Aspen Wealth Management, Inc.

9300 W. 110th Street, Suite 680

Overland Park, KS 66210

913.491.0500

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

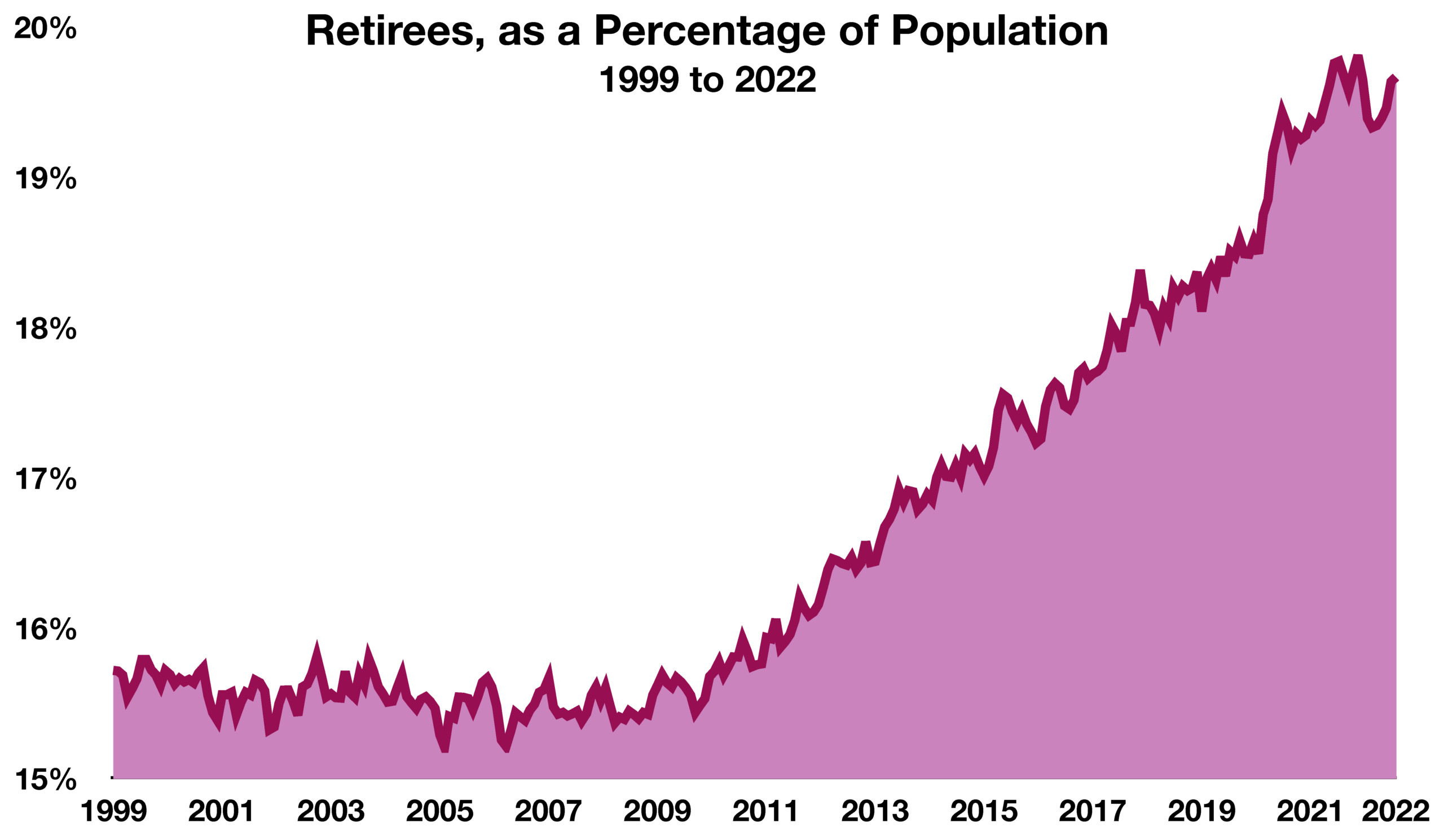

Let’s review where the financial markets are and how we got here. In 2020, Covid-19 hit and the world economies shut down. The U.S. Federal Reserve, as well as the European Union, United Kingdom, Japan, and China, “saved the world” by creating/printing money and buying their own government bonds and mortgages. At the same time, the US government (Congress) decided it should give away trillions of dollars. This combination of buying assets and Congressional hand-outs continued for two years into early 2022. These two government programs have caused most everything to increase in value including bonds, stocks, real estate, food, commodities, etc. to the point most assets became extremely overpriced.

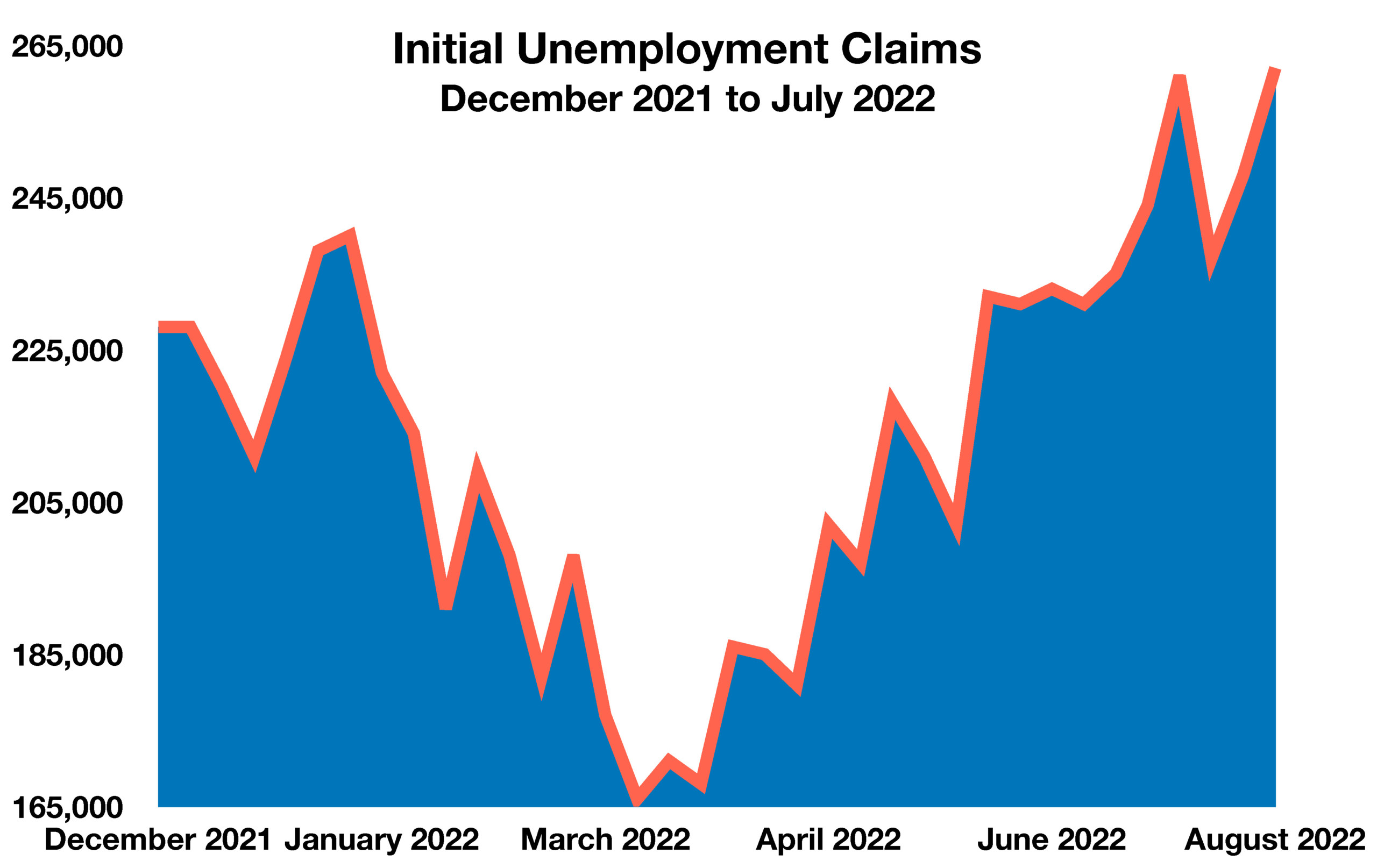

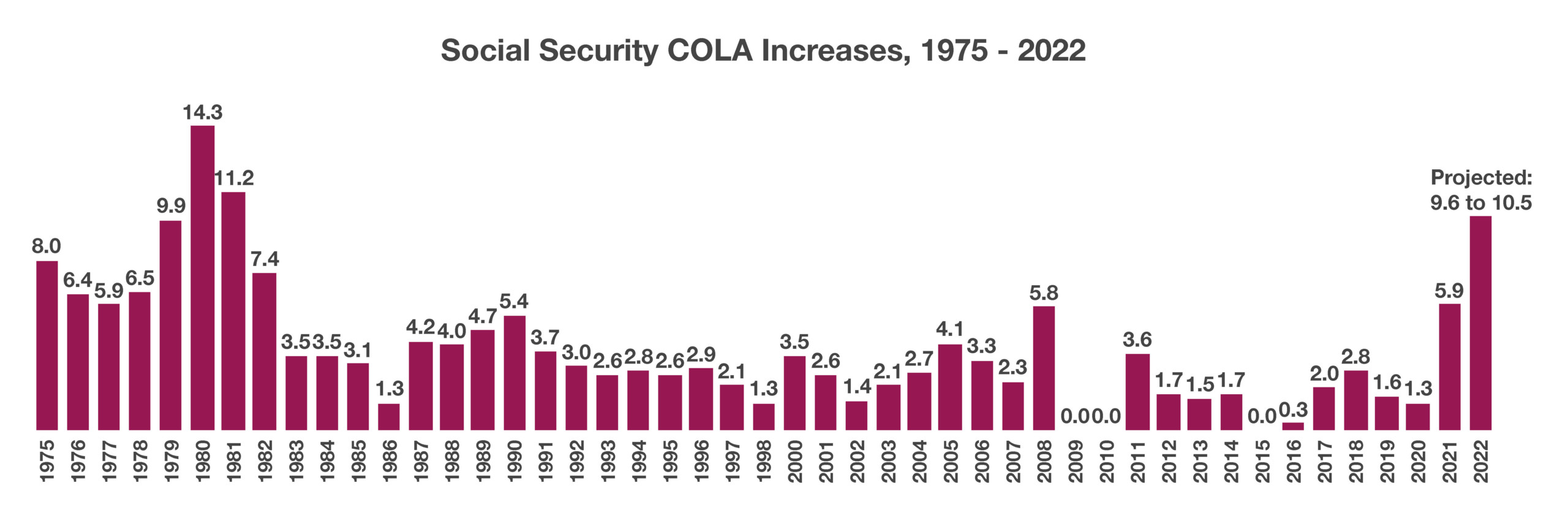

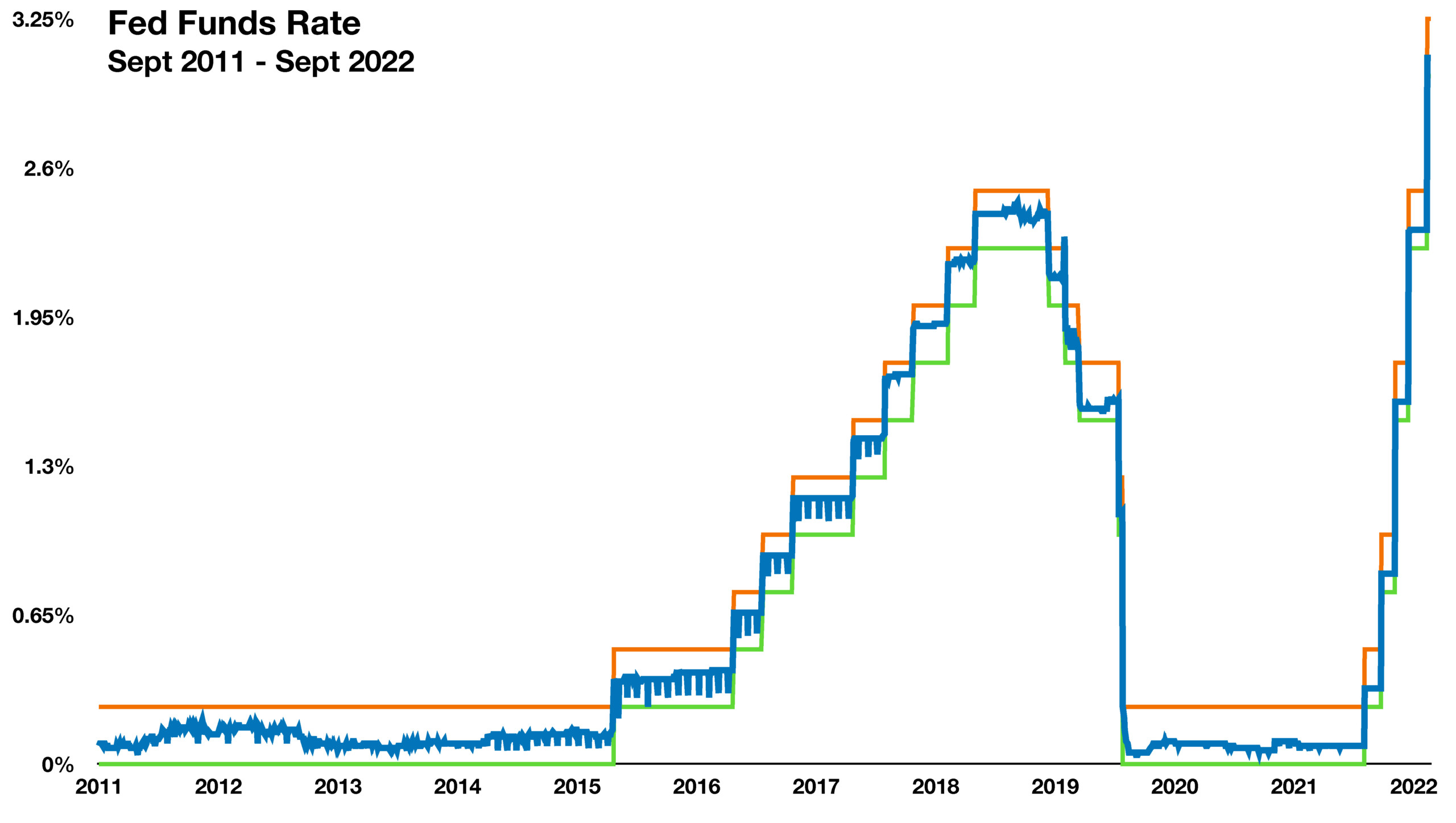

Fast forward to now. In the process of saving the global economies, these governments caused inflation to increase from nearly 0% to 9%. Earlier this year, the US Federal Reserve continued to deny inflation concerns as they expected inflation to be “transitory”. Well, they were wrong. By the time they figured out inflation was here to stay, it was too late as inflation continued to soar. As a result of high inflation, in March, the Federal Reserve began to increase the Fed Funds Rate or interest rates. Before then, the rate was effectively near 0% from April 2020 until March 2022.

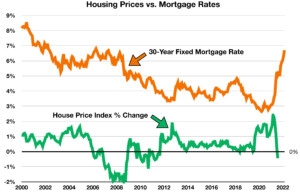

The Fed Funds Rate, which is controlled by the Federal Reserve Board (also known as the Fed), is the interest rate at which banks charge each other to borrow money. The banks, in turn, raise interest rates to their customers. The desired effect of increasing the Fed Funds Rate is more expensive borrowing costs and reduced demand for borrowing money. In other words, the intent is to discourage consumer and business borrowing to pacify rising inflation. This year, the Fed has continued to aggressively increase the rate.

Additionally, the Fed is selling the bonds they purchased the past two years. As a result, the bubbles are deflating and asset prices globally are decreasing precipitously. Our US government and the other foreign governments caused the run up, and now they are causing the decline.

(Sources: Federal Reserve, FreddieMac, Mortgage Bankers Association, Treasury Dept., Bloomberg)