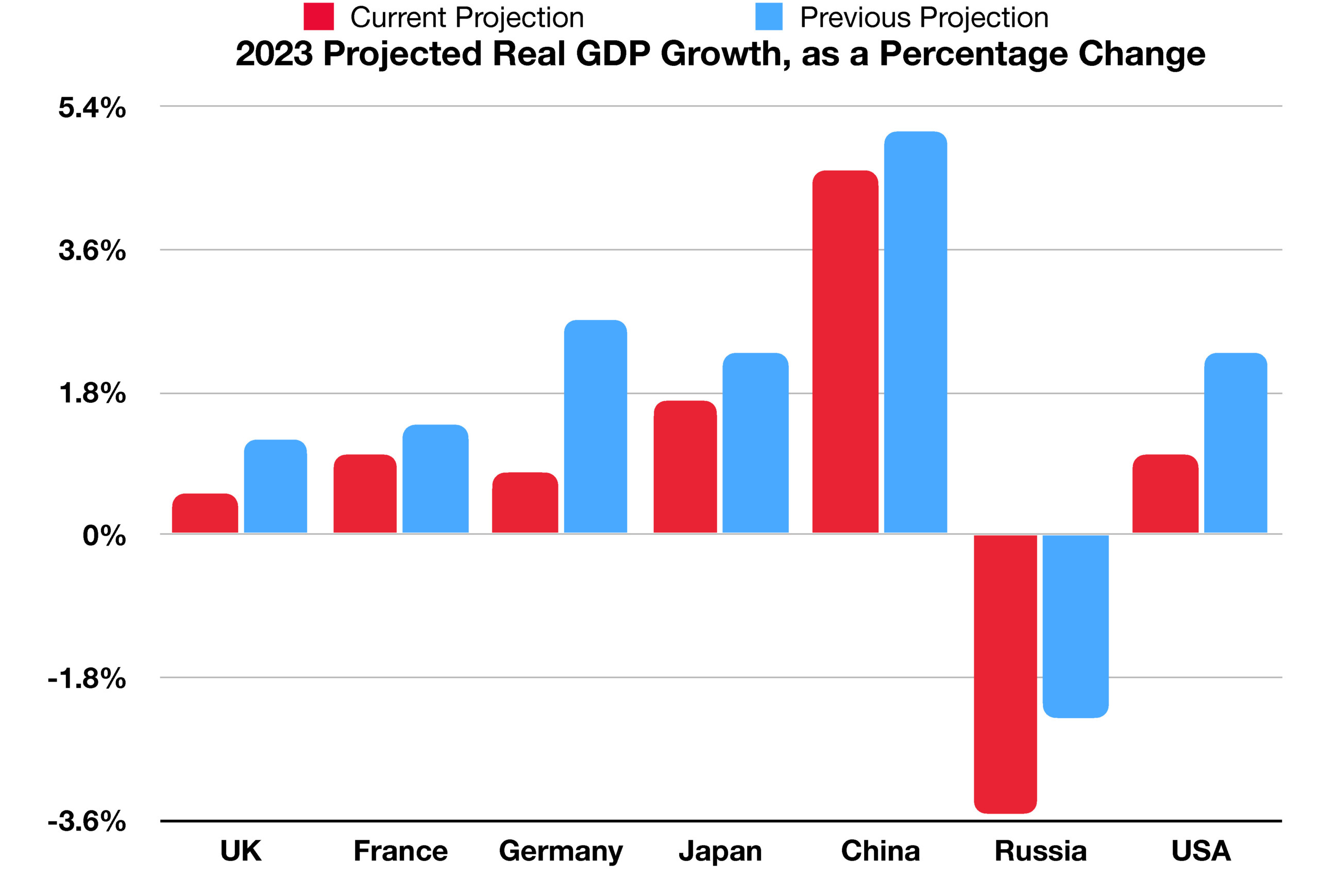

The International Monetary Fund’s most recent World Economic Outlook projected that the global economy has become “gloomy and more uncertain” as a result of inflation, rising rates, and the war in Europe. Revised projections heading into 2023 show less economic growth for most countries, with Russia expecting negative growth. U.S. growth estimates show minimal economic expansion over the next year.

Sources: Federal Reserve, IMF World Economic Outlook Oct 2022, Treasury Dept., Bureau of Labor Statistics, Bloomberg

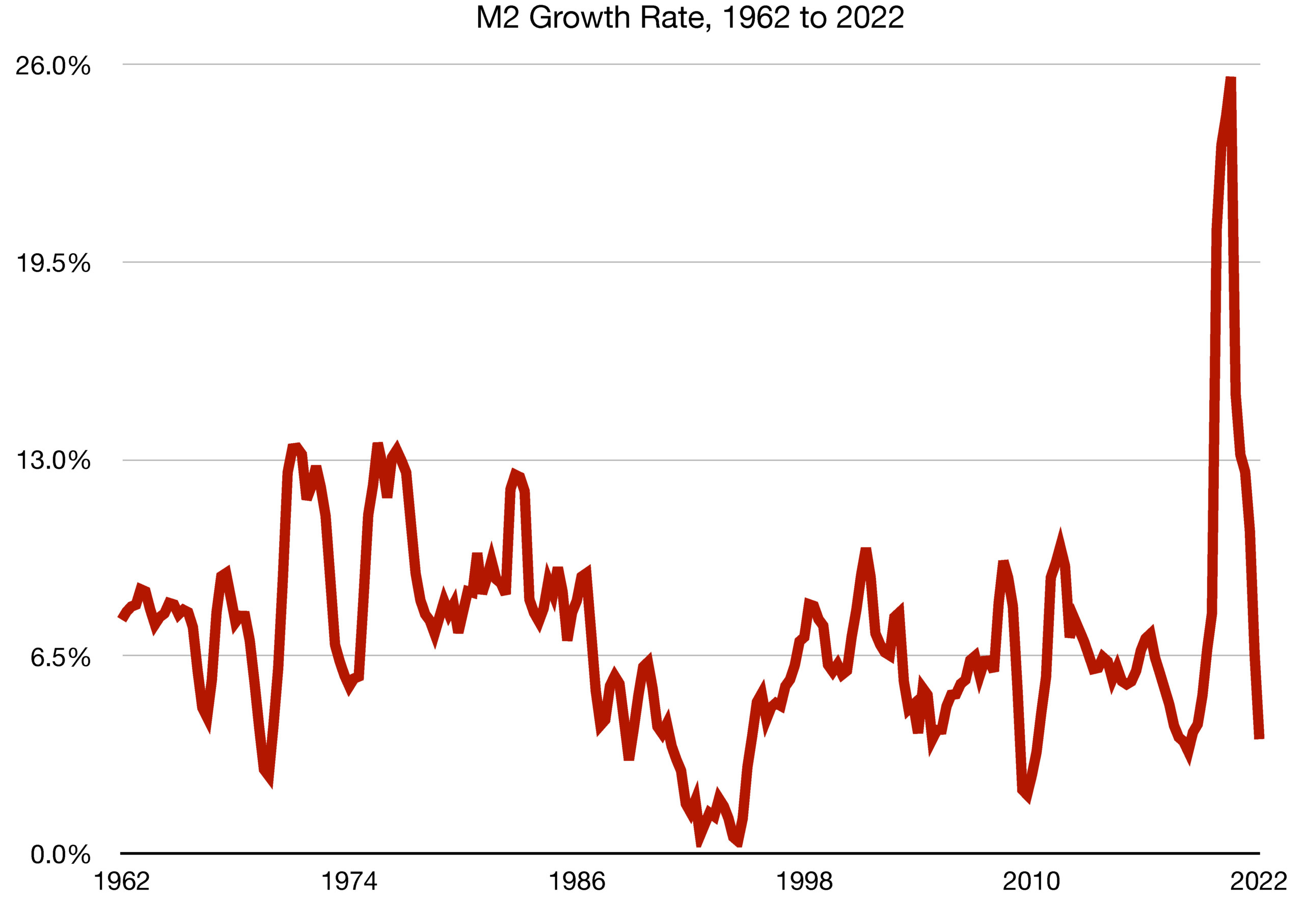

To combat this inflationary pressure, the Fed has constrained M2 growth, with the inflation rate even surpassing M2 growth in the second quarter of 2022 when inflation reached upwards of 9%. This constraint on M2 has contributed to the emergence of a recessionary environment, as evidenced by two consecutive quarters of negative GDP growth. Yet, inflation remains at 40-year highs, having measured in at 8.2% recently, just a 0.8% fall from this year’s highs. The Fed hopes to bring inflation down further by continuing to increase short-term interest rates, yet may pivot soon as immense political pressure mounts on the central bank. (Sources: BLS, Federal Reserve Bank of St. Louis)

To combat this inflationary pressure, the Fed has constrained M2 growth, with the inflation rate even surpassing M2 growth in the second quarter of 2022 when inflation reached upwards of 9%. This constraint on M2 has contributed to the emergence of a recessionary environment, as evidenced by two consecutive quarters of negative GDP growth. Yet, inflation remains at 40-year highs, having measured in at 8.2% recently, just a 0.8% fall from this year’s highs. The Fed hopes to bring inflation down further by continuing to increase short-term interest rates, yet may pivot soon as immense political pressure mounts on the central bank. (Sources: BLS, Federal Reserve Bank of St. Louis)