Gregory M. Hart, CFP®

Haddon Wealth Management

2 Kings Highway W., Suite 201

Haddonfield, NJ 08033

(856) 888-1744

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

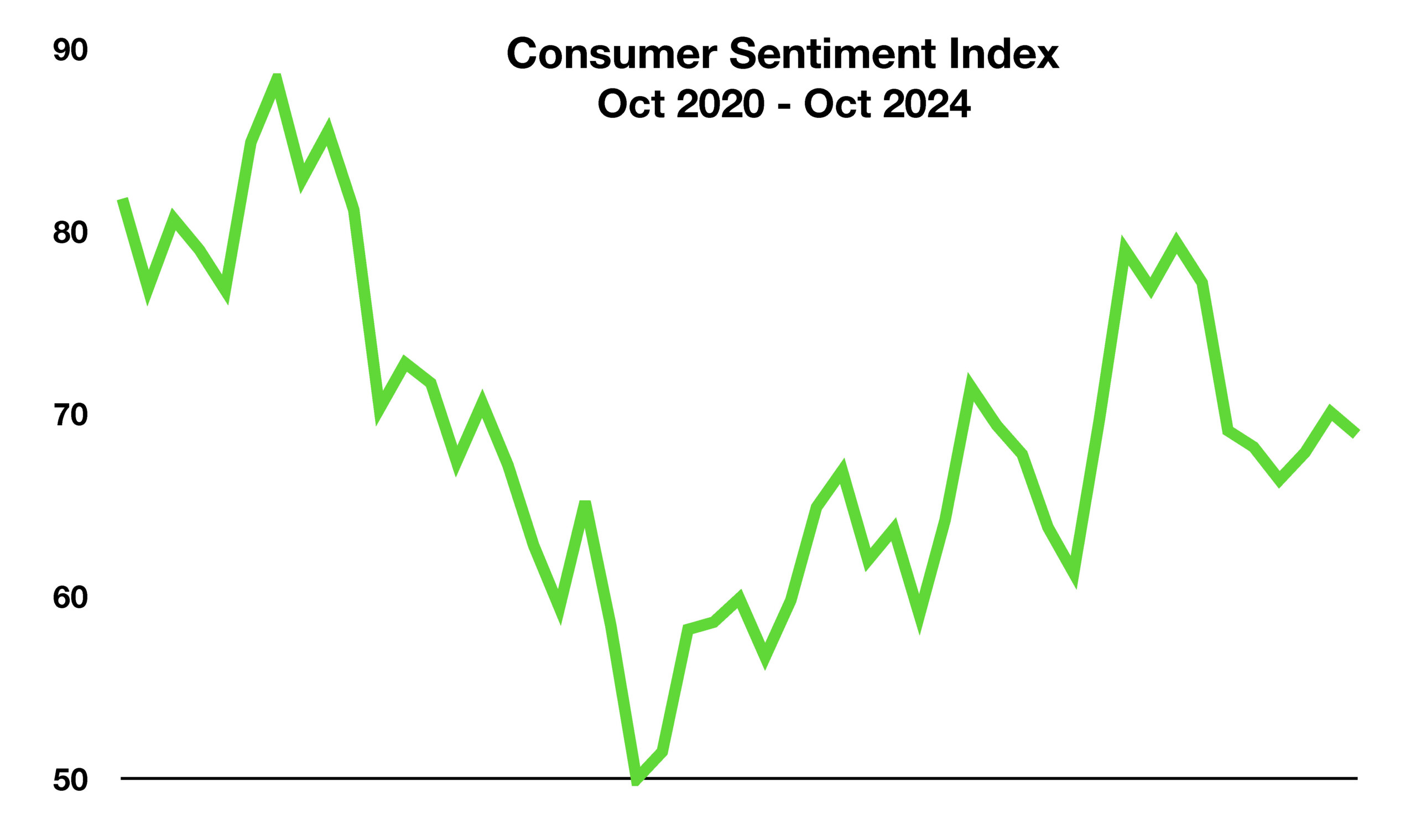

Uncertainty leading up to the presidential election brought about volatility in the equity markets while bonds were weighed by a resurgence in inflation fears. Equity and fixed income markets will digest the outcome of the election over the next few weeks, in anticipation of more detailed and concise fiscal policy objectives by the elected administration.

Fiscal policy, expanding federal deficits, and continued issuance of tremendous government debt drove bond yields higher in October. The expectation of deregulation and low corporate tax rates drove equities higher in response to the election results.

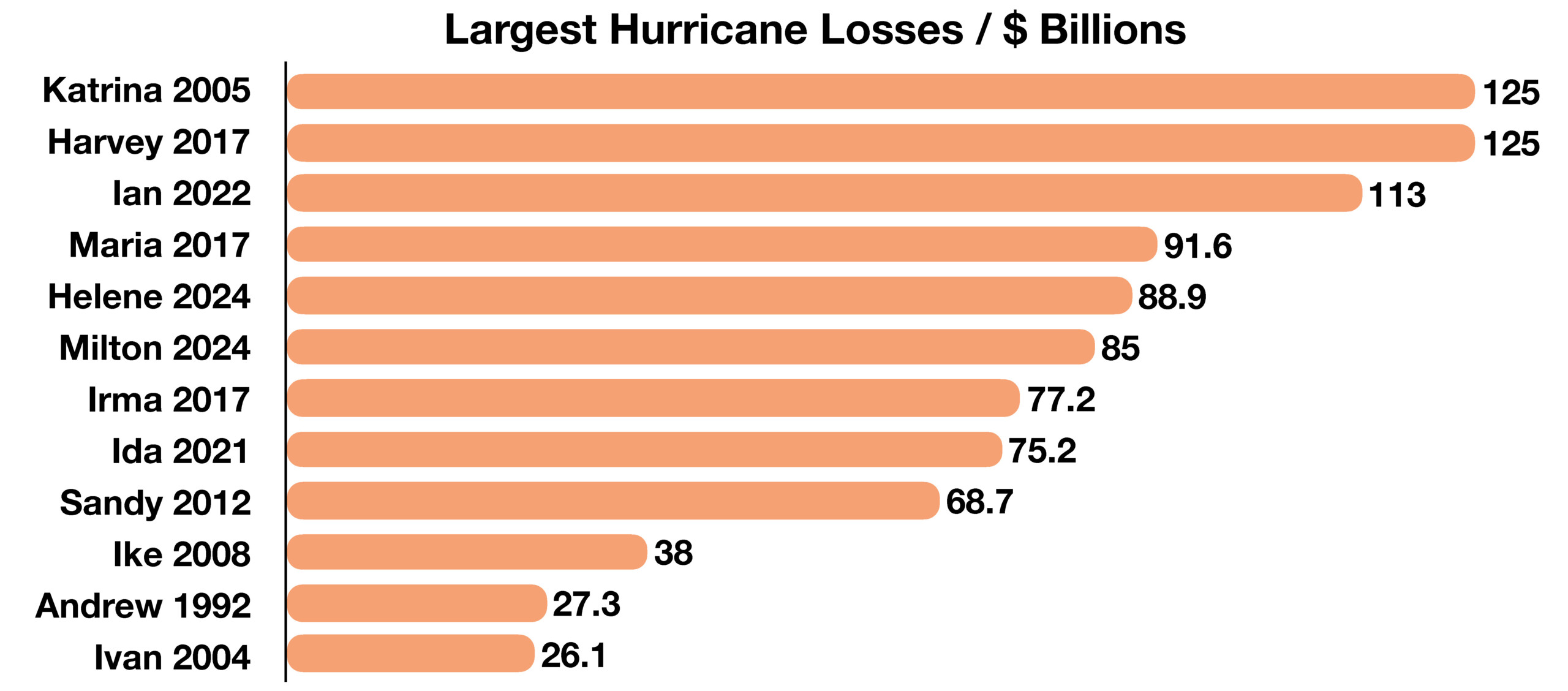

The financial aftermath of Hurricanes Milton and Helene were made apparent by economic and employment data released in October, revealing a slowdown in consumer activity and dismal jobs growth. The affects of the hurricanes were felt nationwide as distribution routes, energy facilities, and travel were hindered.

Mortgage rates rose for the fifth week in a row, ending October with a 6.72% average rate for a 30 year fixed mortgage. The average rate had fallen to 6.08% at the end of September, then steadily began to rise as bond yields rose throughout the month.

Concerns surrounding a resurgence of inflationary pressures weighed on the equity and bond markets, elevating yields throughout October. Proposed tariffs on imported goods as well as discussions to weaken the U.S. dollar, continued debt issuance by the U.S. government, and rising insurance premiums, food costs, housing and energy expenses, all fed inflation fears.

Proposals of imposing new tariffs on imports is directed at countering the nation’s expanding trade deficit. A trade deficit results as the U.S. imports more than it exports, placing a strain on the nation’s economic expansion. Imports into the U.S. in 2023 were valued at $3.83 trillion, while exports were valued at $3.05 trillion in 2023. Tariffs may adversely increase prices for consumers as companies pass along the costs of tariffs, which is considered to be inflationary.

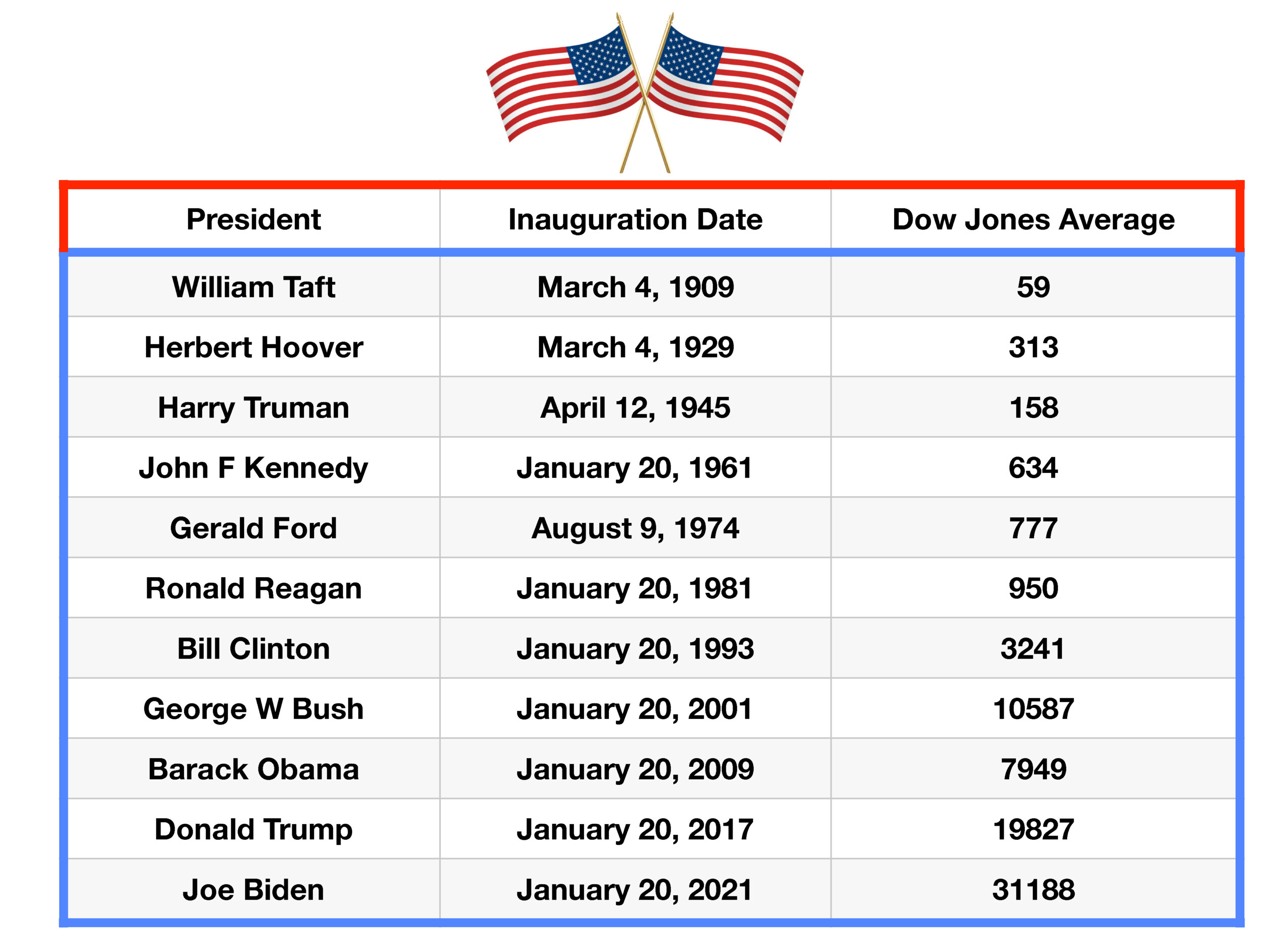

As the Presidential Inauguration approaches in January 2025, the equity markets have been at various levels throughout the decades. Fiscal policy as well as programs structured to enhance economic growth have been crucial to the expansion and stability of equities and the economy for over a hundred years. A historical measure of how the equity markets have performed and grown throughout numerous administrations can be tracked by the Dow Jones Industrial Average. (Sources: Treasury, Fed, Univ. of Michigan, CBO, FreddieMac, NOAA)

Moody’s estimates a total of $20 billion to $34 billion in losses from the damage caused by Hurricane Helene. Other insurance industry estimates run higher, with the inclusion of uninsured businesses and individuals. The storm inflicted widespread damage across numerous states, destroying and crippling power facilities, agriculture, roads, bridges, water reclamation, schools, and business operations among various industries. Historically, rebuilding efforts following natural disasters such as hurricanes, has led to pockets of economic growth. The enormous cost of Katrina in 2005 led to hundreds of millions of dollars for rebuilding homes, roads, buildings, and re-establishing businesses. (Sources: NOAA, Dept. of Commerce, Moody’s)

Moody’s estimates a total of $20 billion to $34 billion in losses from the damage caused by Hurricane Helene. Other insurance industry estimates run higher, with the inclusion of uninsured businesses and individuals. The storm inflicted widespread damage across numerous states, destroying and crippling power facilities, agriculture, roads, bridges, water reclamation, schools, and business operations among various industries. Historically, rebuilding efforts following natural disasters such as hurricanes, has led to pockets of economic growth. The enormous cost of Katrina in 2005 led to hundreds of millions of dollars for rebuilding homes, roads, buildings, and re-establishing businesses. (Sources: NOAA, Dept. of Commerce, Moody’s)