W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Financial markets were distraught during the third quarter as rising rates, inflation, and slowing economic activity hindered major equity indices. Dramatic tax cuts implemented in the U.K. stirred global financial currency markets with the British pound falling to historic lows. Fiscal policy reform is becoming a focal point as various international economies are poised to fall into recession.

The effects of Hurricane Ian on the insurance and property casualty industry may take months to determine. Preliminary estimates are expected to surpass $57 billion in property losses and damage, yet not as catastrophic as Katrina’s $125 billion in losses during 2005.

Affordability constraints from elevated home prices and rising mortgage rates continue to hinder housing nationwide. Consequently, mortgage volume for both purchased and refinanced loans fell to a 22-year low in late September due to increasing rates which are slowing mortgage activity.

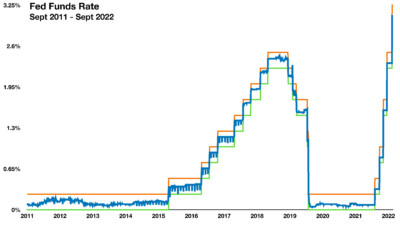

The Fed’s Continuous Increase Of The Fed Funds Rate – Monetary Policy

Concerns surrounding the extent of the Federal Reserve’s strategy on raising rates affected fixed-income and equity markets in September. The Fed’s strategy to combat inflation by increasing the Fed Funds rate has been one of the most ambitious in decades. The Federal Reserve increased short-term rates again in September with the Fed Funds rate reaching a target range of 3% to 3.25%. (Sources: Federal Reserve, FreddieMac, Mortgage Bankers Association, Treasury Dept., Bloomberg)

The Fed Funds Rate, which is controlled by the Federal Reserve Board (also known as the Fed), is the interest rate at which banks charge each other to borrow money. This year, the Fed has continued to aggressively increase the rate. The effects of increasing the Fed Funds Rate are more expensive borrowing costs and reduced demand for borrowing money. By increasing the rate, the Fed hopes to pacify rising inflation, as the U.S. is currently experiencing the highest inflation rate observed since 1981.

In March of this year, the Fed began its increase of interest rates. Before then, the rate was effectively at close to 0% between April 2020 and February 2022. As of September 21st, the rate has a target range of 3% to 3.25%, which means the rate has risen 3% in just 7 months. This is the largest increase made by the Fed in a single year since 1982. Based on this, the Fed Funds Rate would reach 4% to 4.25% by the end of the year. (Sources: Federal Reserve Bank of St. Louis, Federal Reserve Bank of New York)