Equities React To Congressional Uncertainty – Global Equity Overview

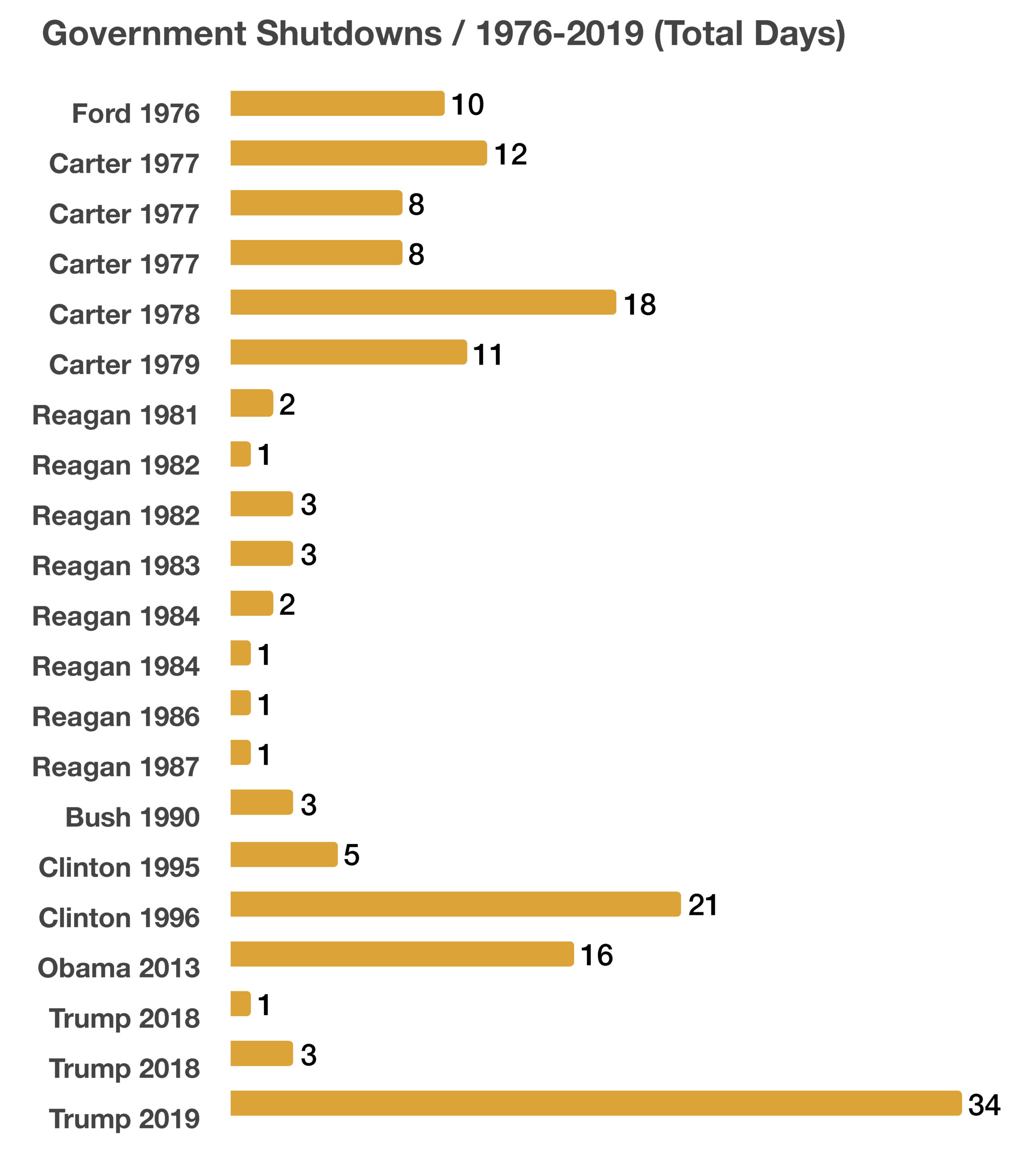

Domestic equities were off in September and in the third quarter, as stocks retracted further with shutdown concerns increasing towards the end of the quarter. Rising interest rates and the labor union strikes also contributed to market anxiety, as uncertainty drove volatility higher throughout the month.

The energy and communication services sector were the only positive sectors for the third quarter. Elevated fuel prices along with improving technology earnings supported the rise in the sectors. Pessimism amid renewed inflation concerns hindered equity momentum during the quarter.

Developed and emerging market equities also pulled back in September and the quarter as uncertainty surrounding the U.S. dollar and elevated fuel prices drove valuations lower. (Sources: S&P, Dow Jones, Nasdaq, MSCI, Bloomberg)

Yields On The Rise – Fixed Income Overview

Looming government shutdown threats hindered the bond markets as concerns surrounding heightened funding costs for the government came into focus. Yields on U.S. Treasury bills, notes, and bonds rose in September as confidence regarding reaching a compromise diminished. Analysts expect the rise in government debt yields to be short-term unless another impasse materializes in mid-November as Congress deliberates the federal budget again. The yield on the 10 year Treasury bond surpassed 4.5% at the end of September, luring investors as equity volatility continued to dampen performance. (Sources: Treasury Dept., Congress.gov)

Medicare Coverage Heading Into 2024 – Retirement Planning

With open enrollment upon us, millions of Americans will be deciding on which, if any, changes to make to their Medicare coverage. The Open Enrollment Period for 2024 coverage is from October 15, 2023 to December 7, 2023. Coverage for any changes or new plans begins January 1, 2024.

Since Medicare doesn’t cover all medical expenses, the decision to buy supplemental insurance coverage or to obtain a Medicare Advantage Plan is important for millions of Medicare recipients. Medicare Advantage Plans allow a recipient to get both Medicare Part A and Part B coverage. Medicare Advantage Plans are sometimes called Part C or MA Plans, and are offered by Medicare-approved private companies. Medicare Supplemental Insurance or Medigap helps pay for gaps in coverage not paid for by Medicare. Even though Medicare does pay for many procedures and services, some remaining expenses such as copayments, coinsurance, and deductibles are covered by supplemental plans. Some Medigap policies also cover services that are not covered at all by Medicare, such as coverage while traveling abroad. So it’s worth shopping and determining what expenses are covered by the various supplemental insurance policies. (Source: medicare.gov)