20860 N. Tatum Blvd Suite 220 / Phoenix, AZ 85050

2021 Midwest Road Suite 200 / Oak Brook, IL 60523

888.494.4440

www.windsoradvisor.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Global financial markets reacted to the conflict in the Middle East war with caution, concerned that the hostility could erupt into a broader situation engulfing other countries and territories. A flight to the U.S. dollar and U.S. government bonds took hold as equity volatility rose in response to the conflict.

The Federal Reserve opted to leave rates unchanged during their most recent meeting, with Fed Chair Jerome Powell hinting that no further rate increases might be needed. The Federal Reserve bases its decisions on economic data that can vary dramatically from month to month, so some analysts doubt that the Fed has formally completed its rate hike strategy.

The Treasury Department announced that it plans to issue less longer-term debt, as the cost of interest payments for the government has increased tremendously as rates have risen. This led to a decrease in long-term Treasury bond yields as investors opted for higher-yielding short-term bonds. Some economists view this dynamic as an indicator that rates may be approaching a pinnacle.

Growing concerns that the war between Israel and Hamas could spread throughout the region is prompting a shift towards global fixed income and the U.S. dollar. Oil and commodity prices have also been affected by the conflict as production and transportation constraints increase concerns.

The Treasury bond market experienced volatility in October that resembled the stock market. Hedge fund manager bets against U.S. government debt, flight to government bonds due to the conflict in the Middle East, and a flood of new debt issuance to fund swelling U.S. budget deficits contributed to the volatility. The yield on the 10-year Treasury bond reached 5%, a 16-year high before retreating back to below 5%.

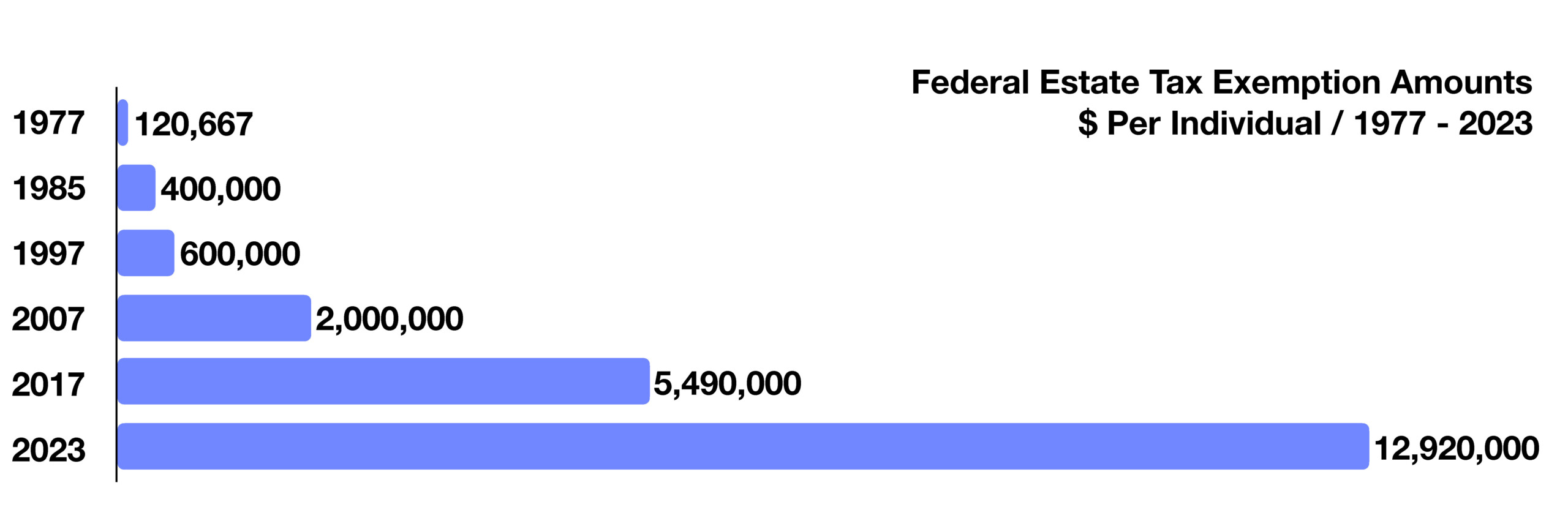

The federal tax estate exemption amount is expected to revert to $5 million on January 1, 2026, yet may be higher depending on where inflation is at that time. Some estimate the revised exemption amount to reach between $6 to $7 million after adjusting for inflation.

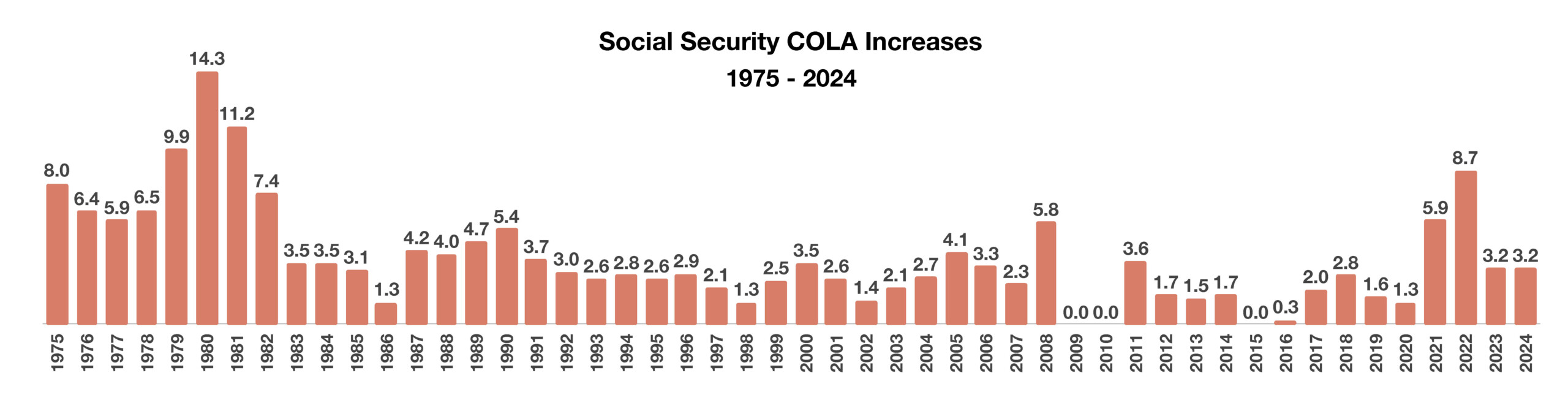

Social Security benefit payments are slated to increase 3.2% effective January 2024, following the same increase as in 2023. The increase, based on the Cost of Living Adjustment (COLA) is designed to keep pace with inflation. Medicare premiums, however, are expected to increase 5.9% in 2024, more than the increase in Social Security.

Sources: Federal Reserve, Treasury Dept., Social Security Adm., Bloomberg