Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 43,840 |

| S&P 500 | 5,954 |

| Nasdaq | 18,847 |

Bond Sector Yields:

| 2 Yr Treasury | 3.99% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 2.88% |

| High Yield | 6.92% |

YTD Market Returns:

| Dow Jones | 2.75% |

| S&P 500 | 1.23% |

| Nasdaq | -2.40% |

| MSCI-EAFE | 7.30% |

| MSCI-Europe | 10.30% |

| MSCI-Pacific | 0.90% |

| MSCI-Emg Mkt | 6.60% |

| US Agg Bond | 2.74% |

| US Corp Bond | 2.60% |

| US Gov’t Bond | 2.65% |

Commodity Prices:

| Gold | 2,864 |

| Silver | 31.69 |

| Oil (WTI) | 70.07 |

Currencies:

| Dollar / Euro | 1.04 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 149.59 |

| Canadian /Dollar | 0.69 |

Dear Friends,

The US economy has yet to present a problem that capitalism has not solved. And yet the future looks as spooky as ever!

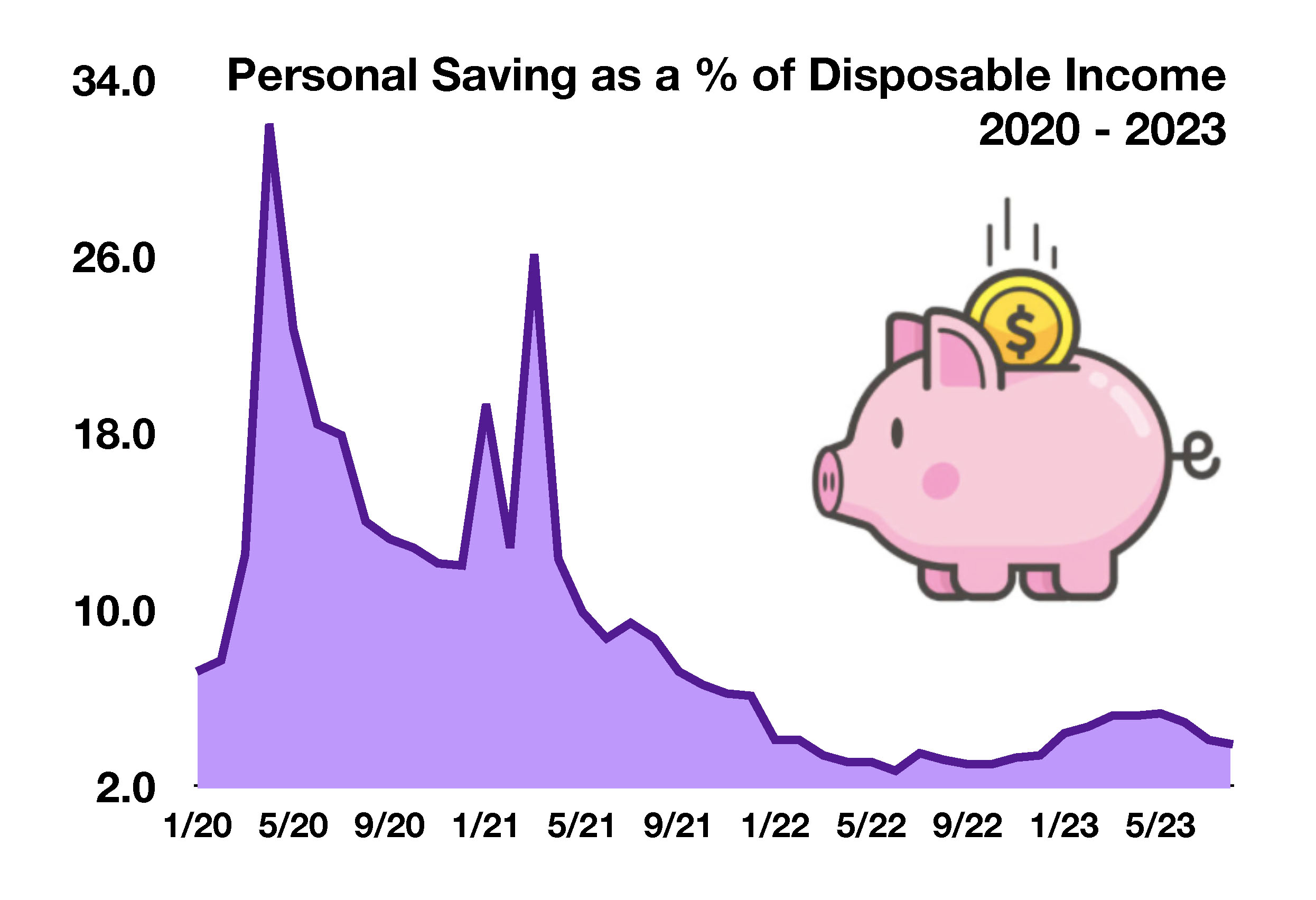

Most everyone thought we would be in a recession by now as punishment for our excessive pandemic spending. Instead, wages continue to rise and demand for everything is keeping prices high. Expansionary economic policies and subsequent indebtedness of the USA of the past decade have yet to cause a problem and the S&P500 has returned 10% in the last 12 months as of this writing. It seems we are climbing a plateau but cannot see beyond. The frenzy of asset growth is dissipating, and people are looking more closely at how much risk they want to carry going forward.

Up on the plateau it’s hard to see very far ahead.

Halloween may bring about a selloff in the tech stocks, or maybe we make it to election season before something breaks. Either way, the hard part about avoiding a selloff is that you have to be correct both before it goes down and then again before it goes back up. It’s better to be prepared before it happens.

Fortunately, we’ve got good options. A great one is to take advantage of these fantastic interest rates available on CD’s and Treasuries. Another may be to discard old mutual funds for more efficient ways to diversify your portfolio. It’s a great time to re-evaluate your plan and I’m happy to help.

The News

The energy and communication services sector were the only positive sectors for the third quarter. Elevated fuel prices along with improving technology earnings supported the rise in the sectors. Pessimism amid renewed inflation concerns hindered equity momentum during the quarter.

A federal government shutdown was averted on September 30th, when Congress voted to fund government operations until mid-November. Volatility in the financial markets increased during September, as uncertainty surrounding a resolution persisted. The federal government shutdown dilemma has increased the possibility of a credit downgrade by Moody’s, the last agency with a AAA rating on government debt. Credit agencies S&P and Fitch have already lowered their ratings on U.S. government debt to AA+, down from the top tier rating of AAA. Another downgrade is expected to make it more costly for the government to borrow funds and maintain already excessive debt levels. The last downgrade was on August 1st when Fitch lowered its rating to AA+ from AAA.

Do you know about the MT Endowment Tax Credit? It’s a way that you can set up a charitable fund for the future and realize some tax advantages now.